A How-To Guide for Personal Health Insurance in Colorado

What is Personal Health Insurance in Colorado?

Personal health insurance in Colorado is designed to provide coverage for medical expenses for individuals and families who do not receive insurance through their employer. Unlike employer-based insurance, personal health insurance offers a range of plans that can be custom to meet specific health needs and financial situations. These plans are crucial for residents looking to ensure comprehensive health coverage without relying on employer-provided options.

Personal health insurance covers a variety of medical services, including doctor visits, hospital stays, preventive care, and prescription drugs. Understanding the basics of personal health insurance in Colorado can help you make informed decisions and secure the protection you need.

Types of Personal Health Insurance Available in Colorado

Colorado residents have access to a variety of personal health insurance options designed to fit different life situations and healthcare needs. Whether you're single, have a family, or fall within specific income brackets, there's likely a plan that can work for you.

Individual plans provide custom coverage for singles or self-employed Coloradans who need health insurance without an employer's support. These plans can be customized to match your specific health concerns and budget constraints, giving you the freedom to choose what matters most in your healthcare journey.

Family plans bring everyone under one protective umbrella, offering comprehensive coverage that addresses the diverse health needs of parents and children alike. These plans typically provide value through shared deductibles and out-of-pocket maximums while ensuring each family member receives necessary care.

ACA Marketplace plans in Colorado offer standardized coverage through Connect for Health Colorado, the state's official health insurance marketplace. These plans are categorized by metal tiers (Bronze, Silver, Gold, and Platinum) and may include financial assistance based on your income, making quality healthcare more accessible for many Coloradans.

Government Health Plans: Medicaid and CHP+

For many Colorado families, government health plans provide vital coverage when private insurance isn't financially feasible.

Medicaid in Colorado (Health First Colorado) serves as a lifeline for lower-income residents who might otherwise go without essential healthcare. Eligibility depends primarily on your income and household size, with expanded coverage available since Colorado adopted Medicaid expansion under the Affordable Care Act.

The Child Health Plan Plus (CHP+) fills an important gap for Colorado families who earn too much to qualify for Medicaid but still struggle to afford private insurance. This program specifically helps children and pregnant women receive necessary medical care, preventive services, and other health benefits at significantly reduced costs.

Applying for these government programs is straightforward, with online, phone, and in-person options available. Many Coloradans are surprised to find they qualify, especially families with children or those experiencing temporary financial hardship.

For detailed information about CHP+ eligibility requirements and benefits, you can visit Do You Qualify for Child Health Plan Plus?.

Understanding the full spectrum of personal health insurance options in Colorado is crucial for making informed decisions about your healthcare coverage. Each type of plan offers different advantages, and finding the right fit often depends on your unique health needs, financial situation, and family circumstances.

How to Choose the Right Personal Health Insurance Plan

Finding the perfect personal health insurance Colorado plan is a bit like shopping for your ideal home – it needs to fit your lifestyle, budget, and future needs. Let's break down how to make this important decision without getting overwhelmed.

When you're exploring your options, first think about your health needs realistically. Do you visit doctors frequently? Take regular medications? Plan to start a family soon? These factors will guide your choice.

On-Exchange vs. Off-Exchange Plans represent two different shopping avenues. On-exchange plans are available through Connect for Health Colorado (the state's official marketplace) and can come with financial help if your income qualifies. Off-exchange plans are purchased directly from insurance companies and, while they don't offer subsidies, they sometimes provide more variety or specialized options.

Understanding plan tiers is crucial to finding your sweet spot between monthly costs and coverage. Think of them as different levels of financial protection:

Bronze plans are like having a higher deductible on your car insurance – you'll pay less each month, but more when you actually need care. These work well if you rarely visit doctors.

Silver plans strike a middle ground and are especially valuable if you qualify for cost-sharing reductions, which can significantly lower your out-of-pocket expenses.

Gold plans cost more monthly but cover more of your care costs. If you know you'll need frequent medical attention, these often provide better overall value despite the higher premiums.

Don't forget to check the provider networks for each plan you're considering. Having to switch from a trusted family doctor because they're suddenly "out-of-network" can be both emotionally and financially taxing. Take a few minutes to verify that your preferred doctors, specialists, and hospitals are covered in any plan you're considering.

Comparing Personal Health Insurance Plans in Colorado

When comparing plans side by side, it helps to understand the financial trade-offs. The classic balancing act is between premiums and deductibles. A lower monthly premium typically means a higher deductible (the amount you pay before insurance kicks in). Ask yourself: would you rather pay more predictably each month, or risk paying more all at once if something happens?

Copays and coinsurance are the smaller payments you make when receiving care. A copay is a fixed amount (like $25 for a doctor visit), while coinsurance is a percentage of the cost (like paying 20% of a hospital stay). These seemingly small numbers can add up quickly, especially for ongoing conditions.

Look carefully at each plan's specific benefits. Some plans offer excellent prescription coverage but limited mental health services. Others might excel in preventive care but charge more for specialist visits. The details matter based on your specific health situation.

For a deeper dive into the various plans available specifically for Colorado residents, our comprehensive guide to Individual Health Insurance Plans Colorado can help you compare options more thoroughly.

The "best" plan isn't necessarily the cheapest or the one with the lowest deductible – it's the one that provides the right balance of coverage and affordability for your unique situation. And don't hesitate to ask questions; that's what insurance professionals are here for.

Applying for Personal Health Insurance in Colorado

Navigating the application process for personal health insurance in Colorado might seem daunting, but it's actually quite straightforward once you understand the timing and steps involved. Let's walk through this journey together.

The most important thing to know is when you can apply. Most Coloradans apply during the Open Enrollment Period, which typically runs from November 1st through January 15th each year. This is your annual opportunity to shop for and select ACA Marketplace plans for the coming year.

But life doesn't always follow a schedule, does it? That's why Special Enrollment Periods exist. If you experience a qualifying life event—like getting married, having a baby, or losing other health coverage—you don't have to wait for Open Enrollment. You'll typically have 60 days from the event to select a new plan.

Connect for Health Colorado is your go-to resource for finding ACA-compliant plans. This state-run marketplace was created specifically to help Colorado residents compare plans, determine eligibility for financial assistance, and enroll in coverage. You can explore your options by visiting the Connect for Health Colorado Marketplace, where trained representatives can also answer your questions.

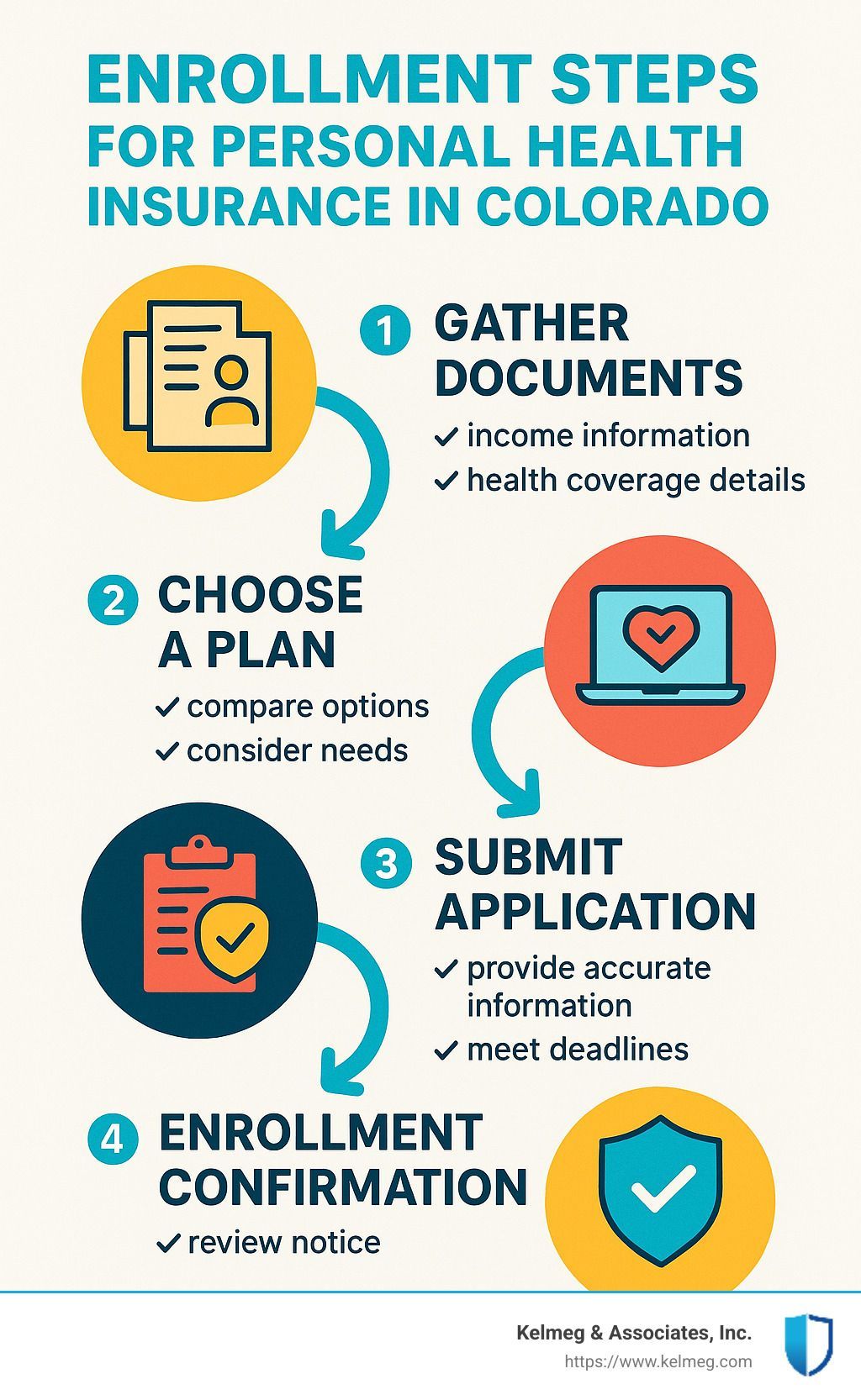

Steps to Enroll in Personal Health Insurance in Colorado

Ready to enroll? Here's how to make the process smooth and stress-free:

First, gather all your essential documents. You'll need proof of income (like pay stubs or tax returns), information about your household size, and details about any current insurance coverage. Having these ready beforehand saves time and prevents frustration during the application process.

Next comes the fun part—choosing your plan! Take your time to evaluate different options based on your healthcare needs, budget, and preferences. Consider factors like premium costs, deductible amounts, and whether your favorite doctors are in-network.

Once you've selected your ideal plan, it's time to submit your application. You can complete this process online through Connect for Health Colorado, over the phone, or with the help of a licensed insurance agent. Many Coloradans find that working with an experienced agent makes the process much easier—and it doesn't cost you anything extra.

After submitting your application, you'll receive enrollment confirmation. This typically includes details about when your coverage begins, how to make your first premium payment, and information about using your new insurance. Be sure to read through all materials carefully so you understand how to make the most of your new personal health insurance in Colorado.

While the process might seem complex, you don't have to figure it out alone. Licensed agents can guide you through each step, ensuring you find the perfect coverage for your unique situation.

Financial Assistance Options for Colorado Residents

Let's face it – health insurance can be expensive. The good news? Many Colorado residents qualify for financial help that can make personal health insurance Colorado much more affordable.

Premium tax credits are one of the most valuable forms of assistance available. These credits work like an instant discount on your monthly premium when you purchase a plan through the ACA Marketplace (Connect for Health Colorado). What makes these credits special is that they're applied directly to your premium each month – no waiting until tax time to see the benefits.

How much could you save? That depends on your household income and size. Generally, individuals and families earning between 100% and 400% of the Federal Poverty Level qualify for some level of premium assistance. For many Colorado families, these credits can reduce monthly premiums by hundreds of dollars.

Can I Get Financial Assistance for Personal Health Insurance in Colorado?

"Will I qualify?" is probably the question on your mind right now. The answer depends primarily on your income relative to the Federal Poverty Level (FPL).

For 2025, a single person earning roughly between $16,000 and $64,000 would likely qualify for some premium assistance. For a family of four, that range increases to approximately $33,000 to $132,000. The lower your income within these ranges, the more assistance you'll generally receive.

Applying for these subsidies is surprisingly straightforward. When you shop for plans through Connect for Health Colorado, the system automatically calculates your eligibility based on the information you provide about your household and income. You'll see exactly how much assistance you qualify for before you choose a plan.

What surprises many Colorado residents is just how dramatic the savings can be. We've seen clients whose $800 monthly premiums drop to under $200 after tax credits are applied. For families struggling to fit health insurance into their budget, these subsidies can be the difference between going uninsured and having quality coverage.

These financial assistance options are only available when you purchase your personal health insurance Colorado plan through the official Marketplace. Off-exchange plans, while sometimes offering different networks or benefits, don't qualify for these subsidies – no matter how low your income might be.

If you're not sure whether you qualify or need help understanding your options, reaching out to a local insurance broker can save you both time and money. At Kelmeg & Associates, we help Colorado residents steer these financial assistance programs every day – at no additional cost to you.

Managing Your Health Insurance Plan with Digital Tools

Gone are the days of paper forms and long phone calls to manage your health insurance. Today's digital tools make it easier than ever to stay on top of your personal health insurance Colorado coverage with just a few taps or clicks.

Your health insurer likely offers a secure online portal where you can access all your important policy information. These user-friendly platforms let you view your coverage details, make premium payments, and track claims—all from the comfort of your home. Many even send helpful reminders about upcoming appointments or preventive screenings.

Mobile apps take convenience a step further. With your health insurance literally in your pocket, you can quickly find in-network doctors near you, check what services are covered, and even access digital ID cards when you arrive at appointments. Some apps also offer personalized health tips and medication reminders to help you stay well.

Perhaps one of the most valuable digital innovations is telehealth. Many personal health insurance Colorado plans now include virtual care services, allowing you to connect with healthcare providers through video calls. This can be a real lifesaver when you're feeling under the weather but don't want to leave home, or if you live in a rural area where specialists might be far away.

Tips for Managing Your Personal Health Insurance in Colorado

Staying informed is your best strategy for getting the most from your health coverage. Take time to thoroughly read your policy documents—yes, all of them! Understanding what's covered before you need care can save you both stress and money down the road.

Preventive services are gold when it comes to maintaining good health. Most plans cover annual check-ups, vaccinations, and screenings at little to no cost to you. These visits can catch potential health issues early, when they're easier and less expensive to treat. Mark your calendar for these important appointments and actually go to them!

Your health needs naturally change over time, which is why it's smart to review your plan annually. The perfect plan for you last year might not be ideal now, especially if you've developed new health conditions or your family situation has changed. During open enrollment, take a fresh look at your options.

Digital tools are meant to complement, not replace, personalized guidance. If you're confused about your coverage or need help navigating the healthcare system, reach out to a professional. For more comprehensive advice on managing your health insurance effectively, visit Affordable Health Coverage Colorado.

By embracing these digital tools and staying proactive about your coverage, you'll be well-positioned to maximize your personal health insurance Colorado benefits while minimizing surprises and frustrations along the way.

Frequently Asked Questions About Personal Health Insurance in Colorado

Navigating health insurance can feel like learning a new language. Here are answers to some of the most common questions Colorado residents ask us about personal health insurance.

What Preventive and Wellness Services Are Covered?

Good news! Most personal health insurance Colorado plans cover a wide range of preventive services at zero out-of-pocket cost to you. These typically include annual wellness check-ups, various health screenings, and immunizations.

Think of these services as the regular maintenance your body needs—just like you'd change the oil in your car before problems develop. Taking advantage of these covered services not only keeps you healthier but can help catch potential issues early when they're easier to treat.

For families, these preventive services are especially valuable, covering everything from well-child visits to prenatal care. Children can receive vaccinations, developmental screenings, and behavioral assessments, while adults benefit from cancer screenings, blood pressure checks, and depression screenings.

Want to learn more about coverage for your whole family? Check out our detailed guide to Family Health Insurance Plans Colorado.

How Do Qualifying Life Events Affect Enrollment?

Life happens, and sometimes it happens outside the standard Open Enrollment Period. That's where qualifying life events come in—they're your ticket to getting insurance coverage when you need it most.

A qualifying life event is a significant change in your life circumstances that opens a Special Enrollment Period, typically lasting 60 days from the event. During this window, you can enroll in a new plan or make changes to your existing coverage.

Some common qualifying life events include:

- Getting married or divorced

- Having or adopting a child

- Losing other health coverage (perhaps from a job loss or aging out of a parent's plan)

- Moving to a new area with different health plan options

- Changes in income that affect your eligibility for financial assistance

If you experience one of these events, don't wait—reach out to us right away so we can help you understand your options during this special enrollment window.

What is the Difference Between On-Exchange and Off-Exchange Plans?

This is one of the most common questions we hear, and it's an important distinction to understand when shopping for personal health insurance Colorado plans.

On-exchange plans are those purchased through Connect for Health Colorado, the state's official health insurance marketplace under the Affordable Care Act. The biggest advantage? If your income qualifies, you might receive financial assistance in the form of premium tax credits or cost-sharing reductions. These subsidies can significantly lower your monthly premiums and out-of-pocket costs.

Off-exchange plans, by contrast, are purchased directly from insurance companies. While these plans don't qualify for government subsidies, they sometimes offer more flexibility in plan design or provider networks. For those who don't qualify for subsidies anyway, off-exchange plans might provide options better custom to specific needs.

Both types of plans must cover the essential health benefits required by the ACA, so you're getting comprehensive coverage either way. The right choice depends on your personal situation, income level, and specific healthcare needs.

Not sure which option is best for you? That's exactly why we're here—to help you steer these choices without the confusion and stress that often comes with insurance shopping.

Conclusion

"No one plans to get sick or hurt, but most people need medical care at some point." This simple truth underscores why finding the right personal health insurance in Colorado matters so much for you and your loved ones.

Throughout this guide, we've walked through the essentials of securing coverage that truly fits your life. From understanding the difference between individual plans and family coverage to navigating the Connect for Health Colorado marketplace, the journey might seem complex – but you don't have to walk it alone.

Your health insurance isn't just a monthly bill – it's protection for what matters most. Whether you're eligible for premium tax credits that make coverage more affordable or you're comparing plan networks to ensure your favorite doctor stays in-reach, each decision shapes your healthcare experience.

The right insurance plan creates peace of mind. It means knowing that preventive care is covered, understanding how to use digital tools to manage your benefits, and having clarity about what happens if life throws you a curveball through qualifying life events.

At Kelmeg & Associates, Inc., we believe everyone deserves personalized guidance through these important decisions. Our team of Colorado insurance experts works to explain your options and find coverage that balances your health needs with your budget – all at no additional cost to you.

Ready to take the next step in securing the right personal health insurance in Colorado? Visit Find the Right Plan for You to explore your options with expert guidance. Your perfect plan is out there, and we're here to help you find it.

Contact us today to find how simple finding the right coverage can be when you have a trusted partner by your side.