When ACA Met COVID: A Health Care Love Story?

How the ACA Became Our Healthcare Safety Net During COVID

The Affordable Care Act Covid response has strengthened healthcare access for millions of Americans during the pandemic. Here's what you need to know:

- Coverage Guarantee: All ACA Marketplace plans cover COVID-19 diagnosis and treatment

- Free Vaccines: Updated 2024-2025 COVID-19 vaccines are covered at no cost

- Expanded Eligibility: The American Rescue Plan removed the subsidy cliff, capping premiums at 8.5% of income

- Medicaid Protection: Nearly 10 million people enrolled in Medicaid/CHIP between February 2020 and January 2021

- No Termination: ACA plans cannot drop coverage due to COVID-19 diagnosis

When the COVID-19 pandemic swept across America in early 2020, our healthcare system faced its greatest test in modern history. As hospitals filled and millions lost their jobs, the Affordable Care Act Covid safety net caught countless Americans who might otherwise have fallen through the cracks.

The pandemic highlighted both the strengths and vulnerabilities of our healthcare system. For many Americans, the intersection of the Affordable Care Act Covid response became a critical lifeline during unprecedented uncertainty. Improved subsidies, special enrollment periods, and mandated coverage for testing and vaccines transformed a decade-old law into the backbone of our pandemic health response.

"It's not an exaggeration to say that the Affordable Care Act saved my life," shared one Long COVID patient whose continuing care depends on the ACA's protections for pre-existing conditions.

The numbers tell a compelling story: more than 31 million Americans were enrolled in coverage directly related to the ACA as of 2021. This includes 11.3 million in marketplace plans and 14.8 million in expanded Medicaid programs. When Americans needed healthcare most, the infrastructure created by the ACA provided critical support.

My name is Kelsey Mackley, and as an insurance specialist at Kelmeg & Associates, I've guided countless clients through the complex landscape of Affordable Care Act Covid provisions, helping them secure affordable coverage during these challenging times. My expertise in tailoring health insurance solutions has been especially crucial as families and businesses steer the pandemic's ongoing impacts on healthcare access and affordability.

For more comprehensive information about the ACA's role during the pandemic, the Kaiser Family Foundation offers an excellent timeline of key events and policy changes, which you can explore here.

Before the Storm: ACA's Foundations in U.S. Healthcare

Remember life before COVID-19? Back when we worried about different things? To understand how the Affordable Care Act Covid response became our pandemic lifeline, let's step back to 2010 when the ACA first took shape. This wasn't just a minor policy tweak – it fundamentally changed how Americans access healthcare.

The ACA created a solid foundation with several key pillars. Medicaid expansion invited states to cover more low-income adults, finally offering coverage to folks who'd been falling through the cracks for decades. The creation of Health Insurance Marketplaces with income-based subsidies made private insurance actually affordable for families who'd been priced out before.

Perhaps most importantly, the protection for pre-existing conditions meant insurers could no longer deny coverage or charge sky-high premiums based on your health history. Little did we know how crucial this would become for those later diagnosed with Long COVID.

The preventive care mandate was another game-changer, requiring insurers to cover essential preventive services at no cost – from vaccines to cancer screenings. And young adults gained the security of dependent coverage until age 26, giving them breathing room during those uncertain early career years.

How Kids Benefited Pre-COVID

Children were among the biggest winners from these reforms. The Children's Health Insurance Program (CHIP) worked alongside Medicaid to cover more kids than ever before. The numbers tell the story – childhood uninsured rates dropped to a historic low of just 3.6 million in 2016.

Regular check-ups, immunizations, and developmental screenings became the norm rather than the exception. For many families, this meant peace of mind that their children could get care when they needed it, without financial ruin.

State of Colorado Snapshot

Here in Colorado, we accepted the ACA early and enthusiastically. Our state expanded Medicaid and established Connect for Health Colorado, our state-based Marketplace. The results speak for themselves – over 400,000 Coloradans gained coverage, many in rural and mountain communities where healthcare access had always been challenging.

At Kelmeg & Associates, we've guided countless neighbors from Lafayette to Broomfield to Boulder through these options, helping them steer Affordable Health Coverage Colorado programs. We've seen how these reforms made healthcare more accessible, especially in areas where hospitals and providers are few and far between.

These foundational elements of the ACA created a healthcare system that, while imperfect, was far more inclusive and accessible than what came before. And when COVID-19 arrived on our doorsteps, these structures would prove to be not just beneficial, but essential.

Affordable Care Act Covid: How the Law Became a Pandemic Lifeline

When COVID-19 swept across America, the foundation built by the Affordable Care Act Covid programs transformed from a safety net into a true lifeline. Like a well-designed emergency system that springs into action during a crisis, the ACA's structure proved remarkably adaptable when Americans needed it most.

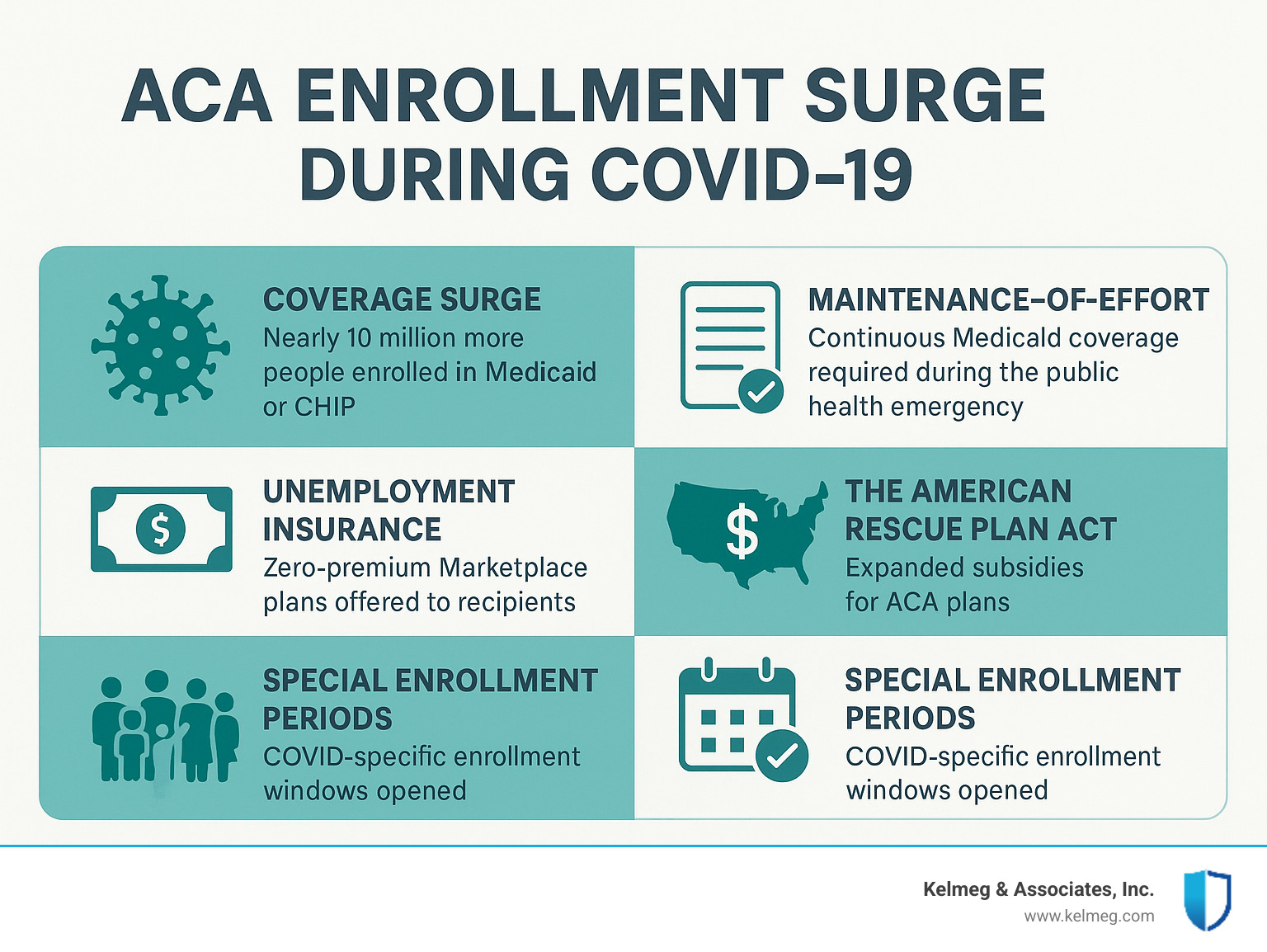

As businesses shuttered and layoffs mounted in those early pandemic months, millions lost their employer-sponsored health coverage at the worst possible moment. The Affordable Care Act Covid response stepped in, with Medicaid and ACA Marketplace plans absorbing the shock. Between February 2020 and January 2021, nearly 10 million additional Americans enrolled in Medicaid or CHIP, pushing total enrollment to an unprecedented 80.5 million people nationwide.

"We saw families who never imagined needing government assistance suddenly turning to the ACA," I tell clients at Kelmeg & Associates. "The pandemic reminded us all how quickly circumstances can change—and how vital health coverage truly is."

The Families First Coronavirus Response Act (FFCRA) created crucial stability through its maintenance-of-effort requirements. This provision prevented states from disenrolling Medicaid members during the public health emergency—ensuring that families wouldn't lose coverage in the middle of a global health crisis. For many of our Colorado clients, this continuity meant the difference between maintaining essential care and facing catastrophic medical bills.

The economic relief packages passed during the pandemic included special provisions for the unemployed. Those receiving unemployment benefits became eligible for heavily subsidized—often zero-premium—Marketplace plans. According to scientific research from the U.S. Department of Health and Human Services , these provisions helped millions maintain coverage during economic uncertainty.

Perhaps the most significant improvement came through the American Rescue Plan Act (ARPA) in 2021. This legislation boosted ACA subsidies by removing what policy experts called the "subsidy cliff." Instead of subsidies disappearing abruptly at 400% of the federal poverty level, premiums were capped at 8.5% of household income for everyone. For middle-class families who previously earned just a dollar too much to qualify for help, this meant savings of hundreds or even thousands of dollars annually.

Affordable Care Act Covid Effect on Medicaid & CHIP

The pandemic's impact on Medicaid and CHIP enrollment was nothing short of historic. As the Affordable Care Act Covid response expanded, these programs became the backbone of pandemic health security for vulnerable populations. The continuous eligibility requirement meant families didn't face the typical bureaucratic problems of periodic redeterminations—their coverage remained stable when they needed it most.

Children were among the biggest beneficiaries of these protections. With approximately half of all Medicaid and CHIP enrollees being kids, these programs essentially became the nation's largest pediatric health initiative during the crisis. For families facing job loss, school closures, and health concerns, knowing their children remained covered provided essential peace of mind.

Affordable Care Act Covid and Marketplace Plans

The Marketplace plans underwent a remarkable change during the pandemic. By eliminating the subsidy cliff, the Affordable Care Act Covid provisions made quality coverage attainable for millions of middle-class Americans who previously fell through the cracks. Many families saw their premium costs drop by 50% or more, making comprehensive coverage genuinely affordable.

Special enrollment periods became another crucial adaptation. Recognizing that people needed flexibility beyond the traditional open enrollment window, both federal and state marketplaces opened COVID-specific enrollment opportunities. Here in Colorado, our team at Kelmeg & Associates helped record numbers of clients take advantage of these special periods, guiding them through the ACA Open Enrollment process even outside normal timeframes.

For those who suddenly found themselves unemployed, the system offered remarkable relief. Many qualified for $0 premium silver-tier plans with robust coverage—a critical support during uncertain times. We've helped countless Coloradans steer these transitions, ensuring they maintained comprehensive coverage despite job changes, income fluctuations, and health challenges.

The Affordable Care Act Covid response demonstrated how public policy can adapt to meet unprecedented challenges. By building upon the ACA's existing framework and enhancing its most helpful provisions, policymakers created a healthcare safety net that bent but didn't break under the weight of a once-in-a-century pandemic.

Keeping the Virus at Bay: Vaccines, Testing & Treatment Under the ACA

When COVID-19 struck, the ACA became our healthcare shield, while pandemic relief bills served as our sword. Together, they ensured Americans could access critical services without financial barriers standing in the way. All Affordable Care Act Covid protections required Marketplace and Medicaid plans to cover testing, treatment, and—most importantly—those life-saving vaccines at no cost to patients.

The Vaccine Mandate: No Cost, No Excuses

The moment a COVID-19 vaccine received the CDC's Advisory Committee on Immunization Practices (ACIP) recommendation, the clock started ticking. Thanks to the CARES Act §3203 and the ACA's preventive care rules, insurance companies had just 15 business days to start covering it at zero cost to you—no waiting periods, no confusing fine print.

All Marketplace Plans must cover the updated 2024-2025 COVID-19 vaccines for everyone 6 months and older. The best part? This coverage applies whether you visit an in-network provider or (when necessary) an out-of-network provider—your wallet stays closed either way.

Behind the scenes, healthcare providers use specific billing codes to get reimbursed, with Medicare paying $28.39 for a single-dose administration. Even if you have a grandfathered plan or are underinsured, the federal HRSA program steps in to cover those costs.

How COVID-19 Vaccines Are Paid For

The financial machinery behind your free vaccine is fascinating. When you roll up your sleeve, your provider submits standard billing codes to your insurance—either as a medical or pharmacy benefit. Your vaccine information also gets entered into state or federal immunization systems, helping track coverage and remind you when it's time for boosters.

Medicare pays providers $28.39 for a single-dose vaccine, or $16.94 for a first dose and $28.39 for the final dose in multi-dose regimens. Private insurers must cover both the vaccine itself and its administration, starting within those crucial 15 days after ACIP recommendation. And for those falling through coverage cracks, the HRSA program ensures no one goes without protection due to cost.

What To Do If You're Charged

Sometimes wires get crossed, and you might receive a bill for what should be a free COVID-19 vaccine. Don't panic! First, check your Explanation of Benefits to confirm whether your provider was in-network (though even out-of-network charges may be covered if no in-network options exist nearby).

If you've been incorrectly charged, request a refund directly from the provider—most billing errors can be fixed with a simple phone call. Still hitting roadblocks? Contact your insurer for help resolving the dispute. And if you suspect something more serious, like fraud, don't hesitate to report it through the OIG hotline.

Need more guidance navigating these waters? At Kelmeg & Associates, we've helped countless Coloradans resolve billing issues. Check out our detailed guide at Covid Coverage Colorado.

Long-Term Care & Vulnerable Populations

The Affordable Care Act Covid response paid special attention to our most vulnerable neighbors—particularly those in long-term care facilities who suffered disproportionately during the pandemic. National pharmacy chains like CVS and Walgreens established on-site vaccination clinics, typically scheduling three visits per facility to ensure complete coverage: first doses, second doses, and later booster shots.

These programs created a safety net within a safety net, making sure that even those who couldn't travel to vaccination sites weren't left behind. The vaccination data was carefully shared between insurers and public health officials, creating a comprehensive protection system for those who needed it most.

Here in Colorado, I've seen how these programs brought peace of mind to families worried about loved ones in nursing homes and assisted living facilities. It's one of those moments when our healthcare system—for all its complexities—showed its heart.

Courtroom Drama & Political Crosswinds

The Affordable Care Act Covid story wouldn't be complete without acknowledging the legal battles it has weathered. Like any hero in a good drama, the ACA has faced its share of cliffhangers in courtrooms across America. Most recently, the Braidwood v. Becerra lawsuit sent shivers through the healthcare community by challenging one of the ACA's most popular features—the preventive services mandate that keeps COVID-19 vaccines and vital screenings free.

The case resulted in a federal district court blocking enforcement of some preventive services rated "A" or "B" by the U.S. Preventive Services Task Force that were added after March 23, 2010. Thankfully, there's good news for pandemic protection: coverage for vaccines recommended by the CDC's Advisory Committee on Immunization Practices (including COVID-19 vaccines) remains intact nationwide, as do children's and women's preventive services.

"These legal challenges create unnecessary anxiety for our clients," I often tell families at Kelmeg & Associates. "But we're keeping a close eye on developments to ensure you don't lose critical protections."

Many Coloradans don't realize that our state has enacted its own requirements for preventive service coverage, creating a valuable safety net even if federal protections weaken. And there's more good news: the improved subsidies that made coverage so much more affordable during the pandemic have been extended through 2025, giving families breathing room as they recover financially.

Future elections will undoubtedly bring new debates about healthcare policy. The best protection? Stay informed, vote, and consider supporting advocacy efforts that align with your healthcare priorities.

Protecting Pre-Existing Condition Safeguards

Long COVID has created a new reality for millions of Americans who now live with a significant pre-existing condition. The Affordable Care Act Covid protections against health discrimination have never been more vital.

"Before the ACA, I saw clients with chronic conditions facing impossible choices," I tell people at community workshops. "Some paid double or triple premiums. Others were flatly denied coverage. Many feared returning to the days of high-risk pools with sky-high costs and limited benefits."

The prospect of losing these safeguards keeps me up at night. At Kelmeg & Associates, we encourage our clients to share their healthcare stories with elected officials and support legislation that strengthens pre-existing condition protections. For more comprehensive information about these protections, visit our Affordable Care Act resource page.

Navigating Medicaid Unwinding

Perhaps the most immediate challenge facing many families is "Medicaid unwinding" – the process of reviewing eligibility for everyone who received Medicaid during the pandemic. With the public health emergency's end, over 25 million Americans have already lost Medicaid coverage, often due to procedural issues rather than actual ineligibility.

This process creates real anxiety for families. Just last week, I helped a Lafayette family of four who lost coverage despite still qualifying—they had simply moved and missed their renewal notice.

Here's what you need to know to protect yourself:

Watch your mail like a hawk. State Medicaid offices are sending crucial renewal paperwork that requires quick response.

Act fast if you lose coverage. If deemed ineligible for Medicaid, you qualify for a special enrollment period to sign up for an Affordable Care Act Covid-compliant Marketplace plan, often with generous subsidies that make coverage surprisingly affordable.

| Renewal Tips | New Enrollment Steps |

|---|---|

| Update contact info with Medicaid | Gather income and household info |

| Respond to all renewal notices | Shop for Marketplace plans |

| Ask for help if unsure | Check eligibility for improved subsidies |

| Keep records of your coverage dates | Use certified agents (like us!) |

At Kelmeg & Associates, we've guided hundreds of families through this transition with minimal disruption to their healthcare. We can help determine if you truly no longer qualify for Medicaid or if a simple paperwork correction might restore your benefits. For families needing to transition to Marketplace coverage, we ensure you understand all available subsidies and find a plan that works with your doctors and medications.

The Affordable Care Act Covid response has been a lifeline. Let's make sure it continues to protect families as we steer these uncharted waters together. For personalized guidance through the unwinding process, check out our resource on staying covered during COVID.

Frequently Asked Questions about the Affordable Care Act Covid Impact

Is COVID-19 considered a pre-existing condition under the ACA?

Absolutely. If you've had COVID-19 or are living with Long COVID, this counts as a pre-existing condition under the law. The good news? The Affordable Care Act Covid protections have your back. Insurers can't deny you coverage or charge you more because of your COVID history—period. This protection applies to all Marketplace plans and Medicaid, giving you peace of mind that your health history won't leave you uninsurable.

"We've helped dozens of clients with Long COVID symptoms find comprehensive coverage," says Kelsey at Kelmeg. "Without the ACA's pre-existing condition protections, many would face impossible healthcare costs."

Do all health plans still cover updated 2024-2025 COVID vaccines at $0?

Yes—with a few small exceptions. All ACA-compliant Marketplace plans and Medicaid must cover the updated COVID-19 vaccines with zero out-of-pocket cost for everyone 6 months and older. This isn't optional for insurers—it's federal law.

What about those exceptions? Some "grandfathered" plans (those that existed before the ACA and haven't substantially changed) or short-term plans might not offer this coverage. But don't worry—if you have one of these plans, the federal HRSA program steps in to help cover vaccine costs for the underinsured.

If you're mistakenly charged for your vaccine, don't just pay the bill. Check out our guide at Covid Coverage Colorado for step-by-step help getting that charge reversed.

How can I stay insured if I lose Medicaid during unwinding?

Losing Medicaid doesn't mean losing coverage altogether. When your Medicaid ends during the unwinding process, you automatically qualify for a special enrollment period on the Affordable Care Act Covid Marketplace. This gives you 60 days to find a new plan—often with substantial subsidies that make coverage surprisingly affordable.

Here in Colorado, we have an added safety net: year-round enrollment is available for residents with incomes up to 150% of the federal poverty line. This means many Coloradans don't need to worry about enrollment deadlines at all.

"The transition from Medicaid to a Marketplace plan can actually work out well for many families," I tell my clients. "Some find they prefer their new coverage because of broader provider networks or specific benefits that better match their needs."

At Kelmeg & Associates, we specialize in guiding you through this exact transition. We'll help compare your options, explain how subsidies work for your specific situation, and ensure you don't experience any gap in coverage—all at no extra cost to you. The Affordable Care Act Covid safety net works best when you have someone helping you steer it.

Conclusion

The journey through the Affordable Care Act Covid era has been remarkable – not just a policy shift, but a real-life demonstration of how healthcare safety nets can catch us when we need them most. From the rolling hills of Boulder to the communities of Adams County, we've witnessed how expanded coverage, no-cost vaccines, and improved subsidies have provided both life-saving care and invaluable peace of mind during unprecedented times.

But we're not at the end of this story yet. Like any good tale, there are more chapters to come. Court challenges continue to emerge. Policy debates rage on in Washington and state capitals. The unwinding of emergency protections means we all need to stay alert and engaged with our healthcare coverage.

At Kelmeg & Associates, Inc., we see ourselves as your trusted guides through this evolving landscape. Whether you're puzzling over renewal paperwork, fighting an unexpected vaccine bill, or simply trying to figure out which plan best fits your family's needs, we're right here beside you – neighbors helping neighbors.

The pandemic taught us all an important lesson: healthcare isn't just about doctor visits and prescriptions. It's about security, dignity, and knowing that a medical condition won't lead to financial ruin. The Affordable Care Act Covid response strengthened that safety net when we needed it most.

Now, as we move forward, the tools and protections built during this time remain vital. From maintaining coverage for pre-existing conditions (including Long COVID) to ensuring vaccines remain accessible, the infrastructure we've relied on needs our continued attention and support.

You're never alone on this journey. Our team of friendly experts across Lafayette, Broomfield, Boulder, and throughout Colorado stands ready to help you steer whatever comes next in your healthcare story.

Stay covered. Stay healthy. Stay informed.

For personalized guidance or more resources about maintaining your coverage through changing times, visit our COVID coverage page or reach out to our team today. We're just a phone call away, and there's never an extra cost for our expertise.

This article is for informational purposes only and should not be construed as legal or financial advice. For customized help, contact Kelmeg & Associates, Inc.