Medicare Supplemental Insurance in Colorado: Blue Cross Blue Shield Options

Navigating Medicare Supplement Options in Colorado

When retirement approaches and Medicare decisions loom, finding the right supplemental coverage can feel overwhelming. If you're a Colorado resident exploring your options, blue cross blue shield medicare supplemental insurance colorado deserves your attention.

Anthem Blue Cross Blue Shield offers several Medicare Supplement plans in our state, specifically Plans A, F, G, and N. What makes these plans special? Unlike some health insurance that restricts you to specific networks, these supplements are accepted by any healthcare provider nationwide that takes Medicare. That's right—you can visit your favorite doctor in Denver or see a specialist while visiting family in Florida without worrying about network restrictions.

The timing of your enrollment matters tremendously. The best opportunity to secure coverage is during your 6-month Medigap Open Enrollment Period, which begins the month you're both 65 or older and enrolled in Medicare Part B. During this window, insurance companies can't deny you coverage or charge higher premiums based on health conditions.

Why consider blue cross blue shield medicare supplemental insurance colorado in the first place? Original Medicare (Parts A and B) leaves significant gaps in coverage that could potentially expose you to over $51,700 in annual out-of-pocket costs. These supplement plans step in to cover deductibles, copayments, and coinsurance that Medicare doesn't pay, creating a financial safety net for your healthcare needs.

Beyond the essential coverage, most Blue Cross Blue Shield Medigap plans include valuable extras like SilverSneakers fitness membership, giving you access to gym facilities and wellness programs across Colorado. Members also enjoy additional discounts on health-related products and services through Blue365.

As a Colorado resident, you benefit from consumer protections overseen by the Colorado Division of Insurance. This means standardized pricing—you'll pay the same premium for identical Medigap plans regardless of which agent you work with. This transparency allows you to focus on finding the right coverage rather than haggling over prices.

With Blue Cross Blue Shield's 88+ years of service tradition and a network reaching over 90% of physicians and hospitals nationwide, their Medigap plans offer both stability and flexibility for Colorado seniors.

I'm Kelsey Mackley, and at Kelmeg & Associates, I've personally helped hundreds of Colorado neighbors steer the complexities of Medicare supplements. My approach isn't just explaining policies—it's understanding your unique healthcare needs and budget constraints to match you with the ideal supplement plan. There's nothing quite like the relief on a client's face when they finally understand how these plans will protect them.

How Medicare Supplement (Medigap) Works in Colorado

Think of Medicare Supplement Insurance (Medigap) as your financial safety net. While Original Medicare (Parts A and B) provides valuable coverage, it leaves you exposed to potentially significant out-of-pocket costs. This is where blue cross blue shield medicare supplemental insurance colorado steps in – filling those coverage gaps like deductibles, copayments, and coinsurance that would otherwise come straight from your wallet.

Colorado follows the same standardized Medigap system as the rest of the country, with plans neatly organized by letters (A, B, C, D, F, G, K, L, M, and N). This standardization is actually great news for you! It means a Plan G from Blue Cross Blue Shield offers identical core benefits as Plan G from any other insurer. The differences come down to three things: the premium you'll pay, customer service quality, and any extra perks offered.

You can feel confident knowing the Colorado Division of Insurance has your back, reviewing and approving all Medigap plan rates. This oversight helps ensure you're getting fair pricing and good value for your hard-earned money.

As Blue Cross Blue Shield puts it: "When it comes to choosing the right Medicare coverage, it helps to understand all of your options. Don't worry, though – we're here to guide you."

For more detailed information, you can always visit www.medicare.gov for the most up-to-date Medicare resources.

Eligibility for blue cross blue shield medicare supplemental insurance colorado

To qualify for blue cross blue shield medicare supplemental insurance colorado, you'll need to check three boxes:

- Be enrolled in both Medicare Part A and Part B

- Call Colorado home (be a resident)

- Typically be 65 or older (though there are exceptions for younger folks with qualifying disabilities)

Timing is everything when it comes to Medigap enrollment. Your golden opportunity is during your Medigap Open Enrollment Period – a six-month window that begins when you're both 65+ and enrolled in Medicare Part B. During this special period, insurance companies must play by consumer-friendly rules:

They cannot deny you coverage because of health conditions, can't charge you more based on your health status, and must sell you any Medigap policy they offer. It's like having a VIP pass to insurance approval!

If you miss this window and apply later, you might face medical underwriting – where the insurer reviews your health history and can potentially deny coverage or charge higher premiums based on what they find.

Special rules for beneficiaries under 65 in Colorado

Colorado shines when it comes to protecting younger Medicare beneficiaries. If you qualify for Medicare before 65 due to disability, End-Stage Renal Disease (ESRD), or ALS, Colorado regulations require Anthem Blue Cross and Blue Shield to make their Medigap plans available to you.

That said, there are some important differences to be aware of:

Your premiums will likely be higher – sometimes significantly so – compared to those for folks 65 and older. The selection of available plans might also be more limited.

Here's the silver lining: when you turn 65, you'll get a second Medigap Open Enrollment Period! This fresh start gives you another opportunity to shop for coverage with all those guaranteed issue rights intact. Many people find much better rates during this second enrollment period.

Guaranteed Renewability & Portability

One of the most reassuring aspects of blue cross blue shield medicare supplemental insurance colorado is that these policies come with guaranteed renewability. What does this mean for you? As long as you pay your premiums on time, your coverage cannot be canceled – even if your health takes a turn for the worse. The insurance company cannot raise your premium based on your individual health changes, though they can increase rates for your entire class of policies.

The freedom these plans provide is truly valuable. Your coverage works with any doctor or hospital nationwide that accepts Medicare – no referrals needed to see specialists and no network restrictions limiting your choices. If you decide to move to another state, your coverage moves with you.

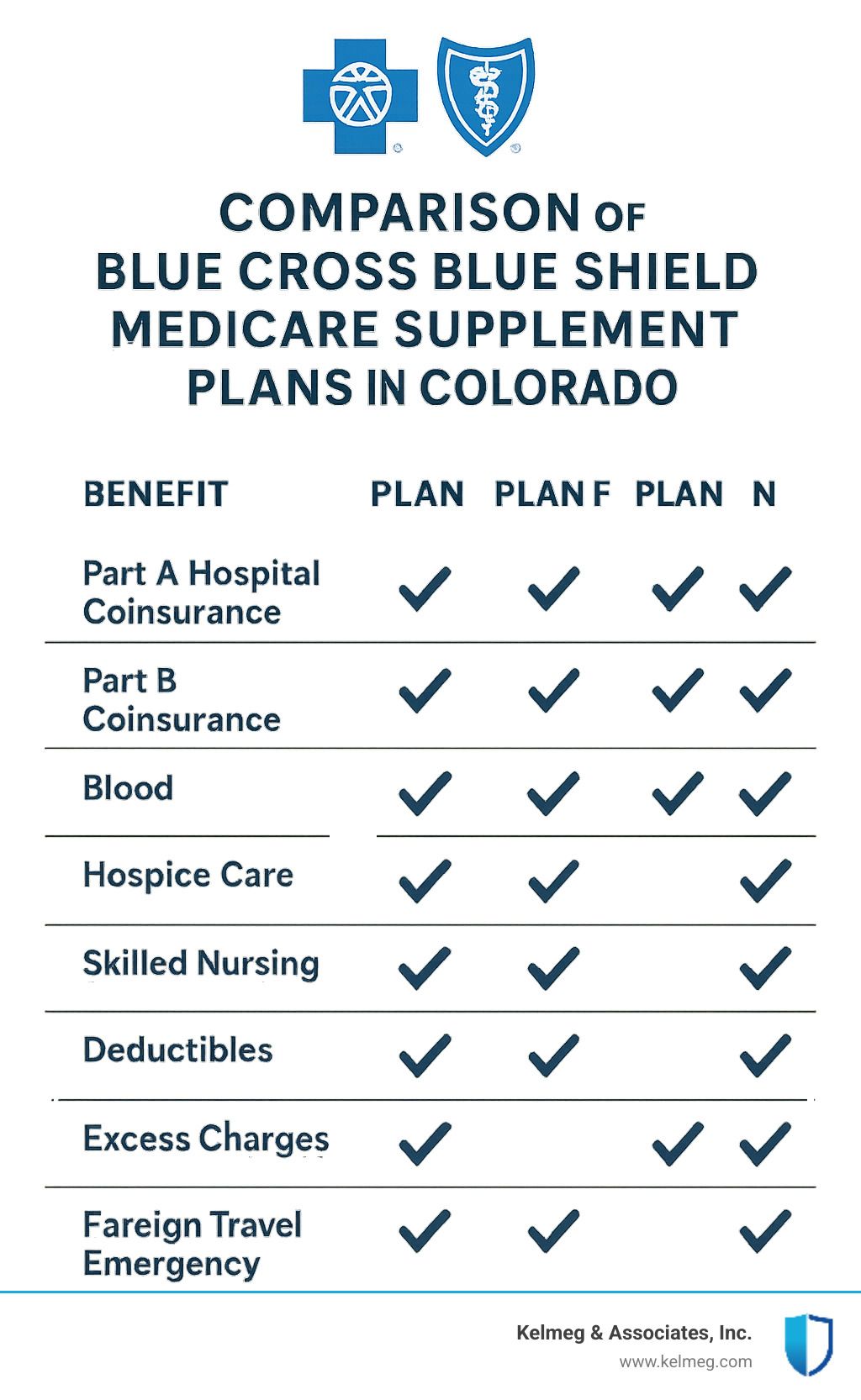

For those who enjoy traveling abroad, select plans (F, G, and N) include foreign travel emergency coverage. This provides peace of mind for emergency care needed during the first 60 days of international travel, after a $250 deductible. The coverage pays up to 80% of billed charges with a $50,000 lifetime maximum – a welcome safety net when you're far from home.

Whether you're staying put in Colorado or exploring the world, your Medigap plan provides consistent, reliable coverage that goes where you go.

blue cross blue shield medicare supplemental insurance colorado: Plan Lineup & Coverage

When it comes to blue cross blue shield medicare supplemental insurance colorado, you have several excellent options to choose from. Anthem offers four main Medicare Supplement plans in Colorado, each designed to fit different healthcare needs and budgets.

Think of these plans like different models of the same reliable car – they all get you where you need to go, but with varying features and price points.

Let's take a friendly stroll through each plan option to help you find your perfect fit:

Plan A Essentials

Plan A is the starter model in the Medigap family. It covers the absolute basics – your Part A hospital coinsurance, Part B coinsurance (that 20% that Medicare doesn't pay), the first three pints of blood, and hospice care coinsurance.

While it typically comes with the lowest monthly premium, Plan A is a bit like buying a car without air conditioning or power windows – functional, but missing some features you might really appreciate later. It doesn't cover your Medicare Part A deductible, skilled nursing facility care, or emergency care when traveling abroad.

This plan makes the most sense if you're on a tight budget but want some protection against the most common Medicare gaps. Just be aware you'll still have some out-of-pocket costs that other plans would cover.

Plan F (for pre-2020 eligibles)

If Plan A is the basic model, Plan F is the luxury edition with all the bells and whistles. It's the only plan that covers literally everything Medicare doesn't – deductibles, coinsurance, excess charges, you name it. With Plan F, you could go an entire year without paying a single medical bill beyond your monthly premium.

The catch? Plan F is only available if you became eligible for Medicare before January 1, 2020. If that's you, congratulations! You have access to the most comprehensive coverage option.

There's also a High-Deductible version of Plan F that offers the same complete coverage after you meet an annual deductible ($2,700 in 2023). Think of it as getting the luxury car at a discount because you agree to pay for the first few oil changes yourself. The monthly premiums are substantially lower, making it attractive if you're relatively healthy.

Plan G – Most Popular Choice

Plan G has become the crowd favorite since Plan F closed to new enrollees. It's nearly identical to Plan F, covering everything except the Medicare Part B deductible ($226 in 2023).

Many of our clients find that Plan G hits the sweet spot – comprehensive coverage without the premium price tag of Plan F. In fact, the annual savings on premiums compared to Plan F often exceeds the Part B deductible you'll pay out-of-pocket, making it a mathematically smart choice.

With Plan G, you're covered for the Part A deductible, excess charges (when doctors charge up to 15% above Medicare-approved amounts), skilled nursing facility coinsurance, and even emergency care during foreign travel. There are no copayments for doctor visits or ER trips – just pay your Part B deductible once a year, and you're generally good to go.

Plan N – Budget-Friendly Option

Plan N is like getting a well-equipped mid-range car – not every luxury feature, but all the important ones at a price that won't break the bank. It uses a clever copay system to keep your monthly premiums lower while still providing substantial coverage.

With Plan N, you'll pay up to $20 for some office visits and up to $50 for emergency room visits (unless you're admitted to the hospital, in which case the copay is waived). It doesn't cover Part B excess charges, so you'll want to make sure your doctors accept Medicare assignment.

Many of our clients who are relatively healthy but want good coverage without high monthly costs find Plan N to be an excellent balance. The modest copays are predictable, and in exchange, you'll save significantly on premiums month after month.

Extra Perks & Member Discounts

One of the nicest surprises with blue cross blue shield medicare supplemental insurance colorado is all the extras that come along with your coverage. These value-added benefits can make a real difference in your day-to-day life:

The SilverSneakers® Fitness Program gives you free access to thousands of gyms nationwide – a benefit many of our clients absolutely love. There's nothing better than staying active without paying extra gym fees!

Blue365® offers year-round discounts on health products and services from leading retailers. Whether it's fitness gear, healthy eating options, or other wellness products, these savings can add up quickly.

Having access to the 24/7 Nurseline means you can call and speak with a registered nurse anytime – day or night – when you have health questions or concerns. It's like having a medical professional in the family.

The ScriptSave WellRx program helps you save on prescriptions, while SpecialOffers provides discounts on vision care, hearing aids, and other health-related products and services.

These extras aren't just nice-to-haves – they can significantly improve your overall healthcare experience while potentially saving you hundreds of dollars on fitness, wellness, and everyday health expenses.

When you're ready to explore which plan might be right for you, while the benefits of each plan letter are standardized, the premiums and extra perks can vary. That's where having a helpful guide (like us at Kelmeg & Associates) can make all the difference in finding your perfect match.

Costs, Premium Ratings & Enrollment Timing

When it comes to blue cross blue shield medicare supplemental insurance colorado, understanding what you'll pay is just as important as knowing what you'll get. Let's break down the dollars and cents in a way that makes sense.

Your premium isn't just a random number – it's calculated based on several key factors. In the beautiful state of Colorado, your costs will vary depending on which plan letter you choose (A, F, G, or N), where you live within the state (as shown in the rate zones map above), your age at enrollment, and the specific rating method Blue Cross Blue Shield uses for your policy.

Speaking of rating methods, Blue Cross Blue Shield typically uses one of three approaches: community-rated (everyone pays the same regardless of age), issue-age-rated (based on your age when you first buy, with no age-related increases later), or attained-age-rated (starts based on your current age and increases as you get older). Understanding which method applies to your policy helps you better predict future costs.

Without a Medicare Supplement plan, your healthcare costs could quickly become overwhelming. For context, in 2025, the Medicare Part B deductible is $257. After meeting this deductible, Original Medicare only covers 80% of approved services – leaving you responsible for the remaining 20% with absolutely no cap on those expenses. That's where these supplement plans become so valuable.

When & How to Enroll

Timing is everything when it comes to getting the best deal on your blue cross blue shield medicare supplemental insurance colorado plan. The golden window is your Medigap Open Enrollment Period – a six-month period that starts the first month you have both Medicare Part B and are 65 or older.

"I always tell my clients that this six-month window is precious," says Kelsey Mackley of Kelmeg & Associates. "During this time, insurance companies can't deny you coverage or charge you more because of health problems."

Beyond this period, you might still qualify for guaranteed issue rights in certain situations – like if you lose employer coverage, move out of your Medicare Advantage plan's service area, or if your Medicare Advantage plan leaves Medicare. If you're interested in learning more about these special enrollment periods, visit the guarantee enrollment period page on Medicare.gov.

Applying outside these protected periods means facing medical underwriting – where the insurer reviews your health history and can potentially deny coverage or charge higher premiums based on pre-existing conditions. It's a bit like trying to buy umbrella insurance when it's already raining – technically possible, but much more expensive.

How Much Will You Pay?

Monthly premiums for blue cross blue shield medicare supplemental insurance colorado follow a fairly predictable pattern based on the comprehensiveness of coverage. Plan F (the most comprehensive option) typically comes with the highest premium, followed by Plan G, then Plan N, with Plan A usually being the most affordable.

To give you a rough idea, a 65-year-old in a typical Colorado rate zone might see monthly premiums ranging from $110-140 for Plan A, $140-170 for Plan G, and $120-150 for Plan N. These numbers can fluctuate based on the factors we discussed earlier.

If you're looking to save on premiums while maintaining solid coverage, consider the High-Deductible Plan F. It typically costs 40-60% less than the standard Plan F but requires you to cover the first $2,700 (2023 amount) in Medicare-covered costs before the plan kicks in. It's a bit like choosing a higher deductible on your car insurance to lower your monthly payment – a smart choice for those who are generally healthy and have some savings set aside.

Another option is Medicare Select versions of these plans, which can save you 10-15% on premiums if you agree to use network hospitals for non-emergency care. You'll still have the freedom to choose any doctor who accepts Medicare.

For a more detailed look at plan options specific to Colorado, check out More info about Medicare Supplement Plans Colorado.

Discounts & Ways to Save

Blue Cross Blue Shield offers several clever ways to trim those premium costs. Their Household Discount can save you 7-10% when multiple household members enroll in BCBS Medigap plans – a nice bonus for couples. The Continue with Blue Discount offers a 7% reduction for those transitioning from another BCBS policy, while the Blue Family Discount provides a generous 12% discount for those with qualifying family members who have BCBS coverage.

Even your payment method can save you money. Setting up Electronic Funds Transfer (EFT) for automatic premium payments typically earns a small discount, and choosing the Annual Payment Option instead of monthly payments can further reduce your overall cost.

"These discounts might seem small individually," notes Kelsey Mackley, "but together they can add up to significant savings over the life of your policy. It's like finding money in your coat pocket – small surprises that make a big difference."

How to apply for blue cross blue shield medicare supplemental insurance colorado

Getting enrolled in a blue cross blue shield medicare supplemental insurance colorado plan is refreshingly straightforward. You can apply online through the Anthem Blue Cross Blue Shield website by visiting their Online Application portal. If you prefer paper, you can download and print an application to complete and mail or fax. For those who prefer a human touch, you can call the BCBS customer service line to apply over the phone.

Many people find it helpful to work with a licensed insurance agent who can guide them through the process at no additional cost. At Kelmeg & Associates, we help clients complete applications accurately and submit them directly to Blue Cross Blue Shield, ensuring nothing falls through the cracks.

When applying, you'll need to have your Medicare number handy, along with your Parts A and B effective dates, personal information like your name, address, and date of birth. If you're applying outside guaranteed issue periods, you might need to provide some health information as well.

The application process doesn't have to be overwhelming. With the right guidance, you can find the perfect balance of coverage and cost that gives you peace of mind without breaking the bank. That's what we specialize in at Kelmeg & Associates – making the complex simple and helping you feel confident in your Medicare decisions.

Medigap vs Medicare Advantage: Key Differences

When you're mapping out your Medicare journey in Colorado, you'll come to a fork in the road: Should you go with a Medicare Supplement (Medigap) plan from Blue Cross Blue Shield, or head down the Medicare Advantage path?

Think of these options as two different philosophies about how your healthcare should work. Let me walk you through the differences in a way that makes sense.

Pros & Cons Side-by-Side

With blue cross blue shield medicare supplemental insurance colorado Medigap plans, you're essentially getting freedom and predictability. You can visit any doctor who accepts Medicare anywhere in the country—no permission slips needed! There's something deeply reassuring about knowing you can see specialists without referrals and that your coverage travels with you from Durango to Denver to Delaware.

The trade-off? You'll pay higher monthly premiums than you would with many Advantage plans. It's a bit like paying more for an all-access pass rather than buying individual tickets as you go.

"I remember when my client Martha was deciding between plans," I often tell people. "She travels to Arizona every winter to visit her grandchildren. For her, knowing her blue cross blue shield medicare supplemental insurance colorado plan would work seamlessly across state lines gave her tremendous peace of mind."

Medicare Advantage plans take a different approach. They often tempt you with low or even $0 monthly premiums and bundle in extras like dental cleanings, vision exams, or hearing aid discounts. They include an annual out-of-pocket maximum that caps your yearly spending—something Original Medicare doesn't have on its own.

The catch? You'll usually be limited to a specific network of providers, may need referrals to see specialists, and typically can only use your coverage within your plan's service area. It's like joining a club with great amenities but stricter rules about when and how you can use them.

As Blue Cross Blue Shield wisely notes, "When it comes to choosing the right Medicare coverage, it helps to understand all of your options. Don't worry, though – we're here to guide you."

If you'd like more detailed information about Anthem's Medicare Advantage options, you can check out our page on Anthem Medicare Advantage Plans Colorado.

Adding Prescription Drug, Dental & Vision Coverage

One important thing to understand about blue cross blue shield medicare supplemental insurance colorado plans is that they don't include prescription drug coverage. This isn't a drawback—it's by design. Medicare has intentionally separated these benefits.

To get your medications covered, you'll need to add a standalone Medicare Part D plan. Think of it as choosing your favorite side dish to go with your main course. Blue Cross Blue Shield offers several Part D options in Colorado that pair nicely with their Medigap policies.

I always tell my clients to consider their current prescriptions carefully when selecting a Part D plan. The right plan for your neighbor might not be the right one for you if you take different medications. The monthly premium is just one factor—you'll also want to check the deductible and what tier your specific prescriptions fall into.

For dental and vision care—services Original Medicare doesn't cover—you have options too. Blue Cross Blue Shield offers separate dental and vision plans that complement your Medigap coverage. There are also bundled packages that combine dental, vision, and hearing benefits for convenience.

Don't forget about the Blue365 program that comes with your blue cross blue shield medicare supplemental insurance colorado plan. These member discounts can help you save on vision care, fitness programs, and other wellness services. It's like having a coupon book that never expires!

At Kelmeg & Associates, we often sit down with clients and map out different coverage combinations. Sometimes the right answer is a Medigap plan plus separate prescription, dental, and vision coverage. For others, a Medicare Advantage plan that bundles everything together makes more sense. There's no one-size-fits-all solution—and that's exactly why having a guide through this process can be so valuable.

If you're trying to weigh these options yourself, you might feel a bit overwhelmed. That's perfectly normal! We're here to help you understand your choices without any pressure or confusion. After all, this is about finding the right fit for your unique healthcare needs, preferences, and budget.

How to Choose the Right Plan & Get Expert Help

Selecting the optimal blue cross blue shield medicare supplemental insurance colorado plan isn't just about comparing premiums—it's about finding coverage that fits your unique healthcare journey. At Kelmeg & Associates, we've helped hundreds of Colorado residents steer these decisions with a personalized approach that considers your whole health picture.

Decision Checklist

When sitting down with our clients to explore Plans A, F, G, and N, we focus on what matters most to you. Your healthcare story is unique, and your coverage should reflect that.

Your healthcare patterns tell us a lot about which plan might serve you best. Do you visit doctors frequently? Someone managing diabetes with regular specialist visits has different needs than someone who rarely seeks medical care. If you're planning knee surgery next year, that's valuable information that might steer us toward more comprehensive coverage like Plan G.

Budget comfort is always a balancing act. I remember helping Martha, a retired teacher in Denver, who initially wanted Plan F for its comprehensive coverage. After discussing her stable health and modest savings, we finded Plan N with its slightly lower premium made more sense for her situation while still providing excellent protection. As she told me later, "That extra $30 a month in my pocket means I can visit my grandkids more often."

Your doctor relationships matter tremendously. If you've built trust with certain physicians over the years, you'll appreciate that blue cross blue shield medicare supplemental insurance colorado plans let you see any Medicare provider nationwide. If your favorite cardiologist sometimes charges more than Medicare's approved amounts, Plans F and G cover those excess charges completely, while Plan N doesn't—a distinction worth considering.

Travel habits often get overlooked in Medicare planning. Do you spend winters in Arizona and summers in Colorado? Do you visit family overseas? Plans F, G, and N include foreign travel emergency benefits that can provide peace of mind during international trips, covering 80% of emergency care costs after a $250 deductible (up to plan limits).

Future health concerns deserve consideration too. The beauty of Medigap plans is their guaranteed renewability. Even if your health changes dramatically, your coverage remains secure as long as you pay your premiums. This long-term stability is something many of our clients find incredibly reassuring.

"If your hospital is part of the Medicare Select network, the Med-Select plan is a good option to consider," notes Blue Cross Blue Shield, which can provide premium savings while maintaining comprehensive benefits. These network-based options can be a smart way to reduce costs if you're comfortable with the participating facilities.

Tools & Resources

Making informed Medicare decisions shouldn't feel overwhelming. Several helpful resources can illuminate your path:

The Medicare.gov Plan Finder offers side-by-side comparisons of Medigap plans in your Colorado zip code, helping you understand standardized benefits across carriers. It's a good starting point, though many clients tell us they appreciate having someone interpret the information.

Blue Cross Blue Shield's Sydney Health App puts your plan information at your fingertips, including digital ID cards and benefit details. It's particularly handy when traveling or visiting new providers.

The Colorado SHIP (State Health Insurance Assistance Program) provides free, unbiased Medicare counseling through trained volunteers. They won't sell you anything, making them a valuable resource for understanding your basic options.

Blue Cross Blue Shield's online resources include educational videos, plan comparison tools, and benefit explanations that can help clarify complex Medicare concepts.

And of course, our team at Kelmeg & Associates offers personalized guidance that takes into account your whole healthcare picture. As one client recently shared, "You explained everything in plain English, not insurance jargon. That made all the difference."

We believe that Medicare decisions shouldn't be made in isolation. The plan that worked wonderfully for your neighbor might not be the best fit for you. That's why we take the time to understand your specific needs, answer your questions (even the ones you didn't know to ask), and help you find coverage that feels right—both for your health and your wallet. You can learn more about working with a Medicare Licensed Insurance Agent in Colorado on our website.

Remember—choosing the right Medicare Supplement plan isn't just about today's needs but about creating a foundation for healthcare security in the years ahead. And you don't have to figure it out alone.

Frequently Asked Questions about Blue Cross Blue Shield Medigap in Colorado

What happens if I move out of Colorado?

One of the beauties of blue cross blue shield medicare supplemental insurance colorado is its flexibility when life takes you to new places. If you decide to leave the Centennial State behind, don't worry about your coverage – it travels with you!

Your Medigap plan remains completely valid anywhere in the United States, as long as the healthcare providers you choose accept Medicare. You'll simply need to update your address and billing information with Blue Cross Blue Shield to keep everything current.

Moving actually gives you an additional advantage – it triggers guaranteed issue rights for a new Medigap policy if you want to make a change. This could be beneficial if your new state offers lower premiums for the same coverage. Just remember, you have 63 days from when your old coverage ends to purchase a new policy with these special rights.

This portability makes Medigap plans particularly valuable for retirees who split time between states or travel frequently. Your coverage remains consistent whether you're hiking in Colorado or visiting family across the country.

Can I keep my plan even if my health changes?

Life brings unexpected health challenges, but your blue cross blue shield medicare supplemental insurance colorado plan provides peace of mind during difficult times. Your coverage is guaranteed renewable as long as you continue paying your premiums on time – no exceptions.

This crucial protection means Blue Cross Blue Shield cannot cancel your policy because of health problems or changes in your medical status. When health issues arise (which is precisely when you need coverage most), your plan remains steadfastly in place.

While your premium may increase over time due to inflation or company-wide rate adjustments, these increases cannot be based on your individual health situation. As Blue Cross Blue Shield clearly states: "Medicare Supplement policies are guaranteed renewable and cannot be canceled if premiums are paid."

This guarantee provides invaluable security, knowing that developing a chronic condition or facing a serious diagnosis won't jeopardize your health coverage when you need it most.

Do Blue Cross Blue Shield Medigap plans include prescription drugs?

When it comes to medications, blue cross blue shield medicare supplemental insurance colorado plans have a specific focus. These Medigap plans are designed exclusively to fill the gaps in Original Medicare (Parts A and B), covering things like deductibles and coinsurance for hospital and medical services – but they don't include prescription drug coverage.

For prescription coverage, you'll need to enroll in a separate Medicare Part D plan. Blue Cross Blue Shield conveniently offers standalone Part D plans specifically designed to work alongside your Medigap policy. Timing matters here – it's important to enroll in Part D when you're first eligible to avoid those pesky late enrollment penalties that can follow you for life.

Similarly, if you're looking for routine dental, vision, or hearing coverage, you'll need separate policies or discount programs. Blue Cross Blue Shield offers these supplemental options as well, allowing you to build comprehensive coverage that addresses all your healthcare needs.

At Kelmeg & Associates, we can help you steer these choices, ensuring you have the right combination of plans to cover everything from hospital stays to prescription medications to dental care – all working together seamlessly.

Conclusion

Finding the right Medicare coverage shouldn't feel like solving a puzzle in the dark. With blue cross blue shield medicare supplemental insurance colorado, you're getting more than just an insurance policy – you're securing peace of mind and protection against those unexpected medical bills that can otherwise derail your retirement plans.

Throughout Colorado, from the mountain communities to the eastern plains, seniors are finding how Medigap plans provide the freedom to focus on enjoying life rather than worrying about healthcare costs. These standardized plans work seamlessly with your Original Medicare, filling those critical gaps that could otherwise leave you exposed to significant financial risk.

At Kelmeg & Associates, we've guided hundreds of Colorado residents through the Medicare maze. Our approach is simple – we listen to your needs, explain your options in plain English, and help you find coverage that fits both your healthcare needs and your budget. Whether you're in Lafayette, Broomfield, Boulder, or anywhere in Adams County, our team is ready to provide personalized support.

What makes the blue cross blue shield medicare supplemental insurance colorado plans particularly valuable is their reliability. The coverage you select today will be there for you tomorrow, next year, and for years to come – regardless of how your health might change. That's protection you can count on when it matters most.

Your ideal plan might be the comprehensive coverage of Plan G, the budget-friendly approach of Plan N, or perhaps another option altogether. What's important is that the choice is informed by your unique situation – your doctors, your health conditions, your travel plans, and your comfort level with potential out-of-pocket costs.

Don't steer this journey alone. Our Medicare specialists at Kelmeg & Associates provide free, no-obligation consultations to help you understand all your options. We'll walk you through the plans, compare costs and benefits, and ensure you feel confident in your coverage decisions.

The best time to enroll is during your Medigap Open Enrollment Period when you have guaranteed acceptance regardless of health conditions. Missing this window could mean medical underwriting and potentially higher costs or coverage denials.

Ready to find your perfect Medicare Supplement plan? Contact us today for straightforward, expert guidance with no pressure and no extra cost. After all, Medicare should give you confidence in your healthcare future, not cause confusion or concern.