Medicare Matchmaking: How to Choose a Broker in Colorado

Finding the Right Medicare Guide in Colorado

When it comes to navigating the maze of Medicare options in Colorado, having a knowledgeable guide by your side can make all the difference. A colorado medicare insurance broker serves as that trusted guide, helping you find your way through complex choices without adding to your expenses.

Think of Medicare as a journey through unfamiliar territory. You could tackle it alone with maps and guidebooks, but wouldn't it be better to have a local expert showing you the way? That's exactly what a good broker does for you.

As a Colorado resident approaching Medicare eligibility or reconsidering your current coverage, you might be surprised to learn that broker services come at absolutely no cost to you. These professionals are compensated by insurance companies, not by clients like you. They offer the valuable service of comparing multiple plans across different carriers, bringing local expertise specific to Colorado's Medicare landscape, and providing ongoing support that extends well beyond your initial enrollment. Best of all, there's no obligation to purchase any plan they recommend.

"Medicare can feel complicated, but know that we're here to guide you," says Liz McPherson, who has worked as a Colorado broker since 2007. Unlike agents who represent just one company, independent brokers work with multiple carriers to find the perfect fit for your unique situation.

I'm Kelsey Mackley, and as an insurance specialist at Kelmeg & Associates, Inc., I've had the privilege of helping countless Colorado neighbors find Medicare coverage that truly works for their lives. My experience as a colorado medicare insurance broker has shown me that personalized guidance makes all the difference when navigating these important healthcare decisions.

Why the Right Broker Matters

Finding the right Medicare broker is a lot like choosing a trusted financial advisor or family doctor. This relationship often spans years, with your broker guiding you through annual plan changes, helping when your health needs shift, and ensuring you're always getting the most value from your healthcare dollar.

Trust forms the foundation of this relationship. A good colorado medicare insurance broker takes time to understand what matters most to you - your doctors, your medications, your budget, and your concerns - before making any recommendations. They explain complex options in plain language you can understand and never pressure you into making hasty decisions.

"I had the sense this was from someone who truly cared about getting me the best provider for my particular situation," shares Linn from Conifer, Colorado, describing her experience with a local broker. This kind of personalized attention makes all the difference.

Medicare isn't one-size-fits-all, and neither should be your approach to choosing coverage. Your broker should consider your preferred doctors, the prescriptions you take daily, any travel plans you have, and your existing health conditions to find plans that strike the right balance between coverage and cost.

The peace of mind that comes from having a knowledgeable advocate in your corner is invaluable - and remarkably, this expert guidance comes at no additional cost to you. As we'll explore further, brokers are compensated by insurance companies while maintaining their commitment to finding the best options for their clients.

What Does a Colorado Medicare Insurance Broker Do?

A colorado medicare insurance broker is your personal guide through the Medicare maze. Think of them as your translator, navigator, and advocate all rolled into one. These professionals have dedicated their careers to understanding Medicare's complex rules and the specific plans available across different Colorado regions - from Denver's urban landscape to the rural communities of the Western Slope.

To stay sharp, brokers complete rigorous annual training and certification requirements. This isn't just bureaucratic paperwork - it ensures they understand the latest Medicare regulations, plan changes, and enrollment rules affecting Colorado residents. When Medicare makes one of its frequent adjustments, your broker is already studying up so you don't have to.

One of the most valuable services your broker provides is comprehensive plan comparison. Rather than drowning in a sea of options alone, your broker can show you exactly how different plans stack up for your specific situation.

A knowledgeable colorado medicare insurance broker also brings invaluable local expertise to the table. They understand which doctors, hospitals, and specialists accept which plans in your specific area. This insight is particularly valuable in Colorado, where healthcare networks can vary dramatically between urban centers like Denver and Colorado Springs, and mountain communities like Durango or Steamboat Springs.

How a Colorado Medicare Insurance Broker Differs From an Agent

Though "broker" and "agent" are often used interchangeably in casual conversation, there's an important distinction that directly affects the service you receive.

A Medicare insurance agent typically represents just one insurance company. While they know their specific plans inside and out, they're limited to offering options from that single carrier - even if another company might have a better fit for your needs.

In contrast, a colorado medicare insurance broker works independently and can offer plans from multiple insurance companies. This independence is your advantage. Your broker can compare options across different carriers, looking at the full landscape to find your perfect match.

As we often tell clients at Kelmeg & Associates, "We don't work for an insurance company; we work for you." This fiduciary mindset - putting your interests first - is what sets quality brokers apart. While both agents and brokers must meet licensing requirements, independent brokers have the freedom to recommend whatever plan best suits your situation, regardless of which carrier offers it.

Costs and Compensation of a Colorado Medicare Insurance Broker

"So what's this going to cost me?" It's one of the most common questions we hear, and we love answering it because the response is so simple: Nothing. Zero. Working with a Colorado Medicare insurance broker costs you absolutely nothing.

Brokers are compensated through commissions paid by insurance companies, not by clients. This arrangement isn't a hidden deal - it's transparent and regulated by both the Centers for Medicare & Medicaid Services (CMS) and the Colorado Division of Insurance.

Here's the important part: your premiums remain exactly the same whether you enroll directly with an insurance company or through a broker. This is known as premium parity, and it's strictly enforced through regulatory oversight. Insurance rates in Colorado are filed with and regulated by the Colorado Division of Insurance, ensuring consistency regardless of how you enroll.

A Forbes Advisor study confirms what we've seen in practice - using a broker doesn't increase your costs. In fact, the opposite often occurs. Brokers frequently help clients save money by finding plans that better match their specific healthcare needs, usage patterns, and prescription requirements.

As one of our clients recently told us, "I thought getting help would cost extra, but I ended up saving nearly $600 a year because my broker found a plan that covered my medications better." That's the power of personalized guidance from someone who knows the system inside and out.

Key Services You Should Expect

When working with a colorado medicare insurance broker, you should expect comprehensive support that goes well beyond just signing you up for a plan. A good broker becomes your personal Medicare guide, offering expertise and assistance throughout your entire Medicare journey.

Side-by-Side Plan Comparisons

The heart of what a quality broker provides is thorough, personalized plan comparisons custom to your specific situation. Rather than simply handing you brochures, your broker should take time to understand your healthcare needs and preferences.

A dedicated colorado medicare insurance broker will verify which plans include your preferred doctors and hospitals in their networks. They'll examine your prescription medications list and compare how different Part D plans cover them - looking at tier placements, copays, and any restrictions that might affect your access or costs.

Sue from Frederick, Colorado experienced this firsthand: "Arla made my choice for a Medicare Supplement very easy. I had a few questions and she answered everything. If she didn't know, she researched until she found the right answers."

Good brokers don't just focus on monthly premiums. They help you understand the true cost of different plans by considering deductibles, copays, and out-of-pocket maximums based on your typical healthcare usage. They'll also identify which plans best cover the benefits most important to you, whether that's low specialist copays, nationwide coverage for travelers, or extra benefits like comprehensive dental and vision care.

Annual Medicare Check-Ups

Medicare isn't a one-and-done decision - it requires ongoing attention. Plans change every year, and so do your health needs. That's why a committed colorado medicare insurance broker provides regular "check-ups" for your coverage.

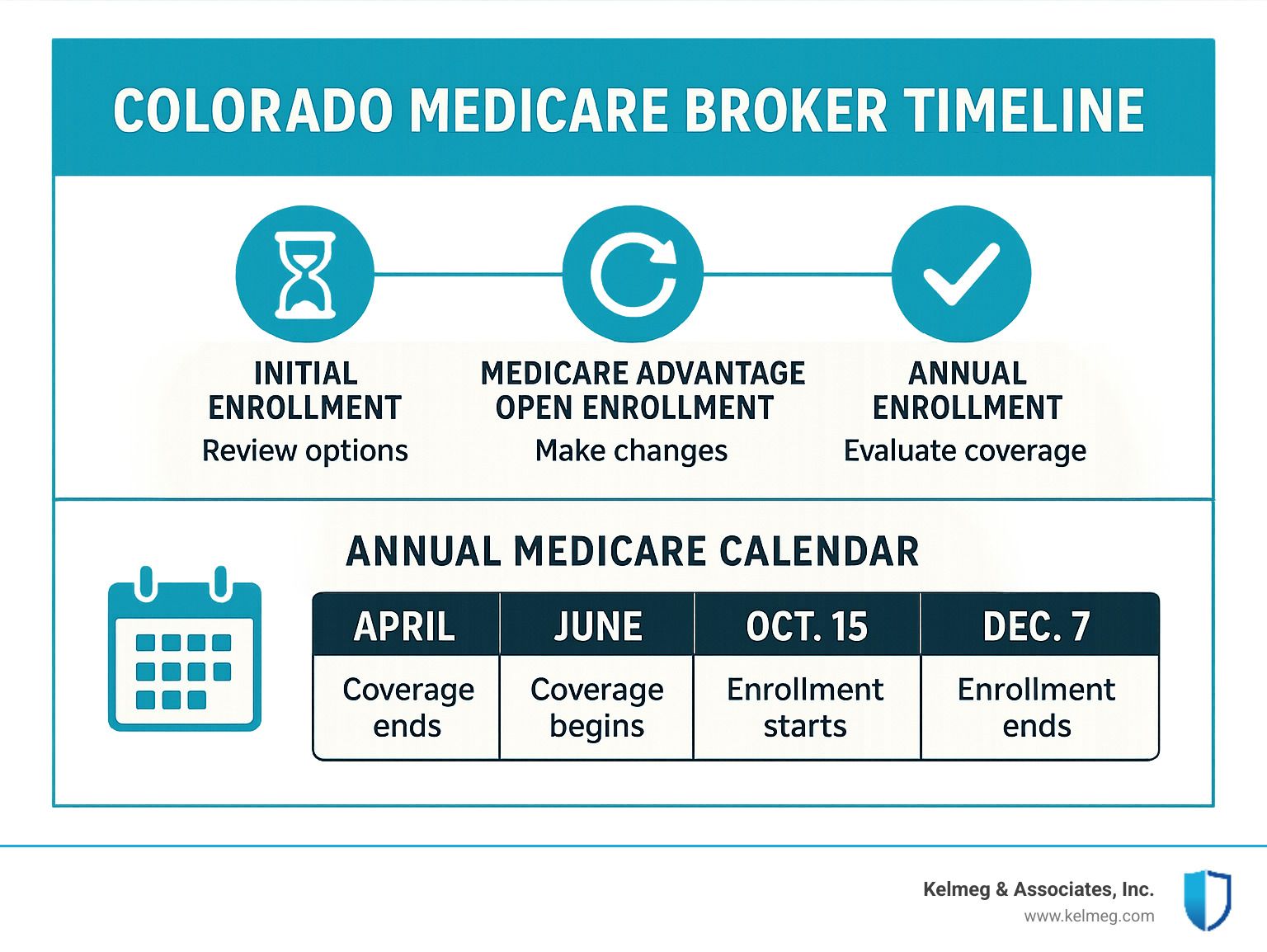

During Medicare's Annual Enrollment Period (October 15-December 7), your broker should proactively review your current plan to see if it still makes sense. They'll let you know about premium increases, benefit changes, and formulary updates that might affect your care or costs. They'll also inform you about Medicare's quality ratings for plans in your area and alert you if your doctors or hospitals are leaving your plan's network.

Many Colorado residents don't realize new plans enter the market each year. A good broker keeps an eye out for these newcomers that might better suit your needs or offer better value. At Kelmeg & Associates, Inc., we're committed to these annual reviews to ensure our clients are never caught by surprise when plan changes occur.

As one broker puts it: "I will review your prescription drug plan annually to make sure it is still the best for you." This ongoing relationship provides peace of mind and potentially significant cost savings over time. For more detailed information about these yearly reviews, you can visit our Medicare Resource Center.

Help With Special Situations

Medicare becomes especially complex in certain situations, and this is where a broker's expertise truly shines. If you qualify for both Medicare and Medicaid (known as "dual eligibility"), a knowledgeable broker can help you steer special plans designed for this situation.

Early retirees face unique challenges too. If you're retiring before 65, your broker can guide you through your coverage options until Medicare eligibility begins. Similarly, those under 65 who qualify for Medicare through disability need specialized assistance with their enrollment process and plan selection.

Recently moved to Colorado? A good colorado medicare insurance broker can help you transition your coverage to plans available in your new location. They can also advise on how to avoid or appeal late enrollment penalties and help coordinate Medicare with any existing employer coverage you might have.

These special situations can create confusion and stress without proper guidance. Having a trusted broker who understands the nuances of these complex scenarios can prevent costly mistakes and ensure you receive all the benefits you're entitled to - all at no additional cost to you.

Step-by-Step Guide to Choosing Your Broker

Finding the right colorado medicare insurance broker feels a bit like dating - you need someone who's qualified, trustworthy, and genuinely interested in your needs. The time you invest in finding this partner pays off with better coverage and peace of mind. Let me walk you through how to find your perfect match.

Vetting Your Shortlist

When I help friends find a broker, I always recommend starting with proper verification. Medicare is too important to trust to just anyone with a business card.

First, confirm they're properly licensed in Colorado through the Department of Regulatory Agencies database. This takes just a minute but tells you they've met the state's requirements.

Next, look for specialized training. Brokers with AHIP Medicare certification have proven their knowledge of Medicare rules and regulations. Also check that they're authorized by the Centers for Medicare & Medicaid Services (CMS) to sell Medicare plans - this isn't automatic!

Don't skip checking their reputation. The Better Business Bureau and online reviews can reveal a lot about how they treat clients. And experience matters - I recommend finding someone who's specialized in Medicare for at least 2-3 years.

As Ryan Kennelly, a Colorado broker, wisely notes: "Almost anyone can become an insurance broker. This is apparent by the hundreds of websites offering health insurance services." This underscores why proper vetting is so crucial.

Questions to Ask at the First Meeting

Your initial consultation is like a job interview - but you're the employer! This is your chance to see if they're truly the right fit for your needs.

I always encourage my clients to ask about which insurance companies the broker works with. A true independent broker should have relationships with all major carriers serving Colorado, not just a select few.

Ask them to explain their recommendation process. Good brokers have a systematic approach that considers your doctors, medications, budget, and health needs - not just whatever plan pays them the most.

The service model question is critical: "Will you be my ongoing point of contact, or will I be transferred to a call center after enrollment?" You want someone who'll be there for the long haul.

Response time matters too. Ask how quickly they typically get back to clients with questions or issues. Within 24 hours is a reasonable expectation for most matters.

Pay close attention to how they communicate during this meeting. Are they rushing through explanations? Speaking over your head with jargon? Or are they taking time to listen and explain things clearly? A quality broker will spend more time listening than talking during your first meeting.

Red Flags to Avoid

In my years at Kelmeg & Associates, I've heard too many stories about brokers who didn't serve clients well. Here are the warning signs to watch for:

High-pressure sales tactics should never be part of Medicare enrollment. Good brokers understand this is an important decision that shouldn't be rushed. If they're pushing you to "sign today," that's a red flag.

Be wary of scare tactics about penalties. Yes, Medicare penalties exist, but ethical brokers explain them factually without trying to frighten you into decisions.

If they claim to be independent but only discuss one or two carriers, that's suspicious. True colorado medicare insurance brokers present multiple options from different companies.

Good brokers are transparent about how they're paid and never request unnecessary personal information like your Social Security number before you've decided to work with them.

And if they're reluctant to provide references from satisfied clients? That speaks volumes.

I love how one Colorado broker promises clients: "I will never use scare tactics relating to Medicare penalties." This ethical stance is exactly what you should expect from anyone you trust with your healthcare decisions.

The right broker becomes a trusted advisor for years to come. Taking time to find someone who genuinely puts your needs first is worth every minute spent in the search.

Working With Your Broker Over Time

The day you enroll in Medicare isn't the end of your journey with your colorado medicare insurance broker - it's just the beginning. A quality broker becomes a trusted healthcare partner who supports you through life's changes and Medicare's annual updates.

"I view my clients as part of my extended family," says Kelsey from Kelmeg & Associates. "When they call with questions years after enrollment, I'm genuinely happy to hear from them and help however I can."

Tools & Resources Your Broker Should Provide

A dedicated colorado medicare insurance broker equips you with practical resources to steer your Medicare coverage confidently. Rather than leaving you to figure things out alone, they should offer tools like user-friendly prescription drug calculators that estimate your annual medication costs under different plans.

Your broker should also help you confirm which doctors participate in specific plans before you enroll. This provider search assistance prevents the unpleasant surprise of finding your favorite doctor isn't covered.

When issues arise with coverage or claims, your broker should offer Medicare rights and appeals guidance. They'll explain the process in plain language and help you understand your options.

Many clients appreciate educational materials that clarify Medicare's complex terminology. A good broker translates "Medicare-speak" into everyday language through helpful guides, videos, or in-person explanations.

At Kelmeg & Associates, Inc., we believe informed clients make better decisions, which is why we regularly host Medicare seminars and send seasonal newsletters highlighting relevant changes and opportunities for Colorado residents.

Staying Informed on Colorado Medicare Changes

Medicare isn't static - it evolves yearly, especially at the local level. Your colorado medicare insurance broker should keep you informed about changes that affect your coverage in Colorado specifically.

When the Colorado legislature passes laws affecting Medicare beneficiaries, your broker should explain how these changes impact you. Similarly, when insurance carriers enter or exit the Colorado market, your broker should evaluate whether these movements create better options for your situation.

Premium trends in Colorado can differ from national averages. A local broker tracks these patterns and helps you understand if your rate increases are typical or if you should consider alternatives.

Local healthcare systems sometimes change their contracts with insurance companies. Your broker monitors these network changes and alerts you if your hospital or doctor group might be leaving your plan's network.

Life changes sometimes qualify you for Special Enrollment Periods, allowing mid-year plan changes. Your broker identifies these opportunities and explains your options during these windows.

According to the latest data on Medicare costs, premiums and benefits can shift substantially from year to year. Having someone who watches these changes for you provides invaluable peace of mind.

As one client recently shared: "Kelsey doesn't just sell me a plan and disappear. She calls me every fall to review my coverage, explains what's changing, and makes sure I'm still in the right plan. It's like having a Medicare guardian angel."

This ongoing relationship - built on trust, expertise, and genuine care - is what transforms a one-time insurance transaction into a lifelong partnership that helps you steer healthcare with confidence.

Frequently Asked Questions about Colorado Medicare Insurance Brokers

Is there ever a fee to use a broker in Colorado?

When people first hear about working with a colorado medicare insurance broker, they often wonder about the cost. The good news is refreshingly simple: you should never pay a fee to work with a Medicare broker in Colorado.

Brokers like our team at Kelmeg & Associates receive compensation through commissions paid directly by insurance companies when you enroll in a plan. These commissions are already built into the premium costs that everyone pays, whether they use a broker or not. The Colorado Division of Insurance regulates these premiums to ensure they're standardized - meaning you'll pay exactly the same amount whether you enroll directly with an insurer or through us.

I always tell my clients to think of it like having a personal shopper who gets paid by the store, not by you. And if a broker ever asks you for payment? That's a definite red flag, and it's time to find someone else to work with.

How early should I contact a broker before turning 65?

"When should I start this process?" is probably the question I hear most often from people approaching Medicare age.

For the smoothest experience, I recommend reaching out to a colorado medicare insurance broker about 4-6 months before your 65th birthday. This timeline gives you plenty of breathing room to learn about your options before your Initial Enrollment Period begins, gather any necessary documents, and understand how Medicare might coordinate with your existing coverage.

Your Medicare Initial Enrollment Period spans 7 months total - starting 3 months before your birth month and continuing 3 months after. Beginning the conversation early ensures you can make thoughtful decisions without feeling rushed, and it helps you avoid those pesky late enrollment penalties that can stick with you for life.

As Martha, one of our clients from Littleton, told me recently: "I'm so glad I started early. It took me a few weeks just to wrap my head around all the options, but having that extra time meant I could feel confident in my choice."

Can a broker help if I'm already on Medicare and unhappy with my plan?

Absolutely! In fact, some of the most rewarding work we do at Kelmeg & Associates involves helping folks who've been on Medicare for years but have that nagging feeling they could have better coverage.

A colorado medicare insurance broker can be particularly valuable if you're dissatisfied with your current plan. We can analyze exactly why your coverage isn't meeting your needs - maybe your medications have changed, your preferred doctors are no longer in-network, or your health situation has evolved.

We can identify alternative options and explain exactly when you can make changes, typically during the Annual Enrollment Period (October 15-December 7 each year), or possibly during a Special Enrollment Period if you qualify for one.

Bob from Colorado Springs came to us after three frustrating years with a plan that didn't cover his specialist. "I had no idea I had other options," he shared. "My only regret is not talking to a broker sooner."

The transition between Medicare plans requires careful timing and paperwork to ensure you maintain continuous coverage. Having a broker guide you through this process provides peace of mind and helps avoid coverage gaps that could leave you exposed to unexpected costs.

It's never too late to improve your Medicare coverage - and working with a knowledgeable broker makes the process so much easier.

Conclusion: Your Next Steps to Finding the Perfect Medicare Broker

Finding the right colorado medicare insurance broker isn't just about checking a box on your retirement to-do list - it's about finding a trusted partner for your healthcare journey. The right broker becomes someone you can call when you have questions, someone who knows your situation, and someone who keeps an eye out for changes that might affect your coverage.

At Kelmeg & Associates, Inc., we've seen how personalized guidance helps our clients feel confident in their Medicare decisions. We believe everyone deserves clear, honest information without sales pressure, whether you live in Lafayette, Broomfield, Boulder, Adams County, or anywhere else in Colorado.

When you're ready to find your Medicare match, start with these simple steps:

First, take some time to think about what matters most to you. Is keeping your family doctor a non-negotiable? Are you worried about prescription costs? Do you travel frequently and need coverage on the road? Jot down your healthcare priorities so you can share them with potential brokers.

Next, gather your medical information - your current doctors, the medications you take, and any planned procedures or treatments. This helps a colorado medicare insurance broker create personalized recommendations rather than one-size-fits-all suggestions.

Research is your friend in this process. Look up potential brokers, verify their credentials, and read what other Colorado folks have to say about working with them. This is someone you might work with for years to come, so their reputation matters.

Don't be shy about scheduling consultations with a few different brokers. Think of these meetings as "getting to know you" sessions rather than sales pitches. A good broker will listen more than they talk during this first conversation.

During these meetings, ask the questions we suggested earlier in this article. How do they determine which plans to recommend? What happens after you enroll? How quickly do they respond to questions? Their answers will tell you a lot about their approach and values.

Finally, trust your gut feeling. Medicare is personal, and you deserve to work with someone who makes you feel comfortable, heard, and respected. The right broker will explain complex concepts clearly without talking down to you.

As Sue from Frederick told us about her experience: "She is a trustworthy and knowledgeable advisor and is well-respected. She makes Medicare options easy to understand and will help you select the best option according to your personal goals and situation."

That's exactly the kind of relationship we aim to build with each person who walks through our door at Kelmeg & Associates, Inc. We believe Medicare doesn't have to be overwhelming when you have the right guide by your side.

Your Medicare journey doesn't end with enrollment - it's an ongoing relationship that changes as your health needs evolve and as Medicare itself changes. The right broker stays by your side through it all, making sure your coverage continues to serve you well year after year.

Ready to find your Medicare match? Learn more about our personalized Medicare guidance services or contact us today to schedule your free, no-obligation consultation. We're here to help you steer Medicare with confidence and peace of mind.