The Colorado Connection: Small Group Health Insurance Explained

Colorado health insurance application small group plans can be a game-changer for businesses and individuals seeking affordable and comprehensive health coverage. If you're navigating this landscape for the first time or as a business owner wanting to offer benefits to your employees, here's what you need to know:

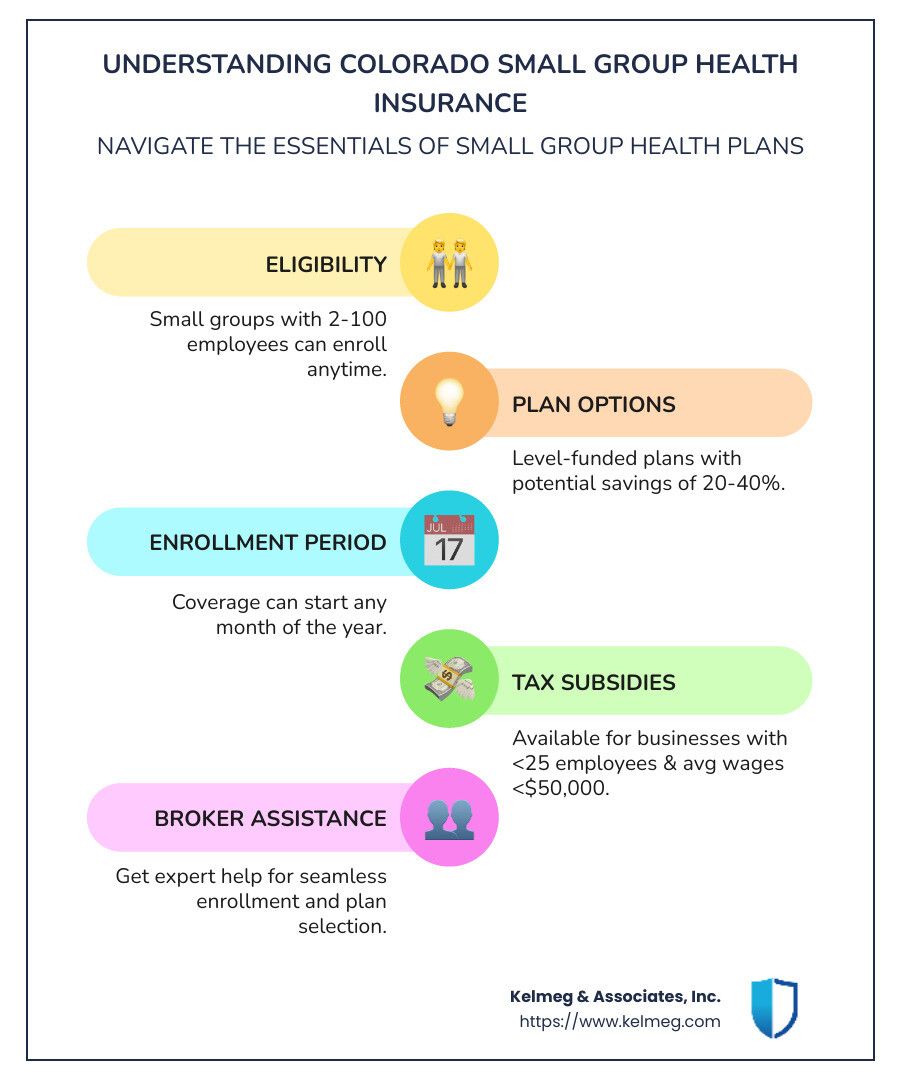

- Who qualifies? Small groups in Colorado with 2-100 employees, including startups and new businesses, can enroll in group health insurance anytime.

- Available Plans: Options include level-funded plans that may save you 20-40% over traditional plans, with potential additional savings through bundled services.

- Enrollment Period: Unlike individual plans, small groups can begin coverage any month of the year.

- Special Benefits: Federal tax subsidies are available for small businesses with fewer than 25 employees earning average wages under $50,000, offering significant savings.

I'm Kelsey Mackley! At Kelmeg & Associates, I've dedicated my career to simplifying the process of securing health insurance for both individuals and businesses. With my expertise in colorado health insurance application small group, I'm here to guide you through understanding and selecting the perfect coverage custom to your needs.

Understanding Small Group Health Insurance in Colorado

Navigating small group health insurance in Colorado can seem daunting, but it doesn't have to be. Let's break it down into simple pieces.

Eligibility

To qualify for small group health insurance in Colorado, your business must have between 2 and 100 employees. This includes both full-time and part-time workers, as long as they meet the minimum hour requirements set by the insurance plan.

Even startups can jump in. If you're a new business with just a couple of employees, you can still enroll in a group plan at any time of the year. This flexibility makes it easier for businesses to offer health benefits as they grow.

Employee Requirements

For a business to maintain its eligibility, a certain percentage of employees must participate in the health plan. Typically, at least 70% of eligible employees must enroll. However, this requirement can be waived during specific enrollment periods, making it easier for businesses to meet the criteria.

Employees must work a minimum number of hours per week to qualify for coverage. This ensures that the benefits are directed toward those actively contributing to the business.

Coverage Options

Colorado offers a variety of coverage options for small groups. Here are a few key types:

- Level-Funded Plans: These are partially self-funded plans that can save businesses 20-40% over traditional community-rated plans. They offer more predictability in costs and potential savings if claims are lower than expected.

- Standardized Plans: These plans are part of the Colorado Option, aiming to reduce premiums by 15% by 2025. They offer comprehensive coverage with added benefits like $0 diabetic supplies.

- Bundled Services: Some providers offer package pricing that includes health insurance and HR services, leading to additional savings of 20-40%.

Employers can choose from a variety of plan types, including HMOs, PPOs, and EPOs, depending on what's available in their area and what fits their employees' needs.

Understanding these elements can help businesses make informed decisions about offering health insurance to their employees. By providing these benefits, companies can attract and retain top talent, showing their workforce that they care about their well-being.

Next, we'll dive into the application process and how Connect for Health Colorado can assist in finding the right plan for your business.

Colorado Health Insurance Application Small Group

Applying for small group health insurance in Colorado might seem complex, but with the right guidance, it becomes straightforward. Here's how you can steer the process effectively.

Application Process

First, gather all necessary documents. This includes the Employer Application, the Employee Enrollment Form, and the Colorado Employee Uniform Application. These forms are essential for both electronic and non-electronic submissions.

Once you have your documents ready, submit them through your chosen insurance provider. If you're working with Kaiser Permanente, for example, you can email the completed forms directly to them. It's crucial to ensure all information is accurate to avoid delays.

Connect for Health Colorado

Connect for Health Colorado is a valuable resource for small businesses. It offers a marketplace where businesses can explore different health plan options. One of the standout features of this marketplace is the potential for financial assistance, which can significantly reduce monthly premiums for employees. Many businesses are unaware that their employees might qualify for this help, which is only available through the marketplace.

Connect for Health Colorado also provides access to certified local experts. These professionals can guide you through the application process and help you understand the different plans available. They offer their services at no cost, making them an excellent resource for businesses unfamiliar with health insurance intricacies.

Standardized Plans

In Colorado, standardized plans are part of the effort to make healthcare more affordable and accessible. These plans are designed to offer consistent coverage across different providers, making it easier for businesses to compare options.

The Colorado Option aims to reduce premiums by 15% by 2025. This initiative includes standardized plans that offer comprehensive coverage. For example, they often include added benefits like $0 diabetic supplies, which can be a significant advantage for employees with chronic conditions.

By choosing a standardized plan, businesses can ensure that their employees receive quality coverage at a more predictable cost. These plans are part of the broader effort to make healthcare more affordable in Colorado.

Navigating the colorado health insurance application small group process doesn't have to be overwhelming. With resources like Connect for Health Colorado and the availability of standardized plans, businesses can find a plan that meets their needs and budget.

Next, we'll explore the benefits of the Colorado Option for small groups, including affordability and premium reductions.

Benefits of the Colorado Option for Small Groups

The Colorado Option offers significant benefits for small groups looking for affordable health insurance. Let's explore how this option can help your business and employees.

Affordability

One of the biggest advantages of the Colorado Option is its focus on affordability. The plans are specifically designed to be cost-effective for small businesses and their employees. By 2025, the Colorado Option aims to reduce premiums by 15%, making it a financially attractive choice for many companies.

Premium Reductions

Premium reductions are a key feature of the Colorado Option. The state has implemented regulations to ensure that health insurance companies offer plans with reduced premiums. This means that businesses can provide their employees with comprehensive health coverage without breaking the bank.

$0 Benefits

The Colorado Option also includes several $0 benefits that can greatly improve the value of the insurance plan for employees. These benefits cover essential services such as:

- Free primary care visits: Employees can see their primary doctor for $0, which encourages regular check-ups and early treatment of health issues.

- Free mental health office visits: Mental health is crucial, and the Colorado Option ensures that employees can access mental health services at no cost.

- Free prenatal and post-pregnancy visits: These visits are covered completely, supporting employees during and after pregnancy.

- Certain free diabetic supplies: Employees with diabetes can receive necessary supplies, like continuous glucose monitors, at no cost, easing their financial burden.

These $0 benefits not only improve access to healthcare but also promote overall well-being and productivity among employees.

Predictable Costs

Another benefit of the Colorado Option is the use of predictable co-pays instead of coinsurance. For example, a specialist visit might have a standard $50 co-pay, allowing employees to know exactly what they'll pay for specific services. This transparency helps employees manage their healthcare expenses more effectively.

The Colorado Option is an excellent choice for small groups seeking to provide comprehensive and affordable health coverage. By leveraging these benefits, businesses can offer valuable health insurance that supports their employees' health and financial stability.

Next, we'll discuss how to apply for small group health insurance and the resources available to assist you in this process.

How to Apply for Small Group Health Insurance

Applying for small group health insurance in Colorado might seem overwhelming, but with the right guidance, it can be straightforward. Let's break down the process into manageable steps, including broker assistance, enrollment periods, and required forms.

Broker Assistance

Working with a broker can simplify the application process. Brokers like Kelmeg & Associates, Inc. are experts in navigating the health insurance landscape. They can help you compare plans, understand coverage options, and manage paperwork. Brokers are especially valuable for small businesses that may not have a dedicated HR team.

Enrollment Period

One of the great benefits of small group health insurance in Colorado is the flexibility in enrollment. Unlike individual plans that have specific enrollment periods, small groups can start a plan any time during the year. This means you can get coverage for your employees whenever it suits your business needs.

Required Forms

To apply for small group health insurance, you'll need to complete several forms. Here's a quick rundown of what you might need:

- Colorado Uniform Employee Application for Small Group Health Benefit Plans: This form collects information about each employee who will be covered. It includes personal details, employment information, and coverage options.

- Employer Application: This form provides details about your business, such as the number of employees and the desired coverage start date.

- Employee Enrollment Form: Each employee must fill out this form to enroll in the health plan. It includes selecting the type of coverage and listing any dependents.

Having these forms ready can speed up the application process. Brokers can assist in ensuring all paperwork is correctly filled out and submitted.

Connect for Health Colorado

Small businesses can also explore options through Connect for Health Colorado, the state’s health insurance marketplace. This platform offers a range of standardized plans that meet state and federal requirements. It’s an excellent resource for comparing different plans and finding the best fit for your business.

Applying for small group health insurance in Colorado doesn't have to be daunting. With the help of a knowledgeable broker and a clear understanding of the process, you can secure the right coverage for your employees quickly and efficiently.

Next, we'll address frequently asked questions about small group health insurance to clear up any lingering uncertainties.

Frequently Asked Questions about Small Group Health Insurance

How do small businesses qualify for health insurance in Colorado?

Small businesses in Colorado can qualify for health insurance by meeting specific criteria. One key factor is the number of employees. Businesses with 2 to 100 employees can apply for small group health insurance. However, to be eligible for tax credits, businesses must have fewer than 25 full-time employees, and these employees should earn an average of about $50,000 a year or less.

Tax credits can significantly reduce the cost of providing health insurance. Eligible businesses can receive up to a 50% tax credit for their contributions to employee health plans through the SHOP marketplace. Nonprofit organizations can receive a 35% tax credit.

What is the minimum number of employees required to offer small group health insurance?

In Colorado, the minimum number of employees required to offer small group health insurance is two. This means even small businesses with just a couple of employees can provide health coverage. Offering health insurance can help attract and retain quality employees, making your business more competitive.

Can small businesses group together for health insurance?

Yes, small businesses can group together to form insurance cooperatives. These cooperatives allow businesses to combine their employee counts to qualify for better group rates. By pooling resources, small businesses can access more affordable and comprehensive health insurance plans.

Insurance cooperatives can be particularly beneficial for very small businesses that might struggle to meet the minimum employee count on their own. Grouping together can also provide more leverage when negotiating with insurance providers, potentially leading to reduced premiums and better coverage options.

Understanding these aspects of small group health insurance can help Colorado businesses make informed decisions about offering health benefits to their employees. With the right approach, small businesses can provide valuable health coverage and take advantage of significant cost savings.

Conclusion

Navigating small group health insurance in Colorado can be daunting, but you don't have to do it alone. At Kelmeg & Associates, Inc., we specialize in providing expert guidance to help you find the perfect insurance plan custom to your business needs. Our personalized approach ensures that you and your employees get the best coverage without the stress of understanding every detail.

We understand that every business is unique, which is why we offer customized plans that fit your specific requirements. From helping you through the application process with Connect for Health Colorado to exploring various coverage options, our team is here to support you every step of the way.

Choosing the right health insurance plan is crucial for attracting and retaining top talent. By offering a comprehensive benefits package, you demonstrate your commitment to your employees' well-being. This not only boosts morale but also improves productivity and loyalty within your workforce.

We are committed to simplifying the insurance process for you, ensuring that you make informed decisions that benefit both your business and your employees. Our expertise in the Colorado health insurance market means you can trust us to find solutions that balance quality and affordability.

Ready to explore your options? Contact Kelmeg & Associates, Inc. today, and let us help you secure the right small group health insurance plan for your business.