Budget-Friendly Health Plans Your Employees Will Actually Love

Why Budget-Friendly Health Plans Are Essential for Modern Businesses

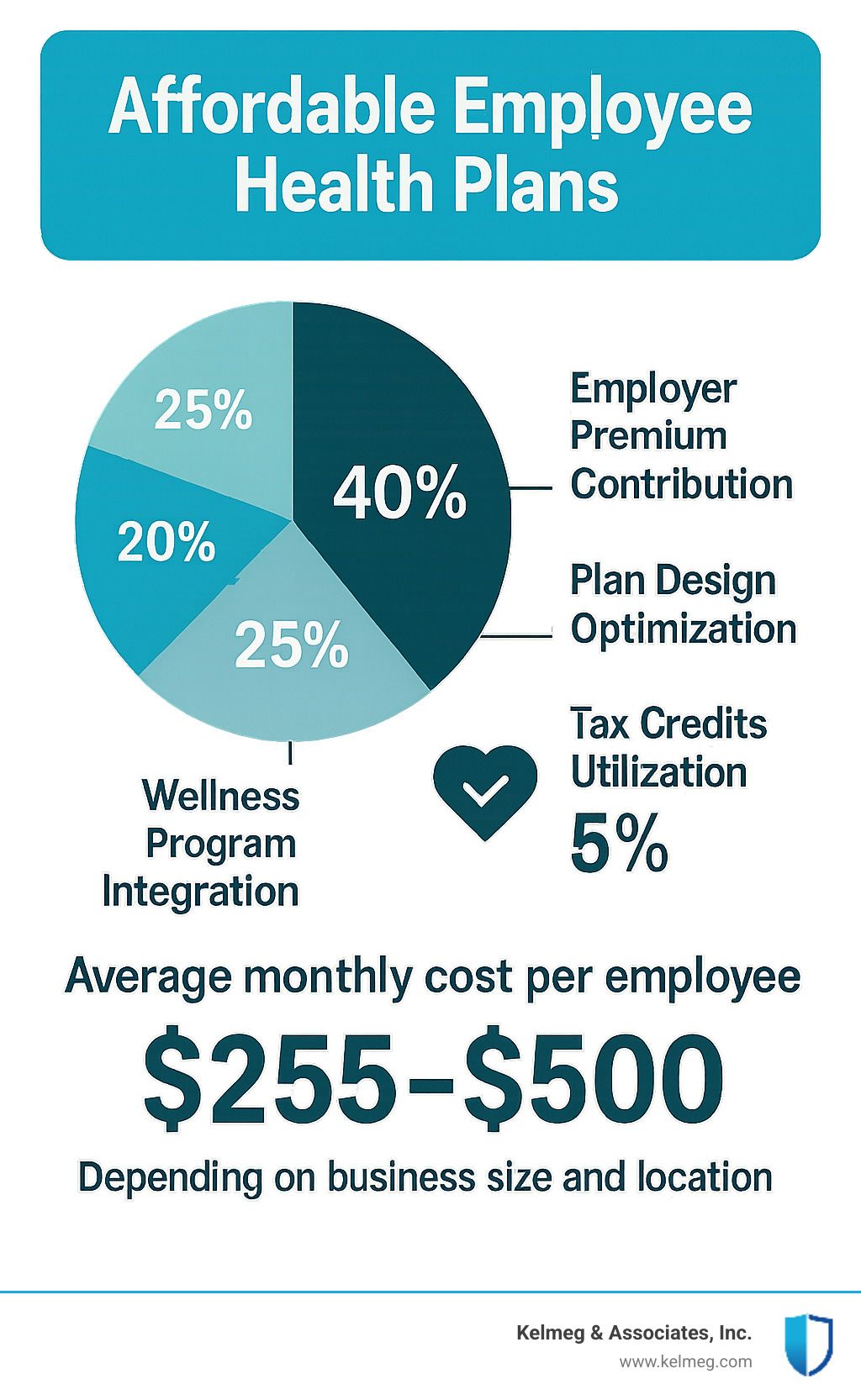

Affordable employee health plans are more critical than ever for attracting and keeping top talent. Here's what makes a health plan truly affordable:

• Employer contribution strategy - Contributing 50-70% of premiums

• Smart plan design - High-deductible plans paired with HSAs

• Flexible funding models - Level-funded plans can save up to 30% for healthy groups

• Tax advantages - Small businesses can claim up to 50% of premiums as tax credits

• Essential benefits bundling - Preventive care, telehealth, and prescription coverage at $0 copay

The numbers tell a compelling story. Research shows that 87% of job candidates say healthcare benefits are the most important employer provision after wages. Meanwhile, businesses offering comprehensive health coverage see a 47% increase in worker tenure compared to those without benefits.

But here's the challenge: premium costs keep rising while small business budgets stay tight. The good news? You don't need deep pockets to offer health plans your employees will love. With the right strategy, businesses with as few as 2 employees can access competitive group rates and potentially save hundreds per employee annually.

As Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., I've helped countless Colorado businesses design affordable employee health plans that balance cost with comprehensive coverage. My experience shows that with proper guidance, even the smallest employers can offer benefits that rival those of Fortune 500 companies.

What Makes an Employee Health Plan Affordable?

The secret to affordable employee health plans isn't finding the cheapest option—it's finding the smartest one. I've learned from years of helping Colorado businesses that true affordability comes from understanding the complete picture, not just the monthly premium sticker price.

Let's break down the real math behind health plan costs. Your employees care about their total annual healthcare spending, which includes monthly premiums, deductibles, copays, and out-of-pocket maximums all rolled together. A plan with a $400 monthly premium might seem budget-friendly until your team faces that $5,000 deductible. Meanwhile, a $500 premium plan with a $1,500 deductible often saves employees money when they actually need medical care.

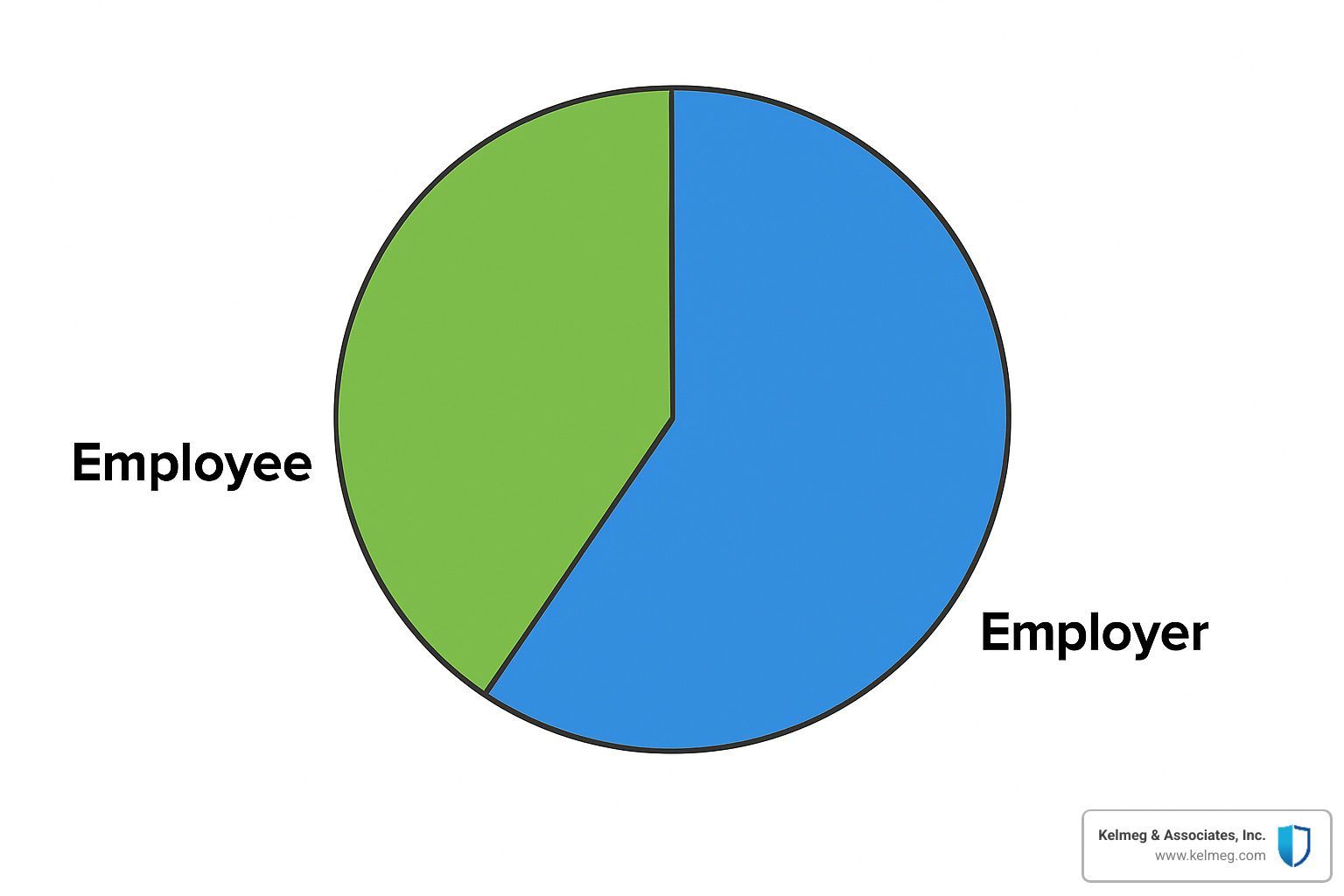

The employer contribution percentage is where the magic happens for affordability. Most competitive Colorado employers I work with contribute between 50-80% of employee premiums. The sweet spot we've found? Contributing 70% toward employee coverage and 50% toward family plans. This approach keeps your costs predictable while making coverage genuinely affordable for your team.

Don't forget about the federal tax advantages that can dramatically improve your bottom line. Small businesses can claim significant tax credits for providing health coverage, and all employer contributions are fully deductible as business expenses. When you factor in these savings, offering health benefits often costs far less than the initial premium numbers suggest.

Employee Only

$645

$612

Employee + Family

$1,837

$1,763

Source: Kaiser Family Foundation 2023 Employer Health Benefits Survey

The recruitment return on investment speaks for itself. When you offer quality health coverage, you're not just providing a benefit—you're investing in a competitive advantage that helps you attract better candidates and negotiate more effectively during hiring conversations.

Why Affordable Employee Health Plans Matter for Businesses

Here's something that might surprise you: affordable employee health plans aren't just a nice-to-have perk anymore—they're a business strategy that directly impacts your bottom line. The numbers don't lie, and they're pretty compelling.

Companies offering health insurance see 47% longer employee tenure compared to those without benefits. Think about what that means for your business. Less time interviewing candidates, less money spent on job postings, and way less stress trying to replace good people who left for better benefits elsewhere.

The productivity gains are equally impressive. Employees with health coverage take fewer sick days and actually seek preventive care instead of waiting until they're really sick. We're talking about 23% fewer missed workdays annually when employees have access to preventive services at no cost.

But here's the part I find most interesting: when your team isn't worried about medical bills, they're more focused at work. They're not distracted by health concerns or spending work time researching expensive treatment options. They're present, engaged, and more likely to refer other quality candidates to your business.

Reduced absenteeism isn't just about fewer sick days—it's about having a team that shows up mentally and physically ready to do their best work. That's the kind of competitive advantage that's hard to put a price tag on.

Legal Requirements & Tax Advantages for Small Employers

Here's some breathing room for small business owners: if you have fewer than 50 full-time equivalent employees, you're not legally required to provide health insurance. The ACA's shared responsibility payment doesn't apply to you, which means offering coverage is a choice, not a mandate.

But here's where it gets interesting—choosing to offer health benefits can open up some serious tax advantages that make coverage surprisingly affordable.

The federal small business health care tax credit is a game-changer for eligible employers. You can claim up to 50% of premium costs (35% for nonprofits) if you have fewer than 25 full-time equivalent employees with average wages below $62,000. Even if you don't qualify for the full credit, all employer premium contributions are fully tax-deductible as business expenses.

Colorado offers additional support through state incentives and programs designed specifically for small employers. The administrative burden is lighter than many business owners expect, and the financial benefits often outweigh the initial investment.

For detailed information about federal requirements, tax credits, and enrollment periods, visit Healthcare.gov. The site has helpful calculators and resources specifically designed for small business owners navigating these decisions for the first time.

The bottom line? You have more flexibility and support than you might think when it comes to offering affordable employee health plans that work for both your budget and your team's needs.

Funding Models That Shape Affordability

Here's something most business owners don't realize: the way you fund your health plan can make a bigger difference in your costs than the actual benefits you choose. It's like the difference between buying a house, renting, or doing a rent-to-own deal—each approach has its own financial pros and cons.

When I first explain funding models to clients, I often see their eyes glaze over. But stick with me here, because understanding these options is where the real savings happen. I've watched Colorado businesses cut their health insurance costs by 15-30% annually just by switching to the right funding model for their situation.

The beauty of affordable employee health plans is that you have options. Most small businesses assume they're stuck with whatever their broker quotes them, but that's simply not true. Your funding choice affects everything from cash flow predictability to potential refunds at year-end.

Fully-Insured: Fixed Costs, Lower Risk

Think of fully-insured plans as the "set it and forget it" option. You pay set premiums every month, and the insurance company takes on all the risk. If one of your employees needs a $100,000 surgery, that's the carrier's problem, not yours.

This predictability comes at a cost, though. Under community rating rules, your healthy 20-something employees help subsidize the costs for other businesses with older, sicker workers. It's fair from a societal perspective, but it means you might be paying more than your group's actual health costs warrant.

For businesses just dipping their toes into group health insurance, fully-insured plans make perfect sense. You'll sleep well knowing exactly what you owe each month, and you won't get any surprise bills. The insurance company handles all the messy stuff like claims processing and customer service calls.

Level-Funded: Hybrid Savings Opportunity

Level-funded plans are my secret weapon for healthy small businesses. You get the predictable monthly payments of fully-insured plans, but with a twist—if your employees don't use much healthcare, you get money back.

Here's the magic: your monthly payment includes a claims reserve that covers expected medical costs, plus admin fees and stop-loss insurance. At the end of the year, if your group's actual claims are lower than what was budgeted, you receive a refund. I've seen healthy groups get back $50-200 per employee.

The real advantage is medical underwriting. Unlike fully-insured plans, level-funded arrangements can price your group based on your actual health profile. Scientific research on level-funded savings shows these plans can reduce costs by up to 30% for groups with good health profiles.

It's like getting a discount for being healthy, which frankly makes a lot more sense than the one-size-fits-all approach of traditional insurance.

Self-Funded: Maximum Flexibility, Higher Risk

Self-funded plans are the "big leagues" of employee benefits. Instead of paying premiums to an insurance company, you pay actual medical bills as they come in. A third-party administrator (TPA) handles the paperwork, but you're on the hook for the costs.

The upside is incredible flexibility. Thanks to ERISA preemption, self-funded plans aren't bound by state insurance regulations. You can design benefits exactly how you want them, choose your own provider networks, and implement creative cost-control strategies.

You'll definitely need aggregate stop-loss insurance to protect against catastrophic claim years—imagine if three employees all needed major surgeries in the same year. The financial risk is real, which is why self-funding typically makes sense only for larger groups with 100+ employees.

For the right business, though, self-funding offers best control over your healthcare dollars. You're essentially cutting out the insurance company's profit margin and keeping those savings for yourself.

Essential Benefits Employees Expect—Without Blowing the Budget

Here's the thing about today's employees—they know what good health coverage looks like, and they're not shy about expecting it. The good news? You can absolutely deliver comprehensive benefits without emptying your business bank account.

Your team expects the basics covered: preventive care, office visits, emergency services, prescription drugs, and mental health support. These aren't luxury add-ons anymore—they're table stakes for attracting quality employees. But here's where it gets interesting: many of these benefits actually save you money in the long run.

Take preventive care, for example. Most plans now cover annual wellness checkups, vaccinations, and routine screenings at $0 copay. This might seem like you're giving away free services, but you're actually investing in keeping your team healthy and out of expensive emergency rooms.

Telehealth has completely changed the game for smart employers. Virtual visits typically run $40-60 compared to $200+ for urgent care visits. When your employee can video chat with a doctor about that persistent cough instead of rushing to urgent care, everyone wins. Your employee gets faster care, and your plan saves money.

Don't overlook prescription coverage and mental health services—these benefits show you care about your team's complete wellbeing. With mental health claims rising, having solid coverage for therapy and counseling isn't just compassionate, it's practical business sense.

Designing Affordable Employee Health Plans That Wow

Creating affordable employee health plans that genuinely impress your team comes down to smart architecture, not big budgets. Think of it like designing a house—you want solid bones with thoughtful details that make people feel at home.

Offering multiple plan options is your secret weapon. Set up a high-deductible health plan paired with an HSA for your budget-conscious employees, alongside a traditional PPO for those who prefer predictable copays. This way, everyone gets to choose what works for their situation and wallet.

Metal tier selection can make or break your strategy. Bronze plans offer rock-bottom premiums but sky-high deductibles that can shock employees when they need care. Silver plans hit the sweet spot for most teams—reasonable premiums with manageable out-of-pocket costs. Gold and platinum plans work beautifully when you want your contribution dollars to have maximum impact.

Here's a money-saving tip that surprises many employers: bundling dental and vision coverage often costs less than buying separate policies. Many carriers offer package discounts when you combine medical, dental, and vision under one roof. Your employees get comprehensive coverage, and you get better rates.

The real magic happens when you focus on cost-effective networks and high-deductible health plans paired with HSAs. HDHPs lower your premium costs while HSAs give employees tax-free money for healthcare expenses. It's a win-win that makes healthcare more affordable for everyone.

Wellness & Rewards Programs That Reduce Claims

Let's talk about wellness programs—and no, I don't mean expensive gym memberships or elaborate health fairs. Smart wellness programs are actually proven cost-control strategies that can slice 15-25% off your claims costs over time.

Digital health coaching, step challenges, and vaccination incentives create real engagement while encouraging healthier habits. Some of our clients have seen remarkable results with simple programs—employees walking more, getting flu shots, completing annual screenings. These small actions add up to big savings.

The trick is making participation easy and genuinely rewarding. Annual health screenings, on-site flu shot clinics, or friendly fitness challenges work because they fit into people's lives. When employees feel supported in staying healthy, they're less likely to end up with expensive chronic conditions.

Many carriers sweeten the deal with premium discounts or HSA contributions for employees who complete wellness activities. Programs like My Rewards Center make it simple to track participation and distribute rewards.

The best part? Wellness programs create a culture of health that goes far beyond insurance claims. When your team feels like you're invested in their wellbeing, they're more engaged, more productive, and more likely to stick around. That's the kind of return on investment every business owner can appreciate.

Cost-Control & Cost-Sharing Strategies That Work

The art of creating affordable employee health plans often comes down to smart cost-sharing strategies. Think of it like splitting the dinner bill—everyone needs to contribute fairly, but nobody should walk away feeling taken advantage of.

The sweet spot we've found with Colorado businesses is when employers contribute enough to show they value their team, while employees contribute enough to make thoughtful healthcare decisions. This usually means employers covering 70-80% of employee premiums and 50-60% of family coverage.

Reference-based pricing is gaining traction as a cost-control tool that can reduce premiums by 10-20%. Instead of accepting whatever hospitals charge, these plans pay based on a percentage of Medicare rates. It sounds complicated, but it simply means more predictable costs for common procedures.

Narrow networks offer another path to savings without sacrificing quality. By partnering with specific healthcare systems that agree to discounted rates, these plans can significantly reduce premiums while still providing excellent care access. The key is ensuring the network includes providers your employees actually want to see.

Value-based care arrangements reward providers for keeping patients healthy rather than performing more procedures. These programs often include improved preventive care and care coordination, which means better health outcomes and lower costs over time.

Consumer-directed health accounts like HSAs and HRAs put employees in the driver's seat of their healthcare spending. When paired with high-deductible plans, these accounts provide triple tax advantages while encouraging more thoughtful healthcare decisions. Employees save money on taxes, and employers benefit from lower premium costs.

Funding Assistance & Alternative Options

Sometimes the best affordable employee health plans aren't traditional group insurance at all. Individual Coverage Health Reimbursement Arrangements (ICHRAs) let you reimburse employees for individual health insurance premiums tax-free. This works especially well for businesses with diverse employee needs or those in multiple states.

Qualified Small Employer HRAs (QSEHRAs) offer an even simpler approach for businesses with fewer than 50 employees. You can reimburse up to $5,850 per employee annually for health insurance premiums and qualified medical expenses. No group insurance required.

Association health plans allow small businesses to band together for better rates and broader coverage options. It's like joining a buying club for health insurance—the collective purchasing power often results in better deals than individual businesses could negotiate alone.

Colorado businesses have unique opportunities through programs like the Colorado Option, which aims to provide more affordable health insurance options. These state-specific initiatives can offer additional savings for qualifying employers. For detailed information about Colorado-specific options, visit More info about Colorado Group Insurance Plans.

Balancing Quality and Budget During Plan Selection

Creating the perfect balance between comprehensive coverage and manageable costs starts with understanding what your employees actually value. We always recommend employee surveys before plan selection—you might be surprised to learn that your team would prefer lower premiums over lower copays, or vice versa.

Benchmark data becomes your best friend during this process. We help clients compare their benefits packages against similar businesses in their industry and region. This ensures you're competitive enough to attract talent without overspending on benefits that won't be appreciated.

Broker negotiation can uncover savings that aren't immediately obvious. Carriers often have flexibility in pricing, especially for groups with good claims experience or those willing to commit to multi-year agreements. Having an experienced broker handle these negotiations can result in meaningful savings.

Network adequacy deserves special attention because it directly impacts employee satisfaction. A plan with fantastic benefits but limited provider access will frustrate your team and potentially cost more in out-of-network charges. We always verify that preferred doctors and hospitals are included before recommending any plan.

The goal isn't to find the cheapest plan—it's to find the plan that delivers the best value for your specific situation. Sometimes paying slightly more upfront results in significant savings through better employee satisfaction, reduced turnover, and fewer surprise medical bills.

How to Compare & Enroll in Affordable Employee Health Plans

Shopping for affordable employee health plans feels like solving a puzzle with moving pieces. The good news? You don't need to figure it out alone. With the right approach and timeline, you can find coverage that makes both your budget and your employees happy.

The secret to successful plan comparison starts with good preparation. Before you even request your first quote, gather your employee census data—their ages, zip codes, family status, and any feedback about current coverage. This information helps insurance carriers provide accurate quotes instead of ballpark estimates that change later.

When you're ready to compare options, don't fall into the premium-only trap. A plan with a $450 monthly premium might actually cost your employees more than a $500 plan when they need care. Look at the total cost picture including deductibles, copays, and network access.

Step-by-Step Enrollment Guide

Starting your search 60-90 days before your target date gives you breathing room to make smart decisions. Rushing through plan selection in two weeks often leads to regrets later.

Your contribution strategy needs to be nailed down early in the process. Will you cover 70% of employee premiums and 50% of family coverage? Do you want to contribute to HSAs or offer wellness incentives? These decisions shape which plans make financial sense.

The behind-the-scenes work matters just as much as plan selection. Your payroll integration needs to handle new deduction amounts and timing. You'll also need to prepare compliance documents and enrollment materials that explain the benefits clearly to your team.

Don't forget about the onboarding timeline. Employees need time to understand their options, especially if you're offering multiple plan choices or introducing HSAs for the first time.

For step-by-step guidance custom to small businesses, our detailed resource at Group Health Insurance for Small Business walks you through every decision point.

Extra Support & Resources from Major Carriers

Here's something many employers don't realize: most insurance carriers provide valuable extras that don't cost you anything additional. Telemedicine apps can save your employees hundreds on urgent care visits. 24/7 nurse lines help them decide whether that midnight fever needs emergency attention or can wait until morning.

Cost estimator tools help employees budget for procedures and find the most affordable providers in their network. Some carriers even offer pharmacy discount programs that work alongside your prescription benefits to reduce out-of-pocket costs.

Many group accounts get assigned a dedicated customer service representative who knows your company's specific plan details. This person becomes your go-to for enrollment questions, claims issues, and plan management throughout the year.

The online member portals have gotten much better too. Employees can access digital ID cards, search for specialists, track claims, and even estimate costs for upcoming procedures. These tools reduce administrative headaches for you while empowering employees to make informed healthcare decisions.

For federal employees exploring specialized options, resources like Visit Aetna Federal Plans provide comparison tools designed for government workers' unique needs.

You're not just buying insurance—you're choosing a partner for your employees' healthcare journey. The right carrier support can make the difference between a benefits program that works smoothly and one that creates constant frustration.

Frequently Asked Questions about Affordable Employee Health Plans

Are small businesses legally required to offer coverage?

Here's some relief for small business owners: if you have fewer than 50 full-time equivalent employees, you're not legally required to provide health insurance under the Affordable Care Act. The ACA's employer mandate only kicks in once you reach that 50-employee threshold.

But here's the thing—just because you don't have to offer coverage doesn't mean you shouldn't consider it. Affordable employee health plans can be your secret weapon for attracting top talent, especially when competing against larger companies.

The tax benefits alone often make coverage surprisingly affordable. Small businesses can claim up to 50% of premium costs as tax credits, and all employer contributions are fully tax-deductible. When you factor in reduced turnover costs and increased productivity, offering health benefits often pays for itself.

Which factors influence premium costs the most?

Geographic location tops the list when it comes to premium costs. Here in Colorado, you'll pay significantly more for coverage in Denver or Boulder compared to rural areas like Sterling or Alamosa. The difference can be 40-50% between urban and rural markets.

Employee age demographics come in second. A group of 25-year-olds will pay much less than a group of 55-year-olds, even for identical coverage. This is why some businesses with younger workforces can offer generous benefits at surprisingly low costs.

Plan design choices round out the top three factors. High-deductible plans with HSAs cost significantly less than traditional PPO plans with low deductibles. The funding model matters too—level-funded and self-funded arrangements consider your group's actual health status, while fully-insured plans use community rating.

Can wellness programs really lower employer expenses?

Absolutely, and the numbers are impressive. Well-designed wellness programs typically reduce healthcare costs by 15-25% over 2-3 years. But here's the key—it's not about fancy gym memberships or expensive health fairs.

The most effective programs focus on preventive care and chronic disease management. Simple initiatives like annual health screenings, flu shot clinics, and digital health coaching deliver the best return on investment. When employees catch health issues early, everyone saves money.

The real magic happens with engagement. Programs that make participation easy and rewarding—like step challenges with small prizes or HSA contributions for completing wellness activities—create lasting behavior changes. We've seen businesses save hundreds per employee annually just by encouraging preventive care visits.

Wellness programs are a long-term investment. You might not see dramatic savings in year one, but by year three, the compound effect of healthier employees, fewer sick days, and reduced claims creates substantial cost savings for everyone involved.

Conclusion

Finding the perfect balance between comprehensive coverage and manageable costs doesn't have to feel like solving a puzzle blindfolded. Throughout this guide, we've explored how affordable employee health plans can become your secret weapon for attracting great talent without emptying your bank account.

The truth is, creating benefits that wow your employees comes down to making smart choices rather than big spending. Whether you choose a fully-insured plan for predictability, explore level-funded options for potential savings, or bundle ancillary benefits for better value, the right strategy can deliver impressive results.

What makes the biggest difference? Having someone in your corner who understands the ins and outs of Colorado's health insurance landscape. At Kelmeg & Associates, Inc., we've helped countless businesses across Lafayette, Broomfield, Boulder, Adams County, and throughout Colorado design benefits packages that work for real budgets and real people.

Here's what sets us apart: expert guidance at no extra cost. That means you get personalized advice, plan comparisons, and ongoing support without worrying about hidden fees or inflated premiums. We believe every Colorado business deserves access to quality benefits guidance, regardless of size.

The health insurance world changes constantly, but you don't need to become an expert overnight. We handle the complex stuff—comparing carriers, understanding funding models, navigating compliance requirements—so you can focus on running your business.

Ready to find what affordable employee health plans could look like for your team? We'd love to chat about your specific situation and explore options that make sense for your budget and goals. Sometimes the best decisions start with a simple conversation.

For comprehensive information about employer group benefits and how we can help your business thrive, visit: More info about Employer Group Benefits.