Healthy Savings Ahead—Affordable Health Plans in Colorado

Finding Quality Coverage That Won't Break the Bank

Affordable health plans Colorado options are more accessible than many residents realize. Here's a quick overview of your best options:

- Connect for Health Colorado Marketplace- The only place to access premium subsidies

- Health First Colorado (Medicaid)- Free coverage for qualifying low-income residents

- Child Health Plan Plus (CHP+)- Low-cost coverage for children and pregnant women

- OmniSalud- Coverage for undocumented residents and DACA recipients

- Colorado Option Plans- Standardized plans with $0 diabetic supplies

The search for affordable health coverage in Colorado can feel overwhelming. With rising premiums and complex plan structures, many individuals, families, and business owners struggle to find the right balance between cost and coverage. The good news is that 9 out of 10 Coloradans who enroll through Connect for Health Colorado qualify for financial help that significantly reduces monthly premiums.

For example, in 2024, a 25-year-old in Denver County earning $35,000 annually pays just $95 per month for a benchmark health plan - saving $372 per year compared to 2023 rates. Similarly, a 50-year-old in Alamosa County with a $50,000 income pays $261 monthly, saving $684 annually.

Recent legislation has expanded eligibility for financial assistance, making coverage more affordable than ever before. Whether you're self-employed, between jobs, or looking to provide benefits for your employees, understanding your options is the first step toward securing quality, budget-friendly health insurance.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I help individuals and families steer the complexities of affordable health plans Colorado options to find coverage that protects both their health and financial wellbeing.

9 Proven Paths to Affordable Health Plans Colorado

Let's face it - finding health insurance that doesn't drain your bank account can feel like searching for a unicorn. But I've got good news! There are actually nine practical ways to get quality coverage without the premium sticker shock.

1. Shop the State Marketplace

Connect for Health Colorado isn't just another website - it's your golden ticket to savings. As our state's official health insurance marketplace, it's the only place where you can access those valuable financial helpers that bring down your monthly costs.

What makes shopping here special? You can compare plans side by side, and those subsidies can be game-changers, sometimes bringing your premium down to zero dollars per month depending on your situation.

Just pop over to view plans , enter some basic info about your household and income, and see what you might save before creating an account.

2. Tap Premium Tax Credits for Affordable Health Plans Colorado

These credits are the secret sauce that makes affordable health plans Colorado possible for so many of us. They're basically the government's way of saying, "We'll help cover part of your monthly premium so you don't have to."

Thanks to recent legislation (the American Rescue Plan and Inflation Reduction Act), these credits are more generous than ever. The savings are real - like a 40-year-old in Summit County earning $45,000 who now pays $207 monthly instead of $247, putting $480 back in their pocket each year.

3. Slash Costs with Cost-Sharing Reductions

Beyond helping with your monthly premium, cost-sharing reductions (CSRs) lower your deductible, copays, and other out-of-pocket costs when you visit the doctor or pick up prescriptions.

You need to pick a Silver plan through the marketplace AND have an income between 100-250% of the Federal Poverty Level. For a family of four, that's roughly between $41,400 and $75,000.

CSRs essentially upgrade your Silver plan to work more like a Gold or Platinum plan - better coverage without the higher premium.

4. Check Medicaid (Health First Colorado) Eligibility

Health First Colorado - our state's Medicaid program - provides free or nearly free comprehensive coverage for those with limited income, and you can apply any time of year.

The program has expanded to include more people: adults without children, parents with higher incomes, and working adults with disabilities. Coverage includes doctor visits, hospital care, emergency services, prescriptions, dental, and mental health care.

To qualify, your income generally needs to be below 138% of the Federal Poverty Level for most adults. You can apply online through Colorado PEAK, by phone, in person, or by mail. Not sure if you qualify? At Kelmeg & Associates, we're happy to help determine if Low Income Health Insurance in Colorado programs might work for you.

5. Enroll Kids & Pregnant Women in CHP+

Child Health Plan Plus (CHP+) is a wonderful middle-ground option for families who make too much for Medicaid but still find private insurance a stretch. It's specifically designed for children and pregnant women, offering comprehensive coverage at a fraction of typical insurance costs.

Families who qualify enjoy no annual enrollment fees, minimal copays, free preventive care, and dental coverage for kids. A family of four earning under about $63,000 may qualify.

6. Explore OmniSalud for Undocumented & DACA Recipients

Colorado stands out as one of the few states offering health coverage regardless of immigration status through OmniSalud. The enrollment process is refreshingly simple and confidential - just provide your name, address, and estimated income with no verification required.

For 2025 plans, you can enroll from November 1 to November 22, 2024. All major insurers participate, including Anthem, Cigna, Denver Health, Rocky Mountain Health Plans, Select Health, and Kaiser Permanente.

7. Consider the Colorado Option Plans

The Colorado Option is our state's innovative approach to simplifying health insurance while keeping costs in check. These standardized plans make comparison shopping much easier since the benefits and cost structures are the same across different insurance companies.

These plans typically offer lower premiums with added perks like $0 copays for diabetic supplies. They emphasize preventive care and early intervention, potentially saving you more in the long run.

8. Add Supplemental Dental, Vision & Accident Coverage

While your main health plan covers the essentials, supplemental coverage fills those annoying gaps that could otherwise lead to unexpected expenses.

Dental insurance helps with regular cleanings, fillings, and major work like crowns. Vision insurance makes annual eye exams, new glasses, or contact lenses more affordable. Accident insurance provides cash benefits directly to you if you have a covered injury.

These plans typically come with modest monthly premiums but can save you from painful out-of-pocket costs. At Kelmeg & Associates, we can walk you through various Health Insurance Options Colorado residents should consider beyond just major medical coverage.

9. Use Employer Group Benefits or ICHRA Reimbursement

If you're employed or run a business yourself, group health benefits might be your most affordable path to coverage. Traditional group insurance allows employers to chip in toward premiums, often making coverage more budget-friendly than going it alone.

For business owners, especially small ones, there's also the flexible Individual Coverage Health Reimbursement Arrangement (ICHRA). This allows you to provide tax-free reimbursement for your employees' individual health insurance premiums without managing a full group plan.

Crunching the Numbers: What Your Health Plan Really Costs

When shopping for affordable health plans Colorado options, looking beyond just the monthly premium can save you thousands. As someone who's helped hundreds of Colorado families steer these choices, I've seen how understanding the full cost picture leads to smarter decisions.

Think of your health plan as a financial puzzle with several interconnected pieces:

How Premiums & Deductibles Interact in Affordable Health Plans Colorado

The relationship between what you pay monthly and what you pay when you need care is crucial to finding the right balance for your budget and health needs.

Your premium is just the starting point - it's your predictable monthly payment whether you visit the doctor or not. But the true cost story unfolds when you actually need care. That's when your deductible, copayments, coinsurance, and out-of-pocket maximum all come into play.

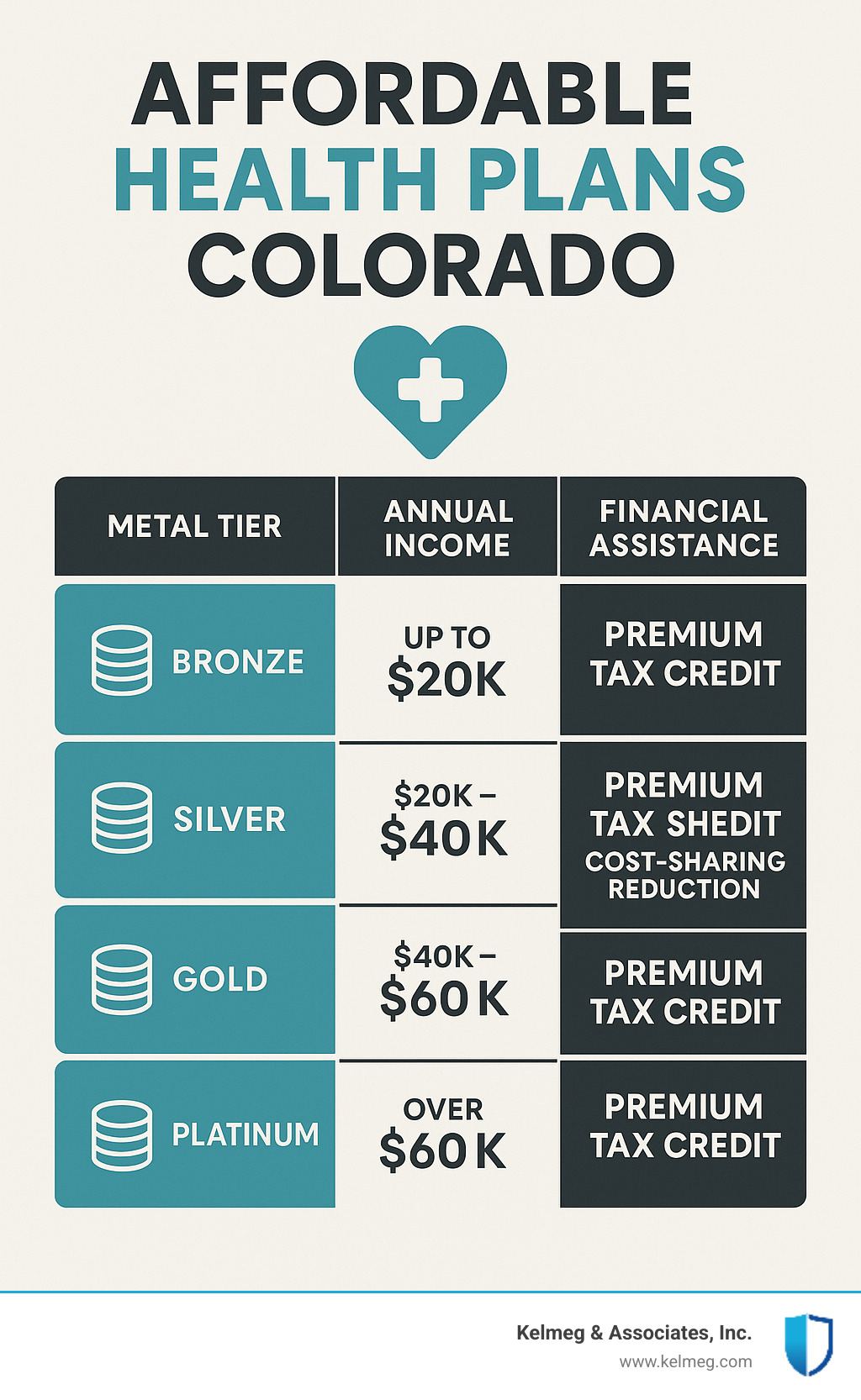

I often explain the metal tier system as a simple way to understand this premium-versus-coverage tradeoff:

| Metal Tier | Premium Level | Deductible/Cost-Sharing | Actuarial Value (Insurer Pays) | Best For |

|---|---|---|---|---|

| Bronze | Lowest | Highest | 60% | Healthy people who rarely need care |

| Silver | Medium | Medium | 70% (higher with CSRs) | Average healthcare needs; those eligible for CSRs |

| Gold | Highest | Lowest | 80% | Frequent healthcare users; those with chronic conditions |

The actuarial value represents how much of your healthcare costs the plan covers. A Bronze plan with 60% actuarial value means you're responsible for about 40% of costs (up to your out-of-pocket maximum), while the insurer covers 60%.

Finding your personal sweet spot depends on your typical healthcare patterns. I worked with a young, healthy client who saved over $1,200 annually with a Bronze plan because she rarely needed care beyond preventive services. Meanwhile, a family managing several chronic conditions found that a Gold plan, despite higher premiums, actually saved them money through dramatically lower out-of-pocket costs.

Free Preventive & Wellness Services

One of the brightest spots in today's health insurance landscape is the comprehensive preventive care that comes at zero cost to you. These services are completely covered even before you meet your deductible, as long as you stay in-network.

Annual wellness exams, vaccines, cancer screenings, blood pressure checks, diabetes screenings, depression assessments, tobacco cessation programs, contraception, and prenatal care are all covered at no cost.

I've seen how these free preventive services can be life-changing. One of my clients found high blood pressure during a routine preventive visit, allowing her to address it before it led to more serious health issues. Another had a preventive colonoscopy that caught precancerous polyps early, potentially saving his life while avoiding thousands in treatment costs.

By understanding both the financial structure of your plan and utilizing the included preventive benefits, you can make choices that protect both your health and your wallet.

When to Enroll: Key Dates & Special Opportunities

Timing is crucial when it comes to securing affordable health plans Colorado options. Understanding enrollment periods and deadlines helps ensure you don't miss your chance to get covered:

Open Enrollment Period

The standard Open Enrollment Period for 2025 health plans in Colorado runs from November 1, 2024, to January 15, 2025. During this time, anyone can enroll in a marketplace plan through Connect for Health Colorado without needing a qualifying life event.

To have coverage starting January 1, 2025, you must enroll by December 15, 2024. Enrollments between December 16 and January 15 will have coverage starting February 1, 2025.

Special Enrollment Periods

If you miss Open Enrollment, you may still be able to get coverage if you experience a Qualifying Life Event (QLE) that triggers a Special Enrollment Period (SEP). These events include:

- Loss of health coverage (job loss, aging off a parent's plan, etc.)

- Household changes (marriage, divorce, birth or adoption of a child)

- Change in residence (moving to a new county or ZIP code)

- Income changes that affect eligibility for financial assistance

- Becoming a U.S. citizen or lawfully present resident

- Release from incarceration

When you experience a QLE, you typically have 60 days to enroll in a new plan or change your existing coverage.

Medicaid and CHP+ Enrollment

Unlike marketplace plans, enrollment for Health First Colorado (Medicaid) and Child Health Plan Plus (CHP+) is open year-round. If you qualify based on income, you can apply at any time.

Staying Covered All Year

Once enrolled, maintain your coverage by paying your monthly premiums on time, reporting income or household changes promptly, keeping your contact information updated, and responding to any requests for additional information.

Extra Help for Special Populations

Living in Colorado means access to affordable health plans Colorado options for everyone - no matter where you live or your unique circumstances. Let's explore the special programs and assistance available for residents who might need extra support.

Rural Residents

If you call rural Colorado home, you know healthcare can sometimes be more expensive and options more limited. The good news? Improved subsidies are specifically designed to help rural Coloradans manage these higher costs.

For example, a 50-year-old in Alamosa County earning $50,000 annually now pays just $261 monthly for a benchmark health plan in 2024 - down from $318 in 2023. That's an impressive $684 yearly savings! Similar cost reductions are available across many Western Slope and Eastern Plains communities.

Undocumented Residents

Everyone deserves access to quality healthcare. Through OmniSalud, undocumented Coloradans can find coverage without concerns about immigration status. The enrollment process is completely confidential, and participation doesn't trigger any "public charge" issues that might affect immigration proceedings.

Tribal Members

American Indians and Alaska Natives enjoy special protections under the Affordable Care Act that make healthcare more accessible:

- You can enroll monthly throughout the year, not just during Open Enrollment

- You may qualify for exemptions from cost-sharing at certain income levels

- You maintain access to Indian Health Service (IHS) providers

- Special cost-sharing variations are available specifically for tribal members

Individuals with Disabilities

Coloradans with disabilities have several specialized programs designed to meet their unique healthcare needs, including the Medicaid Buy-In program and special needs plans to help manage and coordinate care for complex health conditions.

Financial Help Calculators & In-Person Assistance

You don't have to figure out your health insurance options alone. Free help is readily available throughout Colorado:

Connect for Health Colorado's Quick Cost & Plan Finder Tool gives you personalized estimates of costs and potential savings in just minutes. If you prefer face-to-face assistance, Certified Health Coverage Guides provide free in-person help at locations across the state.

Certified Brokers like us at Kelmeg & Associates offer professional guidance at no additional cost to you - we're compensated by the insurance companies, not our clients. At Kelmeg & Associates, we specialize in helping Colorado residents find the perfect coverage match for their situation through Affordable Health Coverage Colorado options.

Smart Shopping Toolkit

Finding the right affordable health plans Colorado option is about more than just comparing monthly premiums. Think of it like buying a car - you need to look under the hood and understand all the features before making your decision.

Check Provider Networks

Nothing's more frustrating than finding your favorite doctor doesn't accept your new insurance. Before you commit to any plan, take time to verify that your trusted healthcare providers are in-network.

Colorado health plans typically use one of these network structures:

HMOs require you to select a primary care physician who acts as your healthcare "home base" and provides referrals to specialists. These plans generally don't cover out-of-network care except in emergencies, but they often have lower premiums.

EPOs give you a bit more flexibility - you don't need referrals to see specialists, but like HMOs, they typically only cover in-network care.

PPOs offer the most freedom, allowing you to see out-of-network providers (though at a higher cost). These plans usually come with higher premiums but might be worth it if you have established relationships with specific doctors.

Review Prescription Drug Coverage

If you take medications regularly, this step could save you hundreds or even thousands of dollars annually. Each health plan has a formulary - basically a menu of covered medications - that categorizes drugs into cost tiers.

Before enrolling, search each plan's formulary for your specific prescriptions. If you take an expensive brand-name medication, check if there's a covered generic alternative your doctor might approve.

Consider Virtual Care Options

Most Colorado plans now include robust telehealth benefits. These virtual visits can be incredibly convenient for routine care, medication check-ins, or mental health support.

Some plans offer $0 copay telehealth visits, while others apply your regular office visit cost-sharing. If you're comfortable with digital healthcare, prioritize plans with strong virtual care benefits.

Use Transparency Tools

Colorado has made impressive strides in healthcare price transparency, giving you powerful tools to compare costs before receiving care:

The Latest research on price transparency helps you compare hospital costs for common procedures.

Most insurance carriers now offer online cost estimator tools where you can get personalized estimates for everything from MRIs to maternity care based on your specific plan benefits.

For deeper insights into ACA-compliant plans available throughout Colorado, visit our detailed guide to More info about ACA plans.

Step-By-Step Marketplace Checklist for Affordable Health Plans Colorado

Finding the right plan doesn't have to be overwhelming. Follow this simple roadmap:

1. Gather your information before you start. You'll need Social Security numbers for everyone applying, recent income information, and details about any employer coverage available to your household.

2. Create your account on Connect for Health Colorado's website.

3. Complete the application thoroughly and honestly. This determines your eligibility for financial help.

4. Compare your options using the factors that matter most to you.

5. Select your plan once you've narrowed down your choices.

6. Pay your first premium promptly to activate your coverage.

7. Watch for your insurance cards in the mail or download digital versions through your insurer's member portal.

At Kelmeg & Associates, we walk through this entire process with our clients, translating insurance jargon into plain English and helping you weigh the pros and cons of each option.

Frequently Asked Questions about Affordable Coverage in Colorado

Who qualifies for premium subsidies and cost-sharing reductions?

Good news for Colorado residents - financial help for health insurance is more accessible than many realize! Premium tax credits are available to individuals and families with household incomes between 100% and 400% of the Federal Poverty Level. But here's the really helpful part: thanks to recent legislation, there's now a provision that caps premium costs at 8.5% of income for those above 400% FPL.

For 2024, this means a single person earning between $14,580 and $58,320 qualifies for premium tax credits. A family of four? You're eligible with household earnings between $30,000 and $120,000. And if your income exceeds these thresholds but health insurance would cost more than 8.5% of your income? You might still qualify for financial help.

Cost-sharing reductions work a bit differently. These valuable discounts on deductibles and copays are available to those with lower incomes (between 100% and 250% FPL) who purchase Silver plans. That translates to an individual earning between $14,580 and $36,450, or a family of four earning between $30,000 and $75,000.

Can I switch plans if my income changes mid-year?

Life happens, and incomes change! The good news is that affordable health plans Colorado options can adapt to your changing financial situation.

If your income decreases significantly during the year, you might qualify for increased premium tax credits or even become eligible for Medicaid. The key is to report this change promptly to Connect for Health Colorado so they can recalculate your subsidies.

On the flip side, if your income increases substantially, it's equally important to report the change. This helps you avoid an unwelcome surprise at tax time, where you might otherwise have to repay excess premium tax credits.

Income changes that significantly affect your financial assistance eligibility may also qualify you for a Special Enrollment Period, giving you the opportunity to switch to a more suitable plan mid-year.

What options exist if I'm self-employed or between jobs?

Being your own boss or between employment opportunities shouldn't mean going without health coverage. Self-employed Coloradans have several solid options to consider.

Marketplace plans through Connect for Health Colorado often work beautifully for entrepreneurs. Your eligibility for premium tax credits is based on your estimated annual income, including your business profit after expenses.

If your income is on the lower side while building your business, Health First Colorado (our state's Medicaid program) might be an option worth exploring.

Coming from employer coverage? COBRA continuation is available, though it tends to be expensive since you're paying both your portion and what your employer previously contributed.

If you're between jobs, the loss of your previous coverage likely qualifies you for a Special Enrollment Period, giving you 60 days to enroll in a marketplace plan regardless of the time of year.

Conclusion

Finding affordable health plans Colorado options shouldn't feel like searching for a needle in a haystack. The good news is that quality coverage has become more accessible than ever before. From improved subsidies that significantly reduce monthly premiums to innovative programs like OmniSalud and the Colorado Option, Colorado residents have multiple paths to protection for both their health and finances.

I've seen how the right guidance can transform what feels like an overwhelming process into a straightforward decision. At Kelmeg & Associates, Inc., we take pride in walking alongside our clients as they steer their health insurance journey. The best part? Our personalized guidance comes at no additional cost to you, as we're compensated directly by the insurance companies we represent.

Our team works with residents throughout Lafayette, Broomfield, Boulder, Adams County, and across Colorado, providing custom recommendations based on your unique circumstances. We understand that everyone's healthcare needs and budgets differ, which is why personalized advice matters so much in this process.

When you work with us, we'll help you:

- Determine your eligibility for valuable premium tax credits and cost-sharing reductions

- Compare plans across multiple insurance carriers so you understand all your options

- Balance the tradeoffs between monthly premiums and potential out-of-pocket expenses

- Steer special enrollment periods if you've experienced qualifying life events

- Access specialized programs you might not realize you qualify for

Whether you're shopping for yourself, looking for family coverage, or exploring More info about group benefits for your business, our expertise ensures you find the sweet spot between comprehensive coverage and affordability.

Health insurance doesn't have to be confusing or overwhelming. With the right partner by your side, you can approach the process with confidence, knowing you'll find a plan that truly fits your needs. Contact Kelmeg & Associates today for a free, no-obligation consultation to explore all your options for affordable, quality health coverage in Colorado.