Beyond the Basics: Comparing Medicare Supplements Like a Pro in CO

Why Comparing Medicare Supplements Is Essential for Colorado Residents

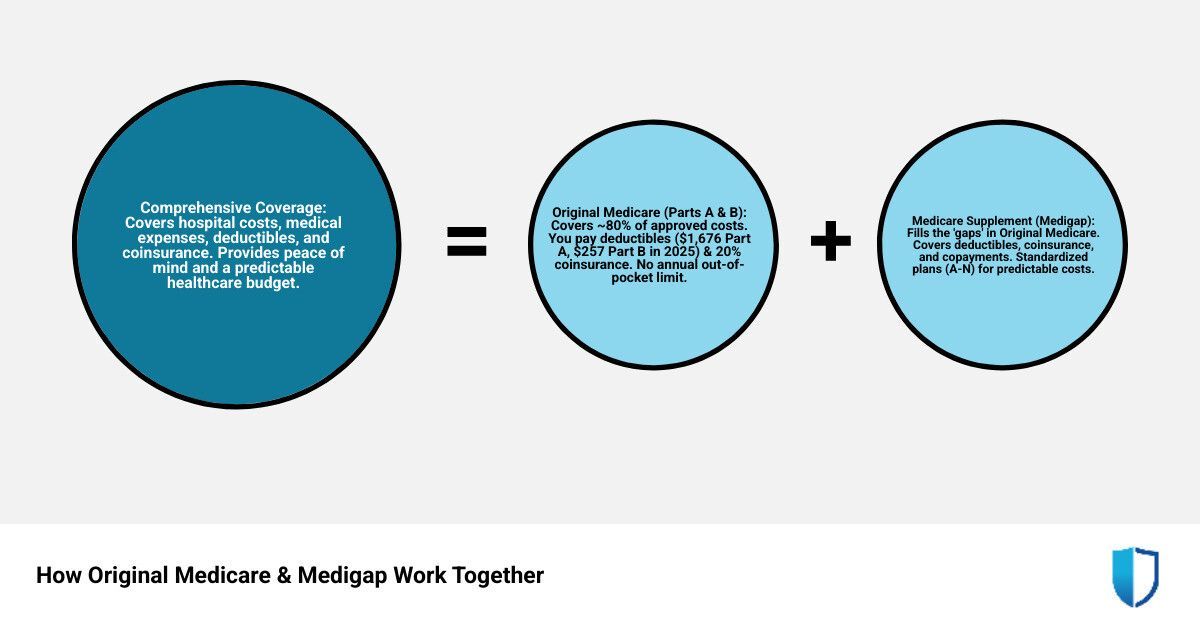

When you compare Medicare supplements, you're making a critical decision about your healthcare and financial future. Original Medicare (Parts A and B) was designed to provide a foundational layer of health coverage, but it was never intended to cover all medical costs. It leaves beneficiaries responsible for significant out-of-pocket expenses, including deductibles, coinsurance, and copayments that can accumulate into thousands of dollars each year without a cap.

These financial gaps are not trivial. In 2025, the Medicare Part A hospital deductible is a substantial $1,676 per benefit period, which is not per year; a person could face this deductible multiple times in a single year. The Part B annual deductible is $257. After these deductibles are met, you are still responsible for 20% of the cost for most medical services, including doctor visits, outpatient surgery, and durable medical equipment. Crucially, there is no annual limit on this 20% coinsurance. A single serious illness, like a cancer diagnosis or a major surgery, could lead to tens of thousands of dollars in medical bills.

This is where Medicare Supplement Insurance, also known as Medigap, provides an essential financial shield. These standardized plans are offered by private insurance companies and are specifically designed to fill the gaps left by Original Medicare, covering your share of the costs. With 10 different plan options available (labeled A through N), understanding how to compare them effectively can save you a substantial amount of money and provide invaluable peace of mind. For active Colorado seniors who enjoy all the state has to offer, having predictable healthcare costs is key to a secure retirement.

A quick look at the most popular Medigap plans:

- Plan G: Now the most popular plan for new enrollees, Plan G covers nearly everything Original Medicare doesn't, with the single exception of the annual Part B deductible.

- Plan N: A great value option, Plan N offers lower monthly premiums in exchange for small, predictable copays for some doctor and emergency room visits.

- Plan F: Previously the most comprehensive plan, Plan F is only available to individuals who were eligible for Medicare before January 1, 2020.

These three plans-F, G, and N-are the clear favorites, covering approximately 85% of all Medigap beneficiaries nationwide. As an insurance specialist at Kelmeg & Associates, Inc., I've helped hundreds of Colorado residents analyze their options to find the right coverage for their unique needs and budget. Understanding the distinct advantages of each plan is the key to protecting both your health and your finances for years to come.

What is Medicare Supplement (Medigap) and Why Do You Need It?

Original Medicare (Parts A and B) covers a significant portion of your healthcare costs, but it leaves "gaps" that you are responsible for, including deductibles, coinsurance, and copayments. Most importantly, Original Medicare has no annual limit on your out-of-pocket spending. This unlimited financial exposure is the primary reason why Medicare Supplement Insurance, or Medigap, provides essential protection for millions of Americans.

Many residents in Lafayette, Broomfield, and across Adams County worry about the unpredictability of medical bills in retirement. In 2025, the Medicare Part A deductible for a hospital stay is $1,676, and you could be required to pay it multiple times in a year. The Part B deductible is $257 annually, after which you are generally responsible for 20% of the cost for most services. This 20% coinsurance can add up alarmingly fast, especially during a serious illness or after an accident.

Medigap plans are specifically designed to cover these costs, changing an unpredictable financial risk into a predictable, manageable monthly premium. This provides not only financial security but also profound peace of mind. Another key benefit is the unparalleled freedom of choice. With a Medigap plan, you can see any doctor, specialist, or hospital in the U.S. that accepts Original Medicare. There are no network restrictions or referral requirements to see a specialist. This freedom is a cornerstone of the Medigap promise. Unlike many Medicare Advantage plans, which often restrict you to a local network of providers (HMOs) or charge more for out-of-network care (PPOs), Medigap travels with you. Since approximately 93% of U.S. primary care physicians accept Medicare, your access to care is virtually unlimited nationwide.

At Kelmeg & Associates, Inc., we provide expert guidance at no extra cost to help you find a plan that fits your life. Learn more about how Medicare works on our page on Understanding Medicare.

What Medigap Does and Doesn't Cover

Medigap plans help pay for your share of costs for services covered by Original Medicare. The coverage is deep but specific. Benefits typically include:

- Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used up)

- Part B coinsurance or copayment (typically 20% of the cost)

- The first 3 pints of blood for a medical procedure

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- The Part A deductible ($1,676 in 2025)

- The Part B deductible ($257 in 2025, for Plan F only for new enrollees)

- Part B excess charges (when a doctor charges more than the Medicare-approved amount)

- Foreign travel emergency care (up to plan limits)

It's equally important to understand what Medigap doesn't cover. These plans do not add new benefits; they only cover the costs for benefits Original Medicare already provides. Medigap's focus is narrow and deep. The federal government created the separate Medicare Part D program specifically for prescription drugs, which is why Medigap policies are legally barred from including this coverage. They generally do not cover:

- Prescription drugs (requires a separate Part D plan, which we can help with on our Colorado Medicare Part D Plans page)

- Long-term care (e.g., custodial care in a nursing home or assisted living facility)

- Routine vision or dental care (e.g., exams, glasses, dentures)

- Hearing aids

- Private-duty nursing

Medigap vs. Other Medicare Options

It's easy to confuse Medigap with Medicare Advantage, but they are fundamentally different paths. You cannot have both at the same time.

- Medigap (Medicare Supplement): This works with Original Medicare. You keep your red, white, and blue Medicare card, and the Medigap plan acts as secondary insurance to pay for the out-of-pocket costs. You retain the freedom to see any doctor nationwide that accepts Medicare.

- Medicare Advantage (Part C): This is an alternative to Original Medicare offered by private insurance companies. These plans bundle Part A, Part B, and often Part D (prescription drug) benefits into a single plan. They typically have network restrictions (like HMOs or PPOs) and may offer extra benefits like limited dental and vision coverage. When you enroll in a Medicare Advantage plan, you are leaving the Original Medicare program for that year.

Our goal at Kelmeg & Associates, Inc. is to clarify these differences so you can make an informed choice that aligns with your healthcare priorities and financial goals. Find more details on our page about

Medicare Options in Colorado.

The A-to-N of Medigap: A Detailed Look at Standardized Plans

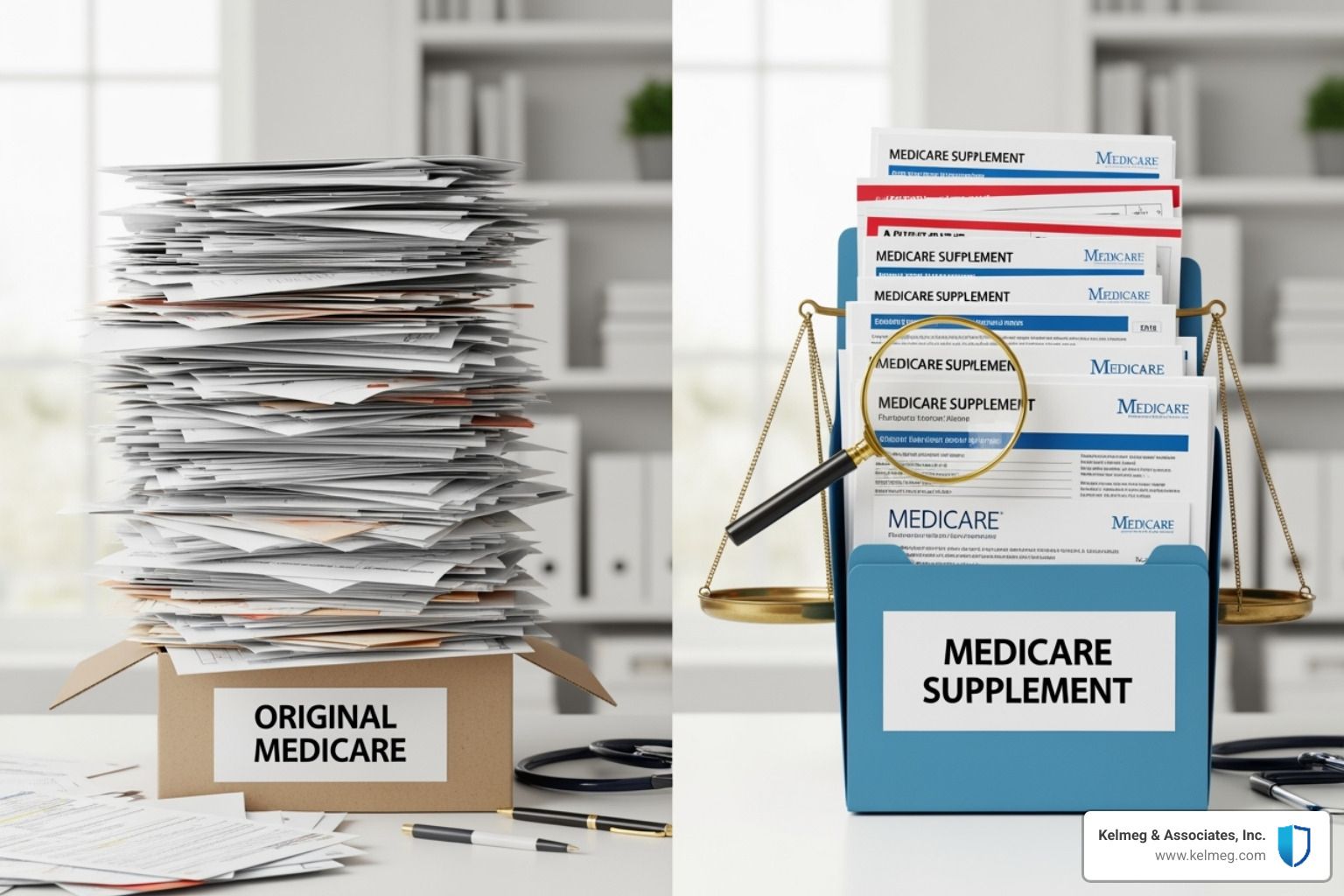

One of the most consumer-friendly features of Medigap is that the plans are standardized by the federal government. This means that a Plan G from one insurance company has the exact same core medical benefits as a Plan G from any other company. This standardization is a powerful tool for consumers, as it allows you to focus your comparison on price, company reputation, and customer service, rather than trying to decipher complex and varying benefit structures.

There are 10 standardized Medigap plans available in most states, labeled A, B, C, D, F, G, K, L, M, and N. Each is designed to cover a specific combination of gaps in Original Medicare. At Kelmeg & Associates, Inc., we partner with top-rated private insurance companies in Colorado to offer you a full range of these options. You can see what's available on our

Medicare Supplement Plans Colorado page.

The Most Popular Choices: A Deep Dive into Plans F, G, and N

When clients ask us to compare Medicare supplements, the conversation almost always centers on three plans: F, G, and N. Together, they cover the vast majority-85%-of all Medigap beneficiaries nationwide, and for good reason.

- Medigap Plan F: For many years, Plan F was the undisputed gold standard of supplement insurance. It offers the most comprehensive coverage possible, paying for all of Original Medicare's gaps, including both the Part A and Part B deductibles. This is often called "first-dollar" coverage. However, due to a federal law change (MACRA), Plan F is no longer available to anyone who became eligible for Medicare on or after January 1, 2020. If you were eligible before this date, you might still be able to purchase it.

- Medigap Plan G: This is now the most popular and comprehensive plan for new Medicare enrollees. It offers the same robust, first-dollar coverage as Plan F, with one simple exception: you must pay the annual Medicare Part B deductible yourself ($257 in 2025). After you've paid that once per year, Plan G covers 100% of the remaining gaps, including Part B excess charges. The monthly premiums for Plan G are often significantly lower than Plan F, and the savings typically far outweigh the cost of the deductible, making Plan G an excellent value. It is ideal for the beneficiary who wants maximum coverage, predictable costs, and minimal hassle. Learn more on our Medicare Supplement Plan G Colorado page.

- Medigap Plan N: For those seeking a lower monthly premium, Plan N is a fantastic option that still provides strong protection. Like Plan G, you are responsible for the annual Part B deductible. In addition, you will have some cost-sharing in the form of small copayments for some office visits (up to $20) and emergency room visits (up to $50, waived if you're admitted). Plan N also does not cover Part B excess charges, but these charges are rare. Plan N is best for the savvy, budget-conscious consumer who is in relatively good health and comfortable with minor, predictable cost-sharing in exchange for a lower premium.

Understanding Other Medigap Plan Options

While F, G, and N are the most common, other plans might be a better fit for your specific budget and risk tolerance.

- Plans K and L: These plans are designed with a cost-sharing model to keep premiums lower. Plan K covers 50% and Plan L covers 75% of most benefits until you reach an annual out-of-pocket limit ($7,220 for Plan K and $3,610 for Plan L in 2025). After you reach that limit, the plan pays 100% of covered services for the rest of the year. These plans can be a good fit for those who want protection from catastrophic costs but are willing to share in the smaller costs.

- High-Deductible Plans F and G: These plans require you to pay all Medicare-covered costs (your deductibles, copays, and coinsurance) up to a set deductible amount ($2,800 in 2024) before the plan begins to pay anything. In exchange, they offer significantly lower monthly premiums. They provide an excellent safety net against catastrophic costs for those who are healthy and willing to cover smaller medical expenses themselves, perhaps using funds from a Health Savings Account (HSA).

Phased-Out Plans: What to Know About Plan C and Plan F

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) changed the rules for Medigap. As of January 1, 2020, plans that cover the Part B deductible (Plans C and F) can no longer be sold to new Medicare beneficiaries. The legislative goal was to encourage beneficiaries to have some "skin in the game" by being responsible for their initial healthcare costs each year.

- If you were eligible for Medicare before January 1, 2020, you are still part of the group that can buy Plan C or F if an insurer in your state offers it. If you already have one of these plans, you are allowed to keep it.

- If you became eligible for Medicare on or after January 1, 2020, you cannot buy Plan C or F. For you, Plan G is the most comprehensive option available.

How to Compare Medicare Supplements: A Step-by-Step Guide

Choosing the right Medigap plan is a manageable process when broken down into clear, logical steps. By thoughtfully assessing your needs, understanding the standardized plans, and comparing costs intelligently, you can map out your healthcare journey with confidence. For a complete overview of your options, visit our page on

Medicare Insurance Colorado.

Step 1: Assess Your Healthcare Needs and Budget

Before you even look at a comparison chart, you must first look at your personal situation. This self-assessment is the most crucial step in selecting the right level of coverage.

- Your Health: Be honest about your current health status. Do you have chronic conditions that require frequent doctor visits or specialist care? Or are you generally healthy with few medical needs? Think about your family's health history as well, as this could indicate potential future needs.

- Your Risk Tolerance and Financial Philosophy: This is about your comfort level with risk. Are you more comfortable paying a higher monthly premium to have predictable, comprehensive coverage with minimal out-of-pocket costs (like Plan G)? Or do you prefer lower monthly premiums and are willing to pay some costs like deductibles or copays when you need care (like Plan N)? A plan is only beneficial if it aligns with your financial style.

- Travel Plans: Do you travel frequently, either domestically or internationally? If you travel abroad, you should strongly consider a plan that includes foreign travel emergency coverage. Plans C, D, F, G, M, and N all offer this benefit up to plan limits.

- Your Budget: Be realistic about what you can comfortably afford for a monthly premium, not just now but in the future. A plan is only useful if you can consistently pay for it. This is where comparing quotes becomes essential.

Step 2: Use a Comparison Chart to Compare Medicare Supplements

Because Medigap plans are standardized, you can easily compare their benefits using a chart. The primary difference between plans is which "gaps" in Original Medicare they are designed to cover. The chart below outlines the benefits of each standardized plan. For the most current information, you can also visit the official government resource at

How to Compare Medigap Policies.

| Benefit | Plan A | Plan B | Plan C* | Plan D | Plan F* | Plan G | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

| Part A Coinsurance & Hospital Costs (up to 365 days) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B Coinsurance/Copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A Hospice Coinsurance/Copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled Nursing Facility Coinsurance | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes | |

| Part A Deductible | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes | |

| Part B Deductible | Yes | Yes | ||||||||

| Part B Excess Charge | Yes | Yes | Yes | |||||||

| Foreign Travel Emergency (80% after $250 deductible, up to $50,000 lifetime max) | Yes | Yes | Yes | Yes | Yes | Yes | ||||

| Out-of-Pocket Limit (2025) | $7,220 | $3,610 |

Plans C and F are only available to those eligible for Medicare before January 1, 2020.

^Plan N covers 100% of Part B coinsurance, except for copayments of up to $20 for some office visits and up to $50 for emergency room visits that don't result in inpatient admission.

Step 3: How to Compare Medicare Supplements by Cost and Carrier Reputation

Once you've identified the plan letter (e.g., G or N) that best suits your needs, the next critical step is to compare prices from different insurance companies. Premiums for the exact same standardized plan can vary significantly from one carrier to the next.

Companies use different pricing methods. In Colorado, attained-age rating is the most common method. This means your premiums start lower, based on your age at enrollment, and will increase as you get older. Other methods include issue-age rating (premiums are based on your age at purchase and don't increase due to age) and community rating (everyone pays the same premium regardless of age). Understanding which method a company uses is key to projecting your long-term costs.

A company's rate increase history and financial strength are also crucial factors. A plan that seems cheap today could become very expensive in the future. A slightly more expensive plan from a stable company with a history of modest, predictable rate increases might be a much better long-term value than a cheaper plan from a company known for frequent, steep increases. You should look for strong financial ratings from independent agencies like A.M. Best.

This is where the expertise of a broker like Kelmeg & Associates, Inc. becomes invaluable. We work with multiple top-rated carriers in Colorado and can help you compare Medicare supplements based on current rates, rate stability, financial strength, and customer service. Our expert guidance is provided at no cost to you. Learn more about how we can assist you on our Kelmeg & Associates, Inc. Medicare Supplemental Insurance Colorado page.

Mastering Medigap Enrollment: When and How to Apply

After you compare Medicare supplements and choose a plan that fits your needs, the timing of your application becomes the most important factor. Applying at the right time guarantees your acceptance and protects you from being charged more due to your health history. Waiting too long can result in being denied coverage altogether.

The Golden Window: Your Medigap Open Enrollment Period

The absolute best time to buy a Medigap policy is during your one-time Medigap Open Enrollment Period. This is a 6-month window that automatically begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. It is a one-time opportunity, and once it's over, it's gone for good.

During this protected period, you have what are known as guaranteed issue rights. This means an insurance company:

- Cannot deny you coverage for any Medigap policy it sells, regardless of your health history.

- Cannot charge you a higher premium because of your health status or any pre-existing conditions.

- Cannot impose a waiting period, meaning your coverage for pre-existing conditions starts at the same time as your policy.

This is the ideal time to enroll, as it gives you the widest array of choices with the strongest consumer protections. For more details on timing, Medicare offers a helpful guide at When Can I Buy a Medigap Policy?.

Applying Outside of Open Enrollment

If you apply for a Medigap policy after your Open Enrollment Period has ended, the rules change dramatically. Insurers can, and usually will, use medical underwriting. This means they will require you to answer detailed health questions on your application, and they can review your medical records and prescription history. Based on this information, they have the right to deny your application, charge you a significantly higher premium, or refuse to cover your pre-existing conditions for a period of time.

Frequently Asked Questions about Comparing Medicare Supplements

When you

compare Medicare supplements, it's natural and wise to have questions. The details matter. Here are clear, simple answers to some of the most common questions we hear from our clients in Lafayette, Broomfield, and across Colorado.

Can I keep my current doctors if I buy a Medigap plan?

Yes, absolutely. This is one of the most significant advantages of choosing a Medigap plan to supplement Original Medicare. Because your policy works alongside Original Medicare, you have the freedom to see any doctor, specialist, or hospital anywhere in the U.S. as long as they accept Medicare patients. There are no restrictive provider networks, and you never need a referral from a primary care physician to see a specialist. With about 93% of primary care physicians accepting Medicare, your access to care is excellent and nationwide.

Do Medigap plans cover prescription drugs, dental, or vision?

No. This is a critical point of distinction. Medigap plans are designed only to fill the cost-sharing gaps in Original Medicare (Parts A and B), such as your deductibles, coinsurance, and copayments. They do not cover services that Original Medicare itself doesn't cover. This means they do not include benefits for:

- Prescription drugs (this requires a separate, standalone Medicare Part D plan)

- Routine dental care, vision exams, or eyeglasses

- Hearing aids

- Long-term custodial care in a nursing home

For these types of benefits, you would need to purchase separate, standalone insurance policies or consider a Medicare Advantage plan that may bundle some of them.

What are Part B Excess Charges?

Part B excess charges are additional fees that some doctors are legally permitted to charge. In the U.S., a doctor can choose to be a 'participating provider' who accepts the Medicare-approved amount as full payment. Or, they can be a 'non-participating' provider who can charge up to 15% more than that amount. This extra 15% is the 'excess charge,' and you are responsible for paying it out of pocket unless you have a Medigap plan that covers it, such as Plan F or Plan G. While not all doctors bill for them, having coverage for excess charges provides complete protection against this potential cost.

Is a High-Deductible Plan G a good idea?

A High-Deductible Plan G can be an excellent choice for the right person. It offers the same comprehensive coverage as a standard Plan G, but only after you have first paid a large annual deductible ($2,800 in 2024). In exchange, the monthly premiums are significantly lower. This type of plan is best suited for healthy individuals who are comfortable covering their routine medical costs out of pocket but want a strong safety net to protect them from the high costs of a major, unexpected medical event. It's a form of catastrophic coverage that can be very cost-effective for those with a high tolerance for risk and sufficient savings.

Your Next Steps to Secure Coverage in Colorado

Navigating your Medicare options can feel complex, but with the right information and guidance, the path forward becomes clear and manageable. As you compare Medicare supplements, remember these key takeaways to guide your decision:

- Plans are standardized: A Plan G is a Plan G, no matter which company sells it. This allows you to focus on comparing price and company quality, not benefits.

- Premiums vary widely: Prices for the exact same plan can differ significantly between insurance carriers. Shopping around is essential to avoid overpaying.

- Enrollment timing is crucial: Your one-time Medigap Open Enrollment Period offers guaranteed acceptance without health questions. This is your golden window of opportunity.

At Kelmeg & Associates, Inc., we are passionate about helping our Colorado neighbors in Lafayette, Broomfield, Boulder, and Adams County find the right health insurance. We simplify the complex details and provide expert, personalized guidance at no extra cost to you. Our experience helping hundreds of clients means we can help you find a plan that fits your health needs, your budget, and your peace of mind.

Ready to take the next step toward predictable healthcare costs and a secure retirement? As your local

Colorado Medicare Insurance Broker, we are dedicated to helping you secure the coverage you deserve. Let us help you

Find the right Medicare Supplemental Insurance in Colorado for your needs.