From Rockies to Beaches—Can Your Colorado Life Insurance License Travel?

Is Your Colorado Life Insurance License Portable?

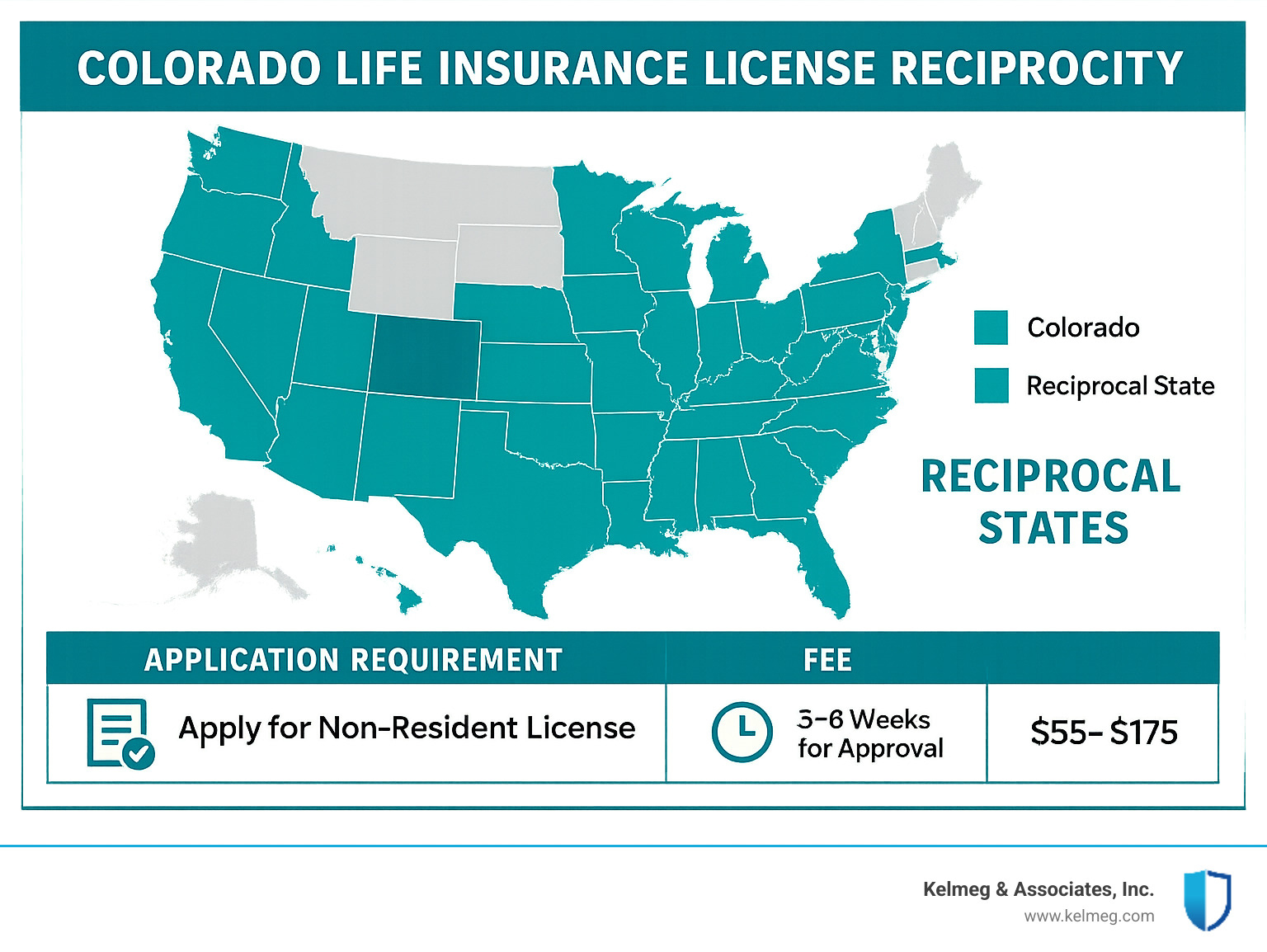

Is a Colorado life insurance license good in other states? Yes, but with some important qualifications:

| Colorado License Portability | Details |

|---|---|

| ✅ Reciprocity Available | Your Colorado license can be used to obtain non-resident licenses in most states without retaking exams |

| ❌ Not Automatic | You must apply for separate non-resident licenses in each state |

| 💰 Additional Costs | Fees range from $55-$175 per state |

| ⏱️ Processing Time | Typically 3-8 weeks for approval |

| 🚫 Non-Reciprocal States | California, New York, and Hawaii do not offer reciprocity |

If you're a life insurance agent with a Colorado license looking to expand beyond state lines, you're asking a smart question. Your Colorado credentials can be your passport to a nationwide practice—but not automatically. The process involves understanding reciprocity agreements, non-resident licensing procedures, and state-specific requirements.

Most states honor Colorado's life insurance license through reciprocity, meaning you won't need to retake licensing exams or complete additional pre-licensing education. However, you'll still need to apply for a separate non-resident license in each state where you plan to sell insurance products.

The concept of license portability stems from efforts by the National Association of Insurance Commissioners (NAIC) to streamline the multi-state licensing process. While the system isn't perfect, it's much improved from decades past.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I've guided numerous agents through the process of leveraging their Colorado life insurance licenses in other states.

Life Insurance Licensing 101: Your Colorado Credential at a Glance

Let's understand what your Colorado life insurance license actually is before exploring taking it across state lines. Think of your Colorado license as your home base—your insurance passport of sorts.

The Colorado Division of Insurance (DOI), within the Department of Regulatory Agencies (DORA), oversees all insurance licensing in our state. When you earn your Colorado credentials, you're obtaining a "resident producer" license with a life insurance "line of authority."

This license is your official permission to sell life insurance products to Colorado residents—from term life policies to whole life coverage, universal life insurance, and annuities. For variable life products or variable annuities, you'll need additional securities licensing through FINRA (typically Series 6 or 7).

Colorado makes the licensing process relatively straightforward compared to some other states:

- Complete 40 hours of pre-licensing education plus an additional 10 hours covering specific topics

- Pass the state licensing exam (administered by Pearson VUE)

- Submit your application through Sircon or NIPR

- Pay the necessary fees ($47 for the exam, $47 for the application, plus a $5.60 NIPR transaction fee)

- Complete a background check

The Core of a Colorado Life License

Your journey begins with a 40-hour pre-licensing course that you can complete either online or in-person. This course covers everything from basic insurance concepts to policy types, ethics, and Colorado-specific insurance laws.

After completing your education, you'll face the Colorado life insurance exam through Pearson VUE. You'll tackle 80 scored questions in 120 minutes, and you need a 70% to pass. If your first attempt doesn't go as planned, you can retake it after just 24 hours.

Once you've passed the exam, you'll submit your application online through either Sircon or NIPR. The state fee is $47, and if all goes smoothly, you'll receive your digital license certificate within 3-5 business days.

What makes this credential particularly valuable is that it serves as your "home state" license—the foundation upon which you can build a multi-state insurance practice.

Want more details about becoming a life insurance agent in Colorado? Check out our comprehensive guide on the steps to becoming a life insurance agent in Colorado.

Is a Colorado Life Insurance License Good in Other States? (Short Answer)

Yes, your Colorado life insurance license can open doors across the country! Thanks to reciprocity, you can use your Colorado credential as the foundation for getting licensed in most other states without starting from scratch.

This interstate cooperation exists because of the National Association of Insurance Commissioners (NAIC), which has worked to create more standardized licensing requirements nationwide. Think of your Colorado license as your insurance passport—it proves you've already demonstrated the basic qualifications to sell insurance.

But let's be clear—reciprocity doesn't mean automatic approval. You'll still need to:

- Submit a separate non-resident license application for each state

- Pay that state's application fee (which varies widely)

- Meet any state-specific requirements

- Keep your Colorado resident license in good standing

The good news? Most states have reciprocal agreements with Colorado, so you won't face the hassle of retaking exams. However, a few states play by different rules—California, New York, and Hawaii in particular don't offer full reciprocity and may require extra steps.

Understanding "is a Colorado life insurance license good in other states" Question

When folks ask if their Colorado life insurance license is good in other states, they're wondering how portable their credential is. It's a smart question, since insurance regulation happens at the state level, not federally.

Your Colorado license gives you a solid home-field advantage. You've already jumped through the educational hoops and passed an exam, which most states will acknowledge through the NAIC's Producer Database (PDB).

The magic happens through what's called the "equivalency rule." If your Colorado life insurance authority matches or exceeds what you're applying for in another state, you'll typically qualify for reciprocity.

Common Myths About "is a Colorado life insurance license good in other states"

Let me clear up some confusion about using your Colorado license beyond state lines:

Myth 1: Your Colorado license automatically lets you sell everywhere. Reality: There's no such thing as automatic multi-state authority. You need a separate non-resident license for each state where you plan to do business.

Myth 2: You can start selling as soon as you apply in a new state. Reality: You must wait until your non-resident license is officially approved before conducting any insurance business there.

Myth 3: Multi-state licensing is a one-and-done process. Reality: Each state has different renewal cycles and continuing education requirements.

Myth 4: All Colorado-approved products can be sold everywhere you're licensed. Reality: Products must be separately approved in each state.

For more in-depth information about license reciprocity, check out this scientific research on license reciprocity.

How Reciprocity Really Works—and Where It Doesn't

Let's talk about what makes your Colorado life insurance license valuable beyond the Rocky Mountains. Reciprocity is like a professional courtesy between states—they agree to honor the hard work you've already done in Colorado instead of making you start from scratch.

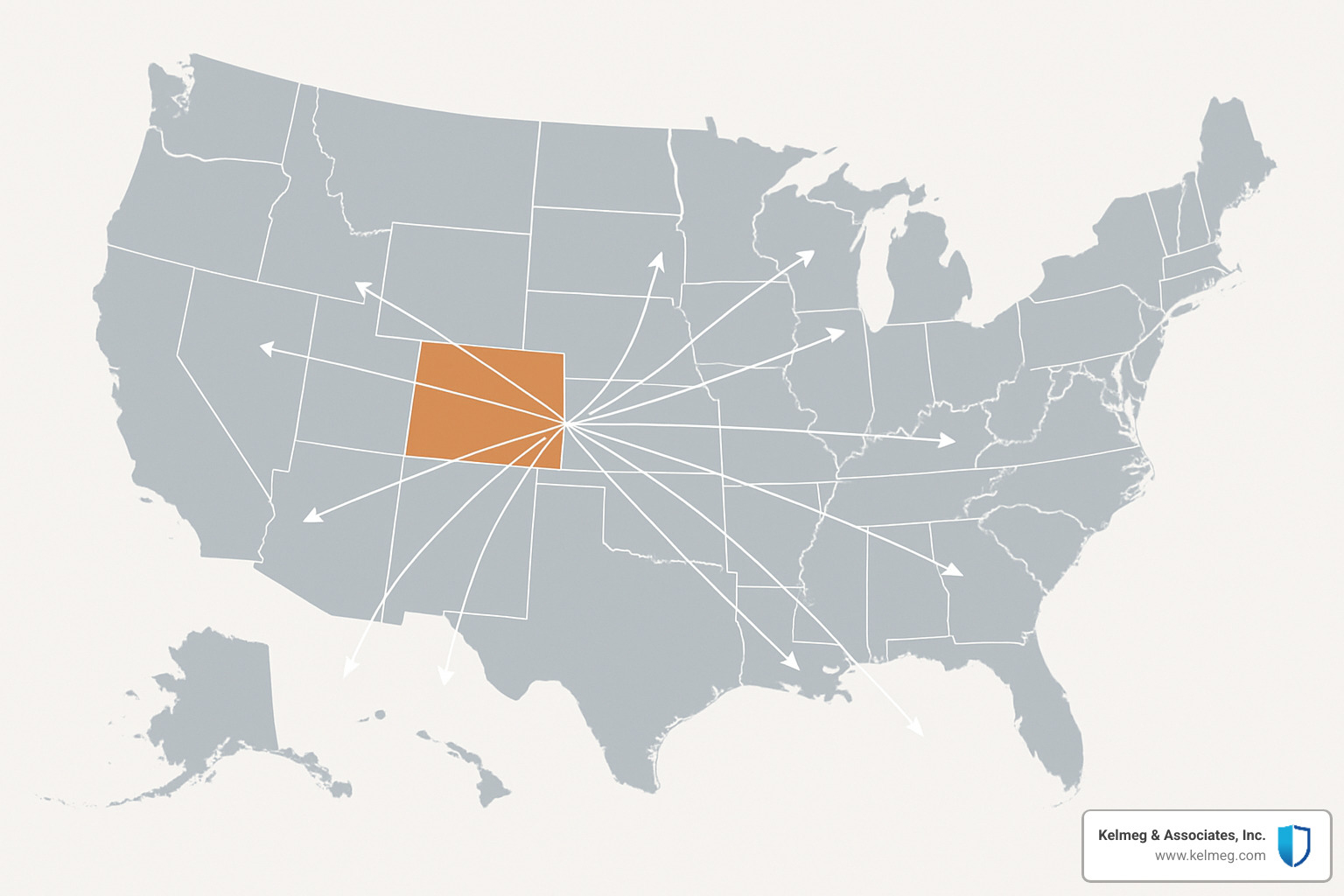

With your Colorado license in hand, you potentially have a pathway to doing business in up to 34 other states. Here's the landscape of reciprocal versus non-reciprocal states:

| Reciprocal States (Most) | Non-Reciprocal States |

|---|---|

| Accept Colorado license as qualification | May require additional exams |

| No additional pre-licensing education | May require state-specific courses |

| Application and fees still required | More extensive application process |

| Typically faster processing | Often longer processing times |

| Examples: Texas, Florida, Illinois | California, New York, Hawaii |

The "Big Three" holdouts that don't play as nicely with Colorado licenses are California, New York, and Hawaii. These states march to the beat of their own regulatory drums and often require extra hoops for you to jump through.

Non-Resident License Basics

When you're ready to expand beyond Colorado using your life license, here's what you need to know:

First, prepare your wallet. Application fees vary widely from state to state, typically ranging from $55 to $175 per state. If you're planning to go big with multiple states, those costs add up quickly!

Some states will want your fingerprints, even though Colorado already has them. Florida and California are particularly fond of their own fingerprinting processes. Many states will happily accept the CE credits you complete in Colorado. However, some states still require state-specific courses, especially for topics like ethics or fraud prevention.

Renewal periods vary from state to state, ranging from annual renewals to four-year cycles. Missing a renewal deadline can mean starting the application process all over again.

Your non-resident licenses can only match what you hold in Colorado. If you only have a life insurance license in Colorado, that's all you can apply for elsewhere.

Thankfully, the process has gotten much easier in recent years. Platforms like the National Insurance Producer Registry (NIPR) and Sircon now allow electronic submissions to multiple states.

States That Say "Maybe Later"

While most states welcome you through reciprocity, some make you work harder for the privilege of selling insurance to their residents:

California requires all non-resident applicants to complete a 12-hour course specifically on California ethics and insurance law. You might also face a state-specific exam.

New York insists on its own examination for non-residents, even if you've already proven your knowledge in Colorado. Their application process is also more detailed and time-consuming than most states.

Hawaii can be rather strict with insurance licensing. They may require additional educational components and have a more thorough application process.

Beyond these three challenging states, you might encounter product-specific limitations elsewhere. For instance, if you sell variable life products or annuities, you'll need to ensure your FINRA registrations are properly recognized in each state.

Step-by-Step: Using Your Colorado License to Go Multi-State

Ready to take your Colorado life insurance license on the road? Let's walk through how to actually make this happen—no fancy jargon, just practical steps that'll get you licensed across state lines with minimal headaches.

Fast-Track Application via NIPR or Sircon

The days of paperwork nightmares are (mostly) behind us, thanks to two online platforms that make multi-state licensing surprisingly manageable:

When using the NIPR licensing portal , you'll create an account, select the non-resident application option, and enter your Colorado license information. The beauty of this system is that you can select multiple states at once, answer standardized questions, and pay all fees in one transaction. The platform then tracks your applications so you're not left wondering what happened to them.

Sircon (Vertafore) works similarly—create your account, steer to the non-resident section, enter your Colorado credentials, select your target states, and you're off to the races.

A friendly tip about payments: If you're applying to five states at once, that could mean $500+ in fees hitting your credit card in one day. Some agents prefer to stagger their applications across a few weeks to spread out the expense.

Checklist Before You Hit "Submit"

Take five minutes to verify these details before submitting:

First, confirm your Colorado resident license is active and in good standing—this is the foundation everything else builds upon. Double-check that your name, address, and personal details match exactly across all applications.

Have your National Producer Number (NPN) handy—this unique identifier follows you everywhere in the insurance world. If you sell variable products, make sure your FINRA CRD# is included in your application.

Some states require proof of Errors & Omissions (E&O) insurance with your application, so have your policy details ready. And use a business email address you check regularly. State insurance departments love to communicate important information via email.

After Approval: Staying Compliant Everywhere

Congratulations! Your non-resident licenses are approved. Now comes the real challenge—staying compliant across multiple jurisdictions:

Renewal tracking becomes essential as you juggle different state schedules. While Colorado renews every two years, other states might be annual or even every four years. I recommend creating a dedicated licensing calendar with reminders 60 days before each deadline.

Continuing education requirements vary widely. The good news is that many states accept CE completed in Colorado (which requires 24 hours every two years, including ethics).

Keep digital records of everything—licenses, applications, CE certificates—in an organized system. And if you move, update your address across all states promptly (most require notification within 30 days).

Don't forget about product-specific training requirements that exist in addition to your license. For example, if you sell annuities or long-term care insurance, most states require specialized training.

For more insights on the financial upside, check out our article on life insurance agent salary in Colorado.

Pitfalls, Costs & Timeframes to Watch

Let's talk about the real-world considerations of expanding your insurance business beyond Colorado. Both your wallet and your calendar need to be prepared!

Initial application fees typically run between $55 and $175 per state—and that's just the beginning. Some states will ask for fingerprinting (another $50-$75) and separate background check fees ($25-$50). And don't forget, these costs come back around when renewal time hits!

The timeframe question is equally important. While some states might approve your application in just a week, others (California, New York, and Hawaii) can take up to two months. The standard processing window of 1-8 weeks depends heavily on the state and your application's complexity.

Here's what typically slows things down: fingerprinting bottlenecks often add 2-4 weeks to your timeline. Background check processing can be surprisingly slow in certain states. Even something as simple as name discrepancies can trigger manual reviews that delay everything.

I cannot stress this enough: you absolutely cannot sell insurance in a state until your non-resident license is officially approved. I've seen agents get excited about new opportunities and jump the gun, only to face penalties that affected their Colorado license too.

Pro Tips to Avoid Compliance Headaches

After years of guiding agents through multi-state licensing at Kelmeg & Associates, I've developed some practical strategies to keep things running smoothly.

First, create a master renewal calendar with alerts set 90 days before any license expires. This gives you plenty of time to complete continuing education requirements without rushing. Speaking of CE, look for providers whose courses satisfy requirements in multiple states—this can save you dozens of hours annually if you're licensed in several states.

If you're maintaining licenses in more than five states, consider investing in a dedicated license management application. Yes, it's an expense, but missing a single renewal deadline can cost you far more in lost business and reinstatement fees.

Be extremely cautious about cross-border client relationships. That client who moved from Denver to Phoenix? You need an Arizona license before discussing their coverage changes, even if you've worked with them for years in Colorado.

Before applying everywhere, honestly evaluate the cost-benefit ratio. Does getting licensed in Maine make sense if you have just one client there? Perhaps focus first on neighboring states like Wyoming, Nebraska, and Utah where you're more likely to have regular business.

Finally, guard your Colorado resident license like gold. Is a Colorado life insurance license good in other states? Only as long as it remains in good standing! If your home license lapses, your carefully built multi-state empire can come crashing down as non-resident licenses automatically suspend.

Frequently Asked Questions about Multi-State Use of a Colorado Life License

Do I ever need to retake an exam outside Colorado?

For most states, your Colorado license opens doors without the headache of additional exams. This is the beauty of reciprocity agreements – they recognize the work you've already done.

However, there are a few situations where you might need to dust off those study materials:

The "Big Three" exceptions – California, New York, and Hawaii – often require additional examination components.

If you're branching out into new territory like property and casualty insurance that isn't covered by your Colorado license, you'll need to meet the new state's requirements for that specific line.

Some specialized products like long-term care insurance or certain annuities require product-specific training with examination components, regardless of reciprocity.

Before making plans, always check the specific state's Department of Insurance website or the NIPR portal for the most up-to-date requirements.

Can I sell policies online to clients in a state where I'm not licensed?

This is a definite no – and it's one of the most common misconceptions I see in our increasingly digital world. The rule is simple but strict: is a Colorado life insurance license good in other states without obtaining non-resident licenses? Not when it comes to selling across state lines.

The client's location – not yours – determines which license you need. This applies whether you're sitting across a kitchen table from them or connecting through a Zoom call from 1,000 miles away.

This includes all aspects of the insurance relationship:

- Any online marketing or sales targeted at residents of specific states

- Phone calls discussing policy options with out-of-state prospects

- Emails about specific policies to clients in other states

- Servicing existing policies for clients who've moved to states where you're not licensed

The penalties can be severe – from hefty fines to suspension of your existing licenses.

How long does it take to add 5 new states through NIPR?

Adding multiple states through NIPR is a bit like planting a garden – you do the work all at once, but things sprout at different times. The application process itself is streamlined – you can knock out applications for five states in one sitting, often in less than an hour.

But after hitting "submit," patience becomes your best friend. Approval timelines vary dramatically:

The speedsters (Texas, Illinois, Georgia) might welcome you to their club in just 1-2 weeks. Most states take a comfortable middle road of 2-4 weeks. Then there are the methodical reviewers (California, New York, Florida) that might take 4-8 weeks or longer to process your application.

To keep things moving as quickly as possible:

- Ensure your Colorado license is squeaky clean and active

- Complete any state-specific requirements before applying

- Triple-check all your application information

- Submit fingerprints early for states that require them

Conclusion

So, is a Colorado life insurance license good in other states? Absolutely—it's your ticket to a multi-state practice, though you'll need to steer each state's unique requirements and stay on top of ongoing compliance.

Your Colorado life insurance license provides a solid foundation for growing your practice beyond the Rocky Mountains. Thanks to reciprocity agreements, you can use your Colorado credential as a springboard to obtain non-resident licenses across most of the country without retaking exams or completing additional pre-licensing education.

Remember though, this process isn't automatic—think of it more like using your Colorado license as a master key that opens doors, but you still need to turn each handle individually. You'll need to apply for each non-resident license separately, budget for the various fees, and meet any state-specific requirements. Some states—particularly California, New York, and Hawaii—have more demanding requirements that might include extra education or examination components.

The investment in multi-state licensing, while requiring some upfront time and money, can dramatically expand your market reach and boost your income potential. With thoughtful planning and careful attention to compliance details, your Colorado credential can serve as the foundation for a thriving nationwide practice.

Here at Kelmeg & Associates, Inc., we've helped countless insurance professionals steer the sometimes confusing world of cross-state licensing. We're dedicated to supporting insurance agents throughout Lafayette, Broomfield, Boulder, Adams County, and all across Colorado as they expand their practices in responsible and compliant ways.

Whether you're just taking your first steps in your insurance career or looking to grow an already successful practice, understanding license reciprocity is a crucial piece of your professional puzzle. For more information about life insurance solutions and career opportunities, our life insurance resources page is packed with helpful information.

The journey from the Rockies to beaches and plains across America begins with your Colorado license—and continues with your commitment to professional growth and compliance requirements. With the right approach, your Colorado license truly can be your passport to a nationwide insurance practice.