Short-Term Covid Insurance: Is It Worth the Risk?

Understanding Your Short-Term COVID Insurance Options

Short term Covid insurance has become a critical consideration for many Americans seeking financial protection against the unpredictable health and economic impacts of COVID-19. As the world has transitioned from a global pandemic to a new normal, the virus remains a persistent threat. The focus has shifted from a widespread public health crisis to a matter of personal risk management. For individuals and families, this means struggling with the potential for unexpected medical bills, trip cancellations, or prolonged periods of illness that can disrupt income and financial stability. Whether you're worried about lost income from Long COVID or unexpected medical bills while traveling, understanding your options is key to building a resilient financial safety net.

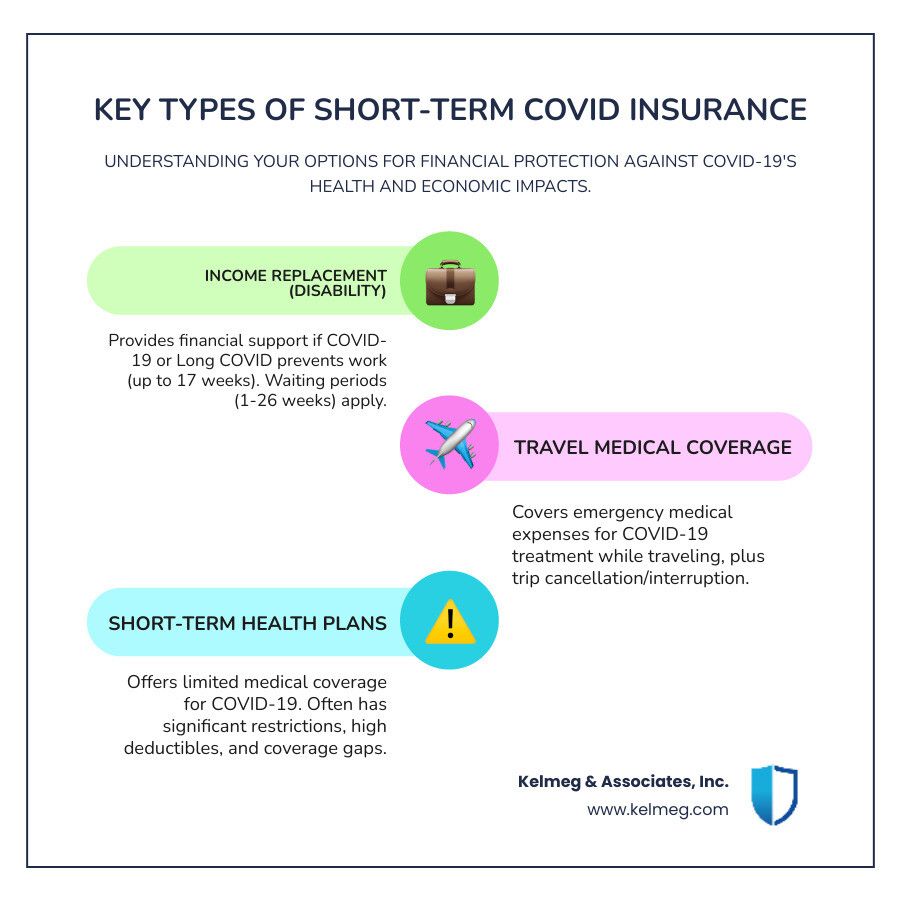

These specialized policies generally fall into two main categories: income replacement (disability insurance) to cover lost wages if you are unable to work, and travel medical insurance for emergency treatment and trip-related expenses. While some short-term health plans may offer a degree of coverage, they often come with significant restrictions and gaps. This type of specialized insurance can be particularly worthwhile if you face specific risks, such as frequent international travel, self-employment without access to employer-sponsored disability benefits, or having a high-deductible health plan that would leave you exposed to substantial out-of-pocket costs. However, it is crucial to remember that these policies are not a catch-all solution; they frequently have waiting periods, notable exclusions, and may not cover every conceivable COVID-related expense.

The primary challenge for consumers lies in navigating the fine print. Many people find significant coverage gaps precisely when they need help the most. For instance, while a substantial portion of adults who contracted COVID-19, estimated to be around 15%, experience long-term symptoms, not all will qualify for disability benefits. This is often due to strict policy definitions of what constitutes a “disability” and the difficulty of objectively proving the severity of symptoms like fatigue or brain fog.

As Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., I've helped countless Colorado residents steer the complexities of Short term Covid insurance. My professional experience consistently shows that a thorough understanding of policy exclusions, benefit triggers, and eligibility requirements upfront is the most effective way to prevent costly and stressful surprises down the road. A proactive approach is essential.

Income Replacement for COVID-19: Protecting Your Paycheck

For millions of Americans, COVID-19 was not a brief, passing illness. Long COVID has emerged as a significant, long-term health battle that can seriously compromise your ability to earn a living. If lingering and often debilitating symptoms make it difficult or impossible to perform your job duties, Short-Term Disability (STD) benefits can serve as an essential financial lifeline. These policies are designed to provide income replacement, typically for a period of up to 17 weeks, though some policies may offer longer benefit periods.

Before any benefits can be paid out, you must first satisfy a waiting period, also known as an “elimination period.” This is the length of time you must be disabled and out of work before the insurance company begins to issue payments. This period can range from 1 to 26 weeks, depending on the specific policy you have. It is critical to understand this feature, as you will receive no income from the policy during this time, highlighting the importance of having a robust emergency savings fund. After the waiting period is met, the benefit period begins, which is the maximum timeframe during which you can receive payments under the STD policy.

If you are traditionally employed, you may have access to employer-sponsored group plans, which are often a cost-effective way to secure this coverage. However, if you are self-employed, a freelancer, or your employer does not offer this benefit, you will need to secure a private disability insurance policy. We frequently assist our self-employed clients in exploring Colorado Self-Employed Health Insurance options that can be bundled with or supplemented by this vital income protection.

The World Health Organization provides a clinical definition for Long COVID, describing it as symptoms that persist for more than 12 weeks after the initial infection and cannot be explained by an alternative diagnosis. These Clinical long-term effects of COVID-19 (PDF, World Health Organization) can be profoundly debilitating and make maintaining regular employment impossible.

Who is Eligible for COVID-Related Income Replacement?

Securing approval for COVID-related income replacement is not an automatic process. While Long COVID can certainly qualify for disability benefits, the claimant must rigorously meet the policy's specific criteria for disability. The burden of proof rests squarely on you and your medical team.

Whether you have a group plan through an employer or a private individual policy, the fundamental requirements are similar. You will need a formal medical diagnosis from a qualified healthcare provider and a detailed physician's statement. This statement is a critical piece of evidence; it must go beyond simply stating a diagnosis and explain in detail how your specific symptoms prevent you from performing the material and substantial duties of your occupation. The absolute key is meeting the definition of disability as it is written in your policy. Some policies define disability as being unable to perform your “own occupation,” while stricter policies may use an “any occupation” definition. It is vital to know which one applies to you.

Pre-existing conditions can significantly complicate claims. If you had underlying health issues that were exacerbated by a COVID-19 infection, the insurer might investigate whether the pre-existing condition is the primary cause of your disability, potentially leading to a denial. Furthermore, your claim may be denied if your employer can offer reasonable workplace accommodations that allow you to continue working, even with your symptoms. As outlined by laws like the Canadian human rights laws, if accommodations such as a flexible schedule, remote work options, or modified duties make it possible for you to work, the insurer may argue that you are not totally disabled.

Understanding Long COVID as a Disability

Long COVID is increasingly recognized by the medical and legal communities as a legitimate and often severe disability. The symptoms are persistent, can fluctuate in intensity, and can be profoundly debilitating, making it extremely difficult to maintain a career and a normal life.

Common symptoms that can support a disability claim include:

- Profound Fatigue: A level of exhaustion that is not relieved by rest and can be worsened by physical or mental exertion.

- Cognitive Dysfunction (Brain Fog): Significant difficulty with concentration, memory recall, information processing, and executive functions like decision-making.

- Shortness of Breath: Dyspnea that can make even simple physical tasks like walking up stairs feel overwhelming.

- Chronic Pain: Persistent and widespread muscle aches, joint pain, and severe headaches.

Statistics indicate that

15% of adults who contracted COVID-19 experience symptoms for three months or longer, with a significant portion of this group reporting that these symptoms impose serious limitations on their daily activities. Proving Long COVID as a disability to an insurance company requires robust and consistent

medical evidence. This includes a formal diagnosis from a physician, detailed documentation of your symptoms and their impact on your ability to work, records of specialist consultations (e.g., with cardiologists, pulmonologists, or neurologists), and evidence of consistent adherence to your doctor's prescribed treatment plan. The

Government of Canada: Post COVID-19 condition (long COVID) notes that over 100 symptoms have been reported, which underscores the condition's complexity and the challenge of documenting it effectively. For our Colorado clients, we can help explore

Personal Health Insurance Colorado options that may offer additional support for therapies and treatments.

Medical & Travel Coverage: Short Term Covid Insurance for Health Expenses

When you are planning a trip, whether for business or pleasure, the last thing you want to contemplate is a medical emergency far from home.

Short term Covid insurance for travel can be a crucial financial lifesaver, as your domestic health plan often provides little to no coverage once you cross international borders. Relying on your standard health insurance abroad is a significant gamble that can lead to catastrophic medical debt.

Travel medical insurance is specifically designed to handle unexpected health crises that occur while you are abroad. These policies are built to cover a wide range of potential expenses, from emergency medical treatments and hospitalization to doctor visits, prescription drugs, and, critically, emergency medical evacuation. Some comprehensive plans also include repatriation of remains, a vital benefit that provides for the transportation of a deceased person's body back to their home country, sparing their family from immense logistical and financial burdens during a time of grief.

At Kelmeg & Associates, we help Colorado residents understand their Health Insurance Options Colorado and how a dedicated travel coverage plan fits into their overall financial protection strategy. The peace of mind that comes from knowing you are properly covered for a medical emergency abroad is invaluable and allows you to focus on your trip.

What Medical Expenses Are Typically Covered?

Comprehensive travel medical insurance policies generally treat COVID-19 like any other sudden, unexpected illness that begins after the policy's effective date. Key covered expenses typically include:

- Emergency Treatment: Medically necessary care received at hospitals, emergency rooms, or urgent care clinics for a sudden illness or injury.

- Hospitalization: In-patient stays, which can include the costs of a semi-private room, board, and intensive care unit (ICU) charges if required.

- Medical Services: Ambulance transport (ground or air), diagnostic tests such as X-rays and lab work, and consultations with physicians and specialists.

- Prescription Drugs: Medications prescribed by a physician during your emergency treatment for the covered condition.

- Medical Evacuation: This is a critical benefit. It covers the cost of transporting you to a better-equipped medical facility or, if medically necessary, back to your home country for continued care. These costs can easily run into the tens or even hundreds of thousands of dollars.

- Quarantine Expenses: Some policies offer a specific benefit to cover additional accommodation and meal costs, up to a specified limit, if you are required by a physician or government authority to quarantine after testing positive for COVID-19.

In the wake of the pandemic, some insurers have offered policies with up to $1 million or more for COVID-19 related emergency medical costs, providing a robust safety net against the potentially astronomical expenses of serious illness in a foreign country.

Does It Cover Trip Cancellation or Interruption?

This is a critical question, as this benefit can protect the thousands of dollars you have invested in non-refundable travel costs. However, it is essential to understand that coverage is triggered only for specific, unforeseen reasons that are explicitly listed in the policy. Common covered events include:

- Positive COVID-19 Test: If you, a traveling companion, or a non-traveling family member tests positive for COVID-19 shortly before your departure and a physician advises that you cannot travel.

- Serious Sickness: If you, a traveling companion, or an immediate family member becomes seriously ill with COVID-19 (or another covered illness), preventing you from starting or continuing your trip.

- Job Loss or Quarantine: Some policies may cover cancellation due to an unexpected, pandemic-related job loss or a mandatory quarantine requirement that prevents you from traveling, but these clauses come with very strict conditions and definitions.

The biggest hurdle for travelers is often the

"known event exclusion." Because COVID-19 is a known global pandemic, many standard insurance policies will not cover cancellations due to general pandemic-related disruptions. This includes things like border closures, government travel bans, or simply a fear of traveling. To get around this, some travelers opt for a

"Cancel for Any Reason" (CFAR) upgrade. CFAR allows you to cancel for reasons not listed in the base policy, but it typically costs 40-60% more, must be purchased within a short window after your initial trip deposit (e.g., 14-21 days), and will only reimburse a portion of your non-refundable costs, usually 50% to 75%. Always check your policy's list of "covered reasons" carefully. You can

View plan benefits to see examples of how these benefits are structured.

How Government Travel Advisories Impact Coverage

Government travel advisories are not mere suggestions; they are official warnings that can directly impact and even void your insurance coverage. These advisories are typically tiered, ranging from

Level 1 (Practice usual precautions) to

Level 4 (Do Not Travel).

If you choose to travel to a destination that has a Level 3 ("Reconsider Travel") or Level 4 advisory in effect at the time of your departure, your policy may explicitly exclude any claims related to the reason for the advisory, which in many cases would be COVID-19. Some policies go even further, stating that your coverage will end if an advisory for your location is raised to a higher level after you have already departed. This means you could be left without coverage mid-trip.

I always advise my Colorado clients to check the Government of Canada Travel Advisories (opens external website in new window) or the U.S. Department of State advisories before booking a trip and again just before leaving. Traveling against official government advice is one of the most common and clear-cut reasons for a claim denial. Before any international trip, we make it a point to review our clients' Covid Coverage in Colorado to ensure they fully understand these critical and often overlooked limitations.

The Fine Print: Common Exclusions and Coverage Gaps

When considering

Short term Covid insurance, the details buried in the fine print are not just formalities; they are the most crucial part of the contract. Insurance policies are legal documents designed to cover specific, unforeseen events, and they all come with a list of exclusions-situations and circumstances where coverage does not apply. A thorough understanding of these boundaries before you purchase a policy is the best way to prevent major financial headaches and disappointment when you need coverage the most.

Common reasons for coverage gaps include known circumstances. Since COVID-19 is a well-established global pandemic, some general disruptions stemming from it are no longer considered unforeseen and are therefore not covered. Other major problems include pre-existing conditions, treatments that the insurer deems not medically necessary, and failing to follow prescribed medical advice. For travelers, expenses like routine COVID-19 testing for entry or exit and trip cancellation due to a general fear of travel are almost universally excluded from standard policies.

It is also critically important to note that many short-term health plans are not compliant with the Affordable Care Act (ACA). This means they are not required to provide the same comprehensive benefits and consumer protections as ACA-compliant plans. They often lack coverage for the ten essential health benefits, which can include vital services like mental health care and rehabilitative services, both of which can be critical for Long COVID recovery.

Here's a comparison of typical coverage and exclusions to help illustrate these differences:

| Feature | STD Income Replacement for COVID-19 | Travel Medical Insurance for COVID-19 |

|---|---|---|

| Typical Coverage | Provides a percentage of your lost income if a medically certified disability from COVID-19/Long COVID prevents you from working. | Covers emergency medical treatment, hospitalization, physician services, prescription drugs, and medical evacuation due to a sudden COVID-19 illness while traveling. Some plans include limited quarantine accommodation expenses. |

| Typical Exclusions | Not meeting the policy's specific "definition of disability"; disability during the initial waiting period; self-imposed quarantine without a doctor's order; non-compliance with prescribed medical treatment; lack of sufficient objective medical evidence; claims arising from a pre-existing condition. | Traveling against government advisories; COVID-19 tests required for travel; general pandemic disruptions (e.g., border closures); trip cancellation due to fear; pre-existing conditions (often subject to a look-back period); non-refundable expenses that could be reimbursed by a travel provider or for which you received a credit. |

Exclusions in Income Replacement Policies

Disability policies for income replacement have very specific and strictly enforced exclusions that can lead to claim denials. Be acutely aware of the following potential pitfalls:

- Not Meeting the Definition of "Total Disability": Your symptoms must be severe enough to prevent you from performing the essential duties of your job as that role is defined by the policy. A doctor's note saying you are sick is not enough.

- Insufficient Medical Evidence: Your claim must be supported by objective medical proof from a healthcare provider. This includes diagnostic tests, specialist reports, and a detailed accounting of your functional limitations.

- Self-Imposed Quarantine: Choosing to quarantine out of caution, without a direct order from a physician stating that you are medically unable to work due to illness, is not a covered reason for disability.

- Pre-Existing Conditions: If you had underlying health issues that were worsened by COVID-19, a pre-existing condition clause, which often includes a "look-back period" of 3-12 months before the policy started, could be used to void your claim.

- Failure to Follow Prescribed Treatment: To remain eligible for benefits, you must demonstrate that you are complying with your doctor's recommended treatment plan.

- Waiting Periods: Benefits are never paid during the policy's initial elimination period. You must satisfy this period of disability without pay before benefits can begin.

Exclusions in Travel & Medical Policies

Travel insurance policies also have key exclusions that are especially relevant in the context of the ongoing pandemic:

- Traveling Against Medical or Government Advice: If your doctor advises against travel or you intentionally go to a destination with a "Do Not Travel" advisory, any related claims will almost certainly be denied.

- Routine COVID-19 Tests: Mandatory tests required for entry to a country, boarding a cruise ship, or for your return flight are considered a foreseeable travel expense and are your own out-of-pocket cost.

- General Pandemic Disruptions: Broad issues like border closures, airline-initiated flight cancellations due to low demand, or closed tourist attractions are typically not covered because the pandemic is a "known event."

- Refundable Expenses: Insurance is designed to be a last resort. It will not reimburse you for costs that your airline, hotel, or tour operator has already refunded, or for which they have provided you with a voucher or credit for future use.

- High-Risk Activities: Injuries sustained from activities like bungee jumping, scuba diving, or other sports deemed high-risk are usually excluded, regardless of whether COVID-19 was a factor in the trip.

Always take the time to read the "Exclusions" section of any policy document before you purchase it. It is arguably the most important section for understanding the true value and limitations of the protection you are buying.

Navigating the Claims Process: From Application to Appeal

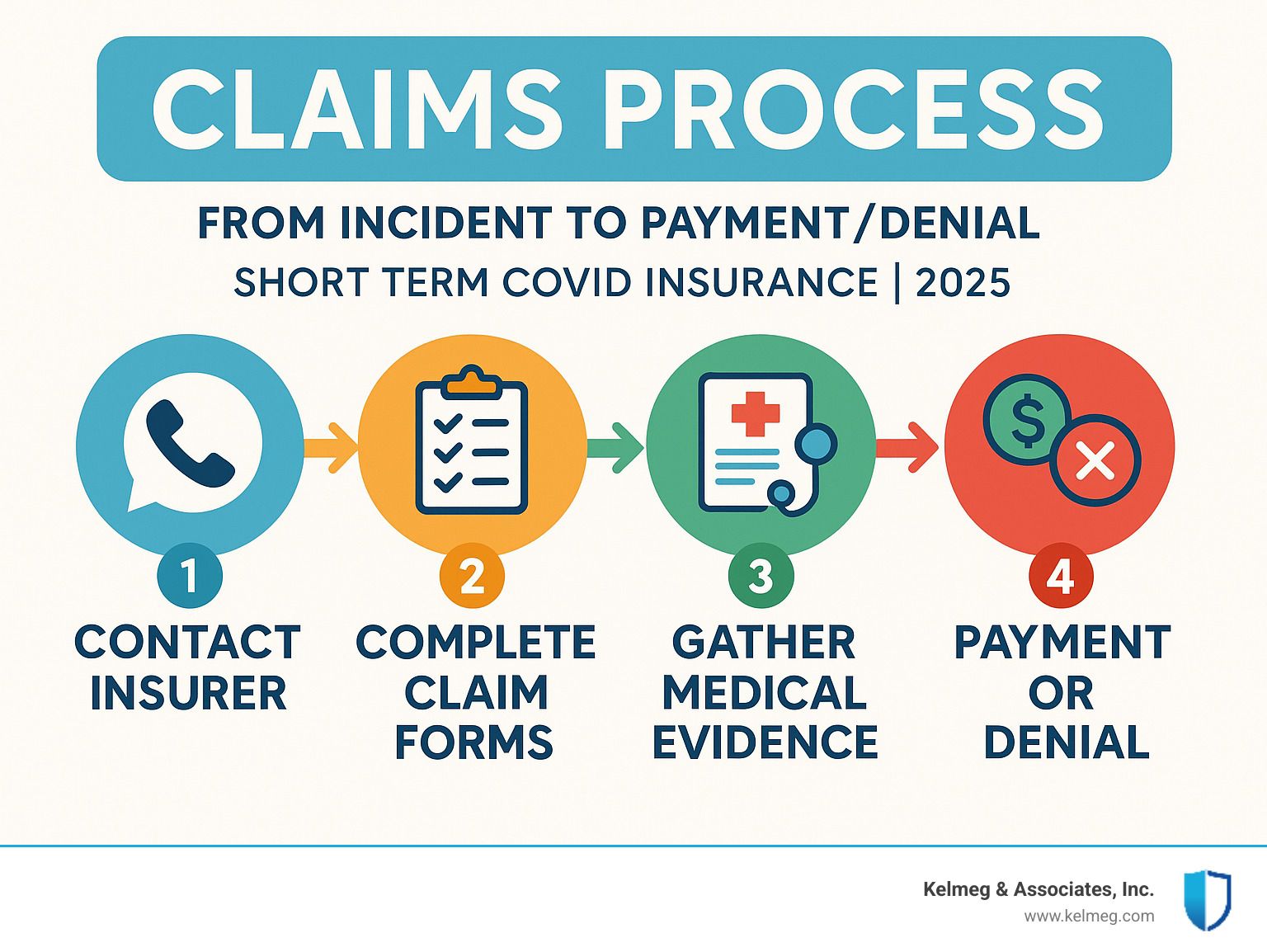

Filing a Short term Covid insurance claim can feel like a daunting and bureaucratic task, but breaking it down into a series of clear, manageable steps can make the process much less intimidating. The entire process hinges on meticulous organization, clear communication, and strict adherence to deadlines. Missing a single step, a required document, or a submission deadline can result in a delay or an outright denial of your claim.

Staying organized by creating a dedicated file for all correspondence and documentation, and communicating regularly and professionally with your insurer, is absolutely key to a successful outcome. This is an area where working with a knowledgeable Health Insurance Broker Colorado can be invaluable. An experienced broker can guide you through the complex paperwork, help you anticipate the insurer's requirements, and ensure that nothing critical is missed.

How to Apply for Short Term Covid Insurance Benefits

- Contact Your Insurer Immediately: As soon as a potentially covered event occurs (e.g., you are diagnosed with a disabling illness or have a medical emergency abroad), notify your insurance provider to initiate the claims process. This first contact is crucial for getting the necessary forms and understanding the specific deadlines that apply to your situation.

- Complete All Claim Forms Accurately and Thoroughly: Fill out every section of the provided forms with honest and complete information. Vague answers, inconsistencies between forms, or leaving sections blank can raise red flags and lead to processing delays or denials.

- Gather All Necessary Supporting Evidence: This is the most labor-intensive but most important step. For disability claims, this means providing a clear diagnosis, a detailed physician's statement outlining your work limitations, and copies of all relevant medical records. For travel claims, you must collect all itemized hospital and doctor bills, payment receipts, proof of non-refundable expenses (like original booking invoices), and any communication with your travel providers about refunds or credits.

- Meet All Deadlines Without Fail: Insurance companies operate on strict timelines for claim submission and providing supporting documentation. Mark all dates on a calendar and set reminders to ensure you submit everything on time. Missing a deadline is one of the easiest ways to have a claim denied.

- Follow Up Regularly and Keep Detailed Records: Do not assume that no news is good news. Check on your claim's status every week or two. Every time you communicate with the insurer, keep a detailed log of the date, time, the name and ID number of the representative you spoke with, and a summary of the conversation.

Common Reasons for Claim Denial and What to Do

A claim denial can be incredibly frustrating and disheartening, but it is not always the final word. Understanding the common reasons why claims are denied can help you prepare a more effective and targeted appeal.

Common reasons for denial include:

- Insufficient Medical Evidence: The documentation provided did not, in the insurer's view, clearly prove the disability or the medical necessity of the treatment. The evidence may be seen as subjective or lacking objective findings.

- Incomplete or Inaccurate Applications: Missing information, unsigned forms, or inconsistencies in the information you provided can lead to an automatic denial pending clarification.

- Policy Exclusions: The situation for which you are claiming falls under a specific exclusion in your policy, such as a pre-existing condition, traveling against a government advisory, or an activity not covered by the plan.

- Not Meeting the Definition of Disability: For income replacement claims, this is a very common reason for denial. The insurer's medical consultants may argue that despite your symptoms, you should still be able to perform the essential duties of your job.

If your claim is denied, you have the right to appeal. Take these steps:

- Carefully Review the Denial Letter: The insurer is required to provide a written explanation for the denial, referencing the specific policy language they used to make their decision. This letter is your roadmap for building your appeal.

- Gather Additional, Targeted Evidence: Go back to your doctor or other specialists. Ask them to provide a supplemental report or letter that directly addresses the insurer's reasons for denial. For example, if they cited a lack of objective evidence, you may need to undergo further testing.

- File a Formal Internal Appeal: Follow the insurer's appeal process exactly as described in the denial letter. Submit a formal, written appeal that includes all your new evidence and a clear, concise letter explaining why you believe the denial was incorrect and should be overturned. Be professional and stick to the facts.

- Consider an External Review: If your internal appeal is also denied, you may have the option for an external review, where an independent third party will examine your case. Persistence and thoroughness often pay off, as many claims that are initially denied are ultimately approved on appeal once the proper documentation is provided.

Frequently Asked Questions about Short-Term COVID Insurance

As an insurance brokerage dedicated to helping Colorado families and individuals, we receive a wide range of questions about the nuances of

Short term Covid insurance. The landscape is complex, and it is natural to have concerns. Here are detailed answers to some of the most common inquiries we handle.

Is Long COVID covered by short-term disability insurance?

Yes, Long COVID can absolutely be covered by short-term disability (STD) insurance, but coverage is not guaranteed. The critical factor is whether your symptoms are severe enough to prevent you from performing the material duties of your occupation, and whether you can provide sufficient medical evidence to meet your policy's specific definition of disability. A simple diagnosis of Long COVID is not enough. You must work with your doctor to build a strong case file that includes a formal diagnosis, detailed documentation of how symptoms like fatigue, brain fog, or shortness of breath functionally impact your ability to work, and records of ongoing treatment. You will also have to satisfy the policy's waiting period (the initial period of disability where no benefits are paid, typically ranging from 1 to 26 weeks) before benefits can begin. If your disability continues beyond the maximum benefit period of your STD plan, you would then need to apply for Long-Term Disability (LTD) benefits, if you have such a policy.

Can I buy travel insurance that covers COVID-19 if I'm not vaccinated?

While it is still possible, your options are likely to be very limited and potentially more expensive. Some insurance providers may still offer coverage to unvaccinated travelers, but it often comes with significant limitations, such as higher premiums, lower benefit limits for COVID-related events, and more stringent exclusions. For example, you may not be covered if you travel against a government advisory that applies specifically to unvaccinated individuals. Other providers may exclude any and all COVID-19 related expenses entirely if you are not vaccinated, treating it as a foreseeable and preventable risk. It is absolutely critical to be transparent and honest about your vaccination status when applying for a policy. Failing to do so could be considered material misrepresentation, which would void your policy and lead to the denial of any claims. Always read the policy's exclusion section carefully to understand how vaccination status impacts your coverage.

Do short-term health plans in Colorado cover COVID-19?

Short-term health plans in Colorado are not required to comply with the Affordable Care Act (ACA), and this is a crucial distinction. This lack of regulation means they have significant coverage gaps compared to comprehensive, ACA-compliant plans. While some short-term plans may offer limited benefits for COVID-19 treatment, they typically feature high deductibles, significant coinsurance, low coverage limits (caps on what the plan will pay), and may not cover pre-existing conditions at all. Furthermore, they are not required to cover the ACA's ten essential health benefits, which include things like hospitalization, prescription drugs, mental health services, and rehabilitative care-all of which could be necessary for a serious case of COVID-19 or Long COVID. These plans are not a substitute for comprehensive health insurance and are best used only as a temporary bridge for a very short period, such as when you are between jobs and waiting for new employer coverage to begin.

Conclusion: Weighing the Risks and Making the Right Choice

Deciding if

Short term Covid insurance is the right move for you requires a careful and honest assessment of your personal situation. There is no single, one-size-fits-all answer. The best decision is an informed one, reached by methodically weighing your potential risks against the cost, benefits, and inherent limitations of the available coverage.

Start by conducting a thorough evaluation of your personal risk and financial vulnerability. Ask yourself a series of pointed questions: Do you travel internationally on a regular basis? Are you self-employed or a gig worker without access to employer-sponsored disability benefits? Is your emergency fund robust enough to handle several months without income? Could your family manage a large, unexpected medical bill from a trip abroad without going into debt? If these scenarios pose a significant and credible threat to your financial stability, then a specialized short-term policy could be a very worthwhile investment in your peace of mind.

However, it is equally important that you fully understand the policy's limitations and exclusions. As we have discussed throughout this article, these plans are not blank checks. They are specifically designed contracts that come with waiting periods, precise definitions of disability, and a long list of situations that are not covered. They are best viewed as temporary bridges over specific financial gaps, not as permanent, comprehensive solutions. For long-term financial security, nothing can replace a robust, ACA-compliant health insurance plan and adequate long-term disability coverage.

This inherent complexity is precisely why seeking expert, independent guidance is so valuable. At Kelmeg & Associates, Inc., we specialize in helping Colorado residents steer these important decisions. Our professional approach is centered on first understanding your unique needs, your budget, and your risk tolerance. Only then do we research and compare options from various carriers to find a coverage solution that offers real, meaningful protection for your life and your finances, all at no extra cost to you. As brokers, we are compensated by the insurance carriers, so our guidance and support are provided without a fee.

We are proud to serve clients throughout Colorado from our locations in Lafayette, Broomfield, Boulder, and Adams County, providing personalized, one-on-one guidance on Medicare, individual, family, and group insurance plans. We have a deep understanding of the local insurance landscape and can help you find the right fit for your specific circumstances.

For a complete understanding of how COVID-19 continues to impact your coverage options in Colorado, we invite you to explore our comprehensive Covid Information resource. To learn more about how we can provide custom assistance in finding the right insurance solutions for your needs, please visit Our Services.

The pandemic has been a stark reminder that life can change in an instant. While we can never predict the future with certainty, we can take prudent steps to prepare for it. Finding the right balance of insurance protection provides a foundation of security and peace of mind, allowing you to focus on what matters most in your life.