Don't Settle: Discovering Colorado's Best Supplemental Insurance

Why Colorado Seniors Need More Than Original Medicare

For Colorado seniors preparing for retirement, understanding the nuances of Medicare is a critical financial step. While Original Medicare (Part A and Part B) provides a foundational layer of health coverage, it was never designed to cover all medical expenses. This leaves significant gaps that can lead to unpredictable and potentially catastrophic out-of-pocket costs. The most effective solution for bridging these gaps are Medicare Supplement plans, also known as Medigap. Among the available options, the best Medigap plans in Colorado are overwhelmingly Plan G and Plan N. Plan G is favored for its comprehensive, near-first-dollar coverage, while Plan N offers a cost-effective alternative with lower premiums in exchange for minor cost-sharing.

Quick Answer for Colorado Residents:

- Top Choice for Comprehensive Coverage: Medigap Plan G, with average monthly premiums around $180.80.

- Top Choice for Lower Premiums: Medigap Plan N, with average monthly premiums around $149.60.

- Market Availability: Colorado's competitive market features over 50 different Plan G policies from dozens of insurance carriers.

- Typical Premium Range: Monthly costs can vary dramatically, from as low as $35 for high-deductible options to over $1,000, depending on the plan, carrier, your age, and other factors.

Original Medicare leaves you responsible for costs like deductibles, coinsurance, and copayments with no annual cap on your spending. For example, Part A has a per-benefit-period hospital deductible ($1,632 in 2024), and Part B requires you to pay 20% of the cost for most doctor services, outpatient care, and medical supplies. A serious illness or major surgery could easily result in tens of thousands of dollars in medical bills. This financial risk is why 47% of Colorado's Original Medicare beneficiaries have wisely chosen to enroll in a Medigap plan to protect their health and their savings.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc. My focus is helping Coloradans steer the complexities of Medicare to find the best Medigap plans in Colorado for their unique circumstances. Securing the right plan during your initial enrollment period is paramount, as it guarantees your acceptance and helps you lock in the most favorable rates without having to undergo medical underwriting.

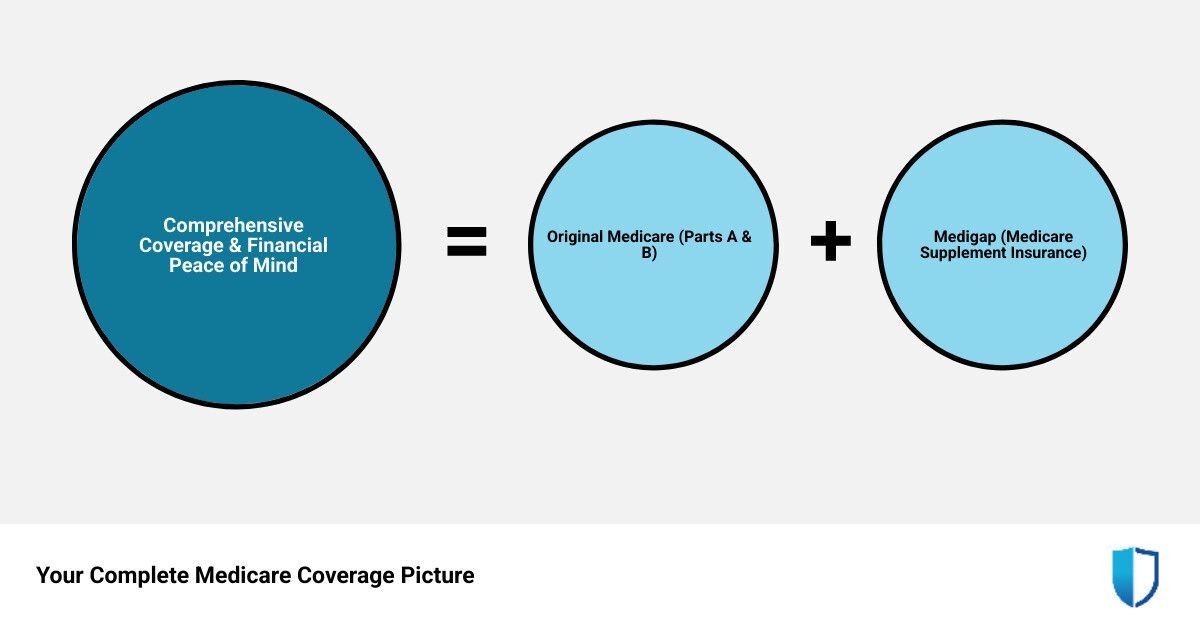

Understanding Medigap and How It Works in Colorado

Original Medicare Parts A and B provide a solid foundation for healthcare, but they typically only cover about 80% of approved medical costs. This leaves you responsible for the remaining 20% with no annual out-of-pocket maximum. Medigap, also known as Medicare Supplement Insurance, is private insurance designed specifically to cover these gaps, paying for some or all of the costs that Medicare does not.

These plans are sold by private insurance companies but are standardized by the federal government. This standardization is a key feature: a Plan G from one company has the exact same medical benefits as a Plan G from another. The only differences are the monthly premium, the carrier's customer service reputation, and potential rate stability. Medigap works in tandem with Original Medicare, meaning you can see any doctor or visit any hospital in the U.S. that accepts Medicare patients, without needing referrals or being restricted to a provider network. At Kelmeg & Associates, Inc., we help you compare these options. You can learn more on our Medicare Supplement Insurance Colorado page or from the official What is Medigap? resource.

A Guide to the 10 Standardized Medigap Plans

Colorado offers up to 10 standardized Medigap plans, labeled A, B, C, D, F, G, K, L, M, and N. Each plan provides a different level of coverage for the costs not paid by Original Medicare. While Plans G and N are the most popular for new enrollees, understanding the full spectrum can help you make an informed choice.

- Plans A and B are the most basic. Plan A covers Part A and B coinsurance. Plan B adds coverage for the Part A hospital deductible.

- Plans C and F offer very comprehensive coverage, including the Part B deductible. However, as of January 1, 2020, they are no longer available to people new to Medicare. If you were eligible for Medicare before 2020, you might still be able to buy one.

- Plan D provides coverage similar to Plan G but does not cover Part B excess charges.

- Plans K and L are cost-sharing plans. They cover a percentage of costs (Plan K covers 50%, Plan L covers 75%) until you reach an annual out-of-pocket limit. Once the limit is met, the plan pays 100% for the rest of the year. These plans have lower premiums but higher out-of-pocket exposure.

- Plan M is another cost-sharing option that covers 50% of the Part A deductible and does not cover the Part B deductible or excess charges.

- High-deductible versions of Plan G and Plan F are also available, offering lower monthly premiums in exchange for a high annual deductible ($2,800 in 2024). These are suitable for individuals who want protection against catastrophic costs but can afford to pay for routine expenses out-of-pocket.

Medigap vs. Medicare Advantage in Colorado

It's crucial to understand the fundamental difference between Medigap and Medicare Advantage, as you can only have one. They represent two distinct paths for your Medicare coverage.

- Medigap: This is supplemental insurance that works with Original Medicare. You pay a separate monthly premium to a private insurer. In return, the plan pays for costs that Medicare leaves behind, such as deductibles and coinsurance. Its greatest strength is freedom of choice; you can see any doctor nationwide that accepts Medicare without network restrictions.

- Medicare Advantage (Part C): This is an alternative way to get your Medicare benefits that replaces Original Medicare. You enroll in a private plan that contracts with Medicare. These plans must provide all the same benefits as Part A and Part B but can have different rules, costs, and restrictions. They often operate as HMOs or PPOs with provider networks, and you will have copays and coinsurance for services. Many also bundle in extra benefits not covered by Original Medicare, such as prescription drugs (Part D), dental, and vision.

Choosing between them depends on your priorities. If you value provider flexibility, predictable costs for medical services, and nationwide coverage, Medigap is often the superior choice. If you prefer a lower monthly premium and are comfortable with network restrictions and a pay-as-you-go model with copays, a Medicare Advantage plan might be a better fit. We can help you explore the alternative on our

Medicare Advantage Plans Colorado page.

What Are the Best Medigap Plans in Colorado for New Enrollees?

For the vast majority of Coloradans new to Medicare, the conversation about the best Medigap plans in Colorado quickly narrows to two excellent options: Plan G and Plan N. A 2020 federal law change, which made plans covering the Part B deductible (like Plan F) unavailable to new enrollees, has firmly established Plan G as the most comprehensive choice and Plan N as its popular, lower-cost counterpart.

These two plans strike an ideal balance between robust financial protection and manageable monthly premiums. They are widely available from numerous insurers across Colorado, making them practical and accessible choices for our new clients at Kelmeg & Associates, Inc. You can explore all your options on our Medicare Supplement Plans Colorado page.

In-Depth Look: Medigap Plan G

Plan G offers the most complete coverage available to new Medicare beneficiaries. Its design is simple and powerful: once you have paid the annual Medicare Part B deductible ($240 in 2024), Plan G covers 100% of the remaining gaps in Original Medicare. This means your out-of-pocket costs for Medicare-approved services are typically zero for the rest of the year.

Plan G covers the Part A hospital deductible, all Part B coinsurance, skilled nursing facility coinsurance, and even Part B excess charges. These excess charges are an additional 15% that some doctors are legally allowed to charge above the Medicare-approved amount. Because Plan G covers them, you have the freedom to see any doctor who accepts Medicare without worrying about this extra bill. This plan is ideal for those who want maximum predictability and peace of mind in their healthcare spending. With dozens of Plan G policies available in Colorado, we can help you find the best rate. Learn more on our Medicare Supplement Plan G Colorado page.

In-Depth Look: Medigap Plan N

Plan N is an excellent choice for healthy, cost-conscious individuals seeking lower monthly premiums without sacrificing significant coverage. It provides strong protection but requires you to share some costs through small, predictable copayments. You may have to pay up to $20 for some office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

Like Plan G, it covers the Part A deductible and Part B coinsurance (after the copays). However, a key difference is that Plan N does not cover Part B excess charges. This makes it a great fit for beneficiaries who can confirm their doctors accept Medicare assignment (meaning they agree to accept the Medicare-approved amount as full payment and will not bill excess charges). Many companies offer Plan N in Colorado, and we can help you compare them, including options on our Blue Cross Blue Shield Medicare Supplemental Insurance Colorado page.

Comparing Plan G vs. Plan N

The choice between Plan G and Plan N comes down to a trade-off between monthly premiums and out-of-pocket costs. Plan G has a higher premium but virtually eliminates all medical costs after the Part B deductible. Plan N has a lower premium, but you retain responsibility for small copays and potential Part B excess charges. For many, the annual premium savings with Plan N (often $300-$500) more than covers potential copay costs, making it a financially savvy choice. However, those who prioritize budget certainty and want to avoid any surprise bills often prefer the comprehensive nature of Plan G.

The High-Deductible Plan G Alternative

For those looking for the lowest possible premiums, the High-Deductible Plan G (HDG) is another option. With this plan, you must pay all Medicare-covered costs, including deductibles and coinsurance, out-of-pocket until you meet a large annual deductible ($2,800 in 2024). After the deductible is met, the plan functions like a standard Plan G, covering 100% of costs for the remainder of the year. This plan offers a safety net against catastrophic health events while keeping monthly premiums very low, often under $50.

Decoding Medigap Costs in Colorado

While Medigap benefits are federally standardized by plan letter, the premiums are not. In Colorado, monthly costs for the same plan can vary by hundreds of dollars from one insurance company to another. Premiums can range from as low as $35 for high-deductible plans to over $1,100 for certain comprehensive policies, with the average Medigap premium hovering around $200 per month in 2023. Understanding what drives this variation is the key to finding the best value for your coverage.

Several factors influence your specific premium:

- Age and Gender: Your age at the time of application is a primary driver of cost. Gender can also affect rates, though this is becoming less common.

- Tobacco Use: Carriers charge significantly higher premiums for tobacco users, often 10-20% more.

- Location: Your zip code matters. Insurers set rates based on local healthcare costs and utilization, so a plan in Denver may cost more than the same plan in a rural part of the state.

- Insurance Company: Each carrier has its own method for calculating risk and setting prices. This is why comparison shopping is absolutely essential.

- Medical Underwriting: If you apply outside of a guaranteed issue period, your health status and medical history will be evaluated. Pre-existing conditions can lead to higher premiums or even a denial of coverage.

At Kelmeg & Associates, Inc., we help you steer these factors to find the most competitive rates. For more on this, visit our Medicare Insurance Colorado page.

How Insurers Price Your Plan: Attained-Age, Issue-Age, and Community-Rated

Insurers use three main pricing methods, which determine how your premium may change over time:

- Attained-Age Rated: This is the most common method in Colorado. Your premium is based on your current age and increases as you get older. These plans often have the lowest initial premiums but can become significantly more expensive over time. It is wise to ask for a carrier's rate increase history before choosing one of these plans.

- Issue-Age Rated: Your premium is based on your age when you first buy the policy. It will not increase simply because you get older, but it can still rise due to inflation and other factors affecting the entire group. This method offers more predictable, stable costs for long-term budgeting.

- Community-Rated: Everyone in a specific geographic area pays the same premium, regardless of their age or gender. These plans can be a great value as you age, but they are less common in Colorado and may have higher starting premiums for a 65-year-old.

Comparing Costs for the Best Medigap Plans in Colorado

Based on 2023 data, here are the average monthly costs for popular plans in Colorado:

- Plan G: Averaged $180.80 per month.

- Plan N: Averaged $149.60 per month, offering about $375 in annual premium savings compared to Plan G.

- Plan F: For those eligible to enroll, this plan averaged $280.90 per month.

Age significantly impacts these costs. A 65-year-old in Colorado paid an average of $124 per month, while a 75-year-old paid $219. High-deductible versions of Plan G and F offer a lower-premium alternative, starting around $35 per month but requiring you to meet a large deductible ($2,800 in 2024) before coverage kicks in.

Medigap plans do not include prescription drug coverage. You will need to enroll in a separate Medicare Part D plan to cover your medications, which we can help you find on our Colorado Medicare Part D Plans page.

How and When to Enroll in a Colorado Medigap Plan

Choosing the right plan is important, but enrolling at the right time is absolutely critical. The process involves applying directly with an insurance company, but your timing determines whether you have guaranteed acceptance or must undergo a rigorous health evaluation known as medical underwriting.

Are You Eligible for a Medigap Plan?

To be eligible to purchase a Medigap plan, you must be enrolled in both Medicare Part A and Part B. Most people become eligible when they turn 65. However, Colorado offers stronger consumer protections than many other states. Colorado law requires insurers to offer at least one Medigap plan (Plan A) to Medicare beneficiaries who are under 65 and eligible due to a disability. This is a crucial benefit for younger individuals on Medicare, providing them with an avenue to limit their out-of-pocket costs, a protection not available in over 20 other states. If you need help with the first steps, visit our Apply for Medicare Colorado page.

Timing is Everything: Your Medigap Open Enrollment Period

The single most important time to buy a Medigap policy is during your Medigap Open Enrollment Period. This is a one-time, six-month window that automatically begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this protected period, you have guaranteed issue rights. This means insurance companies:

- Cannot deny you coverage for any Medigap plan they sell.

- Cannot charge you a higher premium because of your health history or pre-existing conditions.

- Cannot impose a waiting period for coverage of pre-existing conditions.

Missing this window means you lose these federal protections. To buy a plan later, you will likely have to answer detailed health questions, and an insurer could deny your application or charge a much higher rate. This is why we stress the importance of acting during your Open Enrollment Period. You can learn more from Medicare's resources on the

six-month Medigap open enrollment period.

Other Guaranteed Issue Scenarios

While the Open Enrollment Period is the primary time to enroll, certain life events can trigger a shorter guaranteed issue period, allowing you to buy a Medigap plan without underwriting. These situations include:

- Losing employer-sponsored group health coverage that was supplementing Medicare.

- Moving out of your Medicare Advantage plan's service area.

- Your Medicare Advantage plan leaving the Medicare program.

- You enrolled in a Medicare Advantage plan when you first became eligible for Medicare and decide to switch back to Original Medicare within the first year (this is known as a "trial right").

- Your Medigap insurance company goes bankrupt.

How to Choose the Best Medigap Plans in Colorado for Your Needs

Selecting the right plan requires a careful analysis of your health, budget, and personal preferences. Consider these factors:

- Assess Your Health: If you have chronic conditions or anticipate needing frequent medical care, the comprehensive coverage of Plan G may be worth the higher premium. If you are generally healthy, the lower premium of Plan N could save you hundreds of dollars a year.

- Consider Your Budget: Look beyond the monthly premium. Factor in potential out-of-pocket costs like the Part B deductible and Plan N's copays to understand your total potential exposure.

- Compare Companies: Since benefits for a given plan letter are identical, compare companies based on price, long-term rate stability, and customer service ratings. Some insurers also offer household discounts if a spouse or partner enrolls with the same company.

As your

Colorado Medicare Insurance Broker, we can help you weigh these factors and analyze quotes from multiple carriers at no cost to you. We simplify the process to ensure you make a confident choice during your critical enrollment window.

Frequently Asked Questions about Medigap in Colorado

Navigating Medicare raises many questions. Here are concise answers to some of the most common concerns we hear from Colorado residents.

Can I be denied a Medigap plan in Colorado?

Yes, you can be denied, but only if you apply outside of a protected enrollment period. During your one-time, six-month Medigap Open Enrollment Period, you have a guaranteed issue right to buy any plan an insurer sells, regardless of your health. The same is true during other specific guaranteed issue scenarios, like losing employer coverage. Outside of these windows, insurers can and will use medical underwriting. This means they will ask detailed health questions and can deny your application or charge you a significantly higher premium based on your health history.

Do Medigap plans cover prescription drugs, dental, or vision?

No. Medigap plans are designed exclusively to fill the gaps in Original Medicare's hospital (Part A) and medical (Part B) coverage. They do not cover routine dental, vision, or hearing services, nor do they cover prescription drugs. For prescription drug coverage, you must enroll in a separate, standalone Medicare Part D plan. Standalone dental and vision insurance plans are also available for purchase to cover those needs.

Can I switch my Colorado Medigap plan later?

Yes, but it can be difficult. You can apply to switch plans at any time, but unless you qualify for a new guaranteed issue right, you will have to go through medical underwriting again. An insurer can review your current health and decide whether to accept your application and at what price. Colorado does not have a "Birthday Rule," which in some other states allows beneficiaries to switch plans annually without underwriting. This makes your initial plan choice extremely important, as it may be the one you keep for many years.

What is the difference between Medigap and Medicaid?

This is a common point of confusion. Medigap is health insurance you purchase from a private company to supplement Original Medicare. Medicaid is a joint federal and state program that provides free or low-cost health coverage to millions of Americans with limited income and resources. Some people may be eligible for both Medicare and Medicaid, and in those cases, Medicaid often covers most of the costs that Medigap would.

What are Part B excess charges?

Part B excess charges are additional fees that some doctors can charge. Federal law allows doctors who do not accept "Medicare assignment" (the Medicare-approved amount as full payment) to charge up to 15% more than that amount. This extra 15% is billed directly to you. While not all doctors bill for excess charges, it can be an unexpected cost. Medigap Plan G and Plan F cover these charges, while Plan N does not.

Do I need Medigap if I have TRICARE for Life?

Generally, no. TRICARE for Life (TFL) is a health benefit for military retirees and their eligible family members. TFL acts as a secondary payer to Medicare, wrapping around it to cover most out-of-pocket costs. For most TFL beneficiaries, a Medigap plan would be redundant and an unnecessary expense.

Conclusion

Choosing the best Medigap plan in Colorado is a critical decision for your health and financial security in retirement. As we have explored, Original Medicare alone leaves you exposed to significant financial risk. For new Medicare beneficiaries, Plan G and Plan N emerge as the most compelling solutions, offering an outstanding combination of coverage and value. Plan G provides near-complete protection for those who prioritize budget predictability and peace of mind, covering virtually all out-of-pocket costs after a small annual deductible. Plan N presents a smart, lower-premium alternative for those comfortable with small, predictable copays in exchange for substantial annual savings.

Timing is everything. Your six-month Medigap Open Enrollment Period is a golden, one-time opportunity to enroll in any plan you want at the best possible rates, with no health questions asked. Missing this window can result in higher premiums or even an outright denial of coverage, making your initial choices all the more impactful. Understanding the nuances of pricing models, the full range of available plans beyond just G and N, and your specific enrollment rights are all key to making a successful long-term decision.

At Kelmeg & Associates, Inc., our mission is to provide expert, unbiased guidance at no extra cost to you. As your Colorado-based Medicare specialists, we cut through the confusion, compare rates from top-rated carriers, and help you find a plan that fits your health needs, budget, and lifestyle. Your healthcare is far too important for guesswork.

Take control of your healthcare future by making an informed decision. Contact us for a free, no-obligation consultation. We will help you steer your options and secure the right supplemental coverage for your needs.

Find the right supplemental insurance plan for your needs in Colorado today.