Colorado Medicare Supplement: Everything You Need to Know

Why Colorado Medicare Supplement Coverage Matters

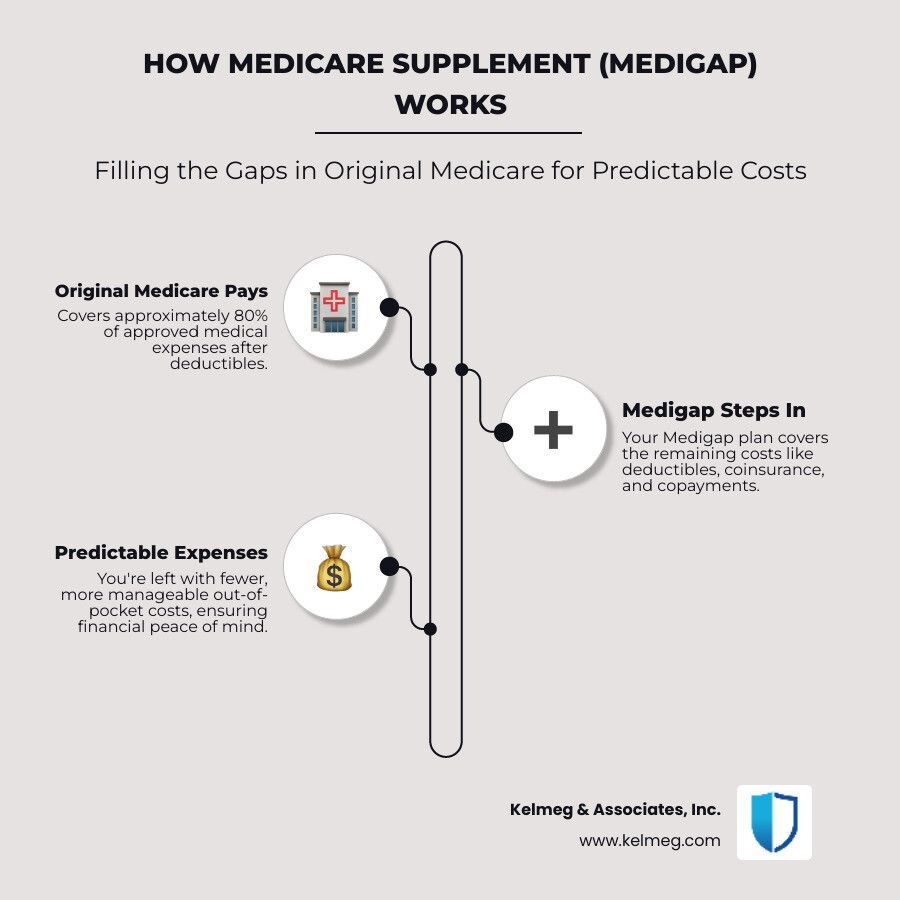

Medicare supplement Colorado plans, also known as Medigap, help fill the significant financial gaps in Original Medicare. These standardized insurance policies are designed to work hand-in-hand with Medicare Parts A and B, covering costs like deductibles, coinsurance, and copayments that you would otherwise be responsible for paying out-of-pocket. For Colorado's active and vibrant senior community, this coverage is not just a convenience-it's a cornerstone of financial security in retirement.

Quick Answer for Medicare Supplement Colorado:

- What it is: Private insurance that pays for costs Original Medicare does not cover.

- Popular plans: Plan G (the most comprehensive option for new enrollees) and Plan N (a lower-premium option with small copays).

- Average cost: Around $200/month in Colorado, but this varies widely based on age, location, tobacco use, and the specific company.

- Best enrollment time: The one-time, 6-month window that starts when you enroll in Medicare Part B at age 65 or older.

- Key benefit: The freedom to see any doctor or visit any hospital that accepts Medicare, anywhere in the U.S., with no referrals required.

- What it does not cover: Prescription drugs, routine dental and vision care, hearing aids, or long-term custodial care.

Original Medicare generally covers about 80% of your major medical expenses. This leaves you, the beneficiary, responsible for the remaining 20% with absolutely no annual limit or cap. A serious illness, an unexpected surgery, or a chronic condition could result in tens of thousands of dollars in medical bills. In Colorado, a state known for its healthy lifestyle, an accident during a hike or ski trip could lead to staggering costs. This is why 47% of residents on Original Medicare have wisely chosen a supplement plan to protect themselves from these potentially catastrophic expenses. Without this coverage, your financial stability could be at risk.

Medigap plans transform this uncertainty into predictable healthcare costs and genuine peace of mind. Unlike many other insurance options that restrict you to a network of providers, Medigap plans work with any doctor or hospital that accepts Medicare nationwide, giving you complete freedom and control over your healthcare choices.

Understanding Medicare Supplement (Medigap) Insurance

Think of Original Medicare Parts A and B as a solid foundation for your healthcare coverage. However, they were never designed to cover everything. They leave 'gaps'-like coinsurance, deductibles, and copayments-that can lead to significant and unexpected bills. These gaps represent your direct financial liability.

Medicare Supplement Insurance, or Medigap, is specifically designed to fill these gaps. Sold by private insurance companies but regulated by the federal government, these plans work seamlessly with Original Medicare to cover most of what is left after Medicare pays its share. This creates a crucial financial safety net, protecting you from the high out-of-pocket costs that can accompany serious medical care.

One of the most valued features of medicare supplement Colorado plans is the unparalleled freedom of choice. You can see any doctor or visit any hospital in the U.S. that accepts Medicare. There are no restrictive provider networks, and you do not need a referral from a primary care physician to see a specialist. Your coverage is portable and travels with you, providing consistent, nationwide protection whether you are at home in Denver, visiting family in another state, or traveling across the country.

For more comprehensive information about how Medicare works overall, you can explore our detailed guide at More info about Medicare.

Why Colorado Residents Need a Medigap Policy

Original Medicare leaves you exposed to significant financial risk, primarily through the 20% Part B coinsurance, which has no out-of-pocket maximum. To put this in perspective, a $100,000 course of cancer treatment would leave you with a $20,000 bill. A complex surgery costing $250,000 would mean you are responsible for $50,000. There is no ceiling on this 20% liability.

This is precisely why nearly half of Colorado's Original Medicare beneficiaries-47% according to the Kaiser Family Foundation-have secured a Medigap policy. They have opted for the peace of mind that comes with predictable healthcare costs. A Medigap plan effectively converts that unlimited 20% risk into a fixed, manageable monthly premium, allowing you to budget for your healthcare with confidence and certainty. For official details on what Medicare covers, visit Medicare coverage information.

How Medigap Plans Are Standardized

To make shopping easier and protect consumers, Medigap plans were standardized by federal and state laws under the Omnibus Budget Reconciliation Act of 1990. This means each plan letter (e.g., Plan G) must offer the exact same set of core benefits, regardless of the insurance company selling it. A Plan G from Company X provides the identical medical coverage as a Plan G from Company Y. This allows you to focus your comparison on two key factors:

price and the company's reputation for customer service and rate stability.

Key features of standardized plans include:

- Guaranteed Renewability: Your policy cannot be canceled by the insurance company as long as you continue to pay your premiums. They cannot drop you if your health declines. While premiums can increase for an entire class of policyholders, your individual health status will not cause your policy to be terminated.

- Nationwide Portability: Your coverage remains the same even if you move to another state. While your premium will likely be adjusted to reflect the healthcare costs in your new location, your fundamental benefits are secure and portable across the U.S.

To see a side-by-side comparison of what each plan letter covers, Medicare offers an official tool at

Compare Medigap plan benefits.

What Are My Medicare Supplement Colorado Plan Options?

In Colorado, you can choose from up to ten standardized Medigap plans, labeled with letters A through N. Because the benefits of each plan letter are identical from one company to the next, your primary task is to find the right balance of comprehensive benefits and affordable cost for your personal situation. You are not comparing coverage, but rather price and service.

While several options exist, most Colorado residents find that a few key plans offer the best combination of value and protection. For a comprehensive look at what is available in our state, you can explore our detailed guide on More info about Medicare Plans in Colorado.

The Most Popular Plans: G, F, and N

Three plans consistently stand out for their popularity and robust value proposition:

- Plan G: This is the most popular and comprehensive plan for anyone who became eligible for Medicare on or after January 1, 2020. Plan G covers nearly all the gaps in Original Medicare. Once you have paid the annual Medicare Part B deductible ($240 in 2024), Plan G covers 100% of your remaining Medicare-approved costs. This includes all hospital deductibles and all of the 20% coinsurance. It offers exceptionally predictable costs for a reasonable premium. For more details, see our guide on

More info about Medicare Supplement Plan G in Colorado.

- Plan F: Often called the 'Cadillac' of plans, Plan F offers the most extensive coverage possible. It pays for everything Original Medicare does not, including the Part B deductible. However, due to a 2020 law change (MACRA), Plan F is only available to individuals who were eligible for Medicare before January 1, 2020. If you are eligible, it provides first-dollar coverage with no out-of-pocket costs for Medicare-approved services.

- Plan N: This plan is an excellent choice for healthy, budget-conscious individuals seeking a lower monthly premium in exchange for some predictable cost-sharing. With Plan N, you will pay small copayments for doctor visits (up to $20) and emergency room visits (up to $50, which is waived if you are admitted to the hospital). Plan N does not cover Part B excess charges (an extra amount some doctors can charge), but these are rare in Colorado. The premium savings compared to Plan G can be substantial.

Comparing Key Medigap Plan Benefits

All Medigap plans cover basic benefits like Part A hospital coinsurance. The primary differences lie in coverage for deductibles, skilled nursing, excess charges, and foreign travel. This table highlights the benefits of some popular plans.

| Benefit | Plan A | Plan D | Plan G | Plan N |

|---|---|---|---|---|

| Part A Coinsurance & Hospital Costs | Yes | Yes | Yes | Yes |

| Part B Coinsurance/Copayment | Yes | Yes | Yes | Yes (with copays) |

| First 3 Pints of Blood | Yes | Yes | Yes | Yes |

| Part A Hospice Coinsurance | Yes | Yes | Yes | Yes |

| Skilled Nursing Facility Coinsurance | Yes | Yes | Yes | |

| Part A Deductible | Yes | Yes | Yes | |

| Part B Excess Charges | Yes | |||

| Foreign Travel Emergency | Yes | Yes | Yes |

Other Available Plans in Colorado

While G and N are the most common choices, other plans serve specific needs:

- Plan A: The most basic plan, covering core benefits like hospital and medical coinsurance at the lowest premium. It is a no-frills safety net.

- Plan D: A solid mid-range option that mirrors Plan G's coverage but does not cover Part B excess charges. It is less common now that Plan G has become the standard.

- High-Deductible Plan G: This plan offers the same comprehensive coverage as a standard Plan G, but only after you meet a high annual deductible ($2,800 in 2024). In exchange, you pay a very low monthly premium. It is an excellent option for healthy individuals who want a safety net against catastrophic costs but can handle routine expenses themselves.

- Plans K and L: These plans feature a cost-sharing model where the plan pays a percentage (50% for K, 75% for L) of most covered services until you reach an annual out-of-pocket limit. They offer lower premiums but less predictability than other plans.

In Colorado, these plans are offered by a variety of trusted national and regional insurance companies.

Medigap Costs and Enrollment in Colorado

Securing the right

medicare supplement Colorado plan involves two critical components: understanding the monthly premium and, most importantly, enrolling at the correct time. These plans require a monthly premium in addition to your standard Medicare Part B premium, but they provide financial protection that can be worth many times the cost.

Timing your enrollment correctly is the single most important factor in securing coverage at the best price and guaranteeing your access. For detailed steps on the application process, visit our page: More info about applying for Medicare in Colorado.

How Much Does a Medicare Supplement Colorado Plan Cost?

The average Medigap premium in Colorado is around $200 per month, but this figure can be misleading as your actual cost will vary significantly. For instance, a 65-year-old female non-smoker in Denver might find a Plan G premium for as low as $120, while another company might charge over $300 for the identical plan. This price difference is due to how each company assesses risk and prices its policies, not a difference in benefits.

Key factors that influence your premium include:

- Age: Younger enrollees (at age 65) receive the lowest rates.

- Gender: Actuarial data often results in slightly different rates for men and women.

- Tobacco Use: Smokers and recent tobacco users can expect to pay significantly higher premiums.

- Location: Premiums vary by ZIP code to reflect local healthcare costs and utilization.

- Pricing Method: Companies use one of three methods to set premiums. Issue-age rated policies are based on your age when you buy the policy and do not increase as you get older (though they can rise due to inflation). Attained-age rated policies start lower but increase as you age. Community-rated policies charge the same premium to everyone in a specific area, regardless of age. Understanding which method a company uses is key to predicting long-term costs.

The Best Time to Enroll: Your Medigap Open Enrollment Period

This is the most important rule of Medigap: the best time to enroll is during your

Medigap Open Enrollment Period. This is a one-time, non-repeatable, six-month window that begins on the first day of the month you are both 65 or older and enrolled in Medicare Part B.

During this protected period, you have guaranteed issue rights. This means insurance companies cannot:

- Deny you coverage for any Medigap policy they sell.

- Charge you a higher premium because of your health history or pre-existing conditions.

- Impose a waiting period for coverage of pre-existing conditions.

Missing this window can be a costly mistake. If you apply later, you will almost certainly have to go through medical underwriting. Insurers will ask detailed health questions, and they can deny your application or charge much higher rates based on your health status. For official details, visit

Medicare Enrollment and Eligibility information.

What Are Guaranteed Issue Rights?

Outside of your Open Enrollment Period, you may still have guaranteed issue rights in specific situations, usually when you lose other health coverage through no fault of your own. These rights allow you to buy certain Medigap policies without medical underwriting.

Common situations that trigger these rights include:

- Your employer-sponsored retiree health plan is ending.

- You are in a Medicare Advantage plan, and you move out of its service area, or the plan leaves your area.

- Your current Medigap insurance company goes bankrupt.

- You tried a Medicare Advantage plan for the first time when you turned 65 and want to switch back to Original Medicare within the first year (this is called a 'trial right').

These federal protections ensure you are not left without access to gap coverage due to circumstances beyond your control. To learn more about these special enrollment situations, see Medicare's guide on

when you can buy Medigap.

Medigap Coverage Structure and Flexibility

One of the greatest advantages of a

medicare supplement Colorado plan is the unparalleled freedom and flexibility it provides. Medigap policies work seamlessly with Original Medicare, putting you in the driver's seat of your healthcare decisions without the restrictive rules and networks common in other types of insurance.

Freedom of Choice: Any Doctor, Any Hospital, Anywhere

With a Medigap plan, you can

see any doctor or visit any hospital in the United States that accepts Medicare. There are no networks to worry about, and you never need a referral to see a specialist. This freedom is especially valuable for several reasons:

- Continuity of Care: You can keep the doctors you have known and trusted for years.

- Access to Specialists: You can self-refer to any specialist in the country for a second opinion or specialized treatment without needing permission.

- Travel and Relocation: Your coverage is portable. For Colorado 'snowbirds' who spend winters in warmer states, or for anyone who travels, this is a critical benefit. Your Medigap plan works the same in Florida or Arizona as it does in Boulder or Colorado Springs.

Medigap vs. Medicare Advantage: A Key Distinction

This freedom stands in stark contrast to Medicare Advantage (Part C) plans, which operate with provider networks, much like HMOs or PPOs. With an Advantage plan, you may be required to use specific doctors and hospitals, get referrals for specialists, and seek prior authorization for certain procedures. While Advantage plans often have lower premiums and may include extra benefits, they trade the freedom of Medigap for a managed care structure. Choosing between Medigap and Medicare Advantage is a fundamental decision based on your preference for freedom versus managed costs.

Predictable Costs and Financial Security

While Medigap plans typically have higher monthly premiums than Medicare Advantage plans, they offer superior predictability and fewer financial surprises. You are essentially trading unpredictable, potentially high out-of-pocket expenses for a fixed monthly premium. Once you have paid your premium (and the annual Part B deductible, for most plans), your major medical costs are covered. This financial predictability allows you to budget with confidence and focus on your health, not on deciphering complex medical bills. This structure provides a powerful sense of security, knowing that a health crisis will not become a financial crisis.

For more on insurance options in our state, visit our page on More info about Medicare Insurance in Colorado.

What Medigap Doesn't Cover and Where to Find Help

While

medicare supplement Colorado plans are excellent for covering the gaps in your medical costs under Parts A and B, they are not all-in-one health insurance. It is crucial to understand what they do not cover so you can make separate arrangements for these essential services.

Medigap plans generally do not cover:

- Prescription Drugs (requires a separate Part D plan)

- Routine Dental Care (such as cleanings, fillings, crowns, or dentures)

- Routine Vision Care (such as eye exams, eyeglasses, or contact lenses)

- Hearing Aids and exams for fitting them

- Long-Term Care (custodial care in a nursing home or assisted living facility)

For help with prescription drug coverage, see our guide on

More info about Colorado Medicare Part D Plans. For dental needs, explore

More info about Medicare Dental Plans in Colorado.

How to Get Prescription Drug Coverage

To cover your medications, you must enroll in a standalone Medicare Part D Prescription Drug Plan. These plans are sold by private insurers and work alongside your Original Medicare and Medigap policy. When choosing a Part D plan, it is vital to compare its formulary (the list of covered drugs), premiums, deductibles, and pharmacy network. These plans can change their costs and covered drugs every year, so it is wise to review your options annually during the Fall Open Enrollment Period (October 15 - December 7). For those who need financial assistance, the federal 'Extra Help' program can significantly lower Part D costs. You can find details here: Information on help with Part D costs.

How to Choose the Right Medicare Supplement Colorado Plan

Finding the best Medigap plan means matching a plan's benefits and costs to your personal health profile and financial situation. Start by assessing your health and budget. If you anticipate frequent medical care or want maximum predictability, a comprehensive plan like Plan G may be more cost-effective in the long run, despite a higher premium. If you are in excellent health and want to minimize your fixed monthly costs, a plan with more cost-sharing like Plan N or a High-Deductible Plan G could save you money.

Ask yourself these key questions:

- What is more important to me: the lowest possible monthly premium or the most comprehensive coverage with few to no out-of-pocket costs?

- Am I eligible for Plan F, or should I focus my comparison on Plan G and Plan N?

- How comfortable am I with small copayments for doctor visits in exchange for a lower premium (as with Plan N)?

- Do I want coverage for Part B excess charges, even though they are rare?

- Do I travel internationally and need the foreign travel emergency benefit?

Finding Local Assistance and Guidance

Navigating your Medicare options is easier with expert, unbiased help. Colorado's

State Health Insurance Assistance Program (SHIP) offers free, volunteer-based counseling to help you understand your choices. You can find more information at Colorado's SHIP program.

For personalized service, an independent insurance broker like Kelmeg & Associates, Inc. can provide invaluable guidance. We are contracted with multiple top-rated insurance companies in Colorado. This allows us to objectively compare plans and find the best fit for your specific needs and budget. Our services are provided at no cost to you, as we are compensated by the insurance companies. We are passionate about helping Colorado residents find coverage that brings true peace of mind. For more information, visit our page on More info about Medicare Insurance Brokers in Colorado.

Frequently Asked Questions about Medicare Supplement Plans in Colorado

Choosing a

medicare supplement Colorado plan brings up many important questions. Here are clear, straightforward answers to some of the most common ones we hear from Colorado residents.

Can I be denied a Medigap plan in Colorado?

It depends entirely on when you apply. During your one-time, 6-month

Medigap Open Enrollment Period, insurance companies

cannot deny you coverage or charge you more due to your health history. This period is your golden ticket to any plan you want, with no medical questions asked. This is a federal protection.

However, if you apply outside of this protected window (and do not have other guaranteed issue rights), insurers can and will use medical underwriting. This means they will review your health history, prescription drug records, and ask detailed health questions. Based on this information, they can deny your application, charge a significantly higher premium, or refuse to cover your pre-existing conditions for a waiting period.

Which Medigap plan is best in Colorado?

There is no single 'best' plan for everyone. The right choice is highly personal and depends on your individual health needs, budget, and tolerance for financial risk.

With that said, Plan G is the most popular option for new Medicare enrollees because it offers the most comprehensive coverage available today. It creates very predictable out-of-pocket costs, which many people value. Plan N is another excellent choice for those who prefer a lower premium and are comfortable with small, predictable copayments for doctor and ER visits. The best plan for you is the one that allows you to sleep at night, knowing you are protected financially.

Can I switch my Medigap plan?

Yes, you can apply to switch your Medigap plan at any time of the year. However, unless you have a specific guaranteed issue right, you will have to go through medical underwriting to be approved for the new plan. The new insurance company can charge you more or deny your application based on your current health.

Crucial advice: Never cancel your current Medigap policy until your application for the new one has been fully approved and you have the new policy in hand. This prevents a dangerous gap in your coverage if your application is unexpectedly denied.

What are Medicare Part B excess charges?

In some states, doctors who do not accept Medicare 'assignment' (the Medicare-approved amount as full payment) are legally allowed to charge up to 15% more than the Medicare-approved amount. This extra 15% is called an 'excess charge'. Medigap Plans G and F cover these charges. Plan N does not. While excess charges are not common in Colorado, having them covered by Plan G provides an extra layer of financial protection.

Are there Medigap plans for Coloradans under 65 on Medicare?

Yes. Federal law does not require insurance companies to offer Medigap plans to Medicare beneficiaries under age 65 (who are typically on Medicare due to a disability). However, Colorado is one of the states that mandates access. Insurers in Colorado must offer at least one Medigap plan (typically Plan A) to eligible individuals under 65. When that person turns 65, they get a new 6-month Medigap Open Enrollment Period and can then apply for any plan without medical underwriting.

Can my Medigap premium increase?

Yes, premiums can and usually do increase over time. Increases are typically due to inflation in healthcare costs and the overall claims experience of the group of policyholders you are in. How much and how often your premium increases can also depend on the pricing method the company uses (attained-age, issue-age, or community-rated). It is wise to ask about a company's rate increase history when shopping for a plan.

Conclusion

Choosing a medicare supplement Colorado plan is a critical decision that directly impacts your financial and physical well-being during your retirement years. These essential plans fill the significant and potentially devastating gaps left by Original Medicare, changing the risk of unpredictable medical bills into the stability of a manageable monthly premium.

Remember these key takeaways on your journey:

- Protect Yourself from Risk: Medigap is your shield against the unlimited 20% coinsurance of Original Medicare, which has no annual cap on your spending.

- Timing is Everything: Your one-time, 6-month Medigap Open Enrollment Period is the most important time to enroll. It guarantees your acceptance into any plan, regardless of your health history.

- Accept Freedom and Flexibility: Enjoy the unparalleled ability to see any doctor or visit any hospital that accepts Medicare, anywhere in the nation, without needing referrals.

- Complete Your Coverage: Remember to secure a separate Medicare Part D plan for your prescription drugs to avoid late enrollment penalties and high medication costs.

At

Kelmeg & Associates, Inc., we firmly believe this decision should not be a source of stress or confusion. We provide

expert, no-cost guidance to help Colorado residents steer their options with clarity and confidence. With local offices serving Lafayette, Broomfield, Boulder, and Adams County, we understand the unique aspects of the Colorado market and are dedicated to finding the plan that fits your life perfectly.

Do not leave your healthcare and financial future to chance. Take the next step to secure coverage that offers true, lasting peace of mind.

Get personalized help with your Colorado Medicare supplemental insurance