From Curious to Licensed—Becoming a Life Insurance Agent in Colorado

Your Roadmap to a Colorado Life Insurance License

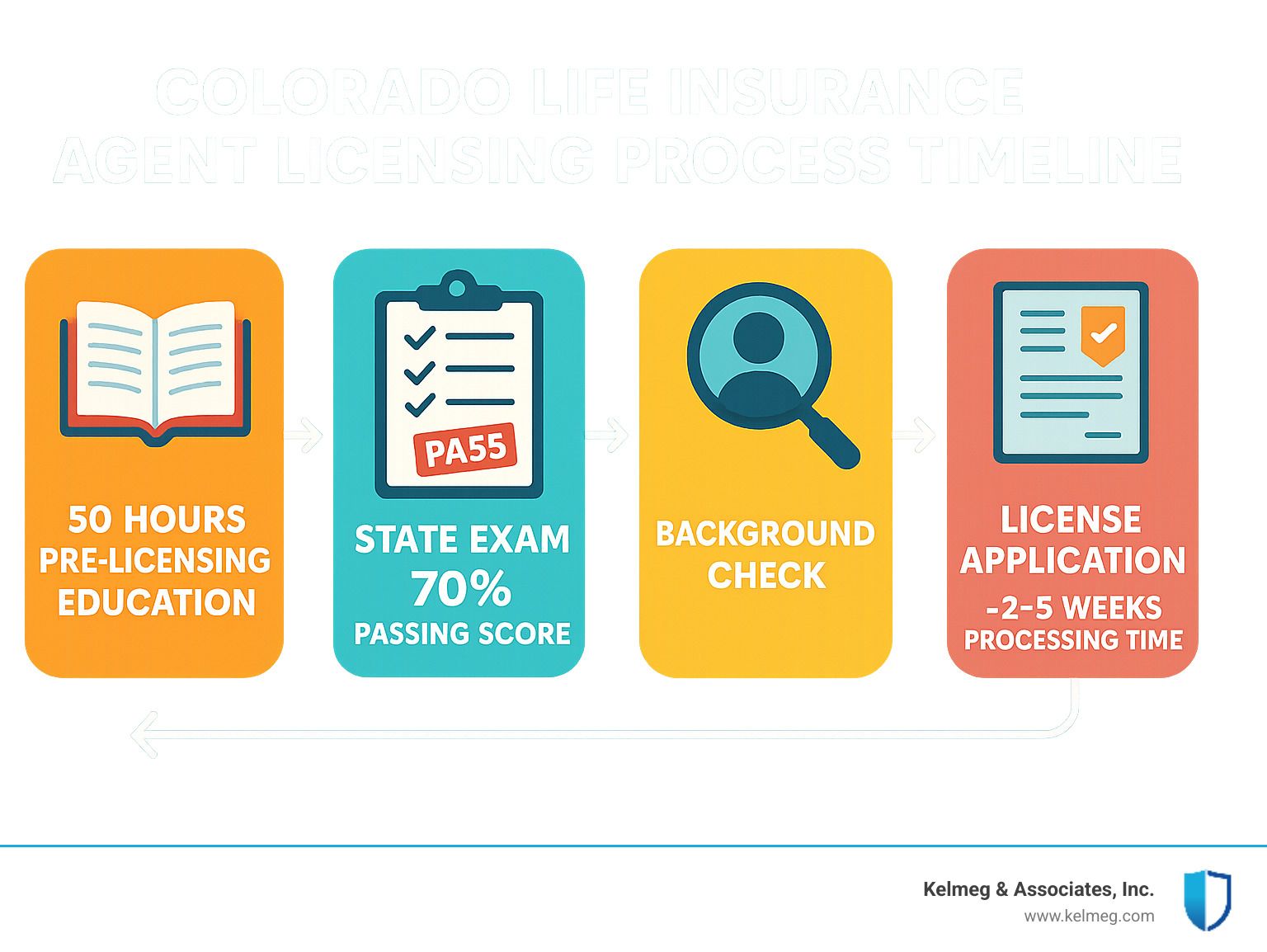

How to become a life insurance agent in Colorado requires completing several specific steps regulated by the Colorado Division of Insurance. If you're looking for the quickest answer, here's what you need to know:

Quick Guide: Becoming a Life Insurance Agent in Colorado

- Be at least 18 years old and a Colorado resident

- Complete a 50-hour pre-licensing education course

- Pass the Colorado state licensing exam with 70% or higher

- Submit fingerprints for a background check

- Apply for your license through Sircon or NIPR ($47 fee)

- Receive your license (typically within 2-5 weeks)

The journey to becoming a licensed life insurance agent in Colorado opens doors to a rewarding career helping families protect their financial futures. While the process involves several regulatory steps, it's straightforward if you follow the proper sequence.

Colorado requires aspiring life insurance agents to complete 50 hours of pre-licensing education, pass a state exam, undergo a background check, and submit an application. Each step serves as a quality control measure to ensure agents are knowledgeable and trustworthy before advising clients on important financial protection products.

The good news? You can complete this process in as little as 4-6 weeks if you stay focused and organized.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I've guided numerous professionals through how to become a life insurance agent in Colorado while helping them understand the requirements and avoid common pitfalls in the licensing process.

Eligibility & Pre-Licensing Education Requirements

Ready to start on your Colorado life insurance career journey? Let's make sure you've got the basics covered first. The Colorado Division of Insurance has established clear eligibility requirements that serve as your starting point:

You need to be at least 18 years old, be a genuine Colorado resident, complete the required pre-licensing education, and demonstrate good character and trustworthiness. Nothing too surprising there, but these foundational requirements ensure you're ready to serve Colorado families with integrity.

The heart of your preparation is the 50-hour pre-licensing education requirement. This isn't just a box to check—it's where you'll build the knowledge foundation that will serve you throughout your career.

"I always tell new agents that those 50 hours are an investment, not an obstacle," shares Maria, one of our senior advisors at Kelmeg. "The material you learn here becomes the expertise you'll use to protect families' financial futures for years to come."

Your 50-hour course must include specific components that the state considers essential:

- At least 3 hours on Principles of Insurance

- At least 4 hours on Legal Concepts and Insurance Regulations

- At least 3 hours dedicated to Ethics training

In Colorado, you'll need to complete at least 16 hours in a classroom setting (or live virtual classroom), with the remaining 34 hours through self-study. This balanced approach gives you both structured learning and the flexibility to absorb complex concepts at your own pace.

Classroom vs. Online Study Options

Study Method: Classroom

Pros: In-person instructor guidance, structured environment, networking opportunities

Cons: Fixed schedule, travel required, potentially higher cost

Best For: Those who prefer traditional learning environments and direct interaction

Study Method: Online

Pros: Flexible scheduling, study at your own pace, often more affordable

Cons: Requires self-discipline, limited peer interaction, technical requirements

Best For: Self-motivated learners, those with busy schedules, or rural residents

"When I was getting licensed," recalls Tom, a Kelmeg agent who joined us last year, "I chose a hybrid approach—classroom sessions for the trickier concepts and online study for the rest. The classroom discussions really brought the material to life for me."

Exemptions from Pre-Licensing Requirements

Already have some insurance or financial credentials? You might be exempt from the pre-licensing education requirement if you:

Hold certain professional designations like CFP®, ChFC, CLU, or CPCU®, have a bachelor's degree or higher in insurance, or held a similar license in another state within the past 90 days.

If you think you might qualify for an exemption, you'll need to provide documentation when applying for your license. Our team at Kelmeg has helped many professionals with diverse backgrounds steer these exemptions successfully.

We've seen remarkable success stories from career-changers. Just last year, Diane, a former teacher, transitioned seamlessly into insurance by leveraging her communication skills and dedication to learning the material thoroughly. She now specializes in helping education professionals secure their financial futures.

Looking for more information about how we can support your insurance career journey? Check out More info about Our Services to learn how Kelmeg & Associates can help you steer the licensing process and build a successful practice.

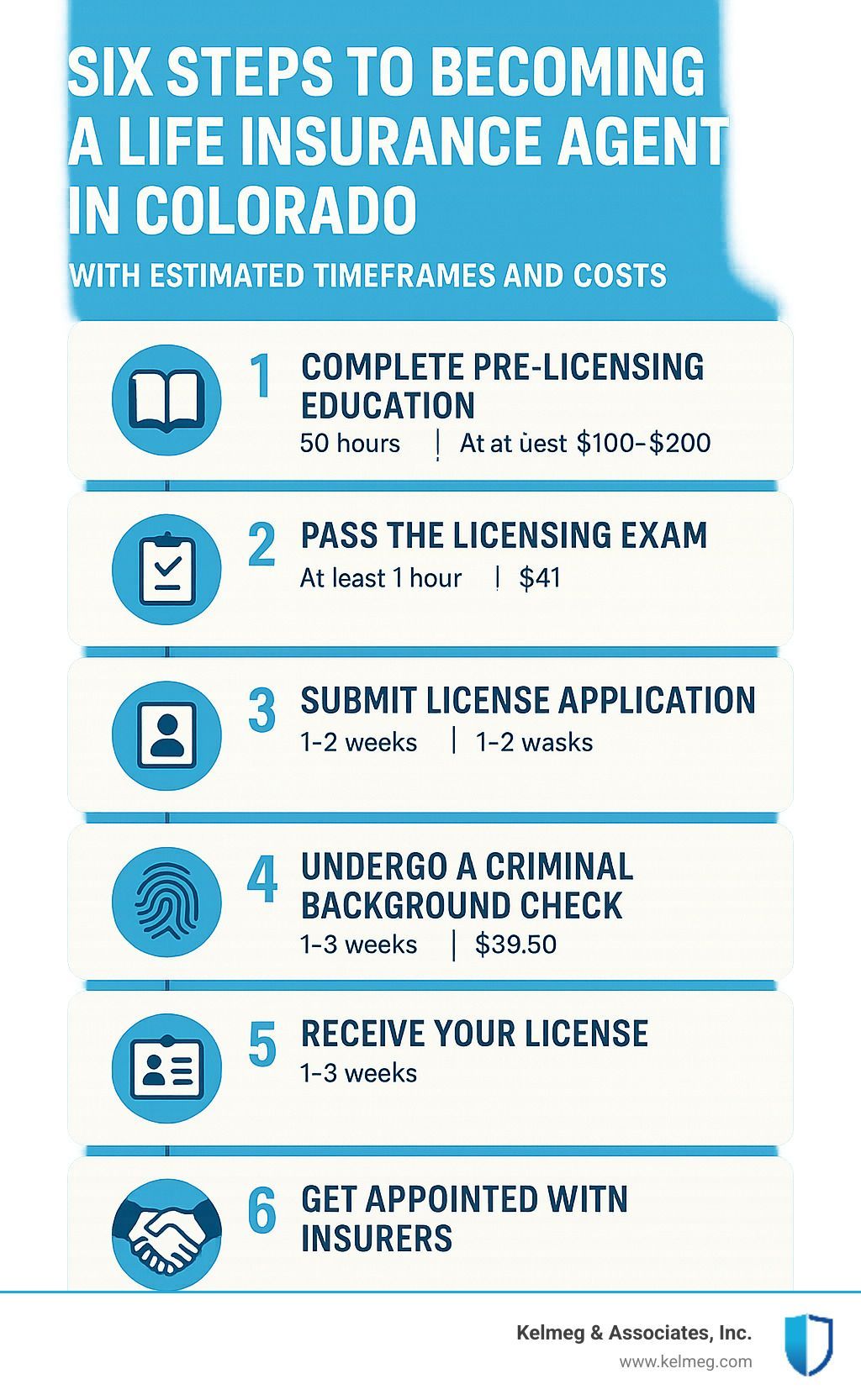

How to Become a Life Insurance Agent in Colorado: The 6-Step Roadmap

Becoming a life insurance agent in Colorado isn't complicated once you break it down into manageable steps. I've guided countless aspiring agents through this process, and while it might seem overwhelming at first, following this roadmap makes the journey much clearer.

Step 1 – Decide Your Line of Authority & Set Up Your Plan

Before jumping into courses and exams, take a moment to consider what type of insurance you actually want to sell. This decision shapes your entire career path.

In Colorado, you can choose from several lines of authority. You might focus on life insurance only, which limits you to life products but allows for deeper specialization. Alternatively, you could pursue an accident & health license for health insurance products, or the more comprehensive life, accident & health combined license that gives you the most flexibility with clients.

You'll also need to decide between becoming a captive agent representing just one company, or an independent agent with the freedom to offer products from multiple carriers.

"I started as a captive agent to learn the ropes with company training," shares Mike, one of our Denver agents. "Three years later, I transitioned to independent status, which was right for my career growth. But starting focused really helped me build confidence."

Your initial decision isn't permanent, but it will influence your study focus and your first professional relationships in the industry.

Step 2 – Complete 50 Hours of Pre-Licensing (how to become a life insurance agent in colorado starts here)

This is where your journey to how to become a life insurance agent in Colorado truly begins. The state requires you to complete 50 hours of education before sitting for the licensing exam.

These 50 hours break down into 16 hours of classroom instruction (which can be virtual or in-person) and 34 hours of self-study. The curriculum covers everything from basic insurance concepts to specific policy types, annuities, Colorado regulations, and ethical practices.

When choosing a pre-licensing provider, make sure they're approved by the Colorado Division of Insurance. The course ends with a certification exam that you'll need to pass with at least 70% to receive your completion certificate.

Your certificate is only valid for one year – you must pass the state exam within that window, or you'll be back at square one.

"Don't just rush through the material," warns Sarah, our training coordinator. "I've seen too many people try to cram, only to struggle with client questions later. These 50 hours build the foundation of your expertise."

Step 3 – Schedule & Pass the Colorado Life Insurance Exam

With your pre-licensing education complete, it's time to schedule your state exam through Pearson VUE. The exam consists of 90 questions (though only 80 are actually scored), and you'll have two hours to complete it. The passing score is 70%.

The test covers both general insurance principles and Colorado-specific regulations. You can schedule your exam through the Pearson VUE website.

My best advice for exam day: arrive early with two forms of ID, get plenty of rest the night before, and remember that understanding concepts beats memorization every time. Take several practice exams in the days leading up to your test – they're the best preparation.

If you don't pass on your first try, don't worry! You can retake the exam after just 24 hours, and there's no limit to how many times you can attempt it in-center (though online attempts are limited to two).

Step 4 – Submit Fingerprints & Background Check

Colorado requires all insurance license applicants to undergo a thorough background check conducted by both state and federal agencies. This step ensures that only individuals with good character and trustworthiness enter the profession.

You'll need to schedule an appointment with an approved fingerprinting vendor like IdentoGO. The process costs about $49.50 and involves electronic fingerprint capture that gets submitted to the Colorado Bureau of Investigation and the FBI.

"Be completely honest about your background," advises our compliance specialist. "The Division of Insurance is far more concerned with dishonesty on applications than with minor past mistakes that you've addressed and moved beyond."

Step 5 – Apply Online for Your License

Now comes the moment of truth – applying for your actual license. Colorado offers two online application portals: the Sircon/Vertafore portal or the National Insurance Producer Registry (NIPR). Either one works fine.

You'll provide personal information, details about your pre-licensing education and exam, and answer background questions. The application fee is $47 per line of authority.

After submission, the Colorado Division of Insurance typically reviews applications within 2-5 business days, though it can take longer during busy periods. Your license will be issued electronically, and while you can print a physical copy for $5 through Sircon, it's optional since your status can be verified online.

Step 6 – Launch Your Practice & Find Mentorship (how to become a life insurance agent in colorado beyond the license)

Getting your license is just the beginning – now comes the exciting part of building your practice. This is where many new agents stumble, not because they lack knowledge, but because they try to go it alone.

The most successful new agents typically join an established agency (like Kelmeg & Associates), secure Errors & Omissions insurance for protection, develop a clear marketing strategy, build a professional network, and find an experienced mentor.

"My license gave me permission to sell, but my mentor taught me how to succeed," explains Jamie, our Boulder team leader. "Having someone show me how to actually talk to clients about their needs made all the difference between struggling and thriving in my first year."

At Kelmeg & Associates, we've developed a structured program specifically for newly licensed agents that includes product training, sales process guidance, and one-on-one mentoring. We've found this approach significantly shortens the learning curve and helps new agents start earning commissions faster.

Exam Insights, Costs & Common Pitfalls

Sitting for the Colorado life insurance exam can feel intimidating, but with the right preparation, you'll walk in with confidence. Let me share what the exam actually looks like and how to avoid the mistakes I've seen trip up many aspiring agents.

Exam Format and Content

When you arrive at the testing center (or log in for an online exam), you'll face a 90-question test that gives you a generous 2-hour window to complete. Of those questions, only 80 actually count toward your score—the other 10 are "pretest" questions that don't affect your results but help develop future exams.

The content isn't designed to trick you, but rather to ensure you understand the fundamentals of what you'll be selling to Colorado residents. About 25% covers life insurance basics, 20% dives into policy provisions and riders, and 15% tests your knowledge of different policy types and annuities. The remaining questions focus on policy issuance (10%), taxation concepts (10%), and—this is crucial—Colorado-specific insurance laws (20%).

"I was surprised by how many Colorado-specific questions appeared on my exam," shares one of our Denver agents. "I'm glad I didn't skip that section in my studies, or I might have been retaking the test!"

The True Costs of Getting Licensed

Being transparent about costs helps you budget properly for your licensing journey. Here's what you can expect to invest to become a life insurance agent in Colorado:

Your pre-licensing education will run between $149-$300 depending on your provider and whether you choose online or in-person instruction. The state exam fee is $41 if you take it at a testing center, or $31 per exam if you opt for online proctoring. Your fingerprinting and background check will cost approximately $49.50.

Once you've passed the exam, you'll pay $47 for each line of authority on your license application. If you want a physical copy of your license (which isn't required but some agents prefer), that's an additional $5.

All told, you're looking at between $271.50 and $442.50 to get licensed—a modest investment considering the income potential of a successful life insurance agent.

Avoiding the Common Pitfalls

After helping dozens of agents through the how to become a life insurance agent in Colorado process, I've noticed several stumbling blocks that appear regularly:

The timing trap: Your pre-licensing certificate expires after one year. I've seen eager students complete their education and then wait too long to take the exam, forcing them to retake the entire course. Schedule your exam soon after completing your coursework while the material is fresh.

Colorado-specific oversights: Many candidates focus exclusively on general insurance concepts and neglect the state-specific sections. Since 20% of your exam covers Colorado laws and regulations, this can be a costly mistake.

Test anxiety sabotage: Even well-prepared candidates can freeze up during the actual exam. Our most successful applicants take multiple practice tests under timed conditions to build both knowledge and confidence.

ID mismatches: It sounds simple, but make sure the name on your ID exactly matches your exam registration. Bring two valid forms of government-issued ID to avoid being turned away at the testing center.

Rushing the application: After passing the exam, candidates are often eager to submit their application quickly. Take your time and answer all background questions honestly and completely. Errors or omissions here can delay your licensing significantly.

If you don't pass on your first attempt, don't panic. You can retake the exam after waiting just 24 hours. However, I recommend taking additional study time to strengthen your weak areas before scheduling a retake. The $41 retake fee adds up quickly, and repeated failures can dampen your enthusiasm.

"The most common mistake I see is candidates focusing too much on memorization instead of understanding," explains our training director at Kelmeg & Associates. "The exam tests your ability to apply knowledge to real-world scenarios, not just recite facts."

For additional information and resources, visit the official Licensing Forms and Resources page. And remember, if you're feeling overwhelmed by the process, our team at Kelmeg & Associates is always here to answer your questions and guide you through each step.

Staying Licensed, Continuing Education & Career Growth

Getting your Colorado life insurance license feels great – but it's really just the first step in your new career journey. Now comes the exciting part: building your business while keeping your credentials current.

As a licensed agent in Colorado, you'll need to fulfill some ongoing requirements to keep your license active. Don't worry, though – these requirements actually help you stay sharp and informed in this ever-changing industry.

Continuing Education Requirements

Colorado requires life insurance agents to complete 24 hours of continuing education every two years. This includes at least 3 hours focused on ethics training. All courses must be approved by the Colorado Division of Insurance, so always check for that approval before signing up.

Your renewal date is tied to your birth month and occurs every two years. While you have the full two-year period to complete your CE hours, I've found spreading them out makes life much easier.

"I used to cram all my CE hours into the last month before renewal, and it was so stressful," shares Maria, one of our Denver-based agents. "Now I take a course every quarter, and it's not only more manageable but I actually retain more information this way."

Here's a nice bonus: Colorado allows up to 12 excess CE credits earned in the last 120 days of your licensing period to carry over to your next renewal cycle. This little hack can give you a head start and reduce pressure during your next renewal period.

Product-Specific Training Requirements

If you're planning to expand your product offerings (which I recommend for business growth), you'll need some additional training for specialized products:

Long-Term Care Insurance requires a 16-hour initial training course plus 5 hours every 24 months to stay certified. Annuity Best Interest certification requires a 4-hour one-time course. And if you want to offer Flood Insurance (NFIP), you'll need a 3-hour one-time training course.

These specialized certifications might require extra time, but they significantly expand what you can offer clients – and they can substantially boost your income too.

Career Growth and Income Potential

Speaking of income – let's talk money. Life insurance agents in Colorado earn an average of $91,644 annually, with top performers bringing in $146,160 or more. Your personal income will depend on several factors:

- Whether you work as a captive or independent agent

- Your product mix and areas of specialization

- How effectively you acquire new clients

- Where in Colorado you primarily work

- Your experience level in the industry

The most successful agents I've worked with at Kelmeg & Associates consistently expand their practices by adding additional lines of authority like health insurance, obtaining securities licenses to sell variable products, developing niche markets like business owners or retirees, and building strong referral networks.

"I started focusing exclusively on pre-retirees in Boulder County," explains James, who joined us three years ago. "By becoming the go-to expert for that demographic, my income has doubled each year since I got licensed."

One particularly effective strategy we've seen at Kelmeg & Associates is combining life insurance with health insurance offerings. This approach lets you provide more comprehensive solutions while significantly increasing your earning potential.

FAQ 1 – How long does the licensing process take in Colorado?

The typical timeline to become a licensed life insurance agent in Colorado ranges from 4-8 weeks. Here's how that breaks down:

Your pre-licensing education typically takes 1-3 weeks, depending on how intensively you study. Exam scheduling and preparation usually requires 1-2 weeks. The background check takes another 1-2 weeks to process. Finally, application review by the state generally takes 2-5 business days.

You can definitely speed things up by scheduling your exam immediately after completing your pre-licensing course, submitting fingerprints right after passing your exam, and making sure your application is error-free the first time.

FAQ 2 – What happens if I fail the exam?

Don't panic if you don't pass on your first try – it happens to about 30% of candidates. Here's the good news: you can retake the exam after waiting just 24 hours. There's no limit to how many times you can attempt the exam in-center, though online proctored exams are limited to two attempts.

Each attempt requires paying the exam fee again ($41 in-center or $31 online), but your pre-licensing certificate remains valid for one year, so you have plenty of time to try again.

"When I failed my first attempt, I was devastated," recalls Sarah from our Fort Collins office. "But I reviewed the diagnostic report, spent three days focusing on the sections where I struggled, and passed with flying colors on my second try. Now I laugh about how nervous I was!"

FAQ 3 – Do non-residents follow the same rules?

If you live outside Colorado but want to sell life insurance here, the process works a bit differently:

You must first get licensed in your home state. Then you can apply for a non-resident license in Colorado. The good news is that you can skip the pre-licensing education requirement if you already hold a similar license in your home state. You'll still need to pay the $47 application fee per line of authority, and you must follow Colorado's insurance regulations when working with Colorado residents.

Already licensed in another state but moving to Colorado? You have a 90-day window to transfer your license without needing to retake pre-licensing education or the state exam – a nice perk for relocating professionals.

At Kelmeg & Associates, we specialize in helping both new and experienced agents steer the licensing process and build thriving careers. Whether you're just getting star

ted or looking to expand your existing practice, we're here to help you grow your business and serve your clients with excellence.

Conclusion & Next Steps

So you've made it through our complete guide on how to become a life insurance agent in Colorado! While the journey requires dedication and attention to detail, it's a path that thousands have successfully traveled before you – and one that could lead to a truly rewarding career.

I've seen how this career transforms lives – not just for clients who receive valuable protection, but for the agents themselves who find purpose and prosperity in this profession. The six-step roadmap we've outlined isn't just a regulatory checklist; it's your blueprint for launching a meaningful business helping Colorado families secure their financial futures.

The beauty of this process is that while it may seem complex at first glance, it breaks down into manageable steps that anyone with determination can accomplish. Yes, there are forms to complete and exams to pass, but these requirements serve an important purpose – ensuring you have the knowledge and ethical foundation to guide clients through important financial decisions.

When you consider the relatively modest investment of time and money (typically 4-8 weeks and under $500), the potential returns are remarkable. Our Colorado agents average over $91,000 annually, with top performers earning well into six figures. Beyond the financial rewards, there's something profoundly satisfying about helping families protect what matters most to them.

Here at Kelmeg & Associates, we've helped countless professionals – from recent graduates to mid-career changers – steer this licensing journey and build thriving practices across Lafayette, Broomfield, Boulder, Adams County, and throughout Colorado. We're passionate about growing the profession because we've seen how good agents make a real difference in their communities.

Ready to take your first step? We're here to help! As part of our commitment to the insurance profession, we offer guidance to aspiring agents at no cost. Our experienced team can answer your specific questions about the licensing process, help you understand what to expect as a new agent, and provide insights into finding the right agency partnership.

The path to how to become a life insurance agent in Colorado is clear – and you don't have to walk it alone. Visit our life insurance page to learn more about our services or reach out directly through our contact page. Your journey toward a rewarding new career starts today – and we'd be honored to be part of it!