Decoding ACA Health Insurance Options in Colorado

Looking into aca plans colorado and feeling overwhelmed by all the options? You're not alone—choosing a health insurance plan can get confusing. Let's quickly decode the basics:

- Gold Plans: Higher monthly premiums, lower out-of-pocket costs.

- Silver Plans: Balanced monthly premiums & out-of-pocket costs (best if you qualify for cost-sharing reductions).

- Bronze Plans: Lower monthly premiums, higher out-of-pocket costs.

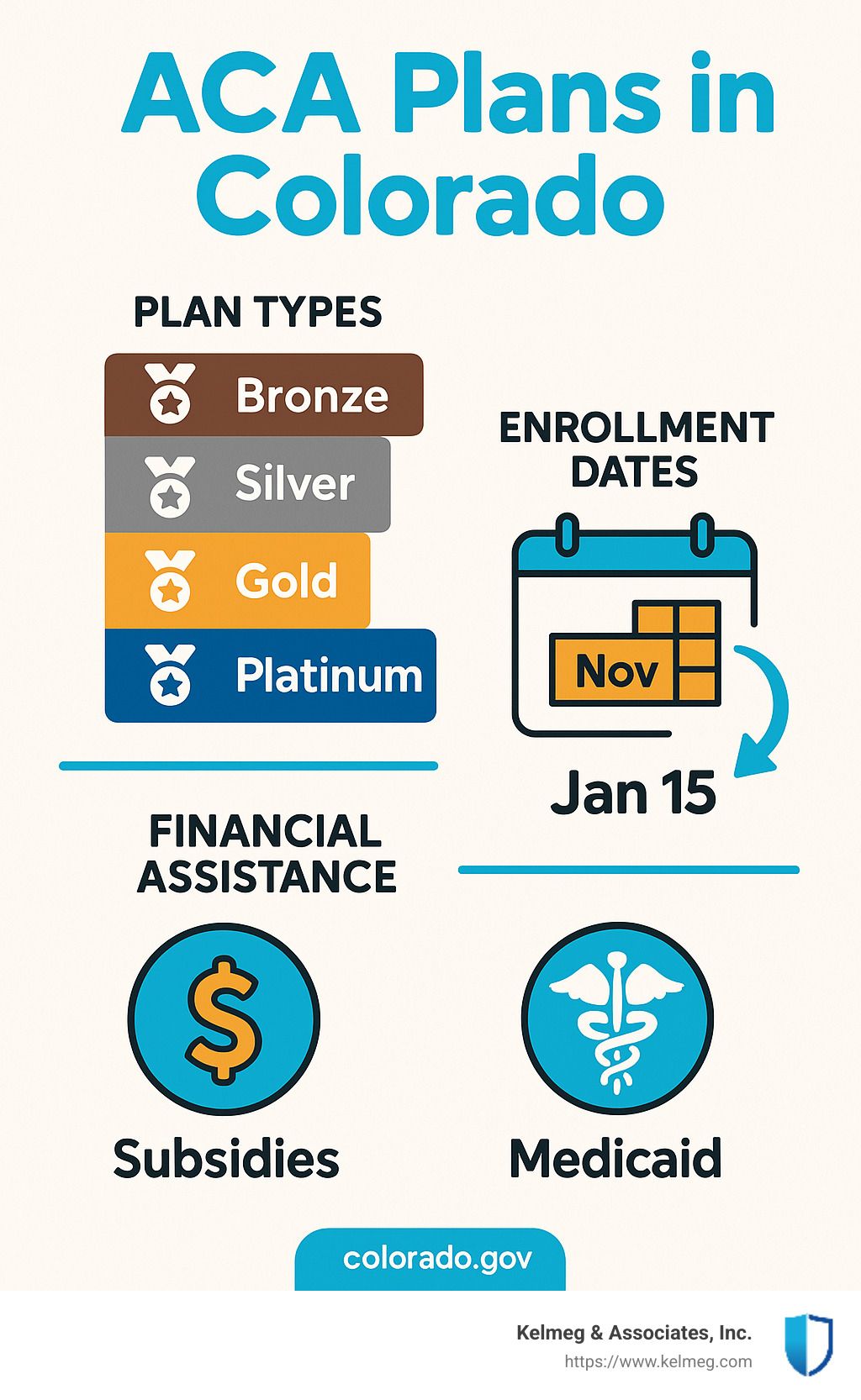

Open Enrollment typically runs from November 1 to January 15. If you miss this, you'll need a qualifying life event to enroll.

You can access ACA plans and financial assistance through Connect for Health Colorado. Financial help depends on your income, and many people can qualify for $0 or low-cost coverage.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., with deep expertise in helping individuals and businesses steer aca plans colorado. My goal is simple: to help you find clear, affordable coverage without hassle.

Understanding the Affordable Care Act (ACA) in Colorado

When people talk about health insurance in Colorado today, the Affordable Care Act (or aca plans colorado) is at the center of the conversation. Since it became law in 2010, the ACA has completely changed how Coloradans get their health coverage – in ways that directly benefit you and your family.

Think of the ACA as setting a new standard for what "real" health insurance means. No more skimpy plans that disappear when you actually need them! In Colorado, every aca plans colorado plan must cover 10 essential health benefits:

Imagine having coverage that includes everything from your regular doctor visits (ambulatory services) to emergency care, hospital stays, maternity care, and mental health services. Your prescription medications are covered, along with rehabilitation services, lab work, and preventive care to keep you healthy. For families, pediatric services including dental and vision for kids are included too.

Colorado takes these requirements seriously. The state has its own benchmark plan that defines exactly what these benefits should look like. In 2023, Colorado rolled out an updated benchmark plan after careful review with stakeholders and health insurance experts. This plan sets the bar for what every insurance company must offer when they sell aca plans colorado plans.

"This is the benchmark health insurance plan for health plans for 2023 and beyond. It went into effect on January 1, 2023," according to official state documentation. You can review the full details of ACA Benchmark Health Insurance Plan - Includes Required Benefits to see exactly what should be included in your coverage.

When you're ready to shop for an aca plans colorado plan, Connect for Health Colorado is your go-to resource. It's the state's official health insurance marketplace – and the only place where you can get financial help with your premiums.

As Kevin Patterson, CEO of Connect for Health Colorado, puts it: "When you find out you need new health coverage, contact Connect for Health Colorado right away. We'll walk you step-by-step through the application and ensure you get all the financial help you qualify for."

That financial help part is crucial! Many Coloradans miss out on savings because they don't realize they need to shop through the official marketplace to get assistance. The numbers show how valuable this resource has become: in its tenth year, Connect for Health Colorado enrolled 201,758 people during the 2023 Open Enrollment Period.

What makes this marketplace special is that it's not just a website – it offers personalized help from real people who understand Colorado's unique insurance landscape. They can guide you through comparing plans, understanding costs, and finding coverage that works for your specific health needs and budget.

At Kelmeg & Associates, we work closely with Connect for Health Colorado to help our clients steer these options. The benchmark plan ensures you get comprehensive coverage, while the marketplace makes that coverage more affordable through financial assistance programs we'll explore in later sections.

ACA Plans Colorado: A Comparative Guide

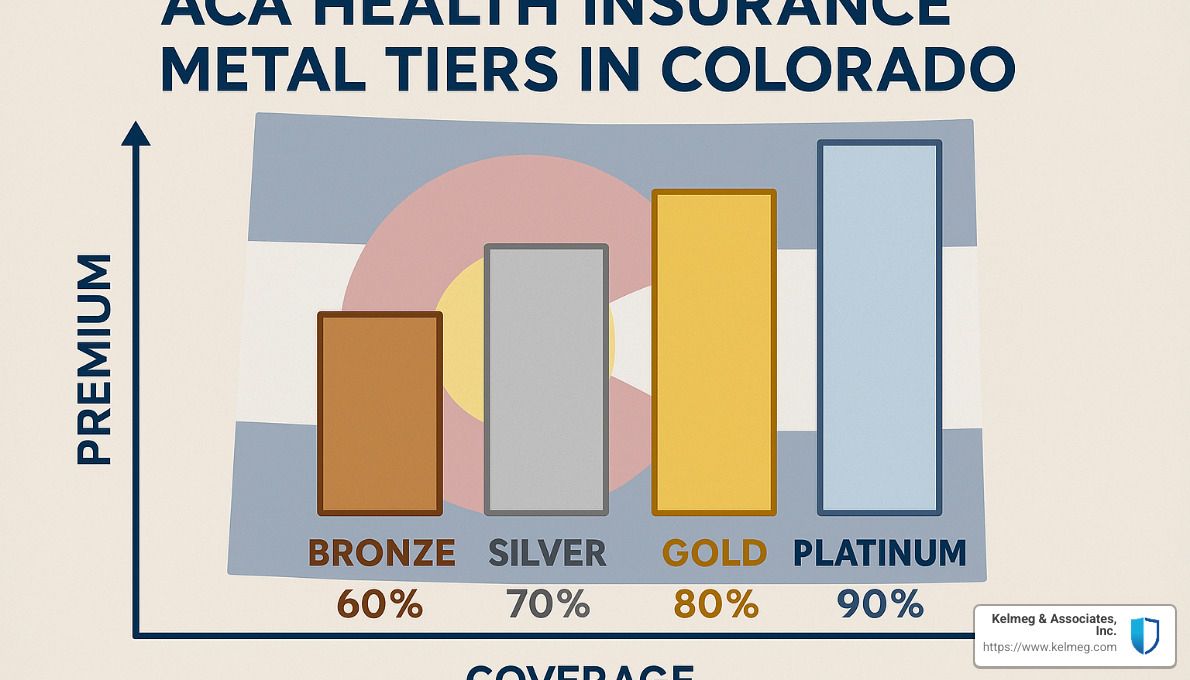

When shopping around for ACA plans Colorado, you've probably noticed that policies come in three shiny "metal" options: Bronze, Silver, and Gold. Understanding these metal tiers isn't about picking your favorite jewelry color (though wouldn't that be nice?), but rather about grasping how you and your insurer split healthcare costs.

Here's how it works in plain English: each metal tier indicates the average percentage of healthcare expenses your insurance covers, while you pay the rest. Bronze plans are designed to split the bill roughly 60/40, Silver plans about 70/30, and Gold plans approximately 80/20.

What does that mean in real life? Well, if you choose a Bronze Plan, your monthly premium will typically be lower—but you'll pay higher out-of-pocket costs when you get medical care. On the flip side, a Gold Plan means you'll pay a bit more each month, but your copays, deductibles, and overall costs when you're sick or injured will be lower. Silver Plans sit somewhere comfortably in the middle, balancing monthly costs with out-of-pocket expenses. (Think of them as the "Goldilocks" option—not too pricey, not too bare-bones, but just right for many people.)

Here's an eye-opener for you: In 2023, the average premium for Coloradans who received financial help through Connect for Health Colorado was just $143 per month. Folks without financial help paid about $412 per month. Yep, that's a big difference. It's a great reminder of why check if you qualify for financial assistance through Connect for Health Colorado.

How ACA Plans Colorado Metal Tiers Affect Costs

Let's dive deeper into the metal tiers and see how they affect your wallet and your healthcare experience.

Gold Plans generally come with higher monthly premiums, but lower deductibles, copayments, and out-of-pocket maximums. These are ideal if you or your family regularly need medical care or if you simply prefer fewer surprises at the doctor's office. While you'll pay more upfront each month, your medical visits and prescriptions will cost you less out of pocket.

Silver Plans typically have moderate monthly premiums, deductibles, and copayments. If you qualify for cost-sharing reductions (CSRs)—special financial assistance only available with Silver plans—your costs at the point of care can drop significantly, making these plans even more affordable and appealing.

Bronze Plans usually feature the lowest monthly premiums but higher deductibles and copayments. They're best suited for healthy individuals who don't often see the doctor but want coverage for unexpected medical events, because even young marathon runners can sprain an ankle.

Interestingly, Colorado has seen a shift in preferences lately. More people—both those receiving financial help and those paying full price—are choosing Gold-level plans. Specifically, there's been an 8-percentage point increase among folks who get financial assistance and a 10-percentage point jump among those who don't. Clearly, Coloradans are finding the value of lower out-of-pocket expenses, even if it means slightly higher monthly premiums.

Choosing Among ACA Plans Colorado Based on Your Needs

Of course, it's not just about picking your favorite metal color or monthly premium. The key to finding the right ACA plans Colorado option depends on your personal healthcare needs and budget.

Start by evaluating how you actually use healthcare. Do you visit the doctor frequently, or just once a year for a check-up? Are you managing a chronic condition or regularly taking prescription medication? Perhaps you're planning a surgery or are expecting a baby (congratulations!). In these cases, a Gold or Silver plan might save you money overall, despite higher monthly premiums.

Next, take an honest look at your budget. Ask yourself: Would I rather pay more each month and have lower costs when I need care, or pay less monthly and risk higher bills later? There's no wrong answer, just the one that works better for your personal finances.

You'll also want to check provider networks. Are your favorite doctors and hospitals included? If having a wide choice of providers is critical to you, make sure your preferred healthcare team is covered before signing on the dotted line.

Connect for Health Colorado offers a great tool—the Quick Cost & Plan Finder—to help you quickly compare plans based on your medications, doctors, and other preferences. It takes the guesswork out of deciding which ACA plans Colorado option is your personal best fit.

One last tip: keep in mind that all ACA-compliant plans cover preventive care at 100%—meaning no copay, no deductible, no charge. So, regardless of whether you choose Bronze, Silver, or Gold, annual check-ups, shots, and preventive screenings won't cost you a dime.

Enrollment Dates and Eligibility for ACA Plans in Colorado

When it comes to enrolling in aca plans colorado, timing really is everything. Colorado's standard Open Enrollment Period for coverage beginning in 2025 runs from November 1, 2024, through January 15, 2025. If you want your coverage to start on January 1, 2025, make sure you pick your plan no later than December 15, 2024. If life gets busy (we get it!), and you enroll between December 16, 2024, and January 15, 2025, your coverage will begin on February 1, 2025.

But what if you miss that Open Enrollment window completely—are you out of luck until next year? Thankfully, no! Life has a habit of changing unexpectedly, and ACA plans account for this reality. Special Enrollment Periods exist just for those unforeseen circumstances, known officially as Qualifying Life Events (QLEs).

These events trigger a 60-day window during which you can enroll or change your ACA coverage. Common examples include losing other health insurance coverage (like losing your job and employer-sponsored coverage, COBRA expiring, becoming ineligible for Medicaid or Child Health Plan Plus (CHP+), aging out of your parent's plan at 26, divorce or legal separation, or the death of the policyholder).

Other qualifying events involve changes in your family or household, such as getting married, entering into a civil union, welcoming a child by birth or adoption, or being required by a court to obtain coverage. Additionally, moving to Colorado from another state, gaining citizenship or lawful permanent resident status, or being released from incarceration also open up eligibility.

The experts over at Connect for Health Colorado recommend applying for your new plan as soon as possible—ideally within 60 days before your existing coverage ends—to avoid any gaps in healthcare coverage.

Eligibility for Health First Colorado and CHP+ is typically based on income thresholds—like making under approximately $19,400 per year for an individual or $40,000 per year for a family of four. Once your income rises above these amounts, ACA marketplace plans provide your next best option.

If you're feeling uncertain about all these dates and eligibility rules, don't stress. At Kelmeg & Associates, Inc., we're here to simplify things and help you find the right coverage. We can walk you through every step of the enrollment process so you never miss a beat (or deadline!).

Financial Assistance and Subsidies for ACA Plans in Colorado

Let's talk honestly—health insurance can get pricey. That's why one of the strongest advantages of aca plans colorado is the availability of financial assistance. Many Coloradans are pleasantly surprised to find they're eligible for significant help to lower their insurance costs. And truthfully, who doesn't love saving money?

When it comes to financial aid under the ACA, there are two primary ways you can cut your expenses:

- Premium Tax Credits (PTCs) help lower your monthly insurance premium. Think of this like a monthly discount applied right off the bat.

- Cost-Sharing Reductions (CSRs) make your out-of-pocket expenses like deductibles, copays, and coinsurance significantly more affordable. Note: These reductions are exclusively available through Silver-level plans—another great reason to consider Silver!

Who Qualifies for ACA Financial Assistance in Colorado?

Your eligibility for ACA financial help depends mostly on your household income, measured against the Federal Poverty Level (FPL)—a benchmark the government uses to determine financial assistance.

Usually, Premium Tax Credits have been available for households earning between 138% and 400% of the FPL. However, recent legislative changes (thanks to the American Rescue Plan and Inflation Reduction Act) have temporarily removed the upper limit. That means even if your income is above 400% FPL, you might still qualify for some assistance. Pretty good news, right?

Cost-Sharing Reductions are specifically available if your income falls between 138% and 250% of the FPL—and remember, you'll need to choose a Silver plan to open up this benefit.

Here's what these percentages look like for 2023 in real-life terms:

- Individuals earning roughly between $20,120 and $36,450 per year (138%-250% FPL) qualify for substantial Cost-Sharing Reductions on Silver plans. Those earning up to around $58,320 or even higher (with recent changes) may also receive Premium Tax Credits.

- A family of four earning approximately $41,400 to $75,000 annually (138%-250% FPL) can enjoy significant reductions in their out-of-pocket costs. Households earning up to $120,000 or more can often still receive a Premium Tax Credit.

How Much Can You Actually Save?

The savings from these subsidies can be life-changing. Let’s put it into perspective: According to Connect for Health Colorado's latest enrollment data, the average premium for those receiving financial assistance was just about $143 per month, compared to $412 per month for those without assistance. That's a huge difference—$269 monthly, or more than $3,200 annually!

And even more exciting: two out of every three Colorado marketplace shoppers can find a quality ACA plan for $25 a month—or less! So if you've been putting off getting insured because of costs, now might be the time to revisit those plans.

How to Apply for ACA Financial Assistance in Colorado

One critical detail to remember: Connect for Health Colorado is your single route to ACA financial assistance. You won't find these savings elsewhere, even if the same insurance plan is offered directly from an insurer.

When you apply, you'll estimate your Modified Adjusted Gross Income (MAGI) for the upcoming year. This estimate helps determine your monthly Premium Tax Credit. Don't worry—if your actual income turns out different, things will balance out when you file your taxes: you'll either receive an additional credit or repay a bit if you received too much.

Here's another important update: If your income falls below 138% of the FPL, you might qualify for Colorado's Medicaid program, Health First Colorado. And if you're a parent or pregnant and earn slightly above Medicaid limits, you might qualify for the state's Child Health Plan Plus program, offering quality, affordable coverage specifically designed for children and pregnant women.

The bottom line: Financial assistance for aca plans colorado is generous and widely available. Take a moment to see how much you might qualify for—it could make all the difference in finding a plan that fits comfortably within your budget.

How to Choose the Right ACA Plan in Colorado

Choosing among aca plans colorado can feel overwhelming at first. But don't worry—a little thoughtful planning makes the process simpler and less stressful. Here's a clear, step-by-step approach to help you confidently pick the best ACA health insurance plan for your unique situation.

Step 1: Determine Your Household Size

First things first: figure out the size of your household. When looking at ACA plans, your "household" usually includes yourself, your spouse if you're married and filing jointly, and anyone you claim as a dependent on your taxes.

Why does household size matter? Because it directly affects how much financial assistance you might qualify for—such as premium tax credits or cost-sharing reductions. The larger your household, the higher your income can be to still qualify for financial help.

Step 2: Estimate Your Household Income

Next, you'll need to estimate your household income for the upcoming coverage year. The ACA uses something called Modified Adjusted Gross Income (MAGI) to determine your eligibility for financial assistance. MAGI includes your wages, self-employment income, investments, social security benefits, retirement distributions, taxable alimony, and rental income.

Try to estimate as accurately as possible. But don't worry—if your actual income ends up being different, you'll reconcile that difference when filing your taxes. If your income is lower than expected, you might even get additional financial help at tax time.

Step 3: Assess Your Healthcare Needs

Now, think about your typical healthcare usage and anything special you anticipate for the coming year. Consider how frequently you visit doctors, specialists, or other providers. Are you on prescription medications? Do you manage chronic conditions or have planned procedures coming up?

For instance, if you're generally healthy and only go to the doctor for preventive care (covered fully by all ACA plans), you might prefer a Bronze plan with lower monthly premiums. But if you visit specialists regularly or take ongoing medications, a Silver or Gold plan might save you money overall—even if the monthly premium is a bit higher.

Step 4: Compare Networks and Coverage

Once you have a sense of your health needs, pay careful attention to the provider networks of plans you're considering. Each ACA plan in Colorado has its own set of doctors, hospitals, and healthcare providers. It's important to double-check that your preferred doctors and facilities are in-network so you can avoid higher out-of-pocket costs.

Don't forget about prescription medications, either. ACA plans have formularies (medication lists), and each drug on the list is assigned a cost tier. Checking the formulary can help you identify if your medications are covered and how much they'll cost with each plan.

Step 5: Analyze Total Costs, Not Just Premiums

It's easy to focus only on monthly premiums, but that's just one part of the story. To find the best ACA plan for you in Colorado, look at the full picture:

- Premiums: your monthly payment for coverage.

- Deductibles: what you'll pay before your insurance starts covering healthcare costs.

- Copayments and coinsurance: your share of the cost when you get healthcare services.

- Out-of-pocket maximums: the most you'll pay during a coverage year.

For example, a Bronze plan typically has lower premiums but higher deductibles and copayments, while a Gold plan has higher monthly premiums but lower cost-sharing when you receive care. Carefully weighing these factors against your health needs helps you save money in the long run.

Step 6: Consider Additional Benefits

Sometimes, ACA plans offer extra perks that can make your life easier or help manage your health better. Many Colorado health insurance plans now include valuable benefits like telehealth services, wellness programs, dental or vision discounts, or even coverage for alternative medicine.

Plus, many ACA plans in Colorado now offer free virtual care options like video consultations and medical chat visits. (Be aware: if you're on a high-deductible or catastrophic plan, you'll usually need to meet your deductible before virtual visits become free.)

Step 7: Seek Professional Guidance

Still feeling unsure? You don't have to steer aca plans colorado on your own. That's what we're here for at Kelmeg & Associates, Inc.. Our team specializes in ACA health insurance, providing personalized guidance at no extra cost to you.

We're proudly based right here in Colorado, serving individuals and families in Lafayette, Broomfield, Boulder, Adams County, and beyond. And because health insurance rates are regulated by the Colorado Division of Insurance, you'll never pay more by working with us—only gain valuable advice and peace of mind.

In fact, according to Connect for Health Colorado, 62% of people enrolled in ACA plans used broker guidance to find just the right fit. If you're ready for clear, friendly support to choose your ACA plan, we'd be delighted to help you.

Let's simplify healthcare together and find the perfect ACA plan for your unique needs—without all the confusion.

Learn more about our personalized services.

Frequently Asked Questions about ACA Plans in Colorado

What are the enrollment deadlines for ACA plans in Colorado?

If you're looking to enroll in aca plans colorado, there are some important dates to keep in mind. The standard Open Enrollment Period for coverage in 2025 runs from November 1, 2024, to January 15, 2025. If you enroll between November 1, 2024, and December 15, 2024, your coverage kicks in on January 1, 2025. Enrolling between December 16, 2024, and January 15, 2025, means your coverage begins on February 1, 2025.

But let's say life throws you a curveball and you miss this window—don't panic! You may qualify for a Special Enrollment Period if you've experienced a Qualifying Life Event, such as losing your existing health insurance, getting married, welcoming a new baby, or relocating to Colorado from another state. In these cases, you typically have 60 days from the event to enroll in a new ACA plan.

How do income levels affect my eligibility for financial assistance?

Your income level has a big impact on the type and amount of financial help you can get with aca plans colorado. Here's how it works:

If your income is below 138% of the Federal Poverty Level (FPL)—for reference, that's around $20,120 per year for an individual or $41,400 per year for a family of four in 2023—you'll likely qualify for Health First Colorado, our state's Medicaid program.

Between 138% and 400% FPL, you're likely eligible for Premium Tax Credits, which bring down your monthly insurance premium. Additionally, if your income falls between 138% and 250% FPL and you choose a Silver plan, you can also get Cost-Sharing Reductions (CSRs). These CSRs lower your out-of-pocket costs like deductibles, copays, and coinsurance.

Recent federal legislation has temporarily removed the 400% cap on Premium Tax Credits. This means even if your income is above 400% FPL, you might still get help if the benchmark ACA plan in your area costs more than 8.5% of your household income.

Just remember, financial assistance is available only through Connect for Health Colorado, the official ACA marketplace for our state. Plans purchased elsewhere won't qualify for these savings.

Can I change my ACA plan outside the Open Enrollment Period?

Life doesn't always stick to an annual schedule—that's why certain events might let you adjust your aca plans colorado outside of Open Enrollment. If you experience a Qualifying Life Event, you'll have a 60-day window to make changes or sign up for new coverage.

Common qualifying events include losing job-based or Medicaid coverage (note: voluntarily dropping coverage or losing it due to non-payment doesn't count), changes to your household size (like getting married or divorced, having or adopting a baby), moving to a new area with different plan options, or even changes in income that affect your financial assistance eligibility. Becoming a new U.S. citizen or getting out of incarceration are also qualifying events.

If you're unsure if your situation qualifies, no worries—at Kelmeg & Associates we're always happy to help you sort it out and find the right path forward.

What if I qualify for Health First Colorado (Medicaid) but don't want it?

You always have options. If you qualify for Health First Colorado but prefer not to enroll, you can still purchase private ACA plans through Connect for Health Colorado. However, here's the catch: if you're eligible for Medicaid coverage, you won't be able to receive the Premium Tax Credits. This means you'll need to pay full price for the private insurance you choose.

Before deciding against Medicaid, it's important to know that Health First Colorado provides comprehensive coverage and comes with little to no out-of-pocket costs. But if you still have reservations or questions about what's best for your situation, please reach out—we'll help you weigh your options and see what makes the most financial sense for you.

How do the networks differ among ACA plans in Colorado?

This is a great question because networks can significantly impact your healthcare experience. ACA plans in Colorado typically come with two main network types: Preferred Provider Organization (PPO) and Exclusive Provider Organization (EPO).

With PPO plans, you get a broader choice of providers and facilities. You can see any doctor you like—though you'll pay less by sticking with in-network providers. PPOs usually come with higher monthly premiums but offer more freedom and flexibility.

On the flip side, EPO plans limit coverage strictly to providers within their network, except in emergencies. While EPO plans tend to have lower monthly premiums, your choice of doctors and hospitals is more restricted.

The availability of these network types can vary across Colorado. For example, the Denver and Boulder areas generally offer multiple options, while more rural counties might have limited choices.

We always encourage our clients to double-check the provider directories to confirm your preferred doctors and hospitals are covered. If you're unsure, we're here to help—after all, nobody wants unpleasant surprises when scheduling healthcare appointments!

Conclusion

Navigating aca plans colorado can feel tricky—but it doesn't have to be. With a clear understanding of the basics, you can confidently pick the best health insurance coverage for your situation. Knowing how the metal tiers (Bronze, Silver, Gold) affect your costs, understanding key enrollment dates, and exploring financial assistance through Connect for Health Colorado are all critical steps toward finding the right plan.

Each metal tier shares healthcare costs differently between you and your insurer. Bronze plans cost less each month but come with higher deductibles and copays. On the other hand, Gold plans usually have higher monthly premiums but lower out-of-pocket costs. Silver plans land somewhere in between—and they're especially valuable if you qualify for cost-sharing reductions.

Timing is also important. Colorado's Open Enrollment runs from November 1 to January 15 each year. Missed this period? Don't worry—life happens! Events like losing coverage, welcoming a new family member, or moving can qualify you for a Special Enrollment Period.

Financial assistance can make a huge difference in affordability. Many Coloradans who enroll through Connect for Health Colorado find that they qualify for reduced premiums and lower out-of-pocket expenses. In fact, the average monthly premium for people receiving financial assistance was just $143—compared to $412 without. So it's definitely worth checking your eligibility.

When comparing plans, look beyond the monthly premium. Be sure to factor in all potential healthcare expenses like deductibles, copayments, and out-of-pocket maximums. Consider your healthcare needs, budget, and preferred doctors. If you're feeling overwhelmed, remember—you don't have to do this alone!

At Kelmeg & Associates, Inc., we're more than just health insurance experts—we’re your neighbors. With our offices serving Lafayette, Broomfield, Boulder, Adams County, and the rest of Colorado, we take pride in helping our community find coverage that truly fits. We'll walk you through every step, from estimating your income to finding the right doctor networks, all at no additional cost to you.

Whether you're enrolling during Open Enrollment, experiencing a qualifying life event, or transitioning from Medicaid coverage, we're here to help. With our personalized approach and locally focused expertise, you'll get clear, straightforward advice custom to your unique situation.

So, why steer the complexities of aca plans colorado alone? Contact Kelmeg & Associates, Inc. today and let us help you find affordable, reliable health insurance coverage that makes sense for you and your family.