Discovering Medicare Health Plans in Colorado

Medicare plans colorado offer a variety of health insurance options custom to meet the diverse needs of residents. As the primary healthcare program for those 65 and older, Medicare is essential in providing comprehensive coverage and peace of mind. In Colorado, individuals have access to an extensive range of plans, including Medicare Advantage, Medigap, and Part D, each designed to offer coverage beyond Original Medicare.

- Medicare Advantage Plans: Often include extra benefits like vision and dental.

- Medigap (Supplement Plans): Help cover out-of-pocket expenses.

- Medicare Part D: Focuses on prescription drug coverage.

For individuals new to health insurance, navigating these choices can feel overwhelming. Rest assured, exploring the landscape of Medicare in Colorado need not be daunting when armed with the right information.

My name is Kelsey Mackley, and with my expertise at Kelmeg & Associates, I am dedicated to simplifying these complex topics, ensuring you find the best Medicare plan to suit your health and financial needs in Colorado. Now, let's dig deeper into understanding how these plans work for you.

Understanding Medicare Plans in Colorado

When it comes to Medicare plans in Colorado, there are three main types to consider: Medicare Advantage, Medigap, and Part D. Each offers unique benefits and coverage options to suit different needs.

Medicare Advantage Plans

Medicare Advantage, also known as Part C, is a popular choice for many. These plans are offered by private insurance companies approved by Medicare. They provide all the benefits of Original Medicare (Part A and Part B) and often include additional perks like vision, dental, and wellness programs.

- Why choose Medicare Advantage?

- Cost-Effective: Often cheaper than combining Original Medicare with a Medigap plan.

- Comprehensive Coverage: Includes extra benefits beyond what Original Medicare offers.

However, keep in mind that these plans typically require you to use doctors and hospitals in the plan’s network. It's crucial to ensure that your preferred healthcare providers are included.

Medigap (Supplement Plans)

Medigap plans, or Medicare Supplement Insurance, help cover some of the out-of-pocket costs that Original Medicare doesn’t, such as copayments, coinsurance, and deductibles.

- Benefits of Medigap:

- Predictable Costs: Helps manage unexpected healthcare expenses.

- Flexibility: Allows you to visit any doctor or hospital that accepts Medicare.

Medigap plans are standardized across the country, which means Plan G in Colorado offers the same coverage as Plan G in another state. However, premiums can vary based on factors like age and location.

Medicare Part D

Medicare Part D is all about prescription drug coverage. This plan is essential if you require regular medication, as it helps reduce the cost of prescription drugs.

- Key Features of Part D:

- Wide Range of Plans: Choose from various plans based on your medication needs.

- Coverage for Most Drugs: Includes a comprehensive list of covered medications.

Before selecting a Part D plan, check the formulary (list of covered drugs) to ensure your medications are included, and understand any coverage rules that apply.

Navigating these options can be complex, but with the right guidance, you can find a plan that fits your health and financial needs. At Kelmeg & Associates, we are committed to helping you make informed decisions about your Medicare coverage.

Medicare Plans Colorado: Key Options

When exploring Medicare plans in Colorado, you'll come across several key options designed to meet diverse health needs. Let's break down the main types: Medicare Advantage Plans, Special Needs Plans, and Part D.

Medicare Advantage Plans

Medicare Advantage Plans, or Part C, are a popular alternative to Original Medicare. Offered by private insurers, these plans bundle Part A (hospital insurance) and Part B (medical insurance) into a single plan. They often include additional benefits like dental, vision, and wellness programs.

- Why Consider Medicare Advantage?

- Cost Savings: Typically more affordable compared to Original Medicare paired with Medigap.

- Extra Benefits: Offers coverage beyond what Original Medicare provides, like routine dental and vision care.

However, it's important to note that these plans usually require you to use a network of doctors and hospitals. Ensure your preferred providers are part of the plan's network before enrolling.

Special Needs Plans (SNPs)

Special Needs Plans are a specific type of Medicare Advantage Plan designed for individuals with particular health conditions or circumstances.

- Who is Eligible?

- Chronic Conditions: Custom for those with specific chronic illnesses.

- Institutional Care: Available for individuals living in nursing homes or requiring similar care.

- Dual Eligibility: For those eligible for both Medicare and Medicaid.

These plans offer specialized care and coverage custom to the unique needs of their members. They often include a network of specialists and providers experienced in treating specific conditions.

Medicare Part D

Medicare Part D focuses on prescription drug coverage. This is an essential component for those who regularly take medications, as it helps manage the costs associated with prescriptions.

- Benefits of Part D:

- Comprehensive Drug Coverage: Covers a wide range of prescription medications.

- Plan Variety: Multiple plans available, allowing you to select one that best matches your medication needs.

When choosing a Part D plan, review the formulary to ensure that your prescriptions are covered and understand any rules or restrictions that might apply.

Navigating these options can seem daunting, but with the right support, you can find a plan that aligns with your health needs and budget. At Kelmeg & Associates, we are here to guide you through the process, ensuring you make informed decisions about your Medicare coverage.

Enrollment Periods and Eligibility

Understanding when and how to enroll in Medicare plans in Colorado is crucial for securing the coverage you need. Let's explore the key enrollment periods and eligibility criteria.

Open Enrollment Period

The Annual Open Enrollment Period is your main opportunity to make changes to your Medicare coverage. It runs from October 15 to December 7 each year.

- Actions You Can Take:

- Switch from Original Medicare to a Medicare Advantage Plan or vice versa.

- Change your Medicare Advantage Plan or Part D plan.

- Enroll in a Part D plan if you haven't already.

Any changes you make during this period will take effect on January 1 of the following year.

Medicare Advantage Open Enrollment

If you're already enrolled in a Medicare Advantage Plan, you have another chance to make changes between January 1 and March 31.

- Options During This Period:

- Switch to another Medicare Advantage Plan.

- Return to Original Medicare and join a Part D plan.

This period is specifically for those who are already in a Medicare Advantage Plan as of January 1.

Special Enrollment Periods (SEPs)

Certain life events may qualify you for a Special Enrollment Period, allowing you to change your Medicare coverage outside of the standard enrollment periods.

- Qualifying Events:

- Moving out of your plan's service area.

- Losing employer-based health coverage.

- Qualifying for Extra Help or Medicaid.

Each SEP is unique, with specific rules and timeframes depending on the event. It's important to understand the details to make timely changes.

Eligibility Criteria

To enroll in Medicare, you generally need to meet the following criteria:

- Age: 65 or older.

- Disability: Under 65 and receiving Social Security Disability Insurance (SSDI) for 24 months.

- Health Condition: Diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Understanding these enrollment periods and eligibility criteria ensures you make the most out of your Medicare options. At Kelmeg & Associates, we're here to help you steer these timelines and choose the best plan for your needs.

Costs and Coverage Details

When it comes to Medicare plans in Colorado, understanding costs and coverage details is key. Let's break down the main components: premiums, deductibles, and copays.

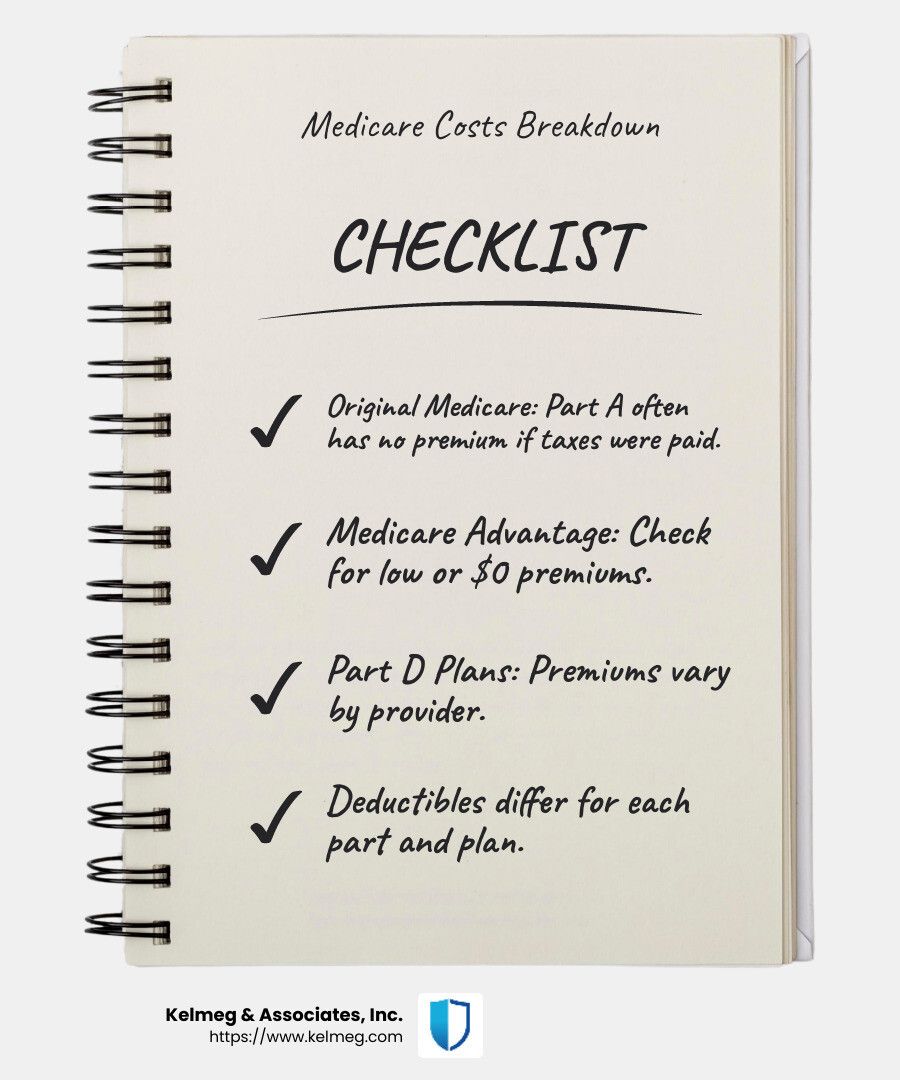

Premiums

Premiums are the monthly fees you pay to have Medicare coverage. The amount can vary based on the type of plan you choose and your specific circumstances:

- Original Medicare (Part A and B): Most people don't pay a premium for Part A if they or their spouse paid Medicare taxes while working. Part B usually has a standard premium, which can be higher for those with higher income.

- Medicare Advantage (Part C): These plans often have low or even $0 premiums, but it's important to check for additional costs.

- Medicare Part D: Premiums for prescription drug plans vary by plan and provider.

Deductibles

Deductibles are the amounts you pay out-of-pocket before your Medicare plan starts to pay. Here's what to expect:

- Part A: Covers hospital stays and has a deductible you pay for each benefit period.

- Part B: Has an annual deductible before coverage kicks in.

- Medicare Advantage and Part D: Deductibles vary widely depending on the plan. Some plans offer $0 deductibles for certain services.

Copays and Coinsurance

Copays are fixed amounts you pay for specific services, while coinsurance is a percentage of the costs you cover after meeting your deductible. Here’s how they typically work:

- Original Medicare: After meeting the deductible, you generally pay 20% of the Medicare-approved amount for most doctor services.

- Medicare Advantage: Copays and coinsurance vary, often offering lower out-of-pocket costs for in-network services. Some plans provide $0 copays for primary care visits.

- Part D: Expect copays or coinsurance for medications, which can vary based on whether the drug is generic or brand-name.

Key Considerations

- Plan Variability: Costs can differ based on the county you live in and the specific plan you choose. Always compare plans carefully.

- Out-of-Pocket Maximums: Medicare Advantage plans have a yearly cap on out-of-pocket costs, providing financial protection once you reach that limit.

Navigating the costs and coverage options can be complex, but understanding these basics will help you make informed decisions. At Kelmeg & Associates, we're here to guide you through the process and find a plan that fits your needs and budget.

Frequently Asked Questions about Medicare Plans in Colorado

What are the 6 things Medicare doesn't cover?

Medicare provides essential health coverage, but there are some key services it does not cover. Here are six things to keep in mind:

- Long-term care: Coverage for extended stays in nursing homes or assisted living facilities is not included.

- Routine eye exams: While eye health is important, routine exams and glasses are not covered.

- Dental care: Basic dental care, including cleanings and fillings, is not part of Medicare.

- Hearing aids: Devices to assist with hearing are not covered.

- Cosmetic surgery: Procedures for purely aesthetic reasons are not included.

- Overseas care: Most medical care received outside the U.S. is not covered.

For those who need these services, additional insurance like Medigap or separate policies might be necessary.

Why are people leaving Medicare Advantage plans?

Medicare Advantage plans can offer extra benefits and lower premiums, but some people choose to leave these plans due to

- Limited network: These plans often require you to use specific doctors and hospitals, which can be restrictive.

- Copays and deductibles: Although premiums might be lower, out-of-pocket costs like copays and deductibles can add up.

- Coverage changes: Plans can change annually, altering coverage for medications or providers, which might not meet everyone's needs.

It's important to weigh these factors and consider personal healthcare priorities when choosing a plan.

How much does Medicare Plan G cost in Colorado?

Medicare Plan G is a popular Medigap option, known for offering comprehensive coverage. The cost of Plan G can vary based on several factors:

- Premiums: Monthly premiums for Plan G in Colorado can range widely, typically from $100 to $200, depending on the provider and your location.

- Age factors: Premiums may increase as you age, and some plans offer discounts for couples or non-smokers.

With Plan G, you pay the Part B deductible, but after that, most other costs are covered. This makes it a great option for those who want predictable expenses.

Understanding the nuances of Medicare plans in Colorado can be challenging, but having the right information helps you make informed choices. At Kelmeg & Associates, we're committed to helping you find the best plan for your needs.

Conclusion

Navigating Medicare plans in Colorado can feel overwhelming, but you don't have to go it alone. At Kelmeg & Associates, we specialize in providing expert guidance to ensure you find a plan that fits your unique needs and budget. Our team understands the complexities of Medicare, from the basics of Medicare Advantage and Medigap to the specifics of Part D coverage.

We pride ourselves on offering personalized plans that cater to your individual health and financial requirements. Whether you're looking for comprehensive coverage or a plan that complements your existing healthcare needs, we're here to help. Our services come at no extra cost to you, and our goal is to make the process as smooth and stress-free as possible.

If you're ready to explore your options, visit our Medicare services page to learn more about how we can assist you. With locations throughout Colorado, including Lafayette, Broomfield, and Boulder, we're conveniently situated to provide local support and expertise.

Let us help you secure peace of mind with the right Medicare plan. Contact us today to start your journey towards better health coverage.