Employer Sponsored Health Insurance Explained Simply

Understanding Employer-Sponsored Health Insurance

Employer sponsored health insurance is health coverage that employers provide to their employees and often their dependents as part of a benefits package. It's the most common way Americans obtain health insurance.

Quick Definition: Employer-sponsored health insurance is a health plan offered by an employer that typically covers employees and their eligible family members. The employer usually pays a portion of the premium costs, with employees covering the remainder through payroll deductions.

Key Facts About Employer-Sponsored Health Insurance:

Coverage Reach

Covers approximately 164.7 million Americans (60.4% of non-elderly population)

Average Annual Cost (2023)

$8,435 for single coverage / $23,968 for family coverage

Typical Cost Sharing

Employers pay ~83% of single coverage and ~71% of family coverage costs

Tax Status

Premiums are tax-deductible for employers and excluded from employee taxable income

Common Plan Types

PPO (49%), HDHP/HSA (29%), HMO (12%), POS (9%)

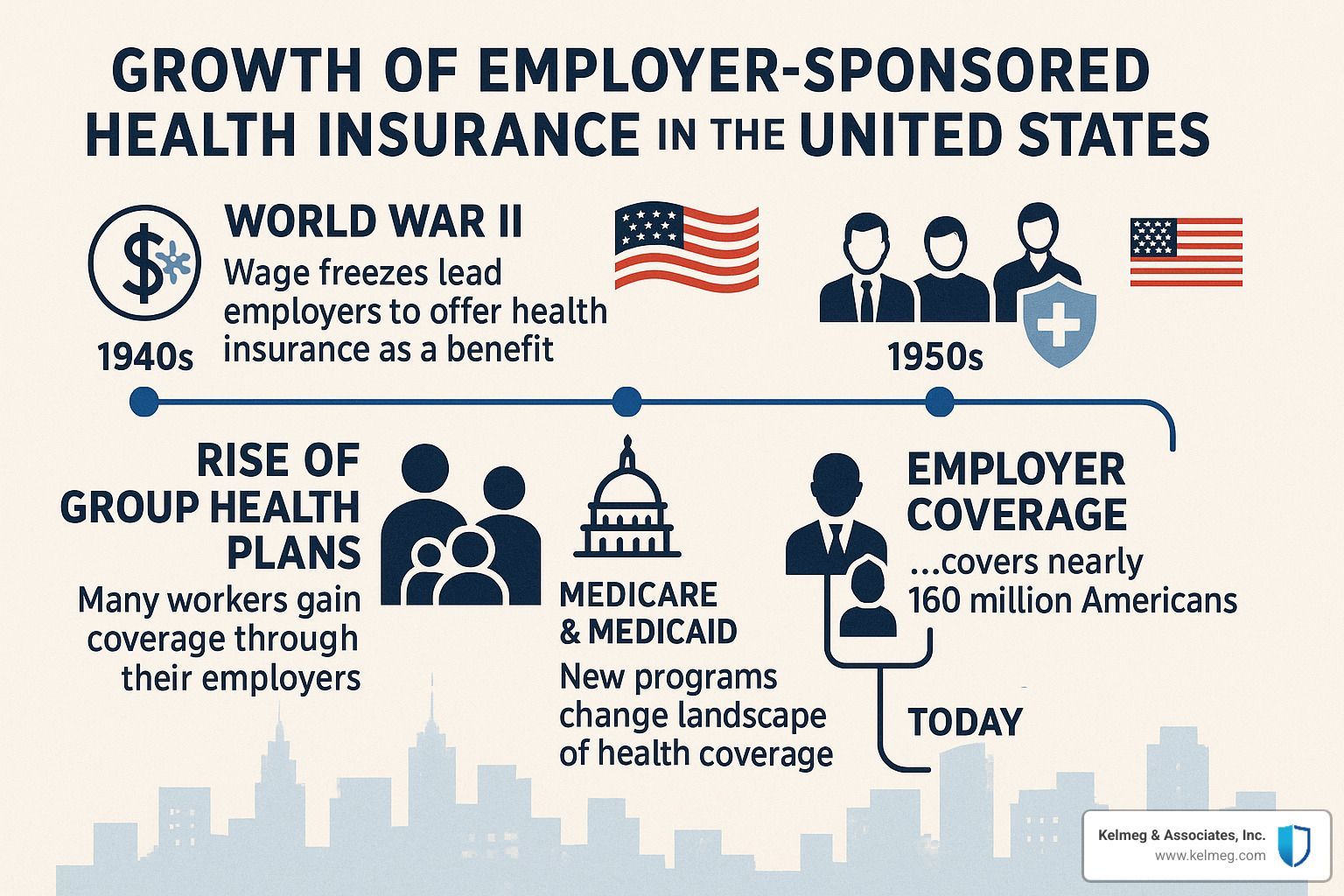

Employer sponsored health insurance originated during World War II when wage freezes prompted companies to offer health benefits instead of raises. Today, it remains the backbone of America's health insurance system, providing more predictable costs through group risk-pooling and significant tax advantages.

The system works by employers either purchasing group insurance policies (fully insured) or paying claims directly (self-funded) while employees typically contribute a portion of the premium costs through payroll deductions. Most employers contribute significantly to premium costs, making this coverage more affordable than comparable individual plans.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc. with extensive experience helping businesses design and implement employer sponsored health insurance plans that balance coverage needs with budget realities. My expertise lies in finding custom solutions that maximize value for both employers and employees.

Employer Sponsored Health Insurance 101

Employer sponsored health insurance (ESI) serves as the backbone of healthcare coverage for most working Americans. It covers more than 60% of Americans under age 65, making it the largest source of health coverage for non-elderly folks across the country. This system has fascinating historical roots that have shaped today's healthcare landscape.

What is Employer Sponsored Health Insurance?

Employer sponsored health insurance refers to health plans that companies offer their employees as part of their overall compensation package. These plans work effectively because they tap into the power of group purchasing – when employers negotiate for dozens or hundreds of employees at once, they secure better rates than individuals could get on their own. Typically, employers pay a significant portion of the premium, while employees cover the rest through payroll deductions.

What makes this system particularly effective is how it creates a natural risk pool. Since people choose jobs for many reasons beyond just health insurance, these plans include both healthy folks and those with medical needs, helping keep premiums more stable for everyone.

Employer Sponsored Health Insurance vs. Individual Market

While both employer plans and individual market policies aim to keep you healthy, they differ in several important ways:

Portability

Tied to employment

Stays with you regardless of job

Premium Cost

Often lower due to employer contributions

Generally higher; may qualify for subsidies

Tax Treatment

Premiums paid with pre-tax dollars

May be tax-deductible depending on circumstances

Plan Selection

Limited to options offered by employer

Wider range of choices

Underwriting

Group rating (not based on individual health)

Community rating under ACA

Enrollment

During hiring and annual open enrollment

Annual open enrollment or qualifying life events

The cost difference can be substantial. A client in Boulder found his family premium through his employer was about $7,500 annually after his company's contribution, while a comparable individual plan would cost over $18,000 without subsidies.

A Brief History of Employer Sponsored Health Insurance

The story of employer sponsored health insurance begins during World War II. With wage freezes in place to control inflation, companies couldn't offer higher salaries to attract workers. In 1942, the War Labor Board ruled that fringe benefits up to 5% of wages wouldn't count as wage increases under these controls. Offering health insurance became an attractive way for employers to compete for talent without breaking wage rules.

This approach gained more momentum in 1954 when the Internal Revenue Code formally made employer-provided health benefits tax-exempt. With this tax advantage in place, coverage skyrocketed – from covering just 9% of Americans in the early 1940s to roughly half the population by the mid-1950s.

Today, this system remains deeply woven into the fabric of American healthcare, continuing to evolve in response to rising costs, changing regulations, and workforce needs.

How Employer Sponsored Health Insurance Works

Understanding how employer sponsored health insurance functions is essential for both employers and employees. Let's explore the key elements that make this system work.

Eligibility & Enrollment Basics

The ACA defines full-time status as 30+ hours weekly (or 130+ monthly). Employees below that threshold might not qualify. New hires often face waiting periods before coverage begins, though these can't exceed 90 days by law.

Most plans extend coverage to family members including spouses and children (typically up to age 26). Special enrollment periods allow changes outside normal enrollment when life events occur, such as marriage, childbirth, or loss of other coverage.

In Colorado, about 86% of private-sector employees work for companies that offer health insurance, though access varies by industry and company size.

Funding Models: Fully Insured vs Self-Funded

Companies take two main approaches to funding health plans:

With fully insured plans, employers buy policies from insurance carriers. Everyone pays fixed premiums, and the insurance company assumes all financial risk. These plans must follow state insurance regulations.

In self-funded plans, employers pay claims directly from company assets, typically with stop-loss insurance as protection against large claims. These plans follow federal ERISA rules, which override most state insurance laws. About 65% of covered workers are in self-funded plans, mostly with larger employers.

A growing trend among Colorado small businesses is "level-funded" plans – hybrid arrangements allowing small employers to make predictable monthly payments while potentially receiving refunds if claims are lower than expected.

Main Plan Types (PPO, HMO, HDHP/HSA)

PPOs (Preferred Provider Organizations) cover about 49% of workers. They offer flexibility to see in-network or out-of-network providers (at higher cost), with no referrals needed for specialists. Premiums are higher for this freedom.

HMOs (Health Maintenance Organizations) cover about 12% of workers. They require staying in-network except for emergencies, with primary doctors providing referrals to specialists. Premiums are lower, but flexibility is reduced.

HDHP/HSAs (High-Deductible Health Plans with Health Savings Accounts) cover 29% of workers. These feature higher deductibles but lower premiums, paired with tax-advantaged HSAs for medical expenses.

POS (Point of Service) plans cover about 9% of workers, blending HMO and PPO features with primary doctors providing referrals but some out-of-network coverage options.

Premium Sharing & Other Costs

For premiums in 2023, employees paid an average of 17% for single coverage ($1,401 annually) and 29% for family coverage ($6,575), with employers covering the remainder.

Beyond premiums, employees face deductibles (averaging $1,735 for single coverage), copayments, and coinsurance, though out-of-pocket maximums provide protection against catastrophic expenses.

Tax Advantages for Employers & Employees

For employers, premium contributions are tax-deductible business expenses. Companies also enjoy payroll tax savings on employee premium contributions made through Section 125 plans. Small businesses may qualify for the Small Business Health Care Tax Credit.

For employees, employer contributions toward health insurance aren't taxable income, and personal contributions can be made pre-tax through payroll deduction – representing roughly a 30% discount for someone in the 22% federal tax bracket plus 7.65% FICA.

This favorable tax treatment costs the federal government about $273 billion annually but provides significant financial benefits for both employers and employees.

Scientific research on tax policy | More info about Our Services

Regulations, Requirements & Special Situations

Navigating employer sponsored health insurance involves understanding the regulatory landscape that creates both obligations for employers and protections for employees.

ACA Employer Mandate & Employer Size Rules

Businesses with 50+ full-time equivalent employees are classified as "Applicable Large Employers" (ALEs) and must offer affordable, minimum-value coverage to full-time employees and their dependents or face penalties.

For 2024, these penalties are substantial – $2,970 per full-time employee (minus the first 30) if no coverage is offered, or $3,750 for each employee receiving marketplace subsidies if coverage fails affordability or minimum value tests.

The IRS defines affordability as an employee's premium contribution for self-only coverage not exceeding 9.12% (2023) of household income. Minimum value means the plan covers at least 60% of total medical service costs.

Smaller employers with fewer than 50 FTEs are exempt from these requirements but may qualify for tax credits if they choose to offer coverage.

The 'Family Glitch' and Recent Fixes

Until recently, families faced a frustrating situation nicknamed the "family glitch." If an employee was offered "affordable" self-only coverage through work, their entire family became ineligible for marketplace subsidies – even if family coverage was prohibitively expensive.

In 2022, the IRS issued a fix. Starting January 2023, family members can qualify for marketplace subsidies if family coverage exceeds the affordability threshold. This change has helped approximately 1 million Americans, including many Colorado families.

Leaving a Job: COBRA, Marketplace, Special Enrollment

When leaving a job, health insurance options include:

- COBRA continuation coverage: Stay on your employer's plan for 18-36 months, paying the full premium plus a 2% administrative fee. You have 60 days from your qualifying event to decide.

- Marketplace plans: Job loss creates a 60-day Special Enrollment Period, with potential premium tax credits based on projected annual income. Coverage starts the first day of the month after selecting a plan.

- New employer coverage: Typically involves a waiting period (up to 90 days) before coverage begins.

At Kelmeg & Associates, we help clients throughout Broomfield, Lafayette, and across Colorado steer these transitions smoothly, ensuring continuous coverage during life changes.

Costs, Pros & Cons of Employer Sponsored Health Insurance

Understanding the financial aspects of employer sponsored health insurance helps businesses and employees make informed decisions about healthcare options.

Cost Breakdown & Recent Statistics

In 2023, average annual premiums reached $8,435 for single coverage and $23,968 for family coverage. Employers typically cover most costs – employees generally pay about 17% ($1,401) for single coverage and 29% ($6,575) for family coverage.

Deductibles average $1,735 for single coverage. Employees at smaller companies (3-199 employees) often pay more than those at larger corporations – about $7,529 versus $6,796 for family coverage, with higher deductibles as well ($5,074 compared to $3,547).

Family premiums increased 7% in 2023, with projected increases of about 8% for 2024. In Colorado, premium increases have generally kept pace with inflation over the past five years, though new weight-loss medications (GLP-1s) are becoming a major cost driver.

Advantages & Disadvantages for Employees

Advantages:

- Lower premiums through employer contributions

- Tax savings on pre-tax premium payments

- No medical underwriting – coverage can't be denied based on health

- Administrative simplicity with automatic enrollment and payroll deductions

- Better coverage and provider networks than typically available individually

Disadvantages:

- Limited to plans selected by employer

- Potential coverage loss when changing jobs

- "Job lock" – staying in positions solely for benefits

- Less control over coverage decisions

- Family coverage costs can be substantial

As one Adams County client shared, "The peace of mind from having comprehensive coverage through my employer outweighs the limitation of having fewer plan choices."

Advantages & Disadvantages for Employers

Advantages:

- Powerful tool for attracting and retaining talent

- Tax deductions for premium contributions

- FICA tax savings on employees' pre-tax contributions

- Healthier, more productive workforce

- Potential cost savings through self-funding

- Small business tax credits for eligible employers

Disadvantages:

- Administrative burden and compliance requirements

- Rising premium costs creating budget pressures

- Unpredictable annual increases complicating financial planning

- Responsibility for plan selection and management

- Potential ACA penalties for non-compliance (for ALEs)

Small businesses throughout Boulder and Lafayette consistently report that offering health benefits significantly improves recruitment and retention efforts despite administrative challenges. As one local business owner noted, "It's one of our biggest expenses, but also one of our most important investments."

Trends, Challenges & Maximizing Value

The landscape of employer sponsored health insurance continues to evolve in response to cost pressures, regulatory changes, and shifting employee expectations.

Current Trends in Employer Sponsored Health Insurance

Premium increases continue to challenge employers and employees, with family premiums rising 7% in 2023 and similar increases expected for 2024. This pressure is driving adoption of high-deductible health plans paired with HSAs, which now cover nearly a third of workers—up from just 4% in 2006.

Mental health resources have become increasingly important, with Colorado employers expanding these services in response to pandemic-highlighted needs. This coincides with strengthened mental health parity requirements ensuring appropriate coverage.

Telehealth has transformed healthcare access, evolving from a pandemic necessity to a standard benefit employees now expect. Many Denver-area clients report sustained telehealth usage even as in-person visits have resumed.

Hospital consolidation continues reshaping healthcare markets, with over 1,000 hospital mergers in recent decades potentially reducing competition and increasing prices.

Pharmaceutical costs—particularly new GLP-1 medications for weight management—present significant cost management challenges, with nearly 80% of employers reporting increased employee interest in these medications.

Smaller businesses are increasingly exploring level-funded arrangements that provide self-insurance benefits with more predictable monthly payments, giving them more control over healthcare spending while maintaining protection against catastrophic claims.

Tools & Resources to Help Employees

Cost transparency resources have become invaluable for healthcare decision-making, showing actual procedure costs across different providers. Colorado's Right to Shop Act has accelerated this transparency, requiring insurers to provide comparison tools for more informed decisions.

Smart provider directories have replaced outdated paper booklets, helping employees quickly find in-network providers and reduce surprise billing risks. One Boulder client saved over $800 by using her plan's directory to find an in-network specialist.

Decision support systems during open enrollment analyze specific health needs and financial situations to recommend appropriate plans, helping employees avoid choosing based solely on premium costs.

Health advocacy services provide personalized support navigating complex systems, resolving billing issues, and finding appropriate care, while mobile apps have simplified access to ID cards, claims information, and benefit details.

Tips for Employers & Employees to Maximize Value

For employers:

- Consider self-funding or level-funding arrangements for potential savings of 15-30%

- Implement comprehensive wellness programs addressing whole-person health

- Contribute to HSAs to offset high deductibles

- Explore narrow networks or tiered provider arrangements for premium reductions

- Provide thorough benefits education to improve utilization and satisfaction

For employees:

- Understand plan details—deductibles, copays, coinsurance, and out-of-pocket maximums

- Stay in-network whenever possible to avoid unexpected costs

- Use preventive care services covered at 100%

- Take advantage of tax-advantaged accounts like HSAs or FSAs

- Review Explanations of Benefits (EOBs) to catch billing errors

Frequently Asked Questions about Employer Sponsored Health Insurance

What happens if employer coverage is unaffordable? If self-only coverage exceeds 9.12% (2023) of household income, you may qualify for Marketplace premium tax credits. Recent rule changes addressing the "family glitch" now apply this affordability test to family coverage costs as well.

When does coverage end after leaving a job? Typically, coverage continues until the last day of the month when employment ends. COBRA provides continuation options, but you'll be responsible for the full premium plus a 2% administrative fee.

Are part-time employees eligible for coverage? The ACA doesn't require coverage for employees working fewer than 30 hours weekly, though some employers extend benefits to part-timers, usually with higher contributions or modified benefits.

Can an employer offer different benefits to different employees? Yes, based on objective criteria like full-time/part-time status, job category, or location—but not based on health status or protected characteristics.

How does employer coverage coordinate with Medicare? For companies with 20+ employees, employer coverage is primary and Medicare secondary. For smaller employers, Medicare pays first. Special rules apply for COBRA coverage and HSA eligibility.

For more information about affordable health coverage options in Colorado, visit our Affordable Health Coverage Colorado page or learn about our Employer Group Benefits services.

Conclusion

Employer sponsored health insurance has become the foundation of health coverage in America, protecting more than 164 million people. From its origins during World War II wage freezes to today's complex system, its core value remains unchanged—bringing people together in groups for better rates and leveraging tax advantages to improve affordability.

The challenges facing this system are significant: rising healthcare costs, complex regulations, and the ongoing struggle to balance comprehensive coverage with affordability. However, thoughtfully designed plans, smart cost management strategies, and clear employee education can make a tremendous difference.

At Kelmeg & Associates, Inc., we help Colorado businesses steer these challenges successfully. Our team provides expert guidance on plan selection, compliance requirements, and cost-control strategies—all at no additional cost beyond the premiums themselves, as insurance carriers pay our compensation.

Whether you're a small business owner in Lafayette offering benefits for the first time, a growing company in Broomfield looking to improve your offerings, or an employee in Boulder trying to understand your options during open enrollment, we're here to help you find clarity.

The future of employer sponsored health insurance will bring changes, but its importance in providing security for working Americans remains constant. With the right approach and expert guidance, employers can continue offering valuable benefits that attract and retain talented employees while controlling costs.

For personalized assistance with employer group benefits anywhere in Colorado, reach out to our team today. We'll take the time to understand your specific situation and help you find the perfect balance between coverage and cost for your business and employees.