Worker's Guide to Covid Insurance: Coverage When You Need It Most

Why Covid Insurance for Workers Remains Critical Today

Covid insurance for workers provides essential financial protection against illness, covering everything from medical bills to lost wages. While the federal government's emergency pandemic programs have ended, the need for robust coverage has not diminished-it has simply shifted. The responsibility now falls more heavily on individuals and employers to secure financial stability in the face of ongoing health risks. Understanding your options through employer benefits, private policies, and workers' compensation is the key to protecting your health and finances in this new landscape.

The pandemic starkly revealed how quickly a public health crisis can spiral into a personal financial one. For a time, unprecedented federal aid programs acted as a buffer. Today, with that aid gone, your primary safety nets are employer-sponsored and private insurance plans. The challenge now is ensuring long-term financial security, whether you're dealing with an initial infection, the debilitating effects of long COVID, or a workplace exposure claim. The financial domino effect is real: an unexpected illness can lead to mounting medical debt, lost income during recovery, and long-term impacts on your earning potential. Without a solid insurance strategy, a single health event can jeopardize years of financial planning.

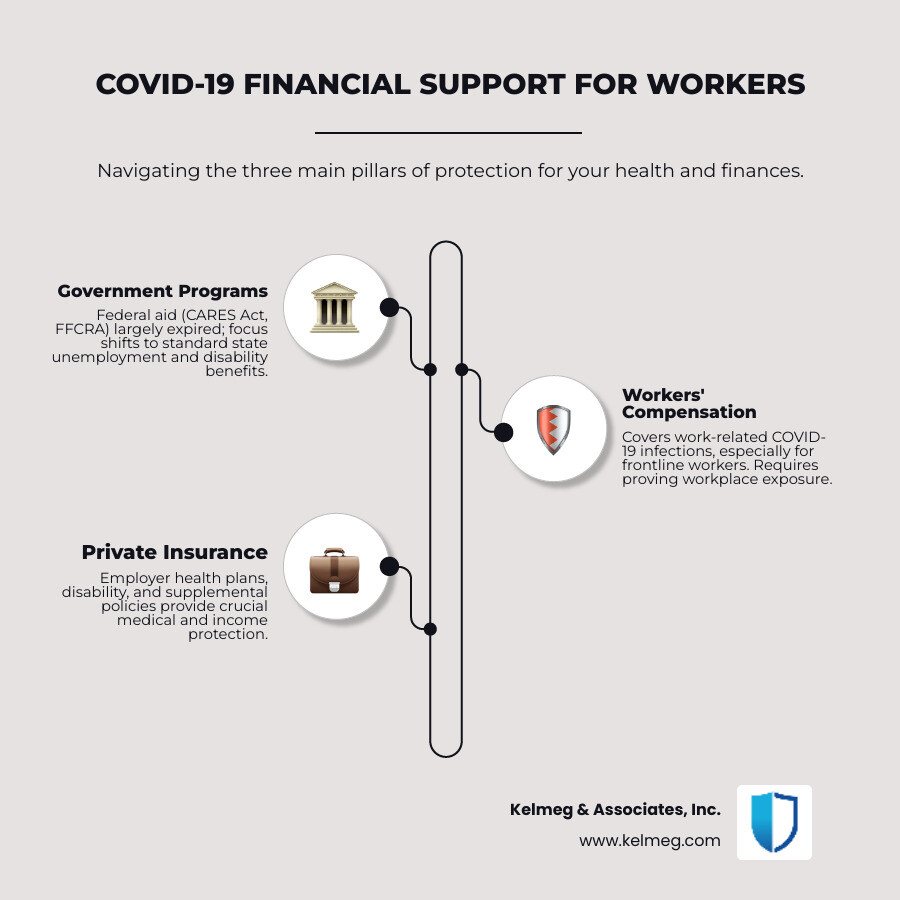

Key support systems for workers include:

- Government Programs: Most federal emergency programs have expired, but some state-level benefits or traditional programs like unemployment may still apply under specific circumstances.

- Workers' Compensation: This specialized insurance covers COVID-19 when it's proven to be a work-related illness, providing comprehensive medical and wage-replacement benefits.

- Private Insurance: This broad category includes employer-provided health plans, individual policies, disability insurance, and supplemental policies designed to fill specific financial gaps.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc. I've helped countless individuals and businesses steer the complexities of Covid insurance for workers both during the peak of the pandemic and in its aftermath. My experience has consistently shown that proactive, informed planning is the most effective strategy to safeguard your health and your financial future against uncertainty. The landscape has changed, but the need for protection is permanent.

Understanding Government COVID-19 Support Programs

When the pandemic hit, the federal government acted with unprecedented speed to create financial safety nets for millions of workers who were suddenly unemployed, quarantined, or caring for sick family members. These programs were a critical lifeline during a period of massive economic disruption, but their temporary nature underscores why private Covid insurance for workers is so essential for long-term security today.

The Past Federal Response: CARES Act and FFCRA

In March 2020, traditional state unemployment systems were completely overwhelmed and ill-equipped to handle the unique nature of the pandemic's economic fallout. The CARES Act(Coronavirus Aid, Relief, and Economic Security Act) responded by creating new, temporary programs to address the crisis on a national scale.

- Pandemic Unemployment Assistance (PUA) was a landmark provision. For the first time, it extended unemployment benefits to millions of self-employed individuals, independent contractors, gig-economy workers, and freelancers who previously didn't qualify for traditional unemployment insurance. This was a game-changer for a significant portion of the modern workforce.

- Federal Pandemic Unemployment Compensation (FPUC) provided a direct and substantial income boost. It added a federal supplement to state unemployment benefits, initially providing an extra $600 per week and later adjusted to $300. For many families, this supplement was the difference between making ends meet and facing financial ruin.

Simultaneously, the Families First Coronavirus Response Act (FFCRA) addressed the public health dimension of the crisis. It mandated that certain employers provide employees with paid sick leave and expanded family and medical leave for specific COVID-related reasons. This crucial legislation meant that workers could take time off to quarantine after an exposure, recover from the illness themselves, or care for a child whose school or daycare had closed, all without the devastating consequence of losing their income. It was a public health measure as much as an economic one, designed to slow the spread by removing the financial pressure to work while sick.

These programs were emergency measures designed for an unprecedented crisis. Their expiration has shifted the responsibility for financial protection squarely back onto the shoulders of individuals and their employers, relying on traditional benefits and private insurance policies. For a more detailed historical review of the federal response, you can consult the Treasury Department's summary of coronavirus assistance for American families and workers.

Taxation and Aftermath

One crucial detail of these emergency benefits that caught many recipients by surprise was that they were considered taxable income. Unlike a stimulus check, all unemployment benefits, including the PUA and FPUC supplements, were subject to federal and, in most cases, state income tax. The IRS required all these benefits to be reported on a Form 1099-G, leading to unexpected tax bills for many who hadn't opted for withholding. Furthermore, the sheer speed of the program rollouts led to administrative challenges. Many states, struggling to implement new rules and verify eligibility for millions of applicants, issued overpayment notices, sometimes months or even years later. Recipients were then required to repay funds according to state-specific guidelines and appeal processes, adding another layer of financial stress. While these government programs were vital during the pandemic's peak, their temporary and complex nature highlights the stability and predictability that well-planned private insurance offers today.

Workers' Compensation: When COVID-19 is a Work-Related Illness

Determining if a COVID-19 infection qualifies for workers' compensation can be one of the most complex aspects of Covid insurance for workers. Unlike your standard health insurance, which covers illness regardless of its origin, workers' compensation is a specific type of insurance that only applies if your illness or injury is a direct result of your employment. For a highly communicable disease like COVID-19, this creates a significant hurdle: you must prove that your workplace exposure was the primary cause of your infection, and that this risk was significantly greater than your risk of exposure as a member of the general public.

Proving Your Claim in Colorado

Recognizing the inherent and unavoidable risks faced by certain occupations, the state of Colorado took steps to simplify this process for those on the front lines. The state established presumptive eligibility for a broad range of frontline workers. This includes not only doctors, nurses, and first responders but also grocery store employees, correctional officers, public transit workers, and other essential personnel in high-exposure environments. For these designated roles, the law presumes that a COVID-19 infection is work-related. This powerfully shifts the burden of proof from the employee to the employer's insurance company, which must then present compelling evidence to dispute the claim and prove the infection was contracted elsewhere.

For workers outside these presumptive categories, such as those in an office setting, filing a successful claim requires more substantial evidence. You might need to provide documentation of a confirmed workplace outbreak, evidence of close contact with an infected coworker, logs from contact tracing, or proof that your employer failed to implement or enforce adequate safety protocols like masking, social distancing, or proper ventilation. Each case is reviewed individually based on its unique facts. You can find the latest information and specific guidelines on the Colorado Division of Workers' Compensation COVID-19 Updates page.

What Benefits Can Workers' Comp Provide?

If your Covid insurance for workers claim is approved through the workers' compensation system, it can provide comprehensive financial relief that often surpasses other types of insurance. The benefits are designed to cover both the medical and financial impact of a work-related illness.

- Medical Expense Coverage: This is a cornerstone benefit. It pays for 100% of all reasonable and necessary medical treatment costs. This includes doctor visits, hospitalization, prescription medications, and rehabilitative therapy, all with no copays or deductibles for you to pay out-of-pocket.

- Lost Wage Replacement: If your illness prevents you from working, you are entitled to temporary disability benefits. In Colorado, this typically replaces about two-thirds of your average weekly wage, paid out while you recover. This provides a crucial financial bridge to cover living expenses when you have no income.

- Permanent Impairment Benefits: For those who suffer from long-term health consequences from COVID-19, such as lung damage or cognitive issues associated with Long COVID, workers' comp can provide compensation for this permanent impairment, even after you return to work.

- Death Benefits: In the tragic event that a worker dies from a work-related COVID-19 infection, the system provides financial support, including funeral expenses and ongoing payments, to their surviving dependents.

Understanding these robust benefits is crucial, as they offer a different and often more complete level of protection than standard health insurance. You can Learn more about workers' comp for coronavirus in Colorado to get more state-specific details.

Private Covid Insurance for Workers: Filling the Gaps

With the vast majority of government support programs having wound down, private insurance has firmly taken its place as the primary source of Covid insurance for workers. These plans, whether sponsored by an employer or purchased individually on the private market, are designed to fill the significant gaps left by expired federal aid and the strict, work-related-only rules of workers' compensation.

Private insurance offers critical protection for medical expenses and lost income that fall outside the narrow scope of work-related claims. This covers the vast majority of COVID-19 cases, which are contracted in the community rather than on the job. At Kelmeg & Associates, Inc., we specialize in helping clients and businesses evaluate and select the right Employer Group Benefits to ensure their teams have robust, reliable coverage for whatever health challenges they may face.

Employer-Sponsored Health Plans and COVID-19

For most workers, your employer's group health insurance is your first and most important line of defense. These plans are required to cover medically necessary services related to COVID-19, including diagnostic testing ordered by a physician, treatment, hospitalization, and telehealth consultations. It is important to understand that during the public health emergency, the government mandated that many plans waive cost-sharing (like copays, deductibles, and coinsurance) for COVID-19 testing and treatment. Most of those mandates have now expired. This means that today, you will likely be responsible for your plan's standard cost-sharing for COVID-related care, just as you would for any other illness like the flu or pneumonia. We can help your business explore Affordable Employee Health Plans that balance comprehensive coverage with manageable costs. For more on our state's specific regulations, see More on Colorado's insurance response to COVID-19.

Supplemental and Disability: Your Financial Safety Net

When a serious illness like COVID-19 prevents you from working, your health insurance pays the doctors, but it does not pay your bills. This is where disability and supplemental insurance provide a crucial financial safety net, protecting your income and savings.

- Disability Insurance: This is essentially income insurance. Short-term disability (STD) replaces a portion of your income for a few weeks to a few months, covering the initial recovery period. Long-term disability (LTD) is designed for more severe or chronic conditions, providing income for several years or even until retirement. LTD is absolutely vital for those suffering from the debilitating effects of long COVID, which can prevent a return to work for an extended period.

- Critical Illness Insurance: This type of plan pays a lump-sum, tax-free cash benefit upon the diagnosis of a covered serious illness. Many modern policies have been updated to include severe COVID-19, especially cases requiring ICU admission. This cash can be used for any purpose you see fit-from covering medical deductibles to paying your mortgage or hiring help for childcare.

- Hospital Indemnity Plans: These plans provide a fixed daily, weekly, or monthly cash benefit if you are hospitalized. For a severe COVID-19 case requiring a lengthy hospital stay, this can provide thousands of dollars in direct payments to you, helping to offset the high out-of-pocket costs and other unexpected expenses that accumulate.

These supplemental plans are designed to cover the real-life financial consequences of a major health event, providing benefits for complications and conditions such as:

- Accidental Loss of Life

- Hospital expense reimbursement

- Wage replacement

- Counseling and behavioral health services

- Wheelchair confinement

- Coma

- Loss of Use/Paralysis

- Rehabilitation expense reimbursement

Specialized Travel and Covid Insurance for Workers

The pandemic fundamentally changed the risk calculus for travel. In response, the travel insurance industry adapted its policies. Modern policies now frequently include specific benefits like medical evacuation if local facilities are inadequate, reimbursement for quarantine costs if you are required to isolate abroad, and trip cancellation or interruption coverage if you or a travel companion test positive for COVID-19 before or during your trip. This is especially important for international travel, as most domestic health plans offer little to no coverage outside the U.S. We can help you explore robust options, including comprehensive Health Insurance for Self-Employed individuals whose work requires frequent travel.

How Employer Subsidies Helped Keep Workers Paid

Beyond the direct payments and benefits sent to individuals, some of the most effective forms of Covid insurance for workers came from massive federal programs designed to help employers prevent mass layoffs. These employer-focused subsidies allowed millions of Americans to keep their jobs, their regular paychecks, and, critically, their employer-sponsored health insurance during a period of widespread economic shutdowns. They formed an indirect but powerful safety net for the workforce.

The Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP) was the flagship initiative, offering potentially forgivable loans to small businesses, sole proprietors, and non-profits. The core concept was straightforward: provide businesses with the capital they needed to cover their payroll and other essential operating costs. The loan forgiveness was the key incentive. To have the loan fully forgiven, businesses were required to spend at least 60% of the funds on payroll costs and maintain their employee headcount and compensation levels. This essentially provided free capital to maintain payroll, allowing businesses that might have otherwise closed their doors permanently to keep their workforce intact. For millions of workers, the PPP was an invisible but essential safety net that ensured their paychecks continued to arrive without interruption, preserving the vital employer-employee relationship through the worst of the crisis.

Employee Retention Tax Credit (ERTC)

The Employee Retention Tax Credit (ERTC), sometimes referred to as the ERC, offered another powerful form of support. Instead of a loan, it provided a refundable tax credit to qualifying employers who kept paying their employees despite experiencing a significant decline in gross receipts or being subject to a full or partial government-ordered shutdown. This was especially valuable for businesses that didn't qualify for the PPP or needed additional aid after their PPP funds were exhausted. The credit was calculated as a percentage of qualified wages paid to employees. By directly rewarding employee retention with a dollar-for-dollar reduction in tax liability (or a cash refund), the ERTC provided a crucial cash flow injection that helped many employers survive the economic turmoil and continue supporting worker salaries. Like the PPP, this program was instrumental in preventing what could have been an even more catastrophic wave of unemployment.

These programs were a cornerstone of the pandemic response, but they were temporary measures that have since ended. For employers navigating the current economic landscape, providing a strong, stable benefits package is more important than ever for attracting and retaining talent. Our expertise in designing and implementing Group Health Insurance for Small Business can help businesses maintain comprehensive and competitive benefits in any economic climate, ensuring their teams remain protected.

Comparing Your Options: Government vs. Workers' Comp vs. Private Insurance

Navigating Covid insurance for workers can feel overwhelming because it involves multiple, distinct systems, each with a different purpose, set of rules, and eligibility requirements. The simplest way to think of them is as different safety nets-some were temporary and have been removed, while others are permanent but require you to set them up and maintain them yourself. Understanding these fundamental differences is the first step in knowing where to turn for help when you need it.

This chart breaks down the key features of each support system, but let's walk through a practical scenario. Imagine you test positive for COVID-19. Your first question should be: where did I likely get it? If you can trace your infection directly to your job-for example, during a confirmed outbreak at your workplace-your first call should be to file a workers' compensation claim. If, like most people, you contracted it in the community, you will turn to your private health insurance for medical care. If the illness is severe and you cannot work, you would then file a claim with your short-term disability insurance for income replacement. If you are hospitalized, a hospital indemnity plan would provide extra cash. This decision tree illustrates how the different systems are designed to work together, but only if you have the private insurance pieces in place.

Comparative Overview: COVID-19 Support Options for Workers

| Feature | Government Benefits (U.S. Federal COVID-19 Programs) | Workers' Compensation (Colorado) | Private Insurance (Health, Disability, Supplemental) |

|---|---|---|---|

| Purpose | Broad income replacement/paid leave during national emergency | Cover work-related illness/injury | Medical care, income protection, and gap coverage for specific events |

| Eligibility | COVID-19 impact (layoff, illness, caregiving); varied by program (e.g., self-employed for PUA) | COVID-19 contracted at work; proof of work-relatedness (presumptive for some frontline workers) | Varies by policy (e.g., enrollment in employer plan, individual purchase, diagnosis of specific illness) |

| Payout Type | Weekly payments (e.g., PUA, FPUC); lump-sum for some leave | Medical bills paid directly; percentage of lost wages; impairment benefits | Medical bills paid to providers (indemnity); percentage of lost wages; lump-sum cash for critical illness/hospitalization |

| Availability Today | Mostly Expired(federal programs like PUA, FFCRA, and FPUC have all ended) | Available(if criteria for work-relatedness are met) | Available(through employers or individual purchase) |

The Support Landscape in a Post-Pandemic World

The reality now is that we have fully transitioned from a crisis response model reliant on public aid back to a traditional model centered on private benefits and personal financial planning. The emergency government lifelines are gone, making your own insurance coverage more critical than it has ever been.

Workers' compensation remains your primary and most powerful option if you get sick as a direct result of your job, provided you can prove the connection. For every other scenario, private insurance-accessed through your employer or through individual policies-is your main safety net. This is especially true when considering the growing threat of long COVID, as a robust long-term disability insurance policy can provide vital income replacement if chronic, debilitating symptoms prevent you from working for months or even years.

Proactive planning is no longer optional; it is a necessity. The days of assuming the government will step in with a new program are over. Your Employer-Sponsored Health Insurance and any individual disability or supplemental policies you hold are your primary protection. Reviewing your coverage annually and during any life event is essential to ensure you are prepared for whatever comes next.

Frequently Asked Questions about Covid Insurance for Workers

As the landscape of Covid insurance for workers has evolved from an emergency response to a long-term management issue, many questions have emerged. Here are straightforward answers to the most common and pressing questions we hear from clients at Kelmeg & Associates, Inc.

Can I still get government benefits for COVID-19?

For the most part, no. The major federal COVID-19 relief programs created during the pandemic have all expired and are no longer accepting new applications. This includes Pandemic Unemployment Assistance (PUA), Federal Pandemic Unemployment Compensation (FPUC), and the paid leave provisions of the FFCRA. While a few state or local-level programs may still exist for specific situations, they are rare and narrowly focused. Today, if you lose your job or get sick, you will need to rely on traditional systems like state unemployment, state-mandated short-term disability (in applicable states), and your own private insurance policies, not COVID-specific emergency benefits.

Is Long COVID covered by insurance?

Generally, yes, but coverage depends entirely on the type of insurance. Your health insurance should cover the medical treatments for long COVID symptoms just as it would for any other diagnosed chronic condition, subject to your plan's deductibles and copays. The most critical coverage for long COVID is disability insurance. Both short-term and long-term disability policies can provide income-replacement benefits if long COVID symptoms are severe enough to prevent you from working, provided you meet the policy's definition of disability, which requires thorough documentation from your physician. Importantly, long COVID is often recognized as a disability under the Americans with Disabilities Act (ADA). This provides significant workplace protections, such as the right to reasonable accommodations, and strengthens the legitimacy of your condition when filing insurance claims.

What should I do if my workers' compensation claim for COVID-19 was denied?

A denial is frustrating but it is not always the final word. You have the right to appeal the decision. The process is structured and requires you to act promptly. Follow these steps:

- Understand the specific reason for denial. The insurance carrier must provide a letter that clearly states why the claim was rejected. Common reasons include insufficient proof of workplace exposure or a belief that you could have been infected outside of work.

- Gather more evidence. This is the most critical step. Collect any and all documentation that can strengthen your case. This could include a timeline of your symptoms, a list of coworkers who also tested positive, statements from colleagues, company emails about the outbreak, and detailed medical records from your doctor that link your illness to your work.

- Meet the appeal deadline. Workers' compensation systems operate on strict timelines. You typically have a limited window, often 30 to 90 days from the date of the denial letter, to file a formal appeal. Do not miss this deadline, as it can permanently bar you from pursuing your claim.

- Consider professional help. The appeals process can be complex and adversarial. A workers' compensation attorney can be an invaluable asset. They understand the evidence needed to win an appeal and can steer the legal procedures on your behalf, especially for complex cases like proving a COVID-19 infection was work-related.

Does my health insurance cover COVID-19 vaccines and boosters?

Under the Affordable Care Act (ACA), most private health insurance plans are required to cover preventive services, including recommended vaccines, at no cost to you, as long as you see an in-network provider. This has generally included COVID-19 vaccines and boosters. However, with the end of the public health emergency, some of these rules have changed. While the initial vaccine series is likely to remain covered, coverage for boosters or future vaccines could vary by plan. It is always best to check with your specific insurance plan to confirm coverage and any potential costs before getting vaccinated.

What if my employer doesn't offer disability insurance?

If your employer does not offer group disability insurance, you are not out of options. You can, and should, purchase an individual disability insurance policy from a private insurer. This is especially critical as you are solely responsible for protecting your income. The best time to buy an individual policy is when you are young and healthy, as this is when premiums are most affordable. An individual policy is also portable, meaning you keep it even if you change jobs. Protecting your ability to earn an income is one of the most important financial decisions you can make.

Conclusion: Securing Your Health and Finances

The COVID-19 pandemic was a stark and universal reminder of how quickly and unexpectedly life can change. While the emergency government programs provided a temporary bridge, their conclusion marks a permanent shift in how we must approach financial security. The need for solid Covid insurance for workers has not disappeared; it has evolved. We've moved from a collective crisis mode to an era of individual smart planning, where private insurance has rightfully resumed its role as your most reliable long-term partner.

The reality today is that being proactive is not just advisable-it is essential. Your employer's health plan, your personal disability coverage, and any supplemental policies you have are your primary financial safety net in a world where health risks persist. You cannot wait for a health crisis to find potential gaps in your coverage. With long COVID now recognized as a real and lasting concern for a significant number of people, ensuring you are protected against catastrophic medical bills and prolonged loss of income is more important than ever.

At Kelmeg & Associates, Inc., we've seen how proper, thoughtful planning provides families and businesses with invaluable peace of mind. Our mission is to help you understand your unique risks, evaluate your options, and build a comprehensive coverage plan that fits your life and your budget. We are committed to providing honest, expert guidance to our clients in Lafayette, Broomfield, Boulder, and across Colorado, at no extra cost to you.

When you know you're truly covered, you can focus on what matters most-your health, your family, and your career-instead of worrying about your finances. Don't leave your future to chance. Take a few minutes this week to pull up your current insurance policies, review your coverage, and identify any potential gaps. If you're unsure where to start or what to look for, we're here to help.

Ready to secure your future? Find comprehensive COVID coverage in Colorado with our dedicated team. Because when it comes to your health and financial security, being prepared isn't just smart-it's essential.