Self-Employment Simplified: How to Succeed on Your Own Terms

Embracing the Freedom of Self-Employment

Self-employed individuals work for themselves rather than an employer who pays a consistent salary. This status gives you control over your work, schedule, and income potential while requiring you to handle your own taxes and benefits.

The self-employment landscape is expanding rapidly. As of March 2024, there were 10.11 million self-employed and unincorporated individuals in the United States. This growth reflects a fundamental shift in how Americans work, with projections suggesting freelancers will make up 50.9% of the U.S. workforce by 2027.

Why people choose self-employment:

- Freedom and flexibility to set your own hours and work location

- Income potential without corporate salary caps

- Work-life balance custom to personal priorities

- Pursuing passion through specialized work

- Building something that belongs entirely to you

Self-employment isn't just a career choice—it's a lifestyle that offers tremendous rewards alongside significant responsibilities. While the independence can be liberating, success requires careful planning, discipline, and a solid understanding of both business fundamentals and industry-specific knowledge.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I've helped countless self-employed individuals steer their unique insurance and financial planning needs. My expertise lies in translating complex topics into practical, actionable advice that empowers you to thrive in your independent career.

Understanding the Self-Employed Landscape

What does it really mean to be self-employed? According to the IRS, you fall into this category if you run a trade or business as a sole proprietor, work as an independent contractor, or are otherwise in business for yourself—even if it's just part-time.

The Bureau of Labor Statistics takes a similar view, defining self-employed folks as those working for profit or fees in their own business, profession, trade, or farm. This includes both people who've incorporated their businesses and those who haven't.

The landscape varies dramatically around the world. While the U.S. self-employment rate sits at about 6.3%, countries like Colombia (with a whopping 53.1%) and Brazil (33.3%) show just how different work cultures can be globally. These differences reflect varying economic structures, opportunities, and labor market traditions.

"Being self-employed generally requires much more work and attention than traditional employment," as one recent industry study puts it—and quite frankly, anyone who's tried it would agree! Despite the challenges, self-employed workers contribute significantly to our economy, generating about $1.2 trillion in revenue, which equals roughly 6% of the national GDP.

Self-Employed vs. Entrepreneur vs. Startup

These terms get tossed around interchangeably at networking events, but they actually represent different approaches to independent work:

When you're self-employed, you essentially are the business. You're focused on creating a sustainable income through your personal skills or services. Your primary goal is supporting yourself doing what you love.

An entrepreneur takes things a step further, typically involving more innovation, risk-taking, and growth ambition beyond just putting food on the table.

A startup founder specifically aims to build something that will grow beyond themselves, scale rapidly, and eventually employ others. They're often hunting for external funding and have more formal business structures.

Grace Wells, a physical therapist who left her hospital job to open her own practice, explains it perfectly: "When I first went self-employed, I was just looking to replace my salary doing what I loved. As my practice grew, I began thinking more like an entrepreneur—considering scalability, systems, and eventually bringing on staff."

Key Self-Employment Models

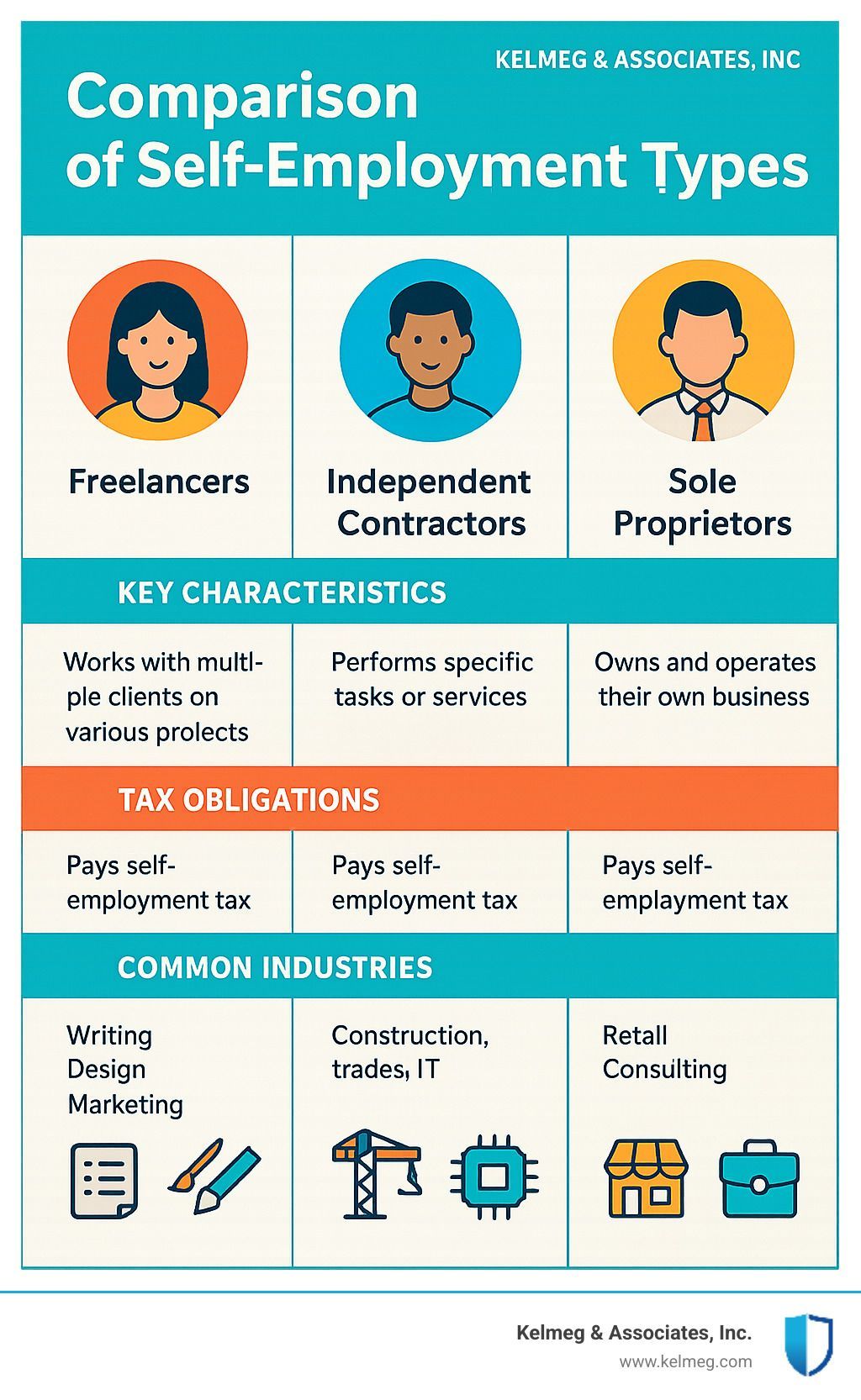

The self-employment world offers several common business structures, each with its own advantages:

A sole proprietorship is the simplest form—you and your business are legally the same entity. It's easy to set up but offers no liability protection between your personal and business assets.

As an independent contractor, you provide specific services to clients under contract while maintaining control over how and when you complete the work.

A single-member LLC gives you liability protection (keeping your personal assets safer) while maintaining the tax simplicity of a sole proprietorship—a popular middle ground for many.

In a partnership, you share ownership and responsibilities with one or more people, dividing both the work and the rewards.

Each structure comes with distinct tax implications, different levels of personal liability protection, and varying administrative requirements. Your choice should align with your comfort with risk, your growth plans, and your specific business goals.

When you're self-employed, understanding these distinctions isn't just academic—it affects everything from how you file taxes to how you're protected if something goes wrong. At Kelmeg & Associates, we've seen how these different structures impact insurance needs and financial planning for our self-employed clients across Colorado.

Major Paths to Self-Employment (Choose Your Lane)

When you decide to become self-employed, you're not just choosing to work for yourself—you're selecting a specific path that aligns with your skills, passions, and lifestyle goals. Think of it as choosing your own trip in the working world.

Freelancers represent one of the most common paths, offering specialized skills to multiple clients without long-term commitments. Whether you're a writer crafting marketing copy or a programmer building websites, freelancing lets you leverage your expertise across various projects and industries.

"I never imagined I could make more as a freelance graphic designer than at my agency job," shares Taylor Rodriguez, who made the leap three years ago. "The freedom to choose projects that excite me has actually made me more creative and productive."

Consultants take a slightly different approach, positioning themselves as experts who provide specialized knowledge rather than just deliverables. This path often commands premium rates and works well for those with deep industry experience or unique problem-solving abilities.

The creator economy has opened exciting doors for self-employed individuals who build audiences around their content. From YouTube channels to newsletters, podcasts to online courses, creators monetize their knowledge and personality through multiple revenue streams.

Home-based business owners enjoy minimal overhead while maintaining work-life balance. This category includes everything from e-commerce store owners and craft makers to virtual assistants and tutors. The pandemic accelerated this trend, with many finding they could run successful businesses without leaving home.

For those wanting more structure, becoming a franchisee offers the independence of self-employment with the safety net of a proven business model. Though it requires more upfront investment, franchise owners benefit from established systems and brand recognition.

Healthcare practitioners like therapists and chiropractors, construction professionals, real estate agents, and personal service providers like hair stylists represent some of the most common self-employed professions. These fields offer clear paths to independence with established client needs.

Independent Contractor: The Contract-Driven Self-Employed

Independent contractors occupy a distinct space in the self-employed landscape. Unlike employees, they maintain control over how they complete their work while being responsible for their own taxes and benefits.

The IRS uses what's called a "control test" to determine if you're truly an independent contractor. This looks at behavioral control (who decides how the work gets done), financial control (who handles business expenses and equipment), and the nature of your working relationship (contract terms, benefits, etc.).

"When I started consulting, I was surprised how many companies wanted to classify me as an independent contractor but still dictate my hours and work methods," explains Jamie Morgan, an IT consultant. "Understanding the legal distinction helped me establish appropriate boundaries."

If you're uncertain about your classification, Form SS-8 allows you to request an official determination from the IRS, though be prepared to wait several months for a response. Worker misclassification is a serious issue that can lead to tax headaches for everyone involved.

Partnership & Qualified Joint Venture Options

Sometimes, the entrepreneurial journey is better shared. Partnerships allow self-employed individuals to combine talents, resources, and risk while dividing responsibilities and profits. This structure works particularly well for complementary skill sets or when starting a business requires more capital than one person can provide.

For married couples running a business together, the IRS offers a special "qualified joint venture" option that simplifies tax filing. Instead of dealing with complex partnership returns, each spouse can file a separate Schedule C for their portion of the business. To qualify, you must be the only members of the joint venture, both materially participate in the business, file a joint tax return, and elect not to be treated as a partnership.

This arrangement is especially beneficial for managing Social Security credits and can make tax season much less stressful for couples building a business together while maintaining their marriage.

No matter which path you choose, understanding the specific requirements and opportunities of your self-employed lane helps you steer with confidence. At Kelmeg & Associates, Inc., we specialize in helping self-employed Coloradans find the right health insurance solutions for their unique situations.

Pros and Cons of Being Your Own Boss

Jumping into self-employment feels a bit like learning to ride a bike without training wheels – exhilarating freedom mixed with moments of "what have I done?" When you're the boss, both the victories and the stumbles belong entirely to you.

Advantages Every Self-Employed Person Should Leverage

That morning alarm hitting differently is just the beginning of the self-employment joy ride. When Carlos Martinez left his corporate marketing job to start his consulting business, he told me, "I can finally schedule my work around my life, not my life around my work." This schedule control represents one of the sweetest fruits of being your own boss.

The potential to earn what you're truly worth is another compelling reason people choose this path. Without the ceiling of corporate salary bands, your income potential expands with your skills and client base. Many of my self-employed clients report earning significantly more than they did as employees – once they've weathered those initial lean months.

"The tax advantages alone made self-employment worthwhile for me," shared James Rivera, a tax professional who made the leap five years ago. Those business expenses – your home office, equipment, travel costs, and even health insurance premiums – can substantially reduce your taxable income when properly documented.

The autonomy to make decisions without running them up a corporate ladder means you can pivot quickly when opportunities arise. This agility becomes your secret weapon in a rapidly changing marketplace. Plus, you get to specialize in work that lights you up rather than handling whatever random tasks get assigned to you in a traditional job.

Common Challenges & How to Mitigate Them

The infamous "feast or famine" cycle catches most new entrepreneurs by surprise. This irregular income reality means building a 3-6 month emergency fund isn't just nice to have – it's essential. Diversifying your income streams can also help smooth out those financial roller coaster rides.

The benefit gaps hit hard for many self-employed individuals. That employer-provided health insurance, retirement matching, and paid vacation time? It's all on you now. At Kelmeg & Associates, we specialize in helping Colorado's self-employed steer health insurance options to find affordable coverage that protects both your health and your business.

The silence of working alone can be deafening sometimes. Mental health pressures from isolation, decision fatigue, and blurred work-life boundaries take a real toll. Regular networking events, co-working spaces (even if just once a week), and deliberately scheduled downtime help combat the entrepreneur's loneliness.

Studies show immigrants and minorities often use self-employment as a path to economic advancement despite facing additional systemic obstacles. These discrimination barriers may include limited access to capital, smaller professional networks, or biased treatment from potential clients.

Studio owner Tara Johnson reflected on her journey: "The hardest part of being self-employed was learning to wear all the hats at first. Once I figured out which tasks to delegate and which to keep, my business really took off." This administrative burden catches many new entrepreneurs off guard – you're suddenly responsible for everything from marketing to bookkeeping to tech support.

The freedom of self-employment comes with significant responsibility, but with proper planning, the rewards typically outweigh the challenges. The key is entering this lifestyle with eyes wide open – realistic expectations paired with strategic preparation creates the foundation for sustainable success.

Taxes, Social Security & Medicare: Staying Compliant

When you're self-employed, tax season isn't just an April affair—it's a year-round relationship with the IRS. Unlike employees who have taxes withheld from each paycheck, you're now responsible for both halves of the Social Security and Medicare tax equation.

This combined tax, known as the Self-Employment Contributions Act (SECA) tax, currently sits at 15.3% of your net earnings. Let's break that down:

- 12.4% goes to Social Security (but only on the first $176,100 of your 2025 earnings)

- 2.9% funds Medicare (on every dollar you earn)

- If you're doing really well and earn over $200,000 ($250,000 for married couples filing jointly), you'll chip in an extra 0.9% Medicare tax on those higher earnings

"The first tax bill after going self-employed can feel like walking into a glass door you didn't see coming," shares tax advisor Maria Gonzalez. "I always recommend setting aside 25-30% of your income in a separate savings account specifically for taxes. Your future self will thank you."

There is a silver lining though—you can deduct half of your self-employment tax on your 1040, which lowers your adjusted gross income and reduces your overall tax burden.

Your tax toolkit will now include:

- Schedule C (Form 1040) to report your business income or loss

- Schedule SE (Form 1040) to calculate your self-employment tax

- Form 1040-ES for those quarterly tax payments we're about to discuss

For more comprehensive information, the Self-Employed Individuals Tax Center on the IRS website offers valuable resources custom to your situation.

Quarterly Estimated Payments Made Easy

If you expect to owe $1,000 or more in taxes for the year (and most self-employed folks do), you'll need to make quarterly estimated tax payments. Think of it as paying your taxes in installments rather than one lump sum.

These payments have specific due dates that don't align neatly with calendar quarters:

- April 15 covers January through March

- June 15 covers April through May

- September 15 covers June through August

- January 15 (of the next year) covers September through December

The Electronic Federal Tax Payment System (EFTPS) makes this process relatively painless. You can schedule payments in advance and receive confirmation numbers that serve as your digital receipt.

Missing these quarterly deadlines can result in penalties, even if you pay everything by April 15. To avoid this, use the "safe harbor" rule by paying either 90% of your current year's tax liability or 100% of last year's tax liability (110% if your adjusted gross income exceeded $150,000).

"I've found that setting calendar reminders two weeks before each quarterly deadline gives me enough time to review my numbers and make informed payments," says freelance photographer Jamie Chen. "It's become just another part of my business rhythm."

Social Security Credits for the Self-Employed

Your future retirement benefits depend on the Social Security credits you earn throughout your working life. For 2025, you earn one credit for each $1,810 in net earnings, with a maximum of four credits per year (which you'll reach at $7,240).

Most people need 40 credits—essentially 10 years of work—to qualify for retirement benefits. But what if you're having a slow year in your self-employed venture?

This is where the optional reporting method comes in handy. It allows you to report a smaller amount of earnings (up to $6,920 for combined farm and non-farm income) to ensure you're still earning those valuable credits even during leaner times.

Retirement specialist David Kim emphasizes, "Many self-employed individuals focus solely on immediate tax savings, but understanding how Social Security credits work is crucial for your long-term financial health. Even during difficult years, the optional method can help ensure you're building toward future benefits."

At Kelmeg & Associates, we understand that navigating these tax waters while also managing your business can feel overwhelming. While we specialize in health insurance rather than tax advice, we're always happy to connect you with trusted tax professionals who understand the unique needs of self-employed individuals in Colorado.

Money Matters: Budgeting, Insurance & Retirement for Sole Proprietors

When you're self-employed, financial stability isn't just nice to have—it's essential. Without regular paychecks and employer benefits to fall back on, you need to create your own financial safety nets and systems.

Today's self-employed professionals have access to powerful financial tools that previous generations could only dream of. Modern accounting software like QuickBooks, FreshBooks, or Wave can transform how you manage money by tracking income and expenses, categorizing transactions for tax purposes, and giving you real-time insights into your cash flow.

"QuickBooks helps me stay on track with profits, loss, income, expenses, and taxes," shares Maria, a self-employed photography studio owner. "I check my dashboard weekly, which keeps me connected to my business's financial health. I honestly don't know how I would run my business without it."

For self-employed individuals, the emergency fund rule of thumb stretches beyond the standard three months. Aim for 6-12 months of expenses safely tucked away, which provides crucial stability during inevitable slow periods. This buffer prevents temporary cash flow issues from becoming business-ending crises and gives you peace of mind to focus on growth rather than survival.

Health Insurance Options for Colorado's Self-Employed

Finding affordable health coverage might seem daunting when you're self-employed in Colorado, but you have several solid options:

The Health Insurance Marketplace offers flexible, high-quality coverage especially suited for self-employed individuals with no employees. Many people are surprised to find they qualify for premium tax credits that significantly reduce monthly costs based on projected annual income.

At Kelmeg & Associates, we specialize in helping self-employed Coloradans compare plans from multiple carriers to find coverage that balances cost with the specific benefits you need. Our clients often tell us they appreciate having someone translate insurance jargon into plain English.

Health Savings Accounts (HSAs) paired with qualifying high-deductible health plans create a powerful financial strategy for the self-employed. These accounts offer remarkable triple tax advantages: tax-deductible contributions today, tax-free growth over time, and tax-free withdrawals for qualified medical expenses whenever you need them.

For those with working spouses, joining their employer-sponsored plan might be the most cost-effective solution. We can help you run the numbers to see if this makes sense for your situation.

"Finding affordable health insurance benefits for your Colorado business is getting tougher every year," notes Tad, a broker who specializes in self-employed health coverage. "But there are still excellent options available, including plans with three-year rate guarantees that provide budget predictability."

If your self-employed lifestyle involves travel or splitting time between locations, PPO plans offer valuable flexibility by allowing access to healthcare providers across different states. As one of our nomadic clients put it, "I need coverage that works for my winters in Arizona and summers in Michigan."

Learn more about health insurance options for the self-employed in Colorado

Building a Retirement Nest Egg

When you're busy building a business, retirement planning often takes a back seat. Yet as a self-employed person, you have access to retirement accounts with higher contribution limits than many traditional employees.

The SEP-IRA (Simplified Employee Pension) lives up to its name—it's easy to set up and maintain, allowing contributions of up to 25% of your net self-employment income with a generous maximum of $69,000 for 2024. This simplicity makes it popular among solo business owners who want straightforward retirement solutions.

The Solo 401(k) offers potentially higher contribution limits through a clever structure that recognizes you as both employee and employer. For 2024, you can contribute up to $23,000 as an "employee," plus up to 25% of compensation as the "employer" (with a combined limit of $69,000). This dual contribution approach often allows for significantly higher annual savings than other retirement vehicles.

Traditional or Roth IRAs provide additional tax-advantaged options with lower contribution limits ($7,000 in 2024, plus $1,000 catch-up contribution if you're 50 or older). Many self-employed individuals maintain these accounts alongside their SEP-IRA or Solo 401(k) for maximum tax diversification.

The recently passed SECURE Act 2.0 has updated contribution limits and rules in ways that benefit self-employed individuals, including higher catch-up contribution provisions and new emergency savings options connected to retirement accounts.

Consistent contributions, even modest ones, can grow substantially over time thanks to compound interest. As one of our clients who started saving in his 40s shared, "I wish I'd started earlier, but I'm amazed at how quickly my retirement accounts have grown once I made them a priority in my business budget."

How to Start Your Self-Employment Journey in 8 Steps

Taking the leap into self-employment can feel both exhilarating and terrifying. I've guided hundreds of new business owners through this transition, and I've found that following a structured approach dramatically increases your chances of success.

Let me walk you through the eight essential steps that will help you build a rock-solid foundation:

The journey begins with validating your idea. Before quitting your day job, test your concept with potential clients to ensure there's genuine demand. Elena Rodriguez, a marketing consultant I worked with, shared her approach: "I started my consulting business as a side hustle while still employed. This allowed me to refine my offering and build a client base before going all-in." This gradual transition minimizes risk and helps you refine your services based on real feedback.

Next, create a business plan that serves as your roadmap. Don't worry—this doesn't need to be a 50-page document! Even a simple one-pager outlining your services, target market, pricing strategy, and financial projections can provide valuable direction when decisions get tough.

The third step involves handling legal requirements. Decide whether you'll operate as a sole proprietor, LLC, or another structure. Obtain any necessary licenses and permits for your industry and location. Consider applying for an Employer Identification Number (EIN) from the IRS—even if you don't have employees, it helps keep your personal and business identities separate.

Securing insurance coverage is a step too many new self-employed professionals skip, often with regrettable consequences. Protect yourself with appropriate business insurance (liability, professional, etc.) and personal coverage (health, disability, life). At Kelmeg & Associates, we specialize in helping Colorado's self-employed individuals find health insurance solutions that provide comprehensive coverage without breaking the bank.

Setting up proper financial systems from day one saves countless headaches later. Open a separate business bank account to avoid commingling personal and business funds. Establish simple but effective bookkeeping processes and select accounting software that matches your technical comfort level. Your future self (and accountant) will thank you during tax season!

Developing a thoughtful pricing strategy requires research and self-awareness. Research market rates in your industry and geography, then calculate your true costs—including taxes, benefits, and overhead—to ensure your pricing is both competitive and profitable. Your time has value, and underpricing your services is a common pitfall for new self-employed professionals.

Creating a consistent client acquisition plan prevents the feast-or-famine cycle that plagues many independent workers. Identify marketing channels that align with your strengths and budget. Build a professional online presence, even if it's just a simple website and LinkedIn profile. Develop a networking strategy that helps you generate consistent leads without feeling salesy.

Finally, establish regular review processes to keep yourself accountable. Schedule quarterly check-ins to assess your business performance, adjust strategies based on what's working, and plan for upcoming tax payments. These structured reviews help you step out of the day-to-day operations to work on your business, not just in it.

Business coach Marcus Lee, who has helped dozens of professionals transition to self-employment, shared this observation with me: "The most successful self-employed individuals I work with are those who treat their transition methodically. They plan thoroughly, start with adequate financial reserves, and continually refine their approach based on results."

Starting your self-employment journey might seem overwhelming, but breaking it down into these manageable steps makes the process much less daunting. You don't have to figure everything out alone. Connecting with professionals who understand the unique challenges of self-employment—from insurance brokers to accountants to business coaches—can provide invaluable support as you build your independent career.

Growing Beyond One: From Freelancer to Employer

Many self-employed individuals eventually reach a crossroads: continue as a solo practitioner or expand by bringing on team members. This transition requires careful consideration and planning.

Before hiring employees, consider these intermediate steps:

- Outsource Non-Core Tasks: Contract with other self-employed professionals for specialized work (bookkeeping, design, administrative support) to free up your time for high-value activities.

- Use Independent Contractors: For project-based work, hiring contractors can provide flexibility without the ongoing commitment of employees.

- Automate and Systematize: Document your processes and implement tools that increase efficiency before adding staff.

When you're ready to hire W-2 employees, you'll need to:

- Obtain an Employer Identification Number (EIN)

- Register with your state's labor department

- Set up payroll systems and tax withholding

- Secure workers' compensation insurance

- Develop compliant employment policies

"The transition from being self-employed to becoming an employer was both challenging and rewarding," reflects retail shop owner Michael Chang. "The key was having systems in place before bringing on staff so I could delegate effectively without micromanaging."

Hiring employees changes your tax obligations significantly. You'll be responsible for:

- Withholding income taxes

- Paying the employer portion of Social Security and Medicare taxes

- Federal and state unemployment taxes

- Regular payroll tax filings and deposits

Technology, Tools & Support Networks

The digital revolution has been a game-changer for self-employed professionals. Today's independent workers have powerful tools at their fingertips that make running a business easier than ever before.

When I talk with newly self-employed clients, I often recommend starting with good accounting software. Programs like QuickBooks Self-Employed or FreshBooks do more than just track money—they automatically categorize expenses, generate professional invoices, and even help prepare for tax time. As one freelance photographer told me, "My accounting software basically gave me a part-time bookkeeper without the hourly rate."

If you drive for business, don't leave money on the table. Mileage tracking apps like MileIQ or Everlance use your smartphone's GPS to automatically log business trips. These apps can save you hundreds in tax deductions with almost no effort on your part.

Managing client relationships becomes increasingly important as your business grows. A good CRM system helps you keep track of communications, set follow-up reminders, and maintain organized client records. Even solo practitioners find these tools valuable for providing consistent service.

"I resisted project management software at first," admits Carlos, a self-employed graphic designer. "But once I started using Asana, I realized I was spending less time managing projects and more time actually designing. It's like having an assistant who never sleeps."

Beyond technology, the self-employed have access to remarkable support networks. The Small Business Administration (SBA) offers free resources that would cost thousands from private consultants. SCORE provides mentorship from retired executives who've "been there, done that" and want to help others succeed. Small Business Development Centers host affordable workshops on everything from marketing to financial management.

These resources aren't just for beginners. Even established self-employed professionals can benefit from fresh perspectives and updated information as markets and regulations change.

Grant & Mentoring Programs for Self-Employed With Disabilities

For people with disabilities, self-employment often provides the flexibility and accommodations that traditional workplaces struggle to offer. Several specialized programs exist to support this path to economic independence.

The START-UP initiative (Self-Employment Technical Assistance, Resources, & Training) has developed best practices for supporting entrepreneurs with disabilities through programs tested in Alaska, Florida, and New York. These models provide custom guidance on business planning, funding sources, and ongoing support.

The Job Accommodation Network (JAN) offers practical advice on workplace accommodations specifically for self-employed individuals. Their Entrepreneurship Resources include guidance on everything from ergonomic office setups to adaptive technologies.

Many state Vocational Rehabilitation programs now include self-employment assistance. As Jamie, a web developer with chronic health issues, shared, "My VR counselor helped me develop a business plan that accounted for my energy limitations. They even helped fund my initial equipment needs."

Community & Professional Networks

The freedom of self-employment can sometimes feel a bit too much like isolation. Building a strong professional community isn't just good for your mental health—it's essential for business growth.

Industry-specific online forums provide 24/7 access to peers facing similar challenges. Whether you're troubleshooting a technical issue at midnight or seeking advice on client contracts, these communities offer practical wisdom from those who understand your specific field.

Co-working spaces have become popular for good reason. They provide the professional environment of an office without the boss, plus built-in networking opportunities. Many self-employed professionals find that even one or two days a week in a co-working space helps maintain motivation and sparks new ideas through casual conversations.

Mastermind groups take networking to another level by creating structured peer support systems. "My mastermind group meets monthly to review goals, discuss challenges, and hold each other accountable," explains Teresa, a self-employed consultant. "It's like having a board of advisors who truly understand the unique pressures of being your own boss."

Local business organizations, from Chambers of Commerce to industry associations, help root your business in the community. These connections often lead to referrals, collaborations, and friendships that make the entrepreneurial journey less lonely and more profitable.

At Kelmeg & Associates, we've seen how the right support network can make all the difference for our self-employed clients. While we focus on solving your health insurance challenges, we're always happy to connect you with other resources that can help your independent business thrive.

Frequently Asked Questions about Self-Employment

How do self-employed people prove income?

Proving income when you're self-employed can feel like a puzzle at first, but it's actually quite straightforward once you know what documents to gather. Unlike employees who simply show a W-2, you'll need to provide a more complete financial picture.

Most lenders, landlords, and agencies will accept tax returns with Schedule C as your primary proof of income. These official documents show both your revenue and expenses, giving a clear picture of your actual earnings. Your 1099 forms from clients serve as additional verification, showing exactly who paid you and how much.

Bank statements can be particularly helpful, especially if you maintain a separate business account (which I highly recommend). Regular deposits create a paper trail that confirms your ongoing income stream. For a more formal approach, profit and loss statements provide a professional summary of your business finances.

Alex Rodriguez, a graphic designer who recently bought a home, shared his experience: "When I applied for a mortgage, I needed to provide two years of tax returns and a year-to-date profit and loss statement. Having organized financial records made this process much smoother."

Client contracts and invoices round out your documentation toolkit, demonstrating both your current work arrangements and expected future income. The more organized these records are, the easier any income verification process will be.

What health insurance options do self-employed Coloradans have?

Finding affordable health insurance is often one of the biggest concerns when going self-employed in Colorado. The good news? You actually have several solid options to choose from.

Connect for Health Colorado, our state's health insurance marketplace, offers a range of individual plans with potential premium tax credits based on your income. These subsidies can significantly reduce your monthly costs, making comprehensive coverage much more affordable than you might expect.

Many of my clients find success with private health plans purchased directly from insurers or through brokers like us at Kelmeg & Associates. These plans come in various network types (HMO, PPO, EPO) and coverage levels to match your specific healthcare needs and budget.

For the financially savvy self-employed person, HSA-eligible plans deserve serious consideration. These high-deductible health plans paired with tax-advantaged Health Savings Accounts offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

"I was paying 30% more each year until I found a plan through Kelmeg that saved me over $400 monthly while providing better coverage," one of our clients recently told me. Our three-year rate guarantee programs have been particularly popular among self-employed Coloradans who value predictability in their healthcare costs.

Some professional associations and industry groups also offer access to group health insurance plans, which might provide better rates than individual coverage depending on your situation.

Learn more about affordable health coverage in Colorado

When must the self-employed file quarterly taxes?

The quarterly tax schedule is something every self-employed person needs to mark on their calendar. Unlike employees who have taxes withheld from each paycheck, you're responsible for making these payments yourself throughout the year.

The basic rule is simple: if you expect to owe $1,000 or more in federal taxes for the year, you need to make quarterly estimated payments. These payments cover both income tax and self-employment tax (Social Security and Medicare).

The due dates follow a somewhat irregular schedule:

- First quarter (January-March): April 15

- Second quarter (April-June): June 15

- Third quarter (July-September): September 15

- Fourth quarter (October-December): January 15 of the following year

To avoid penalties, your payments throughout the year must total either 90% of your current year's tax liability or 100% of your previous year's tax liability (110% if your adjusted gross income was over $150,000). This "safe harbor" provision gives you some flexibility, especially if your income fluctuates.

Maya Patel, a web developer I work with, shared her practical approach: "I set aside 30% of each payment I receive in a separate savings account for taxes. This ensures I always have funds available for quarterly payments and prevents tax season stress."

Many self-employed professionals find that setting up automatic transfers to a dedicated tax savings account helps them stay on track. Online payment through the IRS Electronic Federal Tax Payment System (EFTPS) makes the actual payment process quick and straightforward, giving you immediate confirmation of your payment.

Conclusion

The path of self-employment is like a winding mountain road – challenging at times but offering breathtaking views along the way. As we've explored throughout this guide, working for yourself delivers a unique blend of freedom and responsibility that millions of Americans find deeply fulfilling.

Looking ahead, the landscape for independent workers appears increasingly promising. Remote work technologies continue to evolve, digital payment systems streamline invoicing, and online platforms connect self-employed professionals with clients worldwide. The traditional 9-to-5 job is no longer the only route to financial security and career satisfaction.

Yet success in self-employment demands more than just being good at what you do. The most thriving independent professionals I've worked with have mastered the art of wearing multiple hats – skilled practitioner, savvy business manager, and forward-thinking strategist all rolled into one.

"When I first went self-employed, I thought my photography skills were all I needed," shares Denver-based photographer Jamie Hernandez. "Five years in, I realize that understanding taxes, insurance, and client management has been just as crucial to my success."

At Kelmeg & Associates, Inc., we've guided hundreds of Colorado's self-employed individuals through the maze of health insurance and benefits planning. We've seen how having the right protection creates the foundation for sustainable success in independent work.

If there's one thing I'd want you to remember from this guide, it's that preparation creates possibility. Build your financial safety net before you need it. Understand your tax obligations before they're due. Secure appropriate insurance coverage before health challenges arise. These proactive steps create the stability that allows your independent business to thrive.

Equally important is creating systems that support your freedom rather than constrain it. The right processes for tracking finances, managing clients, and organizing operations aren't just administrative necessities – they're the scaffolding that lets you focus on doing the work you love.

And don't underestimate the power of community. The myth of the lone wolf entrepreneur doesn't match reality. The most successful self-employed individuals I know have built robust networks of peers, mentors, and collaborators who provide support, referrals, and perspective when challenges arise.

Whether you're contemplating your first steps into self-employment or looking to strengthen an established independent business, we're here to help steer the insurance and benefits side of your journey. Our personalized approach ensures you receive guidance custom to your specific situation, goals, and budget.

For more information about health insurance options designed for Colorado's self-employed professionals, visit our group health insurance page or reach out to our team in Lafayette, Broomfield, Boulder, or Adams County.

Your vision of success on your own terms is achievable – and having the right partners along the way makes all the difference.