How Much Does Individual Health Insurance Really Cost in Colorado?

Understanding Health Insurance Costs in Colorado

The average cost of individual health insurance colorado is around $380 to $405 per month for an unsubsidized plan. However, this is just a starting point. Your actual cost can vary dramatically based on your age, location, plan type, and eligibility for financial assistance.

Quick Answer: Colorado Health Insurance Costs

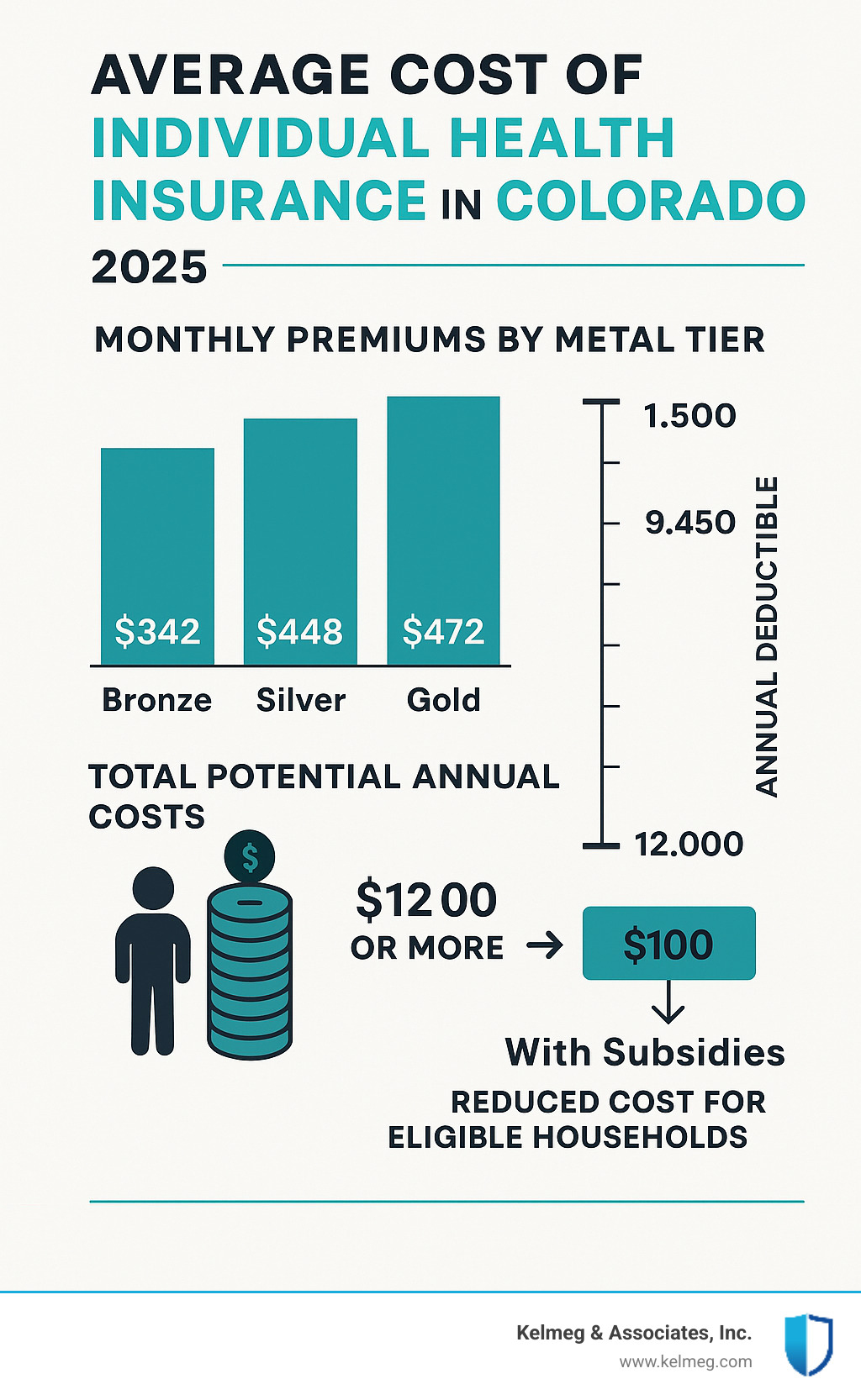

- Average monthly premium: $380-$405 for individuals

- Bronze plans: $342/month (higher deductibles)

- Silver plans: $448/month (balanced coverage)

- Gold plans: $472/month (lower deductibles)

- With subsidies: Many pay less than $100/month

- Total annual cost: Can range from $1,200 to $25,000+ including deductibles

These averages don't tell the complete story. A 25-year-old in Denver might pay $358 monthly for a Silver plan, while a 60-year-old could pay over $1,000 for the same coverage. Furthermore, about 80% of Colorado marketplace shoppers receive subsidies, which can lower premiums to under $100 per month. Add in deductibles that can reach $9,450 and varying provider networks, and the real picture becomes much more complex.

As someone who has spent years helping Colorado residents steer the average cost of individual health insurance colorado market, I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates. I've guided hundreds of individuals and families through the maze of plan options and subsidies to find the right coverage for their needs and budget.

What This Guide Covers

This guide will break down the key factors that influence your health insurance costs in Colorado. We'll explore plan types, financial assistance programs that can dramatically lower your expenses, and how to shop for coverage. Our goal is to provide the clarity you need to make an informed decision.

The Short Answer: What's the Average Price Tag?

Based on recent data, the average unsubsidized cost for an individual plan in Colorado is about $405 per person. However, this figure doesn't reflect the reality for most residents. Thanks to federal subsidies, nearly 80% of people using Connect for Health Colorado (our state's marketplace) qualify for financial aid. In fact, about 77% of those eligible find plans for $100 or less per month.

Your specific premium will depend on your age, county, income, and the plan you choose. Let's dive deeper into these elements to give you a clearer picture.

Understanding the Average Cost of Individual Health Insurance in Colorado

When considering health insurance costs, it's easy to focus only on the monthly premium. However, the true cost involves a balance between your premium and what you pay for care. You can choose a lower monthly premium with higher out-of-pocket costs, or a higher premium for more predictable expenses when you need medical services. Colorado's unique market, including the Colorado Option program on Connect for Health Colorado, offers various ways to manage this balance and find savings.

What is the average cost of individual health insurance in Colorado by Metal Tier?

Health plans on Colorado's marketplace are organized into metal tiers, which indicate how you and your insurer share costs.

Bronze plans have the lowest monthly premiums, averaging $342 in Colorado. They feature higher deductibles, meaning you pay more out-of-pocket for care before insurance helps. These plans are a good fit if you're healthy and want protection from major medical events while keeping monthly costs low.

Silver plans offer a balance between monthly premiums and out-of-pocket costs, with an average premium of $448. Their key advantage is eligibility for Cost-Sharing Reductions (CSRs). If your income qualifies, CSRs can significantly lower your deductible, copays, and coinsurance, often providing better value than a Bronze plan despite the higher premium.

Gold plans have higher average premiums at $472 but feature lower deductibles and out-of-pocket costs. If you expect to use medical services regularly or prefer predictable expenses, a Gold plan can be more cost-effective over the year, as the lower cost-sharing can offset the higher premium.

For a deeper dive into how these plans work, check out More info about ACA Plans Colorado.

How Age and Location Impact the Average Cost of Individual Health Insurance Colorado

Age and location are two of the most significant factors determining your premium.

Age is a primary driver of cost. Insurers can charge older adults up to three times more than younger ones for the same plan. For example, a 25-year-old might pay $358 for a Silver plan, while a 60-year-old could face a premium of over $1,000 for identical coverage. This difference grows substantially after age 40.

Your zip code also matters. Colorado is divided into different rating areas, and costs can vary by county. Urban areas like Denver often have more competition among insurers, which can lead to lower premiums. In contrast, rural counties may have fewer choices and higher costs. A 40-year-old in El Paso County might find a Silver plan for $422, while the same person in Hinsdale County could pay $513 or more.

Defining Your Total Health Insurance Costs

To understand the true cost, you need to know these key terms:

- Premium: The fixed amount you pay each month to keep your plan active.

- Deductible: The amount you must pay for covered health services before your insurance plan starts to pay. Preventive care is typically covered before you meet your deductible.

- Copayment (Copay): A fixed amount (e.g., $30) you pay for a covered service, like a doctor's visit.

- Coinsurance: The percentage of costs you pay for a covered service after you've met your deductible. For example, with 20% coinsurance, you pay 20% of the bill, and your insurer pays 80%.

- Out-of-Pocket Maximum: The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copays, and coinsurance, your health plan pays 100% of the costs of covered benefits.

Understanding these components is vital. A plan with a low premium but high deductible may be more expensive overall if you need frequent care. For more guidance, visit How to Pick a Health Insurance Plan.

Key Factors That Determine Your Health Insurance Rate

Beyond age and location, your final average cost of individual health insurance colorado is shaped by the plan type you choose, state-specific programs, and the size of the provider network. Understanding these elements is key to finding a plan that fits your budget and healthcare needs.

Choosing Your Plan Type: HMO vs. EPO

In Colorado's individual market, you'll mainly find two types of plans: HMOs and EPOs. Both use provider networks to manage costs.

HMO (Health Maintenance Organization) plans generally have lower premiums. They require you to use a specific network of doctors and choose a Primary Care Physician (PCP). Your PCP coordinates your care and must provide a referral before you can see a specialist. There is no coverage for out-of-network care except in emergencies.

EPO (Exclusive Provider Organization) plans offer more flexibility. You must stay within the plan's network, but you don't need a PCP or referrals to see specialists. EPOs typically cost more than HMOs but provide more direct access to care. Like HMOs, they do not cover out-of-network care except in emergencies.

Here's a quick comparison:

| Feature | HMO | EPO |

|---|---|---|

| Primary Care Doctor Required | Yes, you choose one | No requirement |

| Specialist Referrals | Required from your PCP | Direct access within network |

| Out-of-Network Coverage | Emergency only | Emergency only |

| Monthly Premiums | Generally lowest | Moderate pricing |

The Colorado Option: A Standardized Approach to Savings

Colorado created the Colorado Option to make health insurance more affordable and easier to compare. These are not new plans but rather existing plans with standardized benefits and lower cost-sharing. The state works with insurers to offer these plans with premium reduction targets, aiming for a 15% decrease by 2025.

A key feature is that many Colorado Option plans offer $0 copays for primary care and mental health visits before you meet your deductible. However, some of these plans may have more limited provider networks, particularly in rural areas. It's essential to check the network to ensure your preferred doctors are included. For more details, explore More info about Health Insurance Options Colorado.

Understanding Your Network: Why It Matters for Your Wallet

Your plan's provider network is the group of doctors and hospitals that have agreed to discounted rates with your insurer. Staying in-network ensures your costs are predictable and that your payments count toward your deductible and out-of-pocket maximum.

Going out-of-network can be very expensive. Your plan may cover little to none of the cost, and what you pay likely won't apply to your in-network deductible. This is especially critical in Colorado, where network size can vary significantly between urban and rural areas. Some plans, including certain Colorado Option plans, may have narrow networks.

Before enrolling, always use the insurer's online directory to check if your current doctors and preferred hospitals are in the network. This simple step can save you from thousands of dollars in unexpected bills.

How to Lower Your Monthly Health Insurance Premiums

The sticker price for the average cost of individual health insurance colorado doesn't have to be what you actually pay. About 8 in 10 people who shop on Connect for Health Colorado qualify for financial assistance, which can significantly lower costs. Let's review the federal and state programs that can help.

Federal Subsidies: Premium Tax Credits and Cost-Sharing Reductions

The federal government offers two types of subsidies to make coverage more affordable.

Advanced Premium Tax Credits (APTC) act like an instant discount on your monthly premium. Based on your household income and size (typically between 100% and 400% of the Federal Poverty Level), these credits are paid directly to your insurer, lowering your monthly bill. Many recipients find plans for less than $100 per month. To learn more about income qualifications, see the Federal Poverty Level (FPL) explained.

Cost-Sharing Reductions (CSRs) lower your out-of-pocket costs like deductibles, copays, and coinsurance. To qualify, your income must be between 100% and 250% of the FPL, and you must enroll in a Silver-tier plan. With CSRs, a Silver plan can provide the value of a Gold or Platinum plan at a much lower premium, making it an excellent choice for eligible individuals.

State-Level Assistance: Health First Colorado and CHP+

Colorado offers its own programs for residents with lower incomes.

Health First Colorado is the state's Medicaid program, providing comprehensive medical benefits at little to no cost for eligible individuals and families. A major benefit is that you can apply and enroll at any time during the year, not just during Open Enrollment. You can check your eligibility and apply at Apply for Health First Colorado at PEAK.

Child Health Plan Plus (CHP+) provides low-cost health and dental insurance for uninsured Colorado children and pregnant women in families who earn too much to qualify for Medicaid but cannot afford private insurance.

Are You Self-Employed? Special Considerations for You

If you're self-employed in Colorado, you have unique ways to manage health insurance costs.

First, you may be able to deduct your health insurance premiums from your gross income, which lowers your overall tax burden. This is available if you are not eligible for an employer-sponsored plan.

Second, consider a Health Savings Account (HSA) paired with a High-Deductible Health Plan (HDHP). This combination offers a powerful triple tax advantage: your contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. HDHPs have lower premiums, and the HSA provides a tax-advantaged way to save for medical costs. For personalized guidance, explore More info about Health Insurance for Self-Employed Colorado.

How, Where, and When to Buy Individual Health Insurance in Colorado

Knowing how your costs are calculated is the first step. Now, let's cover the logistics of purchasing a plan. Choosing where to shop and enrolling at the right time are critical to securing the best coverage at the lowest price.

On-Exchange vs. Off-Exchange: What's the Difference?

You have two primary ways to buy individual health insurance in Colorado.

Connect for Health Colorado is the state's official health insurance marketplace. It's the only place you can apply for and receive federal financial assistance, such as Premium Tax Credits and Cost-Sharing Reductions, to lower your costs. If you think you might qualify for subsidies (as about 80% of shoppers do) this should be your starting point. You can browse plans and see your personalized costs at Visit Connect for Health Colorado.

Off-exchange plans are purchased directly from an insurance company or through a broker. These plans must offer the same essential health benefits as marketplace plans, but you cannot use federal subsidies to pay for them. This option may be suitable if you are certain you don't qualify for financial aid and prefer to work directly with an insurer or broker. As brokers, we at Kelmeg & Associates can help you compare both on- and off-exchange plans to find the best fit at no extra cost to you.

Mark Your Calendar: Open Enrollment and Special Enrollment Periods

Unlike other types of insurance, you can only enroll in a health plan during specific times.

The Annual Open Enrollment Period is the primary time to sign up for or change your plan. In Colorado, this period typically runs from November 1 to January 15. To have your coverage start on January 1, you must enroll by December 15. If you enroll between December 16 and January 15, your coverage will begin on February 1.

If you experience a major life change outside of this window, you may qualify for a Special Enrollment Period (SEP). These are triggered by Qualifying Life Events (QLEs), which give you a 60-day window to enroll in a new plan. Common QLEs include:

- Losing other health coverage (e.g., from a job)

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new area where your old plan isn't offered

- A change in income that affects your subsidy eligibility

It's crucial to act quickly, as the 60-day window is strict. Missing it could mean waiting until the next Open Enrollment period to get coverage. For more details, see What is a Special Enrollment Period (SEP)?.

Frequently Asked Questions about Colorado Health Insurance Costs

Here are answers to some of the most common questions we receive about the average cost of individual health insurance colorado.

Does Colorado require residents to have health insurance?

No, Colorado does not have a state-level mandate requiring residents to have health insurance, and there is no federal tax penalty for being uninsured. However, going without coverage poses a significant financial risk. A single emergency room visit or hospital stay can cost tens of thousands of dollars. Health insurance provides crucial financial protection and access to preventive care to keep you healthy.

What are the cheapest health insurance plans available in Colorado?

The plans with the lowest monthly premiums typically have the highest out-of-pocket costs.

Catastrophic Plans have very low premiums but extremely high deductibles (equal to the annual out-of-pocket maximum). They are only available to individuals under 30 or those who qualify for a hardship exemption. They are designed to protect against worst-case medical scenarios.

Bronze and Expanded Bronze Plans offer the lowest premiums among the standard metal tiers. The average Bronze plan costs $342 per month. These plans are a good option for healthy individuals who want to keep monthly expenses low but still have protection against major health events.

When choosing the "cheapest" plan, it's important to consider your total potential costs, not just the premium. A low-premium plan could be more expensive overall if you need medical care during the year. For help finding a plan that balances affordability with your needs, see More info about Affordable Health Coverage Colorado.

How can I check if my doctor or medications are covered by a plan?

Verifying your coverage before you enroll is one of the most important steps you can take. Here's how:

- Check the Provider Directory: Every plan has an online provider directory on the insurer's website. Use it to search for your specific doctors, hospitals, and specialists to confirm they are in-network.

- Review the Prescription Formulary: Each plan also has a formulary, or drug list, that shows which medications are covered and at what cost tier. Check this list to ensure your prescriptions are included at an affordable cost.

- Use Marketplace Tools: When shopping on Connect for Health Colorado, the platform often has built-in tools to help you search for providers and drugs across different plans.

- Call to Confirm: For 100% certainty, call your doctor's office and the insurance company directly to confirm that the specific plan you're considering is accepted. This can prevent major surprise bills later.

Conclusion: Finding Your Best-Fit Plan in Colorado

Understanding the average cost of individual health insurance colorado is the first step to finding the right plan. As we've seen, the average unsubsidized premium of $380-$405 is just a benchmark. Your actual cost will depend on your age, location, plan choice, and, most importantly, your eligibility for financial assistance.

Remember to look beyond the monthly premium. A low-premium Bronze plan may be best for some, while a Gold plan with higher premiums but lower out-of-pocket costs could be more economical for others. The key is to balance monthly costs with your anticipated healthcare needs.

The real opportunity for savings comes from financial assistance, with nearly 80% of marketplace shoppers qualifying for help. These subsidies, available only through Connect for Health Colorado, make quality coverage affordable for many, with some finding plans for under $100 per month.

Navigating these options can be challenging, but you don't have to do it alone. At Kelmeg & Associates, we are Colorado-based insurance experts who provide personalized guidance at no extra cost to you. We help you compare all your options, maximize your subsidies, and select a plan that truly fits your life and budget.

Ready to find the right health insurance with confidence? Let's work together.

Explore your options at Find the right Individual Health Insurance Plans in Colorado , or call us for a no-pressure consultation. We're here to help you get the right coverage for your unique Colorado life.