Small Business, Big Coverage: Navigating Covid Insurance Options

Why Covid Insurance for Businesses Became a Critical Issue

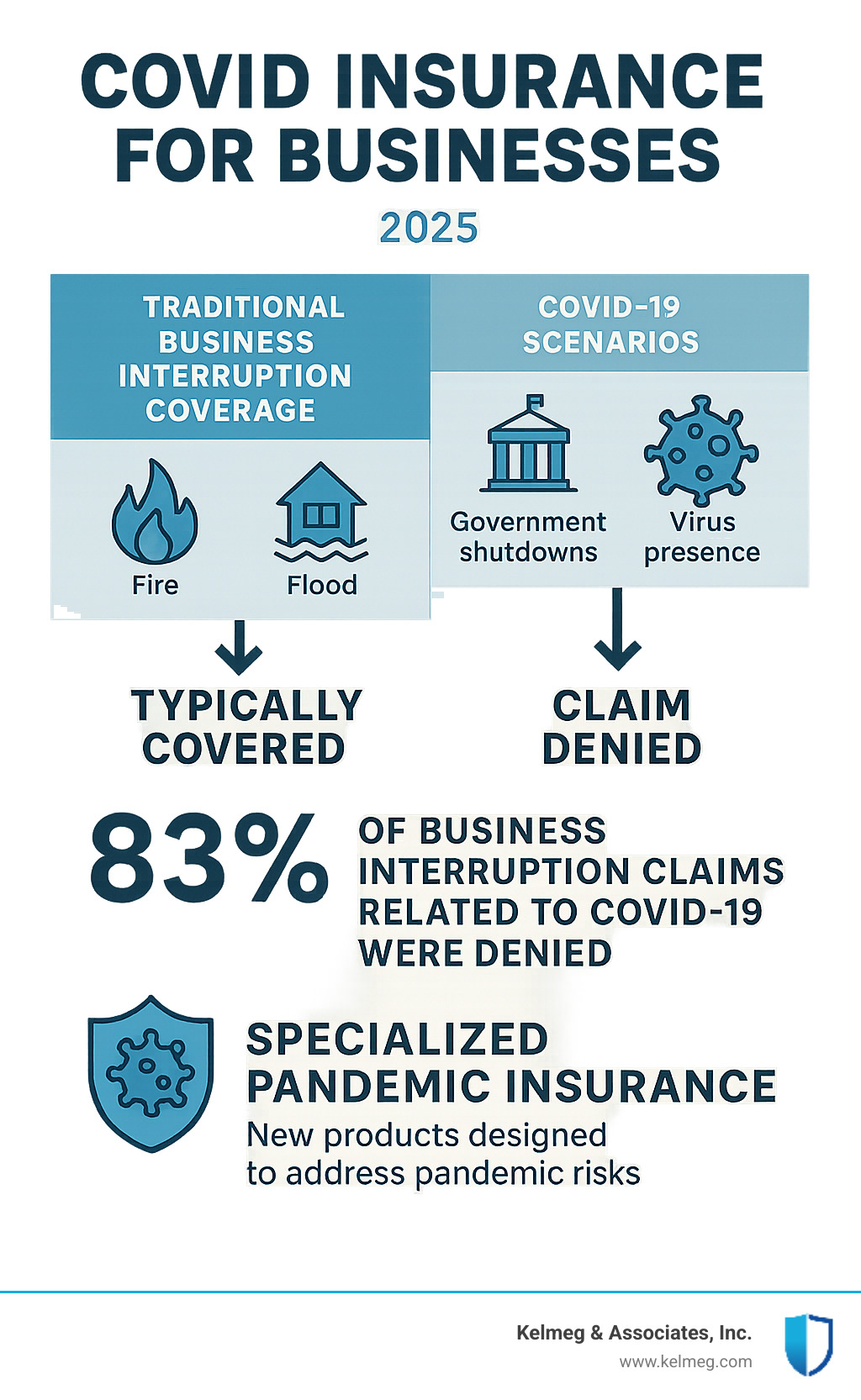

Covid insurance for businesses became a critical issue when countless owners found their existing policies would not protect them during a global pandemic. The initial economic shock of early 2020 was swift and devastating, particularly for sectors reliant on public gathering, such as hospitality, retail, entertainment, and travel. As lockdowns and public health orders swept the nation, revenue streams vanished overnight, but expenses like rent, payroll, and loan payments continued to mount. Business owners, believing they had prudently purchased protection, turned to their insurance policies for a lifeline.

The harsh reality hit when claims were denied en masse. American policyholders filed over 2,500 lawsuits, sparking one of the largest and most complex legal battles in the history of the insurance industry. The problem was a devastatingly simple clause buried in the fine print: standard business interruption policies require "direct physical loss or damage to property." Courts across the country consistently ruled that the presence of the COVID-19 virus and government-mandated shutdown orders did not meet this strict requirement, leaving businesses without the support they desperately needed.

This created a massive, unforeseen coverage gap, exposing businesses to catastrophic losses and highlighting a systemic vulnerability in the commercial insurance market. The insurance industry has since scrambled to develop new products, while owners have learned hard lessons about the importance of precise policy language. As Kelsey Mackley from Kelmeg & Associates, Inc., I've helped businesses steer this complex world, working to identify gaps and find comprehensive solutions. Understanding your options before a crisis is the key to protecting your business and employees.

Understanding Business Interruption Insurance and Its Traditional Role

Business interruption insurance, often called BI insurance, is a financial safety net designed to keep your business stable when you cannot operate due to a covered disaster. It acts as a financial bridge, helping you get back on your feet after a tangible, property-damaging event.

Traditionally, if a fire damaged your restaurant's kitchen and forced you to close, your business interruption insurance would replace the income you are losing. It also helps cover ongoing expenses that do not stop, such as rent, loan payments, and key employee salaries. This coverage is intended to restore your business to the financial position it would have been in had the disaster not occurred.

Covered perils typically include events that cause tangible damage, like fires, floods, and theft. When one of these disasters hits, your BI policy helps replace lost income and cover operating expenses like payroll and rent during the period of restoration- the time it takes to get back to normal.

However, the critical trigger for these policies is direct physical loss or damage to your property. This requirement seemed straightforward until a pandemic challenged everything we thought we knew about what constitutes "damage," creating the complex issue of Covid insurance for businesses.

What Standard Business Interruption Policies Cover

A good BI policy is a financial lifeline when disaster strikes your insured property. Its primary function is income replacement, covering the net income you would have earned if the disaster had not occurred. It also covers ongoing operating expenses like rent and payroll for essential employees during the period of restoration.

This restoration period is the time needed to repair and reopen, lasting until you are operational or hit your policy limits. Many policies also cover extra expenses incurred to speed up recovery. For example, if a storm damages your roof, extra expense coverage could pay for a temporary generator to keep your servers running or for expedited shipping costs for replacement materials. Some policies include contingent business interruption coverage, which applies if a key supplier or customer suffers a loss that impacts you. Imagine your business relies on a single manufacturer for a critical component; if their factory burns down, this coverage could protect your resulting income loss. Another feature, civil authority coverage, can help if government officials restrict access to your business due to nearby physical damage, such as a police cordon around a neighboring building that collapsed.

Understanding these coverages is essential for a complete risk management strategy. For businesses looking to create comprehensive protection for their employees, we provide More info about Employer Group Benefits.

The Critical Trigger: "Direct Physical Loss or Damage"

The phrase "direct physical loss or damage" is the biggest hurdle in traditional BI insurance and the central roadblock for Covid insurance for businesses. For decades, this meant visible, tangible harm to property- structural damage from a fire, property alteration from a flood, or loss of functionality from a break-in. The insurance industry's rationale for this strict requirement was to keep coverage tied to specific, measurable, and somewhat predictable property-based events. It prevents BI insurance from becoming a catch-all policy for any and all economic downturns, which would make it uninsurably expensive.

Courts consistently interpreted this unambiguous language literally, creating a historical precedent that if you could not point to actual physical damage, you did not have a claim. This strict contract interpretation was designed to prevent insurance from becoming a general guarantee against any financial setback. Insurers argued that their pricing models and risk calculations were all based on this fundamental principle. But when COVID-19 arrived, this straightforward requirement became the center of a massive legal debate over whether an invisible virus could constitute physical damage, reshaping how we think about business insurance.

The COVID-19 Test: Why Most Standard Policies Fell Short

When COVID-19 forced businesses to lock their doors, owners naturally turned to their business interruption policies for help. Unfortunately, what followed was one of the most widespread insurance coverage failures in modern history, leaving a trail of financial devastation and legal battles.

Businesses filed over 2,500 lawsuits against their insurers. In Canada, the massive Workman class action targeted major insurance companies for billions in damages. Each case represented a business owner who believed they were protected, only to find significant gaps in their Covid insurance for businesses.

The Central Legal Debate: Physical Loss vs. Loss of Use

The core of every COVID-19 BI claim was whether the presence of a virus or a government shutdown order constituted "physical loss or damage to property."

Business owners and their legal teams advanced a "contamination theory," arguing that the SARS-CoV-2 virus physically contaminated their properties. They contended that the virus attached to surfaces and lingered in the air, rendering the premises unsafe and unusable, which they equated to a form of physical loss. They also argued that government shutdown orders created a "loss of use" of their property, which should trigger coverage, especially under civil authority provisions that cover access restrictions.

Insurance companies disagreed on all fronts. They maintained that viruses affect people, not property, and can be removed with cleaning without any lasting structural impact. They argued that government orders were public health measures to slow the spread of disease, not responses to property damage, which is what civil authority coverage requires. Insurers also raised the issue of systemic risk, stating that a global pandemic is an uninsurable event for the private market alone, as the correlated losses across the entire economy would bankrupt the industry. This fundamental disagreement led to extensive litigation, with a landmark Canadian decision available here: The Court's Reasons for Decision can be viewed here.

How Courts Interpreted "Physical Loss or Damage"

Canadian and U.S. courts, particularly in the pivotal Workman Optometry case in Canada and numerous federal circuit court decisions in the U.S., delivered decisive wins for the insurance industry. The rulings, backed by appeals, took a strict, traditional interpretation of policy language.

The court's reasoning was that physical loss or damage requires a distinct, demonstrable, physical alteration or harm to property. The temporary presence of a virus that can be cleaned did not meet this high standard. Judges emphasized that viruses impact human health, not the physical integrity of a building, and that the properties themselves remained structurally sound.

Crucially, the courts rejected the idea that "loss of use" equals "physical damage." They reasoned that if the policy intended to cover loss of use without a physical trigger, it would have been written that way. Accepting this argument would fundamentally and illogically alter how business interruption insurance is designed, priced, and underwritten. This judicial interpretation effectively closed the door on most standard BI claims for the pandemic, setting a strong legal precedent for Covid insurance for businesses decisions. For Colorado businesses navigating these complex insurance landscapes, we provide More info about Health Insurance for Small Business Colorado.

The Impact of Virus Exclusion Clauses

As if the "physical damage" requirement was not enough, many policies contained an even more direct obstacle: virus exclusion clauses.

These clauses, often added using standard forms from the Insurance Services Office (ISO) after outbreaks like SARS in the 2000s, explicitly exclude coverage for losses caused by viruses or bacteria. A typical exclusion might state that the insurer will not pay for loss or damage caused directly or indirectly by any "virus, bacterium or other microorganism that induces or is capable of inducing physical distress, illness or disease." Insurers had added them to limit exposure to pandemics, which cause widespread disruption without traditional property damage.

For business owners, these exclusions created a frustrating double barrier. Even if a court had been willing to consider a virus as physical damage, the exclusion clause provided a separate, independent reason to deny the claim. This combination of strict legal interpretation and explicit exclusions proved devastatingly effective for insurers and revealed a massive gap in pandemic protection that most business owners never knew existed.

The Evolving Landscape of Covid Insurance for Businesses

After countless court battles and claim denials, it was clear there was a massive hole in the insurance safety net. The widespread rejection of COVID-19 business interruption claims sparked a complete rethinking of how to protect against pandemic risks, forcing businesses, insurers, and governments to confront the new reality.

While insurers celebrated legal victories that provided them with certainty, they also recognized a glaring market need. Businesses wanted protection from pandemic losses, and traditional policies were not the answer. This has spurred innovation and a search for viable solutions.

The Aftermath: A Coverage Gap for Pandemics

The court decisions left business owners with a cold dose of reality. The billions in damages sought in class-action lawsuits represented real businesses struggling to survive. The harsh truth was that pandemics fell into a gray area that traditional insurance was not designed to cover. Without direct physical damage, most standard BI policies offered no help. This vulnerability created the "pandemic coverage gap." Businesses realized they were essentially self-insuring against one of the most disruptive modern risks, a burden that pushed many to the brink and forced a heavy reliance on government relief programs like the Paycheck Protection Program (PPP).

If another pandemic hit, most businesses with standard policies would be just as exposed as they were in 2020. Understanding policy limitations became more critical than ever. For Colorado businesses strengthening their risk management, The Ultimate Guide to Group Health Insurance Plans in Colorado offers valuable insights.

The Rise of Pandemic-Specific Insurance Products

In response, the insurance industry began developing new products specifically for pandemic risks. This was a ground-up innovation in Covid insurance for businesses.

Specialized pandemic coverage emerged with features traditional policies lacked. These new products explicitly cover losses from pandemics and epidemics, eliminating the debate over "physical damage." The triggers for coverage are also broader and more clearly defined, including government-mandated closures, public health emergencies, or confirmed infections near the business.

One innovative approach is parametric insurance. Products like Marsh's PathogenRX, introduced even before COVID-19, operate on automatic triggers. If a predefined event occurs- like a government shutdown order being issued for a specific industry in a specific county- the policy pays out a pre-agreed amount automatically. This provides immediate financial support without a lengthy, contentious claims process. The main drawback is "basis risk," where the trigger might not perfectly align with a business's actual financial loss, but the speed and certainty are major advantages.

New products, such as the HealthCerts COVID-19 Business Insurance Product, exemplify this new approach by bundling liability coverage, employee health support, and business continuity protection. While the market is still evolving and these products can be costly, businesses now have real options for protecting themselves against future health crises. Some experts also advocate for a public-private partnership, similar to the Terrorism Risk Insurance Act (TRIA), where the government would act as a backstop for catastrophic pandemic losses, making private coverage more affordable and widely available.

Proactive Risk Management for Future Health Crises

The COVID-19 pandemic was a wake-up call, highlighting the need for robust risk management that extends far beyond traditional insurance. Proactive planning is now essential for protecting your business, employees, and bottom line from the disruptive force of future health crises.

Smart business owners are taking action now, learning from the pandemic's lessons to build more resilient operations. This means creating a comprehensive safety net that combines the right insurance products with sound operational strategies that work when you need them most.

Reviewing Your Full Insurance Portfolio

When considering Covid insurance for businesses, look beyond just business interruption. A complete insurance portfolio is crucial, as the pandemic stressed businesses in unexpected ways. Several other policies became unexpectedly important:

- General Liability Insurance: This became a first line of defense against claims from customers alleging they contracted COVID-19 on your premises. While proving causation is difficult for the plaintiff, defending against such lawsuits is expensive, and this policy covers legal defense costs.

- Workers' Compensation: This was essential for employees who contracted the virus at work. Many states enacted "presumption of compensability" laws, which presumed that frontline workers who got sick contracted the virus on the job, simplifying the claims process for them and increasing the importance of this coverage for employers.

- Employment Practices Liability Insurance (EPLI): This protected businesses from a wave of new lawsuits over wrongful termination, discrimination related to remote work accommodations, vaccine policies, and alleged failures to maintain a safe work environment.

- Cyber Insurance: With the massive and rapid shift to remote work, this coverage became vital. It protects against data breaches, phishing scams targeting a distributed workforce with COVID-themed lures, and ransomware attacks on less secure home networks.

Reviewing your policies annually with a professional is critical to ensure your coverage reflects your current operations. For guidance on how these policies work together, explore our Colorado Group Insurance Plans resources.

Practical Steps for Pandemic Preparedness

Beyond insurance, smart operational adjustments can make a huge difference. The businesses that weathered COVID-19 best were those that were agile and prepared.

- Communicate with Your Broker: Inform your broker of any significant operational changes, like shifts to remote work or extended closures. These can impact your coverage and potentially trigger vacancy clauses in your property policy, which could reduce or void coverage if not properly addressed.

- Secure Remote Work: Implement robust IT security measures, including multi-factor authentication and VPNs. Train employees relentlessly on cyber threats and establish clear, written policies for handling sensitive data from home.

- Update Safety Protocols: Document and implement clear policies for hygiene, social distancing, and sick leave. This not only protects employees but also creates a strong defense against potential liability claims.

- Review Supply Chains: Do not rely on a single supplier or geographic region. Identify essential suppliers, vet alternatives, and develop backup plans to maintain operations during regional or global disruptions.

- Develop a Crisis Communication Plan: Prepare clear, concise communication templates for employees, customers, and stakeholders. In a crisis, a swift, transparent, and professional response builds trust and minimizes reputational damage.

For detailed guidance, resources like Loss Prevention in Response to the Coronavirus provide valuable insights.

Exploring Your Options for Covid Insurance for Businesses

Exploring specific options for Covid insurance for businesses is now a necessity, not a luxury. Start by assessing your unique risks- a restaurant's needs for shutdown coverage differ vastly from a remote consulting firm's liability concerns. Work with your broker to seek specialized riders and endorsements for existing policies, which can add a layer of communicable disease coverage, though often with low limits.

Compare new pandemic-specific policies carefully. These innovative products offer explicit pandemic coverage and broader, clearer triggers. Some parametric insurance solutions even provide automatic payouts when specific events occur, like government closure orders, ensuring speed and certainty. Finally, investing in employee well-being through comprehensive Group Health Insurance for Small Business is a crucial risk management tool. Healthy, resilient employees are key to business continuity. At Kelmeg & Associates, Inc., we help businesses steer these complex decisions to ensure you have the right protection.

Frequently Asked Questions about Covid Insurance for Businesses

Did any businesses successfully claim business interruption for COVID-19?

Very few did, and almost exclusively under non-standard policies. Success was extremely rare under standard property policies due to the "physical loss or damage" requirement and virus exclusions. The rare exceptions often involved unique policy language. A notable example was a specialized policy Aviva offered to dentists in Canada, which explicitly included pandemic coverage as a named peril. This unique policy provided up to $20,000 per claim for pandemic-related interruptions.

Even then, success often depended on the specific wording of provincial government orders. A mandatory closure order was more likely to trigger a claim than a mere recommendation to close. This illustrates a critical takeaway for Covid insurance for businesses: if you want pandemic protection, you need a policy that explicitly and unambiguously provides it. Relying on a standard policy is a losing bet.

What is the legal difference between "physical loss" and "loss of use"?

This distinction was the central legal battleground for nearly every COVID-19 insurance lawsuit. The courts drew a clear line that determined the fate of billions in claims.

-

"Physical loss" requires a tangible, structural, or material alteration to property. Think of a fire that chars walls or a flood that saturates drywall. The property itself is changed. Courts ruled that the SARS-CoV-2 virus, which can be cleaned from surfaces, does not cause this type of permanent or tangible physical harm to the property itself.

-

"Loss of use" means a property is inaccessible or unusable even though it remains physically undamaged. This is what most businesses experienced due to government shutdown orders. However, courts consistently ruled that loss of use without underlying physical damage does not trigger coverage under standard business interruption policies. They argued that interpreting it otherwise would render the word "physical" in the policy meaningless and transform the insurance into something it was never designed or priced to be.

Is it too late to get insurance for a future pandemic?

Absolutely not. In fact, now is the perfect time to explore Covid insurance for businesses and pandemic-specific coverage. The insurance industry has spent the last few years developing new products to fill the gaps exposed by the pandemic. You are in a much better position now than in 2019 because these options actually exist.

Insurers have created purpose-built policies that explicitly cover pandemic-related business interruptions. Here is what you can do now:

- Review your existing coverage with a knowledgeable broker to identify any hidden protections or, more likely, exclusions.

- Ask about specific endorsements or riders to add communicable disease coverage to existing policies, but be sure to check the coverage limits, as they may be low.

- Explore specialized pandemic insurance products, especially parametric options. Ask your broker: What are the exact triggers? What are the policy limits and payout amounts? What is excluded?

At Kelmeg & Associates, Inc., we are seeing more businesses take a proactive approach. Acting now, while you have time to evaluate options, will leave you far better positioned for whatever comes next. We can help you steer these new options to find coverage that works for you.

What is a government backstop and how would it help with pandemic insurance?

A government backstop is a program where the government agrees to cover losses that exceed a certain, very high threshold, making catastrophic risks insurable for the private market. The Terrorism Risk Insurance Act (TRIA) is a perfect example. After 9/11, terrorism insurance became unavailable. Under TRIA, private insurers cover terrorism losses up to a certain point, and the federal government shares the cost of losses above that point. This makes the risk manageable for insurers, so they can offer the coverage at a reasonable price. A similar Pandemic Risk Insurance Act (PRIA) has been proposed. It would create a public-private partnership to ensure that affordable business interruption coverage for pandemics is widely available, preventing a repeat of the economic fallout from the COVID-19 coverage gap.

Conclusion

The COVID-19 pandemic fundamentally and permanently changed the landscape of business insurance. It revealed in stark terms that traditional business interruption policies were not designed for a global health crisis. The legal precedents are now overwhelmingly clear: without tangible, physical alteration to property, standard policies will not cover pandemic-related losses from government shutdowns or the presence of a virus. This clarity, while painful for many, provides a solid foundation for future planning.

The old way of thinking about insurance as a simple, reactive safety net is over. The good news is that the industry has responded to this crisis with innovation. New, specialized Covid insurance for businesses products are emerging that explicitly address pandemic risks, offering protection where old policies failed. From parametric policies with clear triggers to comprehensive packages, businesses now have options that did not exist before.

Proactive risk management is the new essential for survival and resilience. This means conducting a thorough review of your entire insurance portfolio- including general liability, workers' compensation, and EPLI- and integrating it with robust operational plans for remote work, supply chain disruptions, and crisis communications. Smart business owners are using this moment not just to recover, but to build more resilient, future-proof protection strategies.

You do not have to steer this alone. At Kelmeg & Associates, Inc., we have helped Colorado businesses understand these complex changes since the pandemic began. Our commitment is to provide expert guidance at no extra cost, ensuring you get the knowledge and clarity you need to make informed decisions.

Whether you are in Boulder, Broomfield, Lafayette, or anywhere in Adams County, protecting your business starts with understanding your options. The insurance world has changed, but so have the solutions. Being informed and prepared is your best defense in this new era of risk.