Detailed Guide to Comparing Medicare Plans in Colorado

Why Choosing the Right Medicare Plan in Colorado Matters

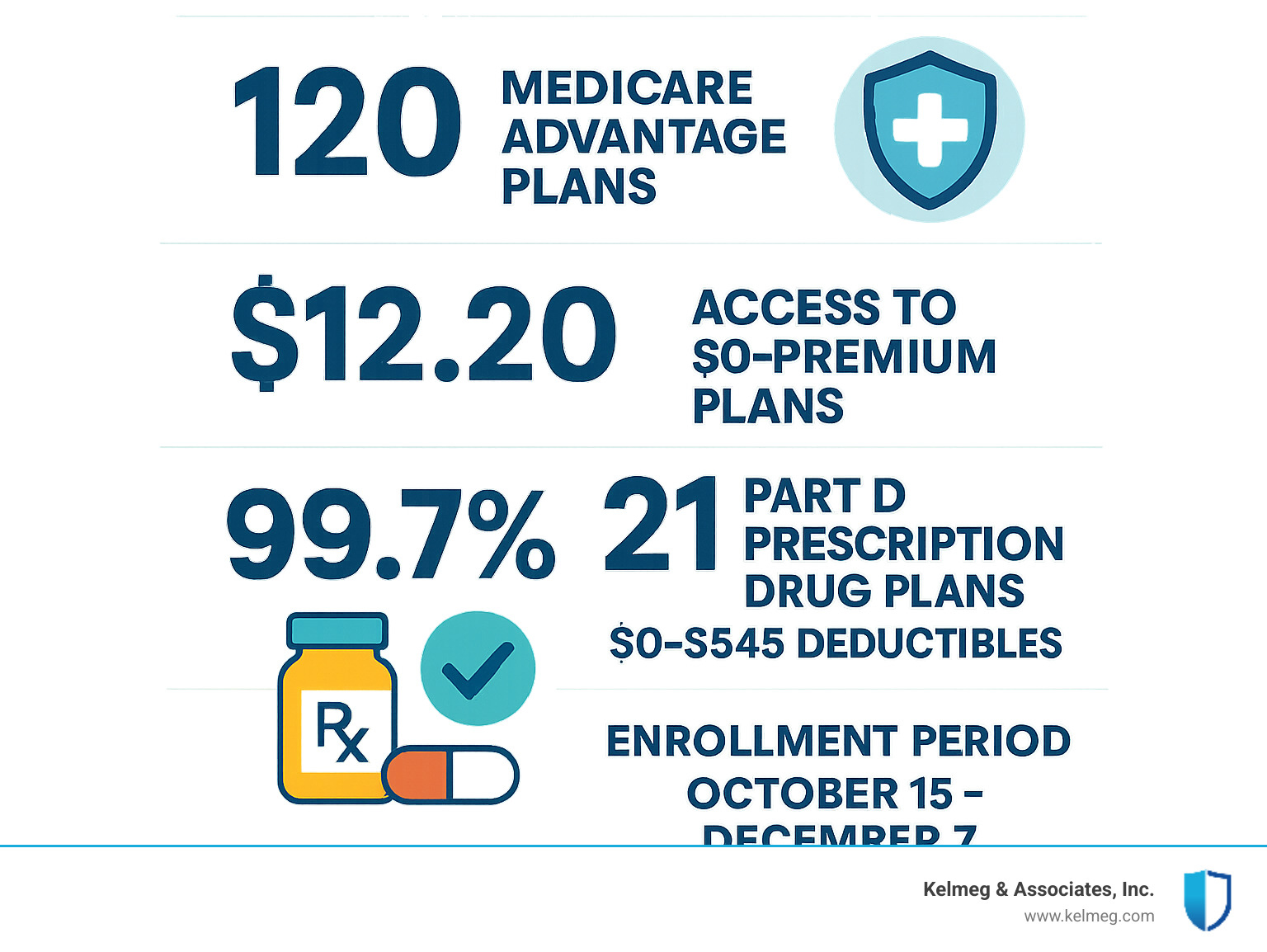

Medicare plans Colorado offers over 1 million residents present a complex landscape of choices that can significantly impact your healthcare costs and coverage. With 120 Medicare Advantage plans available in 2025 and an average monthly premium of just $12.20, Colorado stands out for its affordable options - with 99.7% of eligible residents having access to at least one $0-premium Medicare Advantage plan.

Quick comparison of Medicare plan options in Colorado:

- Original Medicare (Parts A & B): Hospital and medical coverage with 20% coinsurance, no out-of-pocket maximum

- Medicare Advantage: All-in-one plans averaging $12.20/month, includes prescription drugs, $8,850 max out-of-pocket

- Medigap Supplements: Works with Original Medicare, covers gaps like deductibles and coinsurance

- Part D Prescription Plans: 21 standalone options, premiums from $0-$132, deductibles $0-$545

The stakes are high when choosing your Medicare coverage. Original Medicare has no out-of-pocket maximum, meaning unlimited potential costs for major medical events. Meanwhile, Medicare Advantage plans cap your annual spending while often including extras like dental, vision, and even grocery allowances.

Colorado's unique advantages include:

- Nearly 1 in 6 residents are Medicare-eligible

- Strong rural telehealth and transportation benefits

- Free SHIP counseling at 888-696-7213

- At least one 5-star rated Medicare Advantage plan for 2025

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I help individuals and families steer Medicare plans Colorado offers through personalized guidance and comprehensive coverage solutions.

Why This Guide Matters

Comparing costs and coverage gaps between Medicare options can save you hundreds or even thousands of dollars annually. This guide provides you with a decision framework to evaluate your options systematically, considering not just premiums but total annual costs, network access, and extra benefits that matter to your lifestyle.

Understanding Medicare & Eligibility in Colorado

Medicare serves as the healthcare lifeline for over 1 million Coloradans, providing essential coverage when you need it most. Most people become eligible for Medicare when they turn 65, with enrollment opening three months before your birthday.

Younger adults can also qualify for Medicare if they've been receiving Social Security disability benefits for 24 months or have End-Stage Renal Disease (ESRD) requiring dialysis or a kidney transplant.

The standard Part B premium sits at $174.70 per month for 2024, which covers your doctor visits and outpatient care. You'll also encounter a Part A deductible of $1,632 per benefit period for hospital stays, plus a Part B deductible of $240 annually.

Getting enrolled is easier than you might think. You can apply online at ssa.gov, call Social Security directly, or visit a local office. The key is timing - waiting too long can cost you. Part B penalties add up to 10% for each 12-month period you delay enrollment without having creditable coverage elsewhere.

Colorado's geography creates interesting dynamics between rural and urban Medicare experiences. If you're living in Denver, Boulder, or Colorado Springs, you'll typically find more plan choices and larger provider networks. Mountain communities and rural areas might have fewer options, but many Medicare Advantage plans now offer creative solutions like telehealth visits, transportation benefits, and even mobile clinics.

Here's something wonderful about Medicare: preventive benefits are covered at no cost to you. Your annual wellness visit, mammograms, colonoscopies, and flu shots won't cost you a penny - whether you stick with Original Medicare or choose a Medicare Advantage plan.

Overview of Medicare Plans Colorado Offers

Navigating Medicare plans Colorado offers can feel overwhelming at first, but think of it like choosing the right tool for the job. Each Medicare option serves a different purpose, and understanding how they work together helps you build the perfect coverage solution.

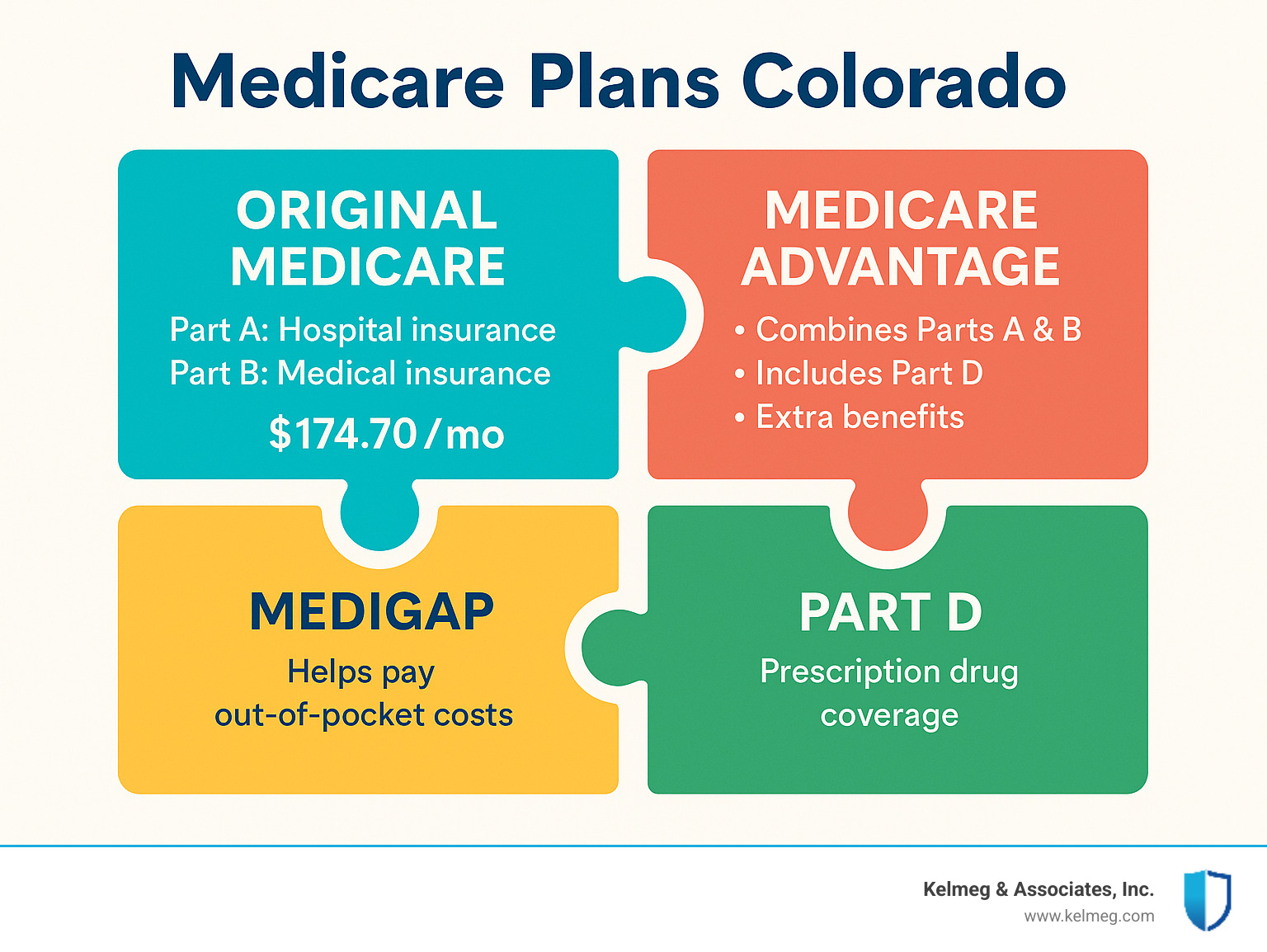

Original Medicare forms the foundation with Part A handling hospital stays and Part B covering doctor visits. While most people don't pay a premium for Part A, you'll pay the standard $174.70 monthly for Part B. The catch? Original Medicare leaves you responsible for 20% coinsurance with no cap on annual spending.

Medicare Advantage plans bundle everything into one convenient package. These plans must cover everything Original Medicare does, but they often add extras like prescription drugs, dental cleanings, and even gym memberships. With 120 plans available in Colorado for 2025 and an average premium of just $12.20, these plans offer remarkable value while capping your annual out-of-pocket costs at $8,850 or less.

Medigap supplements work like a safety net underneath Original Medicare, filling in the gaps where you'd otherwise pay out-of-pocket. These standardized plans help cover deductibles, coinsurance, and copayments.

Part D prescription drug coverage can either be purchased separately to work with Original Medicare, or it comes built into most Medicare Advantage plans. With 21 standalone options in Colorado, you'll find plans with deductibles ranging from $0 to $545.

Medicare Advantage plans Colorado

Medicare Advantage has become incredibly popular in Colorado. These all-in-one plans simplify your healthcare by combining hospital, medical, and usually prescription drug coverage under one roof - often with extras that make daily life easier.

What makes Colorado's Medicare Advantage market special is the affordability and quality combination. With 99.7% of residents having access to at least one $0-premium plan, you're not sacrificing your budget for good coverage.

Star ratings tell the real story about plan quality. Medicare grades plans on a 1-5 star scale based on customer service, care coordination, and health outcomes. Colorado offers at least one 5-star plan for 2025, which comes with a special perk - you can switch to a 5-star plan anytime during the year.

Many Colorado Medicare Advantage plans go beyond basic healthcare coverage. You might find benefits like transportation to medical appointments, grocery allowances, utility bill assistance, or comprehensive dental and vision coverage.

Prescription Drug (Part D) choices

Your prescription medications can make or break your healthcare budget. Colorado offers 21 standalone prescription drug plans, each with different costs and coverage.

Plan costs vary dramatically- from $0 monthly premiums to $132, with deductibles ranging from nothing to $545. But the cheapest premium doesn't always mean the lowest total cost. Your specific medications determine which plan saves you the most money overall.

Every Part D plan maintains a formulary- essentially a menu of covered drugs organized into cost tiers. Generic drugs sit in Tier 1 with the lowest copays, while specialty medications land in Tier 4 with the highest costs.

More info about Pharmacy Tools can help you compare exactly what your medications will cost across different plans.

Medigap supplement options

Medigap plans offer something Medicare Advantage can't: the freedom to see any doctor who accepts Medicare, anywhere in the country, with predictable out-of-pocket costs.

Plan G has become the gold standard for new Medicare beneficiaries. It covers almost everything Original Medicare doesn't - including the Part A deductible, Part B coinsurance, and even emergency care during foreign travel.

Plan N offers a budget-friendly alternative with slightly higher out-of-pocket costs but lower monthly premiums. You'll pay small copays for office visits (up to $20) and emergency room visits (up to $50).

Timing is everything with Medigap. You get a six-month open enrollment period starting when you turn 65 and enroll in Part B. During this window, insurance companies can't deny you coverage or charge higher premiums based on your health.

More info about Medicare Supplement Plans Colorado provides detailed comparisons to help you understand which Medigap option aligns with your healthcare priorities and budget.

Comparing Costs, Coverage & Quality

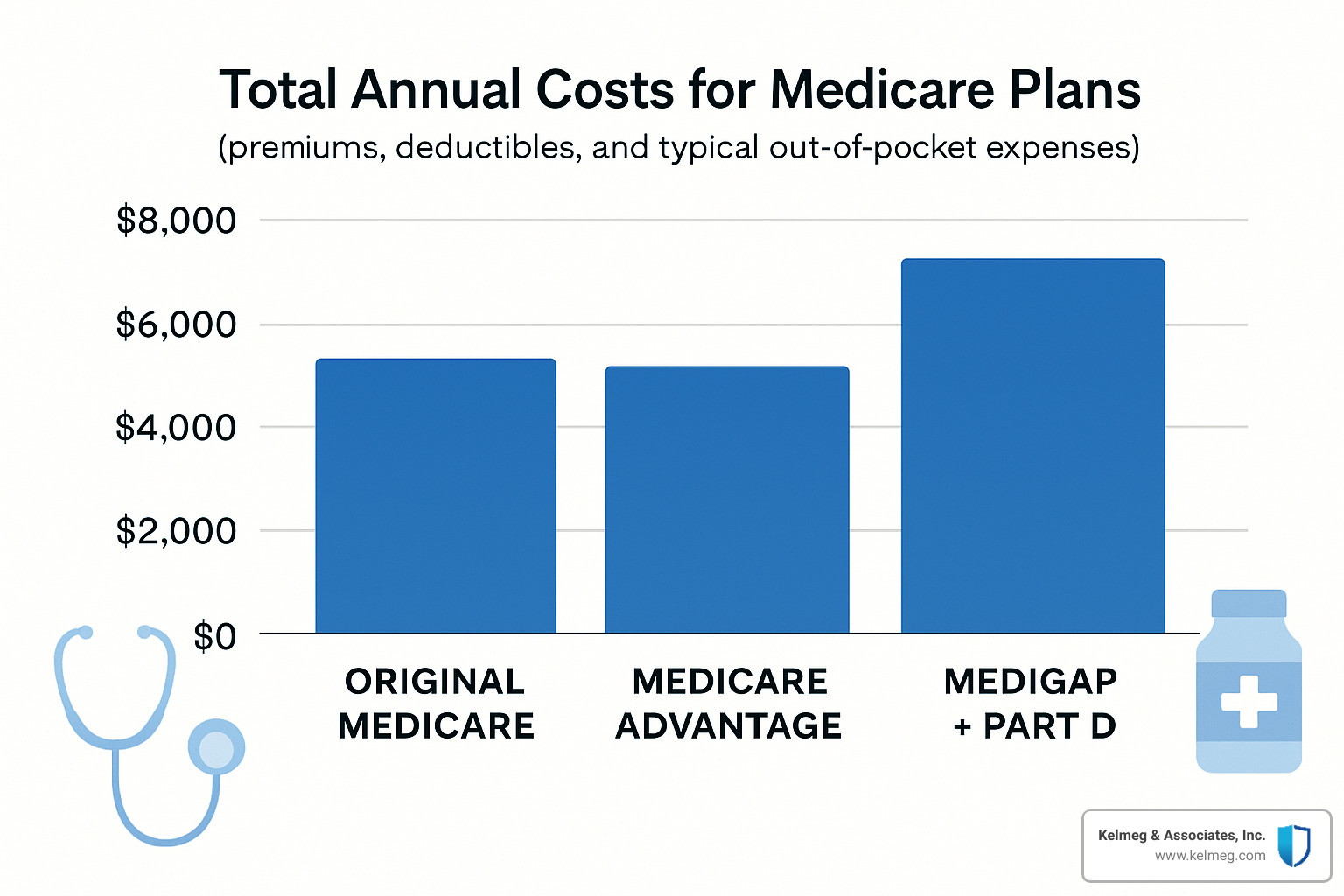

When it comes to Medicare plans Colorado offers, the sticker price rarely tells the whole story. Original Medicare charges you the standard Part B premium of $174.70 monthly, plus a hefty $1,632 Part A deductible and $240 Part B deductible. There's no out-of-pocket maximum, meaning your costs could theoretically be unlimited.

Medicare Advantage plans tell a different story. With an average premium of just $12.20 in Colorado, these plans cap your annual spending at $8,850 maximum. Plus, 99.7% of Colorado residents have access to at least one $0-premium Medicare Advantage plan.

Medigap supplements paired with Part D prescription coverage typically run $200-400+ monthly total, but they work with any Medicare provider nationwide and offer predictable costs.

| Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Max | Network Requirements |

|---|---|---|---|---|

| Original Medicare | $174.70 (Part B) | $1,632 (Part A), $240 (Part B) | None | Any Medicare provider |

| Medicare Advantage | $12.20 average | Varies by plan | $8,850 maximum | Network required |

| Medigap + Part D | $200-400+ total | Varies | Varies | Any Medicare provider |

Medicare Advantage really shines with the extras. Many plans include dental coverage up to $3,000 annually, vision allowances of $300 for glasses, hearing aids and exams, fitness programs like SilverSneakers, and even grocery allowances of $600 or more.

Quality indicators matter just as much as costs. Look for plans with 4-5 star ratings- these indicate superior quality and customer service. Colorado has at least one 5-star Medicare Advantage plan available in 2025.

More info about Best Medicare Advantage Plans Colorado provides current ratings and benefit comparisons for top-performing plans in our state.

How to verify doctors & hospitals

Start with the plan's online provider directory, but don't stop there. These directories can be months out of date.

Call your doctor's office directly and ask specifically about the plan you're considering. Don't just ask if they take "Medicare Advantage" - mention the exact plan name and insurance company.

Use Medicare Physician Compare at medicare.gov to verify your provider's credentials and see quality ratings.

When you call your doctor's office, ask these specific questions: Do you accept this exact plan? Are you accepting new patients with this coverage? What are the typical copays for office visits?

Weighing rural vs urban considerations

Colorado's geography creates unique healthcare challenges depending on where you call home.

Rural residents often worry about provider access, but modern Medicare Advantage plans have adapted with telehealth services, transportation benefits, and mobile clinic programs that bring services directly to remote communities.

Urban residents typically enjoy larger provider networks with more specialists and major medical centers. Cities like Boulder, Fort Collins, and Colorado Springs offer more plan choices due to competition among insurance companies.

Pharmacy access varies significantly between rural and urban areas. Rural residents might rely more heavily on mail-order pharmacy services, which most Part D plans include at no extra cost.

Enrollment Windows & How to Sign Up for Medicare Plans Colorado

Timing is everything when it comes to Medicare plans Colorado enrollment. Miss your window, and you could face penalties that last for years.

Your Initial Enrollment Period (IEP) gives you a generous 7-month window that starts three months before you turn 65. This includes your birthday month and continues for three months after.

The Annual Enrollment Period (AEP) runs from October 15 through December 7 each year, and it's your main chance to make changes. Whatever you choose during this period takes effect January 1st.

The Medicare Advantage Open Enrollment Period (MA-OEP) runs from January 1 through March 31. If you're already in a Medicare Advantage plan and having second thoughts, this gives you another opportunity to switch.

Colorado residents have a special advantage with the 5-Star Special Enrollment Period. Since our state has at least one 5-star Medicare Advantage plan for 2025, you can switch to that plan any time during the year.

Special Enrollment Periods kick in when you move to a new area, lose employer coverage, lose Medicaid eligibility, enter or leave a nursing home, or qualify for a Special Needs Plan due to a chronic condition.

The enrollment process itself is straightforward. Start by gathering your information - make a list of your current doctors, preferred hospitals, and all prescription medications with dosages. Then compare plans using Medicare's Plan Finder at Medicare.gov or work with a licensed broker.

Before you commit to any plan, verify that your doctors and hospitals are in the network. Provider directories can be outdated, so call your doctor's office directly to confirm they accept your chosen plan.

You can apply online at MyMedicare.gov, call 1-800-MEDICARE, or go directly through the insurance company.

More info about Medicare Insurance Providers for Colorado offers detailed enrollment assistance and plan comparisons.

Avoiding penalties & coordinating employer coverage

Medicare penalties stick around forever. The Part B penalty is 10% of your monthly premium for each 12-month period you delay enrollment without creditable coverage. The Part D penalty works differently but is equally persistent.

Creditable coverage is your shield against these penalties. This includes employer or union health plans, TRICARE, Veterans Affairs coverage, and individual health insurance plans that meet Medicare's standards.

COBRA is generally not considered creditable coverage for Medicare purposes. If you're eligible for Medicare, enroll in Medicare rather than continuing COBRA.

If you're still working and have employer coverage, coordinate carefully. Notify your benefits administrator before enrolling in Medicare, and understand how Medicare will work with your employer plan.

Switching & disenrollment rules

Switching between Medicare Advantage plans can happen during the Annual Enrollment Period (October 15 - December 7) or the Medicare Advantage Open Enrollment Period (January 1 - March 31).

Moving from Medicare Advantage back to Original Medicare is possible during both enrollment periods. When you make this switch, you can also add a Part D prescription drug plan.

Medigap guaranteed-issue rights are your safety net in certain situations. You can buy a Medigap policy without answering health questions when you lose employer coverage, when your Medicare Advantage plan leaves Medicare, or when you move out of your plan's service area.

Assistance & Resources for Coloradans

Navigating Medicare plans Colorado offers doesn't have to feel overwhelming. The state provides wonderful free resources designed specifically to help residents make informed decisions about their healthcare coverage.

Colorado's State Health Insurance Assistance Program (SHIP) serves as your personal Medicare guide through trained volunteer counselors at 17 locations across our state. Simply call 888-696-7213 and you'll connect with someone who genuinely wants to help you understand your options.

If prescription drug costs keep you awake at night, Extra Help might be the solution. This federal program assists people with limited income pay their Medicare prescription drug costs. For 2023, you may qualify if your monthly income is under $1,660 as an individual or $2,339 as a couple.

Medicare Savings Programs represent another lifeline for Colorado residents struggling with healthcare costs. The state offers three programs that help pay Medicare premiums, deductibles, and coinsurance.

BenefitsCheckUp.org works like a treasure hunt for savings - this free online tool helps uncover federal, state, and local programs that can help pay for prescription drugs, healthcare, utilities, and other essential services.

Colorado's Senior Medicare Patrol program protects residents from Medicare fraud, errors, and abuse. Call 800-503-5190 if something seems fishy with your Medicare statements.

More info about Medicare Resource Center Colorado Springs provides specialized assistance for residents in the Pikes Peak region.

Special Needs Plans (SNPs) in Colorado

Special Needs Plans deserve special attention because they're designed for people facing specific health challenges or circumstances.

Dual Special Needs Plans serve people who qualify for both Medicare and Medicaid. These plans eliminate the frustrating paperwork shuffle between two different programs by coordinating benefits seamlessly.

Chronic Condition Special Needs Plans focus on people managing serious ongoing health conditions like chronic kidney disease, diabetes, heart failure, or chronic lung disorders.

Institutional Special Needs Plans help people living in nursing homes or those requiring nursing home-level care while living in the community.

The beauty of SNPs lies in their integrated approach- they often include transportation to appointments, meal delivery when you're recovering, home modifications for safety, and care management that makes sense for your situation.

Getting personalized guidance

While this guide covers the essentials, your Medicare journey is as unique as you are. Licensed insurance brokers provide personalized guidance completely free of charge - insurance companies pay our commissions, so these services never cost you anything extra.

Working with a licensed broker means getting unbiased comparisons of all available plans without the sales pressure. We help you understand complex benefit structures in plain English, assist with enrollment and plan changes, and provide ongoing support when you have questions.

At Kelmeg & Associates, Inc., we've made it our mission to help Colorado residents steer their Medicare options with confidence. Our deep understanding of the local market means we know which plans work best whether you're enjoying retirement in Boulder, managing healthcare needs in Denver, or living in one of Colorado's charming rural communities.

Frequently Asked Questions about Medicare plans Colorado

When you're exploring Medicare plans Colorado offers, certain questions come up again and again. These are the real concerns I hear from clients every day at Kelmeg & Associates.

What if my doctor is not in any Medicare Advantage network?

This situation is more common than you might think. Don't panic - you have several good options to maintain quality care.

Start by having a conversation with your doctor's office. Sometimes providers aren't in networks simply because no one has asked them to join. If you and other patients express interest in a particular Medicare Advantage plan, your doctor might be willing to contract with that insurance company.

Consider a PPO-style Medicare Advantage plan if one's available in your area. These plans typically allow you to see out-of-network providers, though you'll pay higher copays and coinsurance.

Original Medicare with a Medigap supplement gives you the ultimate flexibility. Your doctor accepts Medicare? You're covered. This combination works anywhere in the country and doesn't require referrals or network restrictions.

Finding a new doctor within available networks might sound daunting, but Medicare's Physician Compare tool can help you find quality providers.

Are $0-premium Medicare Advantage plans really free?

Here's where I need to be completely honest with you - $0-premium doesn't mean zero cost.

You'll still pay the standard Medicare Part B premium of $174.70 monthly- that's not going away regardless of which plan you choose. Think of Medicare Advantage as an add-on to your basic Medicare coverage.

What the $0 premium means is that the insurance company isn't charging you anything extra beyond what you already pay to Medicare. But you'll still have costs when you actually use healthcare services - copays for doctor visits, prescription drug costs, and potentially deductibles.

The real value in these plans comes from the annual out-of-pocket maximum- something Original Medicare completely lacks. Even if you have a major health event, you'll never pay more than $8,850 in a year. Plus, most include prescription drug coverage and extras like dental and vision.

How do star ratings influence my plan choice?

Medicare's star rating system is like reading reviews before buying something online. Plans are rated from 1 to 5 stars based on dozens of factors, from customer service to how well they coordinate your care.

Higher-rated plans typically mean better experiences for you as a member. Four and five-star plans usually have faster customer service, better care coordination between your doctors, and more satisfied members.

Five-star plans come with a special bonus- you can enroll in them any time during the year, not just during the annual enrollment period. Colorado has at least one 5-star plan available for 2025.

But don't let star ratings be your only deciding factor. A 4-star plan that covers everything you need is infinitely better than a 5-star plan that doesn't.

Use star ratings as one piece of your decision puzzle. If you're comparing two plans that both cover your doctors and medications at similar costs, the one with higher star ratings is probably the better choice.

Conclusion

Navigating Medicare plans Colorado offers can feel complicated, but you don’t have to go it alone. With 120 Medicare Advantage plans, 21 Part D choices, and several Medigap options, there is a combination that fits both your health needs and budget.

Average Medicare Advantage premiums are just $12.20, and nearly every Coloradan can choose at least one $0-premium plan. Still, premiums are only part of the story—verify that your doctors are in-network, check prescription costs, and weigh extras like dental or vision benefits.

Quality matters too. Plans with 4–5 star ratings generally deliver better customer service and care coordination, and Colorado’s 5-star plans let you switch at any time of the year.

Timing is critical. Review your coverage during the Annual Enrollment Period (Oct 15–Dec 7) or, if you already have Medicare Advantage, during the Jan 1–Mar 31 open-enrollment window.

Kelmeg & Associates, Inc. provides no-cost, expert guidance from licensed brokers who understand Colorado’s market. Schedule your free Medicare consultation today and move forward with confidence.