Colorado Medicare Advantage Plans Made Simple

Colorado Medicare Advantage Plans: Your 2025 Guide

Medicare Advantage plans in Colorado offer comprehensive healthcare coverage that combines hospital insurance (Part A), medical insurance (Part B), and usually prescription drug coverage (Part D) into one convenient plan. Here's what you need to know:

Available Plans

120 plans (down from 132 in 2024)

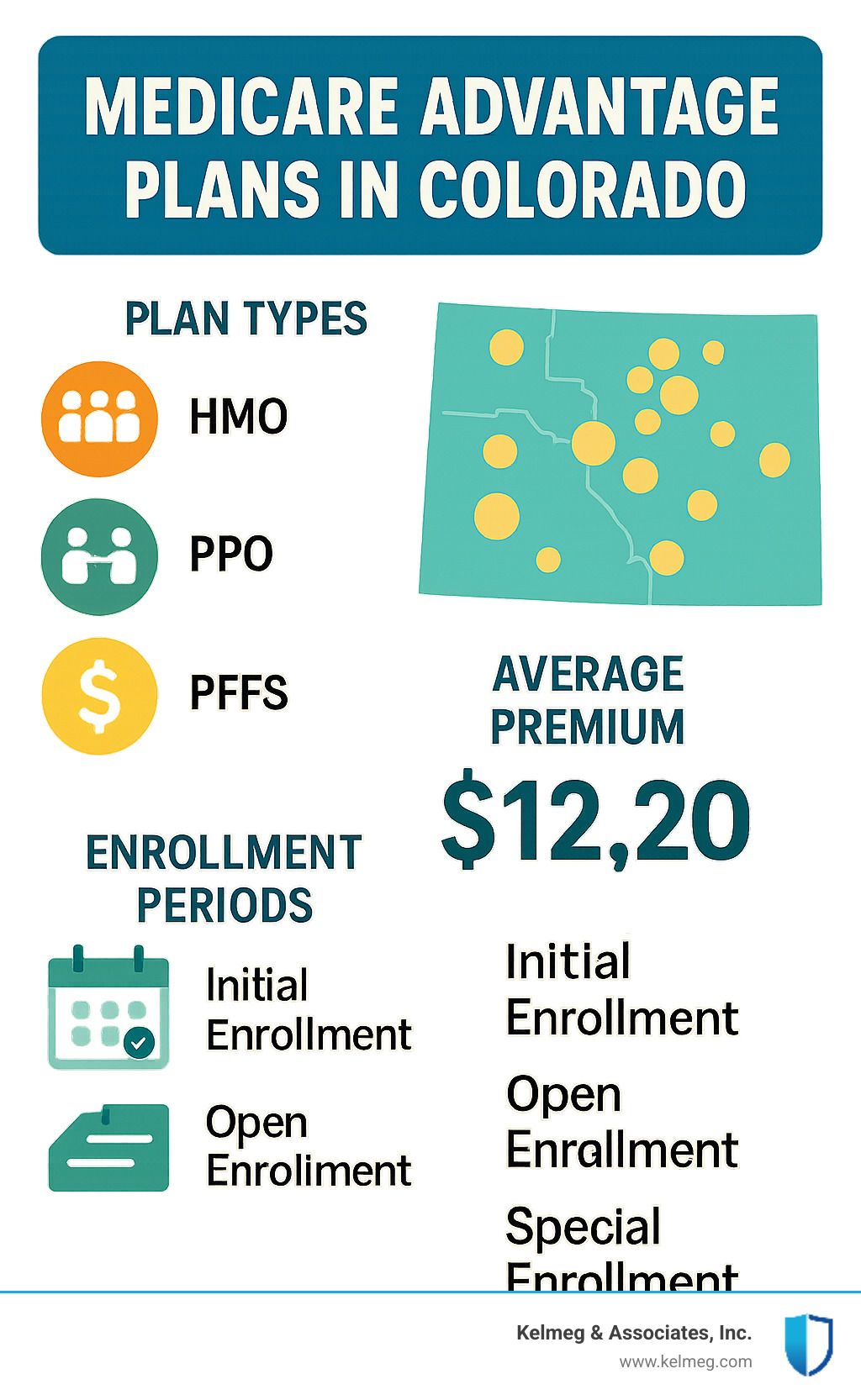

Average Monthly Premium

$12.20 (decreased from $15.11 in 2024)

$0 Premium Plan Availability

99.7% of Medicare-eligible Coloradans

Top-Rated Plans

UnitedHealthcare (5-star), Aetna (4.5-star)

Enrollment

Over 1 million Medicare beneficiaries

Medicare Advantage plans in Colorado offer more than just basic Medicare coverage. These plans typically include:

- Prescription drug coverage (Part D)

- Extra benefits like dental, vision, hearing, and fitness programs

- Out-of-pocket maximums for financial protection

- Coordinated care through provider networks

For 2025, Colorado residents have access to 120 Medicare Advantage plans, with premiums averaging $12.20 per month. Nearly all Medicare-eligible Coloradans (99.7%) can access at least one $0-premium plan.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I've helped hundreds of Colorado residents steer Medicare Advantage plans in Colorado to find coverage that matches their healthcare needs and budget. My expertise allows me to simplify complex Medicare options into clear, actionable guidance for our clients.

Medicare Advantage vs Original Medicare in Colorado

Deciding between Original Medicare and Medicare Advantage plans in Colorado feels a bit like choosing between a reliable sedan and a fully-loaded SUV. Both will get you where you need to go, but the features and experience are quite different!

Original Medicare (Parts A & B)

Original Medicare is the traditional government-run program that's been around since 1965. It gives you two essential pieces of coverage:

Part A covers your hospital stays, skilled nursing care after a hospital stay, hospice care, and some home health services. Most people don't pay a premium for Part A because they've already paid for it through payroll taxes during their working years.

Part B handles your doctor visits, outpatient care, preventive services, and medical supplies. In 2024, most people pay $174.70 monthly for Part B.

While Original Medicare provides good basic coverage, it leaves some pretty significant gaps in your healthcare safety net. There's no cap on what you might pay out-of-pocket in a year, which can be scary if you have a major health event. You're responsible for 20% of most Part B services with no upper limit.

For perspective, if you needed outpatient surgery costing $70,000, your 20% share would be $14,000 coming straight from your pocket. Ouch!

Plus, Original Medicare doesn't cover prescription drugs (you'll need a separate Part D plan), and you won't get coverage for routine dental care, vision exams, or hearing aids.

Medicare Advantage (Part C)

Medicare Advantage plans in Colorado take a different approach. These plans are offered by private insurance companies approved by Medicare and bundle your coverage into one convenient package.

Think of Medicare Advantage as "Medicare Part C" it includes everything Original Medicare covers, plus extras. Most plans include:

- Prescription drug coverage built right in

- An annual out-of-pocket maximum (between $3,500-$8,850) that caps your financial exposure

- Extra benefits like dental cleanings, eye exams, hearing aids, fitness memberships, and even allowances for over-the-counter items

The trade-off? Most Medicare Advantage plans in Colorado use provider networks, so you'll need to see doctors within that network to get the best coverage rates.

Monthly Premium

Part B: $174.70 (2024)

$0-$100+ (avg. $12.20 in 2025)

Provider Access

Any provider accepting Medicare nationwide

Network-based (HMO, PPO, etc.)

Referrals

Not required

May be required (plan dependent)

Out-of-pocket Maximum

None (unlimited exposure)

Yes ($3,500-$8,850)

Prescription Coverage

Requires separate Part D plan

Usually included

Extra Benefits

None

Often includes dental, vision, hearing, fitness

Travel Coverage

Nationwide coverage

May be limited to service area or emergencies

Colorado-Specific Differences

Colorado's unique landscape and population spread create some special considerations when choosing your Medicare path.

Mountain & Rural Access

Our beautiful Rocky Mountains and wide-open plains present unique healthcare challenges. If you live in a remote mountain town or rural eastern Colorado, Original Medicare might give you more flexibility since you can see any provider who accepts Medicare.

That said, many Medicare Advantage plans in Colorado have worked hard to expand their networks to include rural providers. If you live in Summit County or another mountain community, it's worth checking the provider networks before making your decision.

Provider Participation

Good news! About 96% of doctors in Colorado accept Medicare patients. However, not all of these providers participate in every Medicare Advantage plan's network.

Before enrolling in any plan, it's worth a quick call to your favorite doctors to make sure they're in-network. This simple step can save you from surprise bills down the road.

Travel Coverage

If you're among the many Coloradans who escape our winter months for Arizona or Florida (lucky you!), travel coverage matters:

Original Medicare travels with you throughout the entire United States. You can see any Medicare provider anywhere in the country.

Medicare Advantage plans in Colorado vary in their travel coverage. HMO plans typically only cover emergencies outside their service area, while PPO plans offer more flexibility with out-of-network coverage (though usually at higher costs).

Some national carriers offer Medicare Advantage plans with nationwide networks, perfect for snowbirds who want consistent coverage across state lines.

At Kelmeg & Associates, we specialize in helping you steer these choices based on your unique circumstances. Whether you're a mountain dweller, frequent traveler, or city resident, we'll help you find the Medicare solution that fits your lifestyle.

Eligibility, Enrollment Periods & Plan Types

Who Is Eligible for Medicare Advantage Plans in Colorado?

Thinking about joining a Medicare Advantage plan in Colorado? First, let's make sure you qualify. To enroll in Medicare Advantage plans in Colorado, you need to meet a few basic requirements:

You must already have both Medicare Part A and Part B (the foundation of Medicare), live within the plan's service area in Colorado, and... that's pretty much it! While there used to be restrictions for people with End-Stage Renal Disease, that limitation was removed in 2021, opening doors for more Coloradans.

Most folks become eligible for Medicare when they celebrate their 65th birthday. However, you might qualify earlier if you've been receiving Social Security Disability Insurance for 24 months, or if you have ALS or End-Stage Renal Disease.

Medicare Advantage plans in Colorado are offered on a county-by-county basis. The specific plans available to you depend on where you live in our beautiful state – whether that's along the Front Range, up in the mountains, or out on the eastern plains.

Enrollment Periods

Timing is everything when it comes to signing up for Medicare Advantage plans in Colorado. Here's when you can make your move:

Your Initial Enrollment Period spans seven months surrounding your 65th birthday – the three months before your birthday month, your birthday month itself, and the three months after. If you qualify through disability, your window starts three months before your 25th month of disability benefits.

The Annual Election Period runs from October 15 to December 7 each year. This is your yearly opportunity to switch plans, move from Original Medicare to Advantage, or vice versa. Any changes take effect January 1.

Already in a Medicare Advantage plan but having second thoughts? The Medicare Advantage Open Enrollment Period (January 1 - March 31) lets you switch to a different Advantage plan or return to Original Medicare.

Life happens, and Medicare understands that. Special Enrollment Periods can be triggered by events like moving to a new address, losing employer coverage, qualifying for Medicaid, or moving into a nursing facility.

For those who want only the best, the Five-Star Special Enrollment Period allows a one-time switch to a 5-star rated plan between December 8 and November 30. For 2025, UnitedHealthcare offers 5-star plans in Colorado.

Medicare Advantage Plan Types in Colorado

Colorado offers a variety of Medicare Advantage plan types, each with its own approach to providing care:

Health Maintenance Organization (HMO) plans keep things simple and affordable. With an HMO, you'll choose a primary care doctor, stay within a network of providers, and get referrals for specialists. Think of it as a more structured approach with predictable costs and generally lower premiums. The tradeoff? Less flexibility in choosing doctors.

If flexibility matters to you, Preferred Provider Organization (PPO) plans might be your best bet. These plans let you see any Medicare-accepting provider (though you'll pay less with in-network doctors). No need for a primary care physician or referrals – you're in the driver's seat. The cost? Usually higher premiums than HMOs.

Looking for a middle ground? HMO Point-of-Service (HMO-POS) plans blend HMO structure with some PPO flexibility. You'll have a primary network like an HMO, but with the option to go outside the network for certain services (typically at higher cost).

For the financially savvy, Medical Savings Account (MSA) plans combine a high-deductible health plan with a savings account. Medicare deposits money into your account to use for healthcare expenses. After reaching your deductible, the plan covers Medicare-approved services. Just note that most MSAs don't include drug coverage, so you'll need a separate Part D plan.

Understanding Special Needs Plans (SNPs)

Some Coloradans have unique healthcare needs that require specialized attention. That's where Special Needs Plans come in:

Dual-Eligible Special Needs Plans (D-SNPs) serve folks who qualify for both Medicare and Medicaid. These plans coordinate your benefits between both programs, often feature $0 premiums, and include valuable extras like transportation and meal delivery. D-SNPs in Colorado are available through carriers like UnitedHealthcare with their Dual Complete plans.

Living with a chronic condition? Chronic Condition Special Needs Plans (C-SNPs) are custom for people with specific health challenges like diabetes, heart failure, cardiovascular disorders, chronic lung conditions, or kidney disease. These plans offer specialized care management and provider networks with expertise in your specific condition.

For those in long-term care facilities, Institutional Special Needs Plans (I-SNPs) provide coordinated care for residents of nursing homes or those requiring equivalent care at home. These plans work closely with facilities to ensure seamless healthcare delivery.

All SNPs include prescription drug coverage and offer care coordination to help you steer the healthcare system – something that can be particularly valuable when managing complex health needs.

Need help determining which plan type is right for your situation? At Kelmeg & Associates, we're here to help you explore your Anthem Medicare Advantage plans in Colorado options and find the perfect fit for your healthcare needs and budget.

2025 Costs, Star Ratings & Extra Benefits

Cost Overview for 2025

Good news for Colorado Medicare shoppers! Medicare Advantage plans in Colorado are more affordable in 2025 than the previous year. The average monthly premium has dropped to just $12.20 (down from $15.11 in 2024), making these plans even more accessible.

Almost every Medicare-eligible Coloradan (99.7%) can find a $0 premium plan in their area. That's right – zero dollars per month for comprehensive coverage! Of course, you'll still need to pay your Medicare Part B premium ($174.70 monthly for most people in 2024), but the plan itself won't add to that cost.

When you're comparing plans, remember to look beyond the premium. Deductibles range from $0 to $545 for medical and prescription coverage, while copays and coinsurance vary significantly depending on the services you need and the plan you choose.

Part B Premium Reduction (Giveback)

Here's a little-known perk that could put money back in your pocket: some Medicare Advantage plans in Colorado actually help pay your Part B premium through what's called a "giveback" benefit. These plans contribute toward your monthly Part B premium – up to $60 in some Colorado plans!

For example, the AARP Medicare Advantage Patriot No Rx CO-MA04 (PPO) offers a giveback of up to $60 monthly. That's potential savings of $720 per year while still getting comprehensive coverage and extra benefits. It's like getting paid to have insurance!

Extra Benefits

One of the biggest advantages of Medicare Advantage plans in Colorado is the array of extra benefits beyond what Original Medicare covers. These extras can make a real difference in your healthcare experience and budget.

Most plans include dental coverage with preventive services like cleanings, exams, and X-rays often at $0 copay. Many also cover comprehensive services like fillings, extractions, and dentures, with annual allowances ranging from $500 to $2,500.

Your eyes and ears aren't forgotten either! Vision benefits typically include annual routine eye exams (usually $0 copay) and allowances of $100-$300 every 1-2 years for glasses or contacts. Hearing benefits generally cover annual exams and provide allowances of $500-$2,000 every 1-3 years for hearing aids and accessories.

Need vitamins, pain relievers, or first aid supplies? Many plans offer Over-the-Counter (OTC) allowances of $25-$125 quarterly that you can spend on these items. This benefit usually comes as a prepaid card or through a catalog ordering system.

Staying active is easier with fitness benefits like SilverSneakers®, included in most plans. This popular program gives you access to over 15,000 fitness locations nationwide, group exercise classes designed for seniors, and online fitness resources.

Many plans go even further, offering transportation to medical appointments, meal delivery after hospital stays, in-home support services, $0 copay telehealth visits, acupuncture, chiropractic care, and even allowances for groceries and utilities in some Special Needs Plans.

Star Ratings & Top-Rated Carriers

Not all Medicare Advantage plans are created equal, which is why the Centers for Medicare & Medicaid Services (CMS) rates them on a 1-5 star scale. These ratings help you identify high-performing plans.

For 2025, Colorado Medicare beneficiaries have access to excellence with UnitedHealthcare offering 5-star rated plans. Additionally, both Aetna and UnitedHealthcare provide 4.5-star rated plans in the state.

These ratings aren't arbitrary – they're based on over 40 quality measures across five categories: preventive care and screenings, managing chronic conditions, member experience, complaint handling, and customer service. Higher-rated plans typically deliver better care and higher member satisfaction.

One special advantage of 5-star plans: you can switch to them at any time during the year through a special enrollment period, not just during the typical enrollment windows!

Budgeting for Premiums & Out-of-Pocket Costs

When planning your healthcare budget, look beyond the monthly premium. Every Medicare Advantage plan in Colorado includes a maximum out-of-pocket limit – the most you'll pay for covered services in a year. This crucial financial safeguard ranges from about $3,500 to $8,850 in Colorado plans. Once you reach this limit, your plan pays 100% for covered services for the rest of the year.

If prescription costs are a concern, you might qualify for Extra Help (also called Low-Income Subsidy or LIS). This program reduces or eliminates drug premiums and deductibles while lowering prescription copays. For 2024, individuals with income below $21,870 ($29,580 for married couples) and limited assets may qualify.

Colorado also offers Medicare Savings Programs that help pay Medicare premiums and sometimes other costs like deductibles and coinsurance. These programs – QMB, SLMB, QI, and QDWI – have varying income and asset limits, with Colorado's limits often more generous than federal standards.

Good news about the dreaded "donut hole" – the Medicare Part D coverage gap has been closed. You'll never pay more than 25% for covered brand-name and generic drugs during this phase. However, if you take multiple medications, consider plans with additional gap coverage to keep your costs predictable throughout the year.

At Kelmeg & Associates, we've helped hundreds of Coloradans steer these options to find the perfect balance of coverage and cost. The right plan can save you thousands while providing better benefits than you might expect!

Comparing & Choosing Medicare Advantage Plans in Colorado

Finding your way through 120 Medicare Advantage plans in Colorado for 2025 might feel overwhelming at first. It's like standing at the base of one of our beautiful Colorado mountains the view is impressive, but you need a clear path to the top!

Comparing Medicare Advantage Plans in Colorado Step-by-Step

Let's break this journey down into manageable steps, just like we would for a mountain hike.

First, gather your medications list. Think of this as packing your essential gear note all prescription names, dosages, and how often you take them. Don't forget to include your preferred pharmacy. This information is your compass when comparing drug coverage between plans.

Next, map out your healthcare providers. Your doctors are like trusted trail guides you want to keep them on your journey if possible. Write down your primary care physician, specialists, preferred hospitals, and any labs or imaging centers you regularly visit. Checking if these providers are in-network could save you significant money.

Consider what matters most to you in healthcare coverage. Are you willing to pay higher monthly premiums for lower costs when you receive care? Do you value the freedom to see providers outside your network? Perhaps specific benefits like comprehensive dental coverage or hearing aids are essential for your quality of life. Maybe you travel frequently and need coverage that travels with you.

The Medicare Plan Finder at Medicare.gov is your trail map for this journey. Enter your ZIP code, county, medications, and preferred pharmacy to see plans custom to your needs. You can filter by plan type, sort by costs, and compare star ratings and extra benefits side by side.

Don't be fooled by looking at monthly premiums alone that's like judging a hiking trail solely by its starting point. Instead, calculate your estimated annual costs by multiplying the premium by 12 and adding expected drug costs, typical copays, and deductibles. Sometimes a plan with a higher monthly premium actually costs less overall because it offers better coverage for your specific needs.

Quality matters in healthcare just as much as it does in hiking gear. Check plan star ratings think of 4-5 stars as well-maintained trails, 3-3.5 stars as average paths, and below 3 stars as potentially rough terrain. Colorado is fortunate to have several 4.5 and 5-star plans available for 2025.

Understand how each plan's network restrictions might affect your care. HMO plans generally limit you to in-network providers except for emergencies, while PPO plans offer more flexibility but at higher costs for out-of-network care. Consider how these limitations align with your healthcare needs and travel habits.

Once you've selected your plan, enrollment is straightforward. You can sign up online through Medicare.gov, by calling 1-800-MEDICARE, directly through the insurance company, or with help from a licensed insurance agent who knows the terrain.

Online & Local Tools to Help You Decide

You don't have to steer Medicare Advantage plans in Colorado alone. Think of these resources as your hiking buddies, offering support along the way:

Medicare.gov serves as your comprehensive guidebook, with plan comparison tools, provider lookups, and educational resources all in one place.

The Colorado SHIP (State Health Insurance Assistance Program) offers free, unbiased Medicare counseling like having a personal guide who knows every trail in the state. They provide one-on-one assistance with plan selection, help understanding benefits, support with claims issues, and guidance on appeals. Reach them at 1-888-696-7213 when you need that personal touch.

The Senior Health Care & Medicare Assistance program through the Colorado Division of Insurance provides Colorado-specific resources and consumer protection information. They're especially helpful if you encounter problems with insurance companies.

At Kelmeg & Associates, Inc., our Medicare Licensed Insurance Agents in Colorado are like experienced trail guides who know every path and viewpoint. We provide personalized plan comparisons custom to your specific situation, offer expertise on local options, help determine if you qualify for money-saving programs, and assist with enrollment. Best of all, our services come at no additional cost to you we're compensated by the insurance companies when you enroll.

We're also proud to offer our Medicare Resource Center where you can find additional information and guidance on your Medicare journey.

Finding the right Medicare Advantage plan in Colorado doesn't have to feel like scaling a fourteener without a map. With the right resources and guidance, you can find a plan that offers the coverage, benefits, and value that perfectly match your healthcare needs and budget.

Assistance, Special Circumstances & FAQs

Navigating Medicare doesn't have to feel overwhelming. Let's walk through some helpful resources and answers to common questions about Medicare Advantage plans in Colorado that might make your journey a bit smoother.

Extra Help and Medicare Savings Programs

Are prescription costs stretching your budget thin? You're not alone. Many Colorado seniors qualify for financial assistance but don't know it.

Applying for Extra Help

Extra Help can save you thousands on prescription medications. For 2024, you might qualify if your income falls below $21,870 for individuals or $29,580 for married couples, with assets under $16,660 for individuals or $33,240 for married couples.

Applying is simpler than you might think:

- Visit SSA.gov to apply online

- Call Social Security at 1-800-772-1213

- Stop by your local Social Security office

- Work with your State Medicaid office

I recently helped a client save over $300 monthly on insulin and heart medications through Extra Help. Don't leave this money on the table!

Medicare Savings Programs (MSP) Income Limits

Colorado's Medicare Savings Programs can help cover your Medicare costs when money is tight. For 2024, here's approximately what you need to qualify:

For QMB (Qualified Medicare Beneficiary) which covers premiums, deductibles, and copayments, income limits are around $1,235 monthly for individuals and $1,663 for couples.

The SLMB (Specified Low-Income Medicare Beneficiary) program helps with Part B premiums only, with limits of about $1,478 for individuals and $1,992 for couples.

For QI (Qualifying Individual) assistance with Part B premiums, limits are roughly $1,660 for individuals and $2,239 for couples.

Colorado often has more generous asset limits than federal standards, so don't assume you won't qualify without checking first.

Special Circumstances

Life is rarely one-size-fits-all, and neither is Medicare coverage.

Employer & Retiree Coverage

Still working or have retiree health benefits? Smart move to compare them with Medicare Advantage plans in Colorado before making any decisions.

Always chat with your benefits administrator first—joining a Medicare Advantage plan might impact your employer coverage. Request a "creditable coverage" letter for your records, as this documentation can help you avoid penalties down the road.

One of my clients nearly lost valuable retiree coverage by enrolling in a Medicare Advantage plan without checking first. A quick conversation with her HR department saved her from a costly mistake.

VA & TRICARE Rules

Veterans and military families have unique considerations when exploring Medicare options.

If you have VA Benefits, you can absolutely pair them with a Medicare Advantage plan. Your VA benefits cover care at VA facilities, while your Medicare Advantage plan gives you access to non-VA providers. Just remember, you can't use VA benefits to cover Medicare Advantage copays or deductibles.

For those with TRICARE For Life, know that it works seamlessly with Original Medicare but not with Medicare Advantage. If you choose a Medicare Advantage plan, you'll need to use your plan's network providers. Many of my clients with TRICARE find that their existing coverage provides better value than available Medicare Advantage options.

Late-Enrollment Penalties

Nobody likes paying penalties, especially ones that stick around for life.

The Part B Penalty adds 10% to your standard Part B premium for each 12-month period you could have enrolled but didn't. This isn't a one-time fee—it continues for as long as you have Part B.

The Part D Penalty adds 1% of the national base beneficiary premium ($34.70 in 2024) times the number of months you went without creditable drug coverage. This extra amount gets tacked onto your monthly premium indefinitely.

Enrolling when first eligible or maintaining creditable coverage is the simplest way to avoid these costly penalties.

Drug Coverage & Formularies

Understanding how your medications are covered can save you hundreds—sometimes thousands—of dollars annually with Medicare Advantage plans in Colorado.

Formulary Tiers

Think of formulary tiers as a medication pricing menu. Most plans organize drugs into five tiers with increasing costs:

Tier 1 offers preferred generics with the lowest copays—often just a few dollars. Tier 2 includes non-preferred generics, while Tier 3 covers preferred brand-name drugs. Tier 4 medications are non-preferred brand-name drugs, and Tier 5 includes specialty medications with the highest costs.

I always recommend checking your specific medications' tier placement before enrolling in any plan. A drug's tier can make a dramatic difference in your monthly costs.

Step Therapy and Prior Authorization

Some plans use management techniques that might affect how quickly you can access certain medications:

Step therapy requires trying more affordable medications before covering pricier options. Prior authorization means your doctor must get plan approval before certain medications are covered. Quantity limits restrict how much medication you can receive in a specific timeframe.

While these rules can be frustrating, understanding them helps avoid surprise pharmacy counter sticker shock.

Preferred Pharmacy Networks

Where you fill your prescriptions matters almost as much as what you're filling. Many plans offer significantly lower copays at preferred pharmacies—sometimes $0 for generic medications. Standard network pharmacies typically charge higher copays, while non-network pharmacies may not be covered at all.

I recently helped a client save over $200 quarterly just by switching to her plan's preferred pharmacy for her regular prescriptions.

Coverage Gap Strategies

The coverage gap (or "donut hole") isn't as daunting as it once was, but costs can still add up. Consider asking about generic alternatives, checking if your plan offers additional gap coverage, exploring pharmaceutical assistance programs, or applying for Extra Help if eligible.

Reporting Medicare Fraud in Colorado

Medicare fraud isn't just wrong—it drives up costs for everyone. If something seems suspicious, trust your instincts and report it.

The Colorado Senior Medicare Patrol (SMP) at 1-800-503-5190 helps identify and report Medicare errors, fraud, and abuse. The Colorado Division of Insurance (1-303-894-7490 or 1-800-930-3745) handles complaints about insurance companies or agents. You can also contact the CMS Fraud Hotline directly at 1-800-MEDICARE.

When reporting, provide as many details as possible—dates, provider information, and descriptions of the suspicious activity all help investigators address the issue.

Frequently Asked Questions

What happens if I miss my enrollment window?

If you miss your Initial Enrollment Period, you'll generally need to wait until the General Enrollment Period (January 1-March 31) to sign up for Original Medicare, with coverage starting July 1. And yes, those late enrollment penalties we discussed earlier may apply.

For Medicare Advantage plans in Colorado, missing the Annual Election Period (October 15-December 7) typically means waiting until the next AEP unless you qualify for a Special Enrollment Period due to life events like moving or losing other coverage.

Can I switch plans during the Medicare Advantage Open Enrollment Period?

Absolutely! If you're already enrolled in a Medicare Advantage plan, you get a second chance to make a change during the Medicare Advantage Open Enrollment Period (January 1-March 31). You can switch to a different Medicare Advantage plan or return to Original Medicare and add a standalone Part D plan.

Just note that this period doesn't allow those on Original Medicare to join a Medicare Advantage plan—that's what the fall Annual Election Period is for.

Are $0-premium plans really free?

While "$0 premium" sounds like "free," it's important to understand the full picture. These plans don't charge an additional monthly premium beyond your Part B premium ($174.70 for most people in 2024), but you'll still have cost-sharing when you receive care.

Think of it like a restaurant with no cover charge—you still pay for what you order inside. These plans often have higher copays or coinsurance than plans with premiums, and network restrictions apply.

That said, $0-premium plans can offer excellent value for many people, especially those who are relatively healthy or budget-conscious. The true cost depends on your personal healthcare needs and usage.

Conclusion

Navigating Medicare Advantage plans in Colorado can feel like trying to find your way through a maze. But with the right guidance, you can find a plan that fits your healthcare needs like a well-worn pair of hiking boots comfortable, reliable, and suited to Colorado's unique terrain.

With 120 plans available for 2025, you have plenty of options. Think of your search like planning a trip through our beautiful Rocky Mountains you need the right map and sometimes a friendly guide who knows the territory.

When comparing plans, remember to look beyond just the monthly premium. A $0 premium plan might seem attractive at first glance like a "free" trail pass but you'll want to check what's waiting around the bend in terms of deductibles, copays, and out-of-pocket maximums. The true cost of your healthcare journey includes all these landmarks along the way.

Your relationship with your doctors matters too. Before setting out with a new plan, verify that your trusted healthcare providers are in-network. It's like making sure your favorite mountain lodge is open before planning your stay.

For those who take medications regularly, reviewing drug formularies is essential. Each plan's prescription coverage is unique some might cover your medications at $5 a month while others might charge $50 or not cover them at all. This difference alone can determine whether a plan is right for you.

Many Medicare Advantage plans in Colorado include extra benefits that Original Medicare doesn't cover dental care for that confident smile, vision coverage for enjoying Colorado's spectacular views, hearing benefits to catch every word of conversation with friends, and fitness programs to keep you active on our trails and in our communities.

At Kelmeg & Associates, Inc., we believe everyone deserves a knowledgeable companion on their Medicare journey. Our team of licensed insurance specialists serves neighbors throughout Colorado, from Lafayette to Broomfield, Boulder to Adams County, and we do it at no cost to you. We're your neighbors who understand Colorado's unique healthcare landscape.

We take the time to listen to your healthcare story your doctors, your medications, your priorities and help you find the plan that provides the best value and coverage for your unique situation. It's like having a friend who knows all the best trails and viewpoints.

For personalized assistance with Medicare Advantage plans in Colorado, reach out to our team at Kelmeg & Associates, Inc. today. We're here to help you steer your Medicare journey with the confidence of a Colorado native on a familiar mountain path.