The ACA Explained Simply (No Acronyms Allowed!)

Understanding ACA: What Does It Actually Mean?

When people mention ACA, they're typically referring to one of several organizations or laws.

The most common meaning of ACA is the Affordable Care Act, also known as "Obamacare," which was signed into law in 2010. This healthcare legislation aims to make health insurance more affordable and accessible to Americans through subsidies, expanded Medicaid eligibility, and insurance market reforms.

If you're confused about which ACA someone is referring to, the context usually provides clues. In healthcare discussions, it's almost always the Affordable Care Act, while in financial services, it might be ACA Group or ACA International.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I help individuals and businesses steer the complexities of ACA health insurance coverage and find plans that meet their unique needs. My experience has taught me that understanding these distinctions is crucial for making informed decisions about your healthcare options.

What "ACA" Can Mean (Beyond Health Law)

When someone mentions "ACA" in conversation, it can feel like hearing a popular first name in a crowded room—you need a little more context to know exactly which one they mean. Let's explore the different organizations and laws that share these three letters.

Affordable Care Act (ACA) vs. Other ACAs

While the healthcare law is the best-known ACA, several other prominent organizations also use the acronym, each serving very different purposes:

In the healthcare world, the Affordable Care Act transformed how Americans get health insurance by creating marketplace exchanges, expanding Medicaid eligibility, and requiring coverage for people with pre-existing conditions.

In the financial sector, ACA International represents the accounts receivable management industry—the companies that help businesses recover outstanding debts while following ethical guidelines and consumer-protection laws.

For mental-health professionals, the American Counseling Association provides education, advocacy, and ethical standards that guide counseling practice nationwide.

For outdoor enthusiasts, the American Canoe Association has promoted paddling safety and conservation since 1880, making it one of America's oldest recreational organizations.

And in financial regulation, ACA Group helps investment firms steer complex compliance requirements with specialized expertise and technology solutions.

ACA International at a Glance

Founded back in 1939, ACA International serves as the voice of the accounts-receivable management industry. While that might sound like dry corporate speak, their work touches many aspects of our everyday economy.

They help establish ethical standards for how debt collection should work, provide education to their members on staying compliant with changing regulations, and advocate for balanced legislation that protects both consumers and businesses. Their regular industry events bring professionals together to share best practices and improve standards.

As they explain on their website, "ACA International members play a critical role in supporting the credit-based economy." Without their standardized collection practices, our entire lending system would be less stable and potentially more expensive for regular consumers like you and me.

ACA Group in Finance & Compliance

The ACA Group operates in a specialized corner of financial services that most of us rarely see but definitely benefit from. They focus on governance, risk, and compliance solutions that help keep financial markets functioning properly.

With over 600 employees serving more than 6,000 clients worldwide, they've spent more than two decades building expertise in financial regulation. Their services blend human knowledge with technology solutions, offering compliance advisory from former regulators, managed services for routine compliance tasks, and their own proprietary ComplianceAlpha platform.

They also provide specialized cybersecurity consulting and, increasingly important in today's market, ESG (Environmental, Social, Governance) advisory services. Their clients include hedge funds, private-equity firms, broker-dealers, and wealth managers—basically, the companies that manage investments for individuals and institutions.

What makes ACA Group distinctive is how they combine deep human expertise with technological solutions, helping financial companies steer increasingly complex regulatory requirements while remaining focused on their core business.

Deep Dive: Affordable Care Act (ACA)

Now let's focus on the most commonly referenced ACA—the Affordable Care Act. Officially called the Patient Protection and Affordable Care Act, this landmark legislation was signed into law by President Barack Obama on March 23, 2010.

Affordable Care Act (ACA) Goals in Plain English

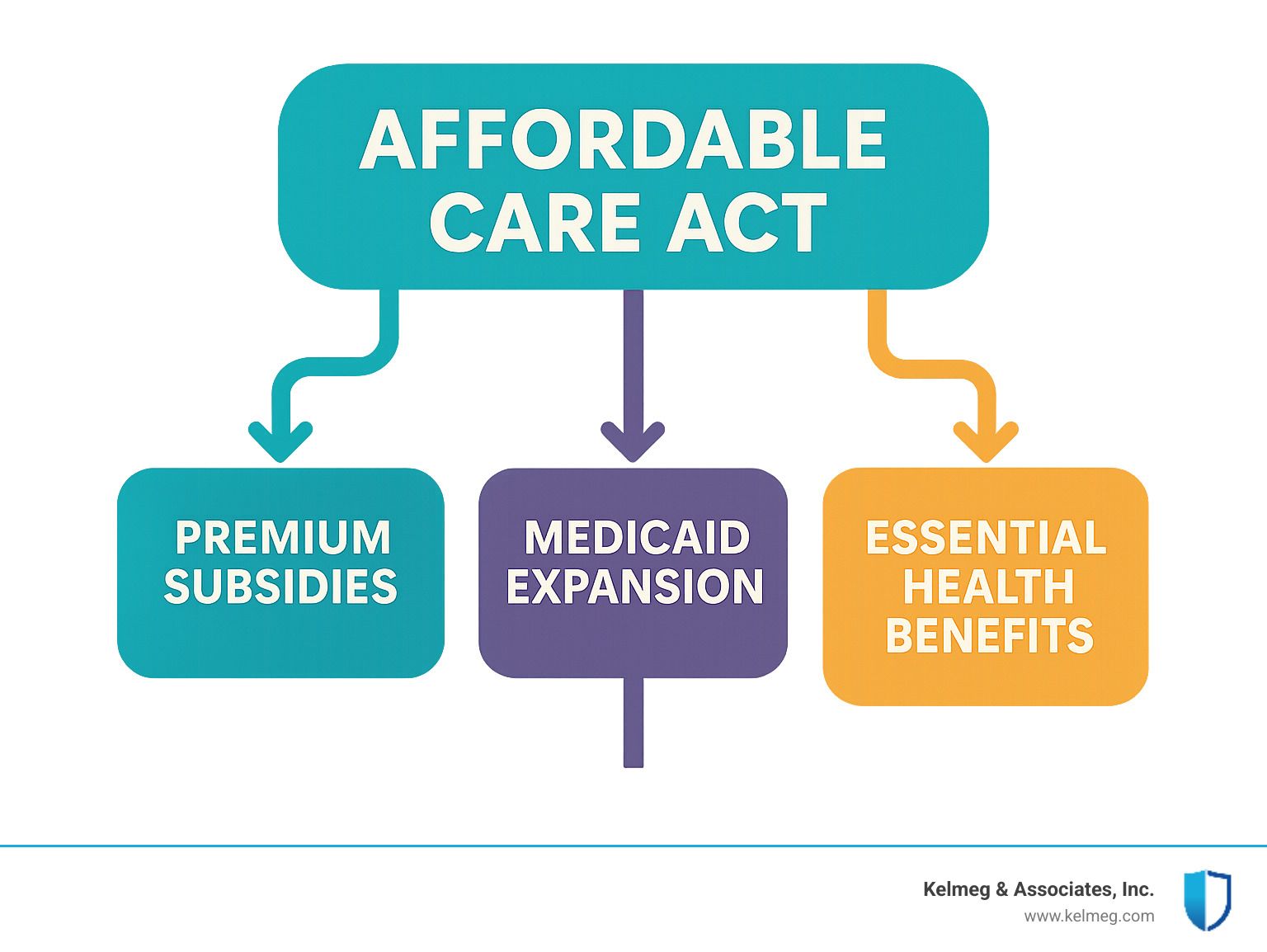

The ACA wasn't just another piece of legislation—it represented a fundamental shift in how Americans access healthcare. At its heart, the law had three straightforward goals:

First, it aimed to make health insurance available to more people. Remember the days when getting sick could mean financial ruin? The ACA created health-insurance marketplaces where individuals could shop for coverage, offered income-based subsidies, and expanded Medicaid eligibility to help more Americans get covered.

Second, it worked to make health insurance more affordable for everyday families. Through premium tax credits for households earning between 100 % and 400 % of the federal poverty level, millions of Americans who previously couldn't afford coverage suddenly found it within reach. For many Colorado families we work with, these subsidies have been game-changers.

Third, it sought to support innovative medical-care delivery methods. Rather than just paying for more of the same, the ACA encouraged healthcare providers to explore new approaches that could improve quality while controlling costs—something we can all appreciate when those medical bills arrive.

Beyond these goals, the law established consumer protections that many of us now take for granted. Insurance companies can no longer turn you away because of pre-existing conditions. Your college graduate can stay on your family plan until age 26. Your annual check-up is covered without cost-sharing. And those scary "lifetime limits" that could cut off your coverage when you needed it most? Gone.

If you're wondering how these protections might benefit your family specifically, we're always happy to walk through your options at Kelmeg & Associates. You can also learn more about Affordable Health Coverage in Colorado on our website.

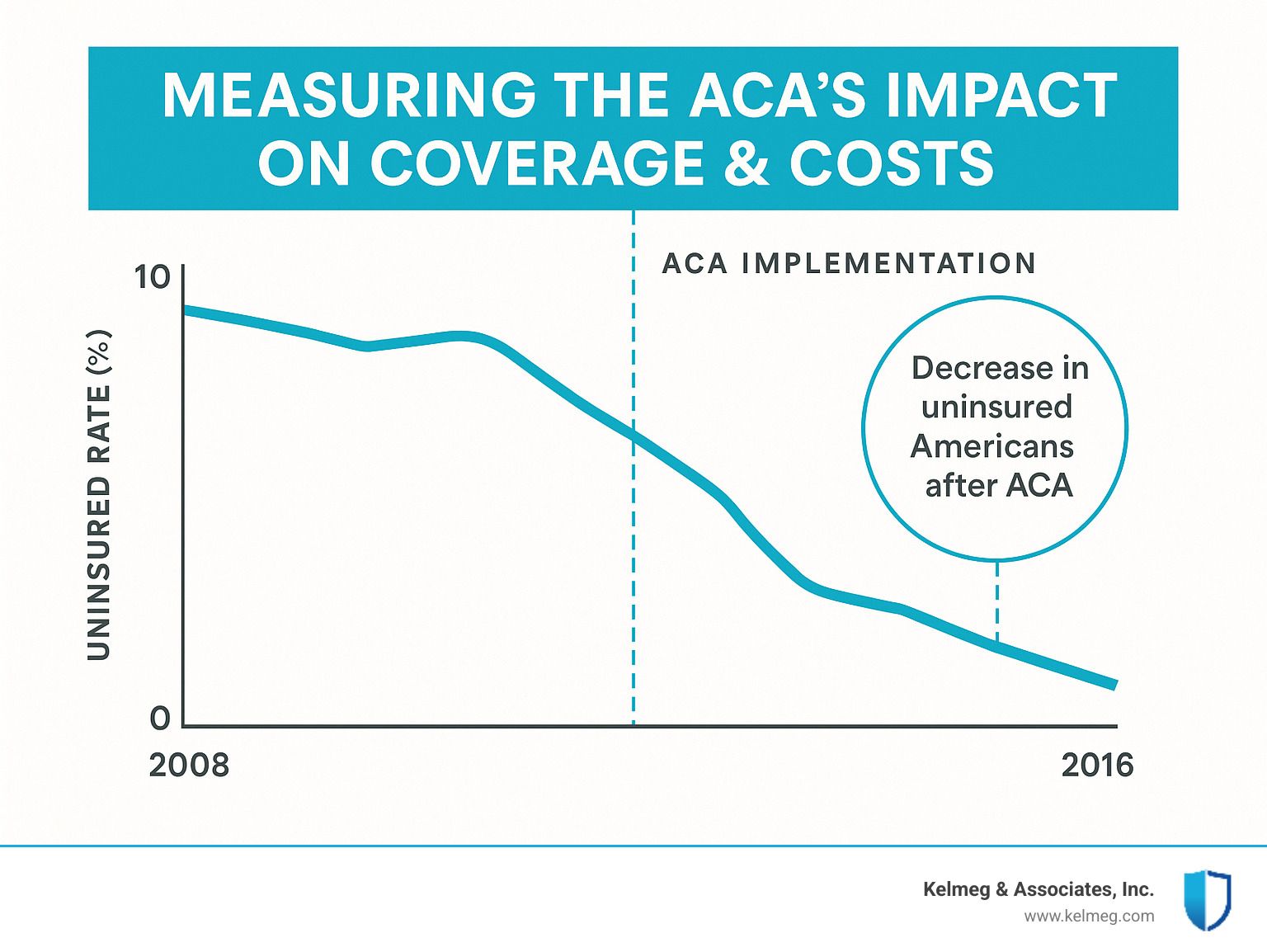

Measuring the ACA's Impact on Coverage & Costs

The proof, as they say, is in the pudding. Since the ACA was implemented:

The uninsured rate in America approximately halved by 2016, with between 20 and 24 million additional people gaining health coverage. That's roughly the population of Florida suddenly having access to healthcare they couldn't get before.

Healthcare spending growth slowed compared to historical trends—a welcome change after decades of costs outpacing inflation. Even premiums for employer-based plans grew more slowly than they had before.

The Congressional Budget Office—which doesn't have a political dog in the fight—concluded that the ACA actually reduced the federal budget deficit. Repealing it would cost more, not less.

The law also reduced income inequality by shifting resources. Primarily through taxes on the top 1 % of earners, the ACA funded about $600 in benefits on average to families in the bottom 40 % of income distribution.

Here in Colorado, we've seen these national trends reflected in our local communities. Many of our clients have shared stories about finally being able to afford regular check-ups or vital medications thanks to their ACA coverage.

Amendments & Court Battles You Should Know

The journey of the ACA hasn't been a smooth ride down I-25. It's faced more twists and turns than a mountain pass, including several major legal challenges:

In NFIB v. Sebelius (2012), the Supreme Court upheld the individual mandate as constitutional under Congress's taxing power, while making Medicaid expansion optional for states. This ruling preserved the law but created a coverage gap in states that chose not to expand Medicaid.

Then came King v. Burwell (2015), where the Supreme Court ruled that federal tax credits could be provided in all states, not just those that set up their own insurance exchanges. This decision ensured that millions of Americans wouldn't suddenly lose their subsidies.

In 2017, as part of the Tax Cuts and Jobs Act, Congress effectively eliminated the individual mandate penalty by reducing it to $0 starting in 2019. Many predicted this would cause the insurance markets to collapse—but they've proven more resilient than expected.

Most recently, Texas v. United States/California (2018-2021) challenged whether the ACA could survive without the mandate penalty. In June 2021, the Supreme Court dismissed the case, keeping the law intact.

Through all these challenges, the core protections and structures of the ACA have endured. For Colorado residents trying to steer these changes, having an experienced guide can make all the difference. You can learn more about the federal poverty levels that determine subsidy eligibility at healthcare.gov.

At Kelmeg & Associates, we've helped countless clients understand how these legal shifts affect their coverage options, ensuring they don't miss out on benefits they're entitled to receive.

Spotlight on Other ACA Organizations

While the Affordable Care Act dominates discussions about "ACA" in healthcare circles, several other organizations sharing this acronym make meaningful contributions in their own fields. Each has a unique mission that impacts thousands of people in very different ways.

ACA International & ACA Group: Financial World Uses

Since 1939, ACA International has been the trusted voice for the accounts-receivable management industry. If you've ever wondered who sets the standards for how companies collect payments, this is the organization. They're not just about collecting debts—they're about doing it ethically and professionally.

Their members benefit from advocacy efforts that help shape fair industry regulations, comprehensive compliance resources to steer complex rules, and specialized insurance options through their Collectors Insurance Agency. What I find particularly valuable is their commitment to education—offering professional credentials that raise standards across the industry.

When members gather at ACA International events, they're not just networking; they're sharing best practices that ultimately protect consumers while helping businesses remain viable. Their work touches virtually every sector of our economy.

The ACA Group takes a different approach to financial services, focusing on governance, risk, and compliance solutions. With over two decades of experience, they've become trusted advisors to more than 6,000 clients worldwide. What makes them special is their blend of human expertise (including former regulators) with cutting-edge technology.

Their ComplianceAlpha platform helps financial firms streamline regulatory compliance, while their benchmarking services let companies understand how they measure up against industry standards. In today's complex regulatory landscape, their cybersecurity and ESG advisory services have become increasingly vital for hedge funds, private-equity firms, and other financial institutions.

The American Counseling Association proudly calls itself "the home for professional counseling," and with good reason. As the world's largest organization representing professional counselors, they're on a mission to advance mental health through community, inclusion, advocacy, and research.

One of their most exciting recent initiatives is the Counseling Compact—an interstate agreement that allows licensed counselors to practice across state lines. This is a game-changer for mental-health access, especially in underserved areas. They recently celebrated Washington, D.C. signing this legislation, marking another step toward nationwide mental-health accessibility.

Their advocacy extends beyond professional concerns to fight for mental-health parity in insurance coverage—something we at Kelmeg & Associates deeply understand the importance of. Their annual conference brings together thousands of professionals for over 200 educational sessions, creating a vibrant community of learning and support.

What truly stands out about this ACA is how they blend professional development with genuine care for community wellbeing. Their continuing education opportunities ensure counselors stay at the forefront of their field, ultimately benefiting everyone who seeks mental-health support.

American Canoe Association Programs

There's something wonderfully timeless about the American Canoe Association. Founded in 1880, it's one of America's oldest recreational organizations, yet its mission remains fresh and relevant: connecting diverse communities through paddlesports while promoting safety, stewardship, and fun.

Their paddlesport safety education program has set the gold standard for water safety, with comprehensive instructor certifications that have likely saved countless lives. Their stewardship initiatives go beyond just enjoying waterways to actively protecting them—promoting clean water and access for future generations.

Recently, the ACA celebrated American teams bringing home silver and bronze medals at the 2024 Rafting World Championships—a testament to their support for competitive excellence alongside recreational enjoyment.

What I find most remarkable about this organization is how they blend serious safety and conservation work with the pure joy of paddling. Whether you're a weekend kayaker or a competitive canoeist, their insurance coverage for paddlers, clubs, and events provides peace of mind while their advocacy ensures continued access to our precious waterways.

Each of these organizations may share the same acronym, but they serve their communities in beautifully different ways—from financial integrity to mental-health support to environmental stewardship—reminding us that three simple letters can contain worlds of meaning.

How to Know Which ACA Someone Means

Imagine you're in a conversation and someone mentions "ACA" - without more information, it's like trying to figure out which "John" someone's talking about at a family reunion. With several organizations sharing these three letters, a little detective work helps clear things up.

Simple Tips to Clarify "ACA" in Conversation

The context usually gives away which ACA someone means. When I'm helping clients at Kelmeg & Associates, I've found that paying attention to a few simple clues makes all the difference.

If someone mentions premiums, coverage limits, or healthcare marketplaces, they're almost certainly talking about the Affordable Care Act. Their questions often revolve around enrollment periods or subsidy eligibility.

On the other hand, if the conversation involves financial compliance or debt collection practices, they're likely referring to ACA Group or ACA International. These discussions typically happen in business settings and involve regulatory concerns.

The setting itself offers valuable hints too. A conversation at a doctor's office or insurance agency is probably about healthcare, while one at a financial firm might focus on compliance services. And if you're near water with people carrying paddles? That's definitely the American Canoe Association!

Industry vocabulary is another giveaway. Words like subsidy or marketplace point to the healthcare law, while terms like counselor licensure or mental health parity suggest the American Counseling Association.

When reading about an ACA, pay attention to capitalization. In writing, "ACA" (all caps) typically refers to an organization, while "Aca" might be short for "academic" or something else entirely.

Here's my favorite tip from years of explaining insurance options: when in doubt, just ask for clarification. A simple "Are you referring to the healthcare law or something else?" saves everyone time and confusion. Most people appreciate the chance to be more specific.

At Kelmeg & Associates, we specialize in the healthcare-related ACA, helping Colorado residents steer their coverage options. But we understand the importance of clear communication, which is why we typically use the full name "Affordable Care Act" in our client discussions.

The most important thing to remember is that confusion about which ACA is being discussed is completely normal - even industry professionals sometimes need to double-check which organization is being referenced. A quick visit to the organization's website can provide the definitive answer when you need absolute clarity.

Frequently Asked Questions About ACA

Does "ACA" always refer to health insurance?

Not at all! While many people immediately think of healthcare when they hear "ACA," this three-letter acronym wears many hats. The Affordable Care Act is certainly the most famous "ACA" in the room, especially in healthcare conversations. However, it also represents several important organizations including ACA International (those folks who help with credit and collections), ACA Group (the financial compliance experts), the American Counseling Association (mental health advocates), and even the American Canoe Association (for all things paddling).

When we sit down with clients here at Kelmeg & Associates, and we mention ACA, we're talking about the healthcare law that changed the insurance landscape by expanding coverage options and creating important consumer protections. Context is everything!

How did the Affordable Care Act change buying individual health insurance plans?

Remember the "wild west" days of health insurance before the ACA? The landscape for individual health insurance has completely transformed since then in ways that truly benefit consumers.

Before the ACA, insurance companies could simply show you the door if you had asthma, diabetes, or even a history of pregnancy. Now, they must offer you coverage regardless of pre-existing conditions – that's the guaranteed issue protection that's helped millions of Americans.

Your insurance card also carries more weight now. All ACA-compliant plans must cover ten essential health benefits, from doctor visits and emergency services to prescription drugs and mental health care. Gone are the days of "skinny" plans that left you vulnerable when you actually needed care.

For many Colorado families, the premium subsidies have been game-changers. If your household income falls between 100% and 400% of the federal poverty level, you might qualify for tax credits that significantly reduce your monthly premiums. Some of our clients are genuinely surprised by how affordable their coverage becomes with these subsidies.

The ACA also introduced a helpful "metal" system – Bronze, Silver, Gold, and Platinum plans – that makes it easier to understand how costs are shared between you and your insurance company. And perhaps most importantly, insurance companies can no longer set lifetime or annual dollar limits on essential benefits, providing peace of mind that your coverage won't run out when you need it most.

For our Colorado neighbors shopping for individual health insurance, these changes mean more comprehensive protection and potentially significant financial assistance. We love helping clients find that perfect balance between coverage and cost for their unique situation.

More info about Individual Health Insurance Plans Colorado

Where can I find reliable details on each ACA?

With so many organizations sharing the same acronym, it's important to get your information from the source. For trustworthy details about each ACA, we recommend bookmarking these official websites:

For the healthcare law, Healthcare.gov is your go-to resource. It's the official government site with comprehensive information about the Affordable Care Act, including enrollment guides and subsidy calculators.

The other ACAs maintain equally helpful websites: acainternational.org for the collections association, acaglobal.com for the financial compliance firm, counseling.org for the counseling professionals, and americancanoe.org for the paddlesport enthusiasts.

Here in Colorado, navigating health insurance options under the Affordable Care Act doesn't have to be a solo journey. Our team at Kelmeg & Associates stays immersed in the latest ACA developments and regulations so you don't have to. We provide personalized consultations at no additional cost – yes, our guidance is completely free to you! – to help you find coverage that truly fits your needs and budget.

We've guided countless Colorado residents through their ACA options, translating insurance jargon into plain English and helping them find plans that work for real life. After all, health insurance should give you peace of mind, not a headache.

Conclusion

Sorting through what "ACA" means isn't just an academic exercise—it can directly impact your healthcare decisions, financial planning, and even your recreational activities.

When it comes to the ACA that affects most Americans' lives—the Affordable Care Act—understanding your options can feel overwhelming. The law's many provisions, from premium subsidies to essential health benefits, create a complex landscape that's challenging to steer alone.

That's where we come in. At Kelmeg & Associates, Inc., we've built our reputation on helping Colorado residents cut through the confusion around health insurance. We're not just insurance brokers—we're your neighbors and guides through the healthcare maze.

Our team works with clients from Lafayette to Broomfield, Boulder to Adams County, and throughout Colorado to find coverage that truly fits their lives and budgets. The best part? Our expert guidance comes at no additional cost to you. We believe everyone deserves clear, personalized advice when making decisions that affect their health and financial wellbeing.

When someone mentions "ACA" during our consultations, we know they're typically referring to the Affordable Care Act—the landmark legislation that transformed how Americans access health insurance. But we also understand the importance of clarity, which is why we take the time to ensure we're all speaking the same language.

Whether you're shopping for an individual health plan during open enrollment, trying to understand if you qualify for premium subsidies, or simply wanting to know what rights the ACA guarantees you as a healthcare consumer, our team is here to help. We translate insurance jargon into plain English and transform complex options into clear choices.

The healthcare world has enough acronyms and abbreviations without adding to the confusion. At Kelmeg & Associates, we're committed to making your insurance experience straightforward and stress-free. We believe in building relationships based on trust and understanding—because your health coverage is too important to leave to guesswork.

For personalized guidance on your health insurance options under the Affordable Care Act, reach out to us today. Let's clear up the confusion together and find the coverage that best protects you and your family.