Navigating Health Insurance for the Self-Employed in Colorado

Why Self-Employed Coloradans Need Specialized Health Insurance Guidance

Running your own business means wearing every hat1including the one marked "HR department." Traditional employees can lean on company HR for plan selection and premium contributions; freelancers, gig-workers, and independent contractors cannot. In Colorados fast-growing freelance economy2from Boulder tech consultants to Vail mountain guideschoosing the wrong health plan can threaten both personal finances and business stability.

Quick view of your main options in Colorado:

Connect for Health Colorado Marketplace 1 qualify for premium tax credits (APTC) and costsharing reductions (CSR)

Colorado Option plans 1 standardized benefits, $0 primary care & mental-health visits

Private off-exchange plans 1 full ACA coverage, no subsidies

Medicaid / Health First Colorado 1 free or very low cost for limited income

Short-term plans 1 temporary gap protection

Because Colorado runs its own exchange, help is local: multilingual call centers, in-person assisters, and the Colorado Options consumer-friendly designs. Still, acronyms such as MAGI, APTC, and FPL create confusion. A single misstep1missing open enrollment, estimating income incorrectly, or picking the wrong metal tiercan cost thousands.

Im Kelsey Mackley of Kelmeg & Associates, Inc. After years guiding self-employed Coloradans, Ive found that almost everyone can secure affordable, comprehensive coverageprovided they know where to look and which questions to ask. The rest of this guide simplifies those choices so you can focus on running your business, not deciphering insurance jargon.

Who Counts as "Self-Employed" Under Colorado Law?

The IRS calls you self-employed if you earn income from a trade or business and file taxes on 1099 income or Schedule C profits. That captures the rideshare driver in Denver, the freelance coder in Fort Collins, and the single-member LLC consultant statewide.

Hiring other independent contractors does not change your classification. What does change it? Putting your first W-2 employee on payroll. Until then, you shop in the individual market.

Colorado has a special rule that surprises many husband-and-wife teams: a two-person business made up only of spouses still counts as individual coverage, not a small group. To access group plans you must have at least one non-spouse W-2 worker.

More info about self-employed rules

Why Classification Drives Your Savings

Marketplace subsidies are based on your projected Modified Adjusted Gross Income (MAGI) for the coming yearnot last years tax return. You report net self-employment income after legitimate business deductions, which often places successful freelancers well within subsidy range. Estimate carefully, update when income shifts, and you could save hundreds every month on premiums.

Health Insurance for Self Employed Colorado: Core Coverage Paths

Self-employed Coloradans usually choose among five routes:

- Connect for Health Colorado marketplace1best value when you qualify for APTC or CSR.

- Colorado Option1standardized benefits, $0 primary & mental-health visits, easy apples-to-apples comparisons.

- Private off-exchange plans1ACA compliant but unsubsidized; good when income is too high for credits.

- Medicaid / Health First Colorado1no-cost coverage if income dips below 138% FPL.

- Short-term or supplemental plans1stopgaps when you miss enrollment or want extra accident protection.

Marketplace Subsidies in a Nutshell

If 2024 household income is roughly $14,58058,320 (single), you likely receive premium help. Silver-level CSR plans cut deductibles and copays dramatically for incomes up to 250% FPL.

Why Many Freelancers Prefer Colorado Option

Every carrier must offer the same Colorado Option benefit design: $0 primary care, $0 standard mental-health therapy, predictable copays in place of percentage-based coinsurance, and $0 prenatal visits. That transparency simplifies budgeting when income fluctuates.

Missed Enrollment? Bridge the Gap

Short-term plans (up to 4 months) and private off-exchange policies keep you covered until the next open enrollment or special enrollment window. Pairing a high-deductible plan with an accident rider up to $10,000 is a common cost-saving move for active Coloradans.

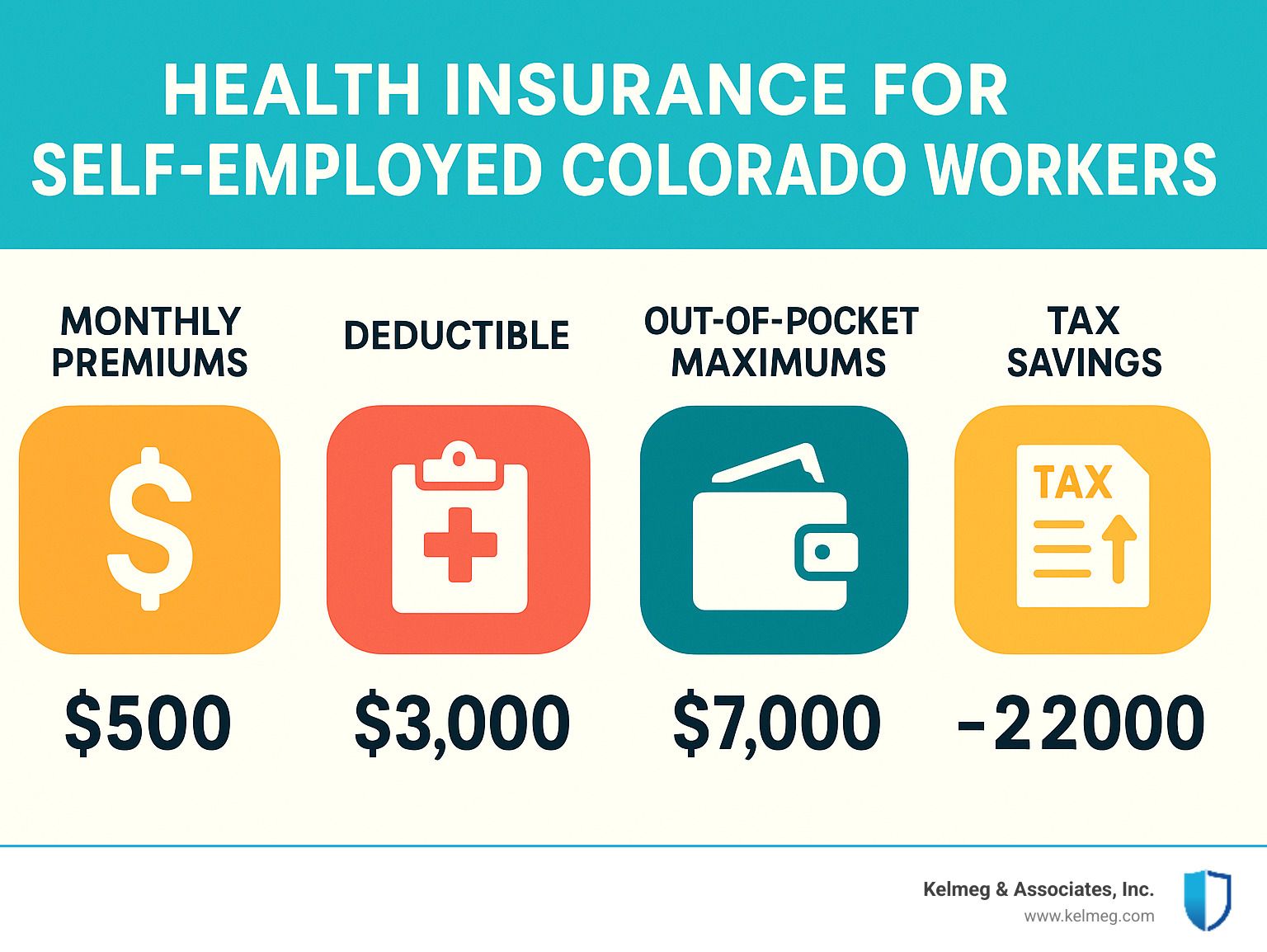

Comparing Costs, Deductibility & Tax Breaks

Numbers matter, but so do tax rules:

100% premium deduction 1 every dollar you pay for coverage (for you, spouse, and dependents) comes off your taxable income.

Typical 2024 premium ranges 1 $250400 (Bronze), $350550 (Silver), $450650 (Gold) for single adults; roughly double for families.

Out-of-pocket maximums cap at $9,450 per person ($18,900 family).

HSA: Triple Tax Advantage

Pair a Qualified High-Deductible Health Plan with a Health Savings Account and you can stash up to $4,150 individual / $8,300 family pre-tax in 2024 (plus $1,000 catch-up at 55+). Contributions lower taxable income, grow tax-free, and exit tax-free for medical billsan invaluable tool for self-employed retirement planning.

Real-World Snapshot: Sarah in Denver

Sarah, 40, projects $55,000 net income:

Bronze plan: $320 premium $180 APTC = $140/mo; $7,000 deductible.

Silver CSR plan: $420 $180 = $240/mo; deductible drops to $2,500.

If Sarah rarely sees a doctor, Bronze wins. If she needs regular care, Silvers lower cost sharing is worth the extra $100 per month.

Enrollment Timelines & Plan-Picking Checklist

Annual Open Enrollment: Nov 1 1 Jan 15

Enroll by Dec 15 1 coverage starts Jan 1.

Enroll Dec 16 1 Jan 15 1 coverage starts Feb 1.

Special Enrollment Periods (SEP) last 60 days after qualifying events (losing coverage, moving, marriage, birth, big income swing, etc.). File early to avoid gaps.

What Youll Need to Apply

Social Security numbers

Projected MAGI for the plan year

Details of any current coverage

Quick Comparison Checklist

Net monthly premium (after subsidies)

Deductible & out-of-pocket max

Provider & hospital network (keep favourite doctors?)

Drug formulary 1 are your meds on lower tiers?

Telehealth and $0 preventive care benefits

Lost Employer Insurance? How SEP Works

Self-employed after job loss? You have 60 days from the final day of employer coverage to choose any marketplace plan. Coverage starts the 1st of the month after you enrollno COBRA required unless you prefer it.

Special Situations & Supplemental Protection

Medicaid / Health First Colorado: Free coverage up to 138% FPL (about $20,120 single in 2024).

CHIP: Covers kids up to 260% FPL even when parents earn too much for Medicaid.

Catastrophic plans: Low premium option for adults under 30 or with hardship exemption.

Supplemental Safety Nets

Disability income insurance 1 replaces paychecks if illness or injury stops you from working.

Critical illness or accident policies 1 one-time cash for cancer, heart attack, or injuries (great for Colorados outdoor crowd).

Travel medical for consultants frequently crossing state or national borders.

Income Fluctuations & Subsidy Adjustments

Update your marketplace income estimate any time its likely to shift $5,000+. Smaller monthly credits beat large tax-time repayments. Safe-harbor rules cap repayment if you stay under 400% FPL.

Growth Stage: Hiring Your First Employee

Add a non-spouse W-2 worker and you qualify for small-group plans (including Colorado Option group versions). Employer contributions become business deductions, and employees enjoy group rates without medical underwriting.

Frequently Asked Questions about Health Insurance for Self Employed Colorado

Do self-employed Coloradans really qualify for subsidies?

Yes. If 2024 income is between 100% and 400% FPL (up to about $58,320 single / $120,000 family of four) you can receive APTC. Estimate next years net self-employment incomenot last years gross.

Can I deduct premiums if my spouses job offers insurance?

You may still deduct premiums as long as you are not eligible for your spouses employer plan. Marketplace subsidies, however, vanish if the employer family plan is deemed affordable (less than 9.12% of household income).

What if I move mid-year or work from another state?

Moving to a new coverage area triggers a 60-day SEP. Update your address; you can switch to a new plan starting the next month. For frequent out-of-state work, choose a carrier with a robust national network or add travel medical coverage.

Conclusion

Choosing health insurance for self employed colorado coverage is easier when you have an expert in your corner. Colorados marketplace, Colorado Option, and tax advantages give independents genuine leveragebut only if you know how to use them.

Kelmeg & Associates, Inc. offers personalized, no-cost guidance from licensed brokers in Lafayette, Broomfield, Boulder, Adams County and across the state. Well help you:

2 Project income correctly to maximize subsidies 2 Compare Colorado Option vs. traditional plans 2 Layer in HSAs or supplemental policies for complete protection

The most expensive plan is the one you dont have when you need itor the one that doesnt fit your life. Reach out today and lets find the sweet spot between affordability and peace of mind.