Navigating Health Insurance Agents in the Centennial State

Navigating health insurance can be daunting, especially in the diverse landscape of Colorado. For anyone seeking a health insurance agent colorado, understanding the local market and finding the right guidance is crucial. Here's what you need to know right away:

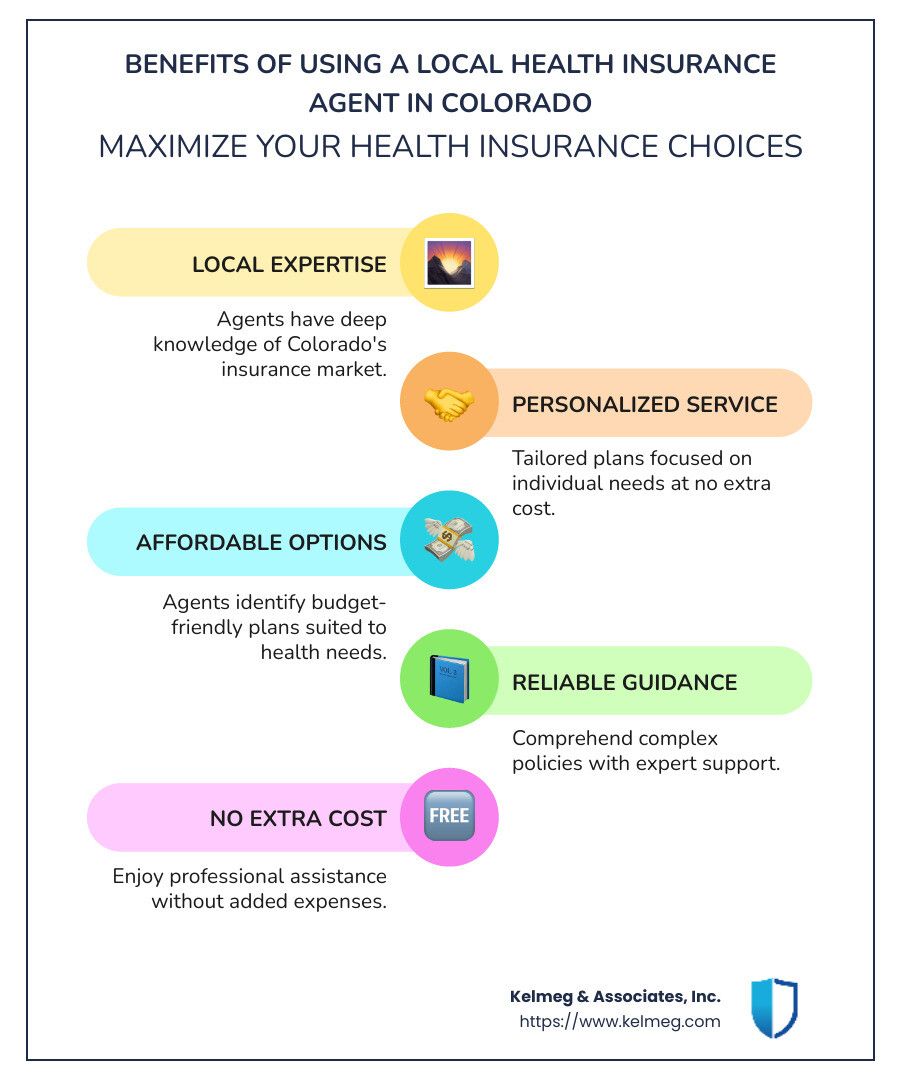

- Local Expertise: Agents familiar with Colorado's insurance landscape can offer custom advice.

- Personalized Service: Work with agents who focus on your unique needs without extra costs.

- Affordable Options: Agents help identify plans that fit your budget and health needs.

- Reliable Guidance: Get support in understanding complex insurance policies.

With numerous health insurance options available, having an expert who knows the nuances of Colorado's market is invaluable. This aligns perfectly with the services offered by Kelmeg & Associates, Inc., where we prioritize your needs and ensure you receive personalized and cost-effective health insurance solutions.

My name is Kelsey Mackley, and I've dedicated my career to assisting individuals and businesses find the best health insurance coverage. With expertise as a health insurance agent colorado, I help clients understand their options and secure the right plan to meet their needs.

Understanding Health Insurance Agents in Colorado

When it comes to finding the right health insurance, having a health insurance agent in Colorado by your side can make all the difference. Here's why:

Licensed Agents

In Colorado, health insurance agents must be licensed. This means they have passed exams and met the state requirements to provide you with the best advice. These agents are trained to understand the intricacies of health insurance policies and can guide you through the options available.

Local Expertise

Colorado's insurance market is unique, with specific plans and providers that may not be available elsewhere. Local agents, like those at Kelmeg & Associates, Inc., know the ins and outs of the state's offerings. They can help you find plans that fit your needs, whether you're in Boulder, Broomfield, or Adams County.

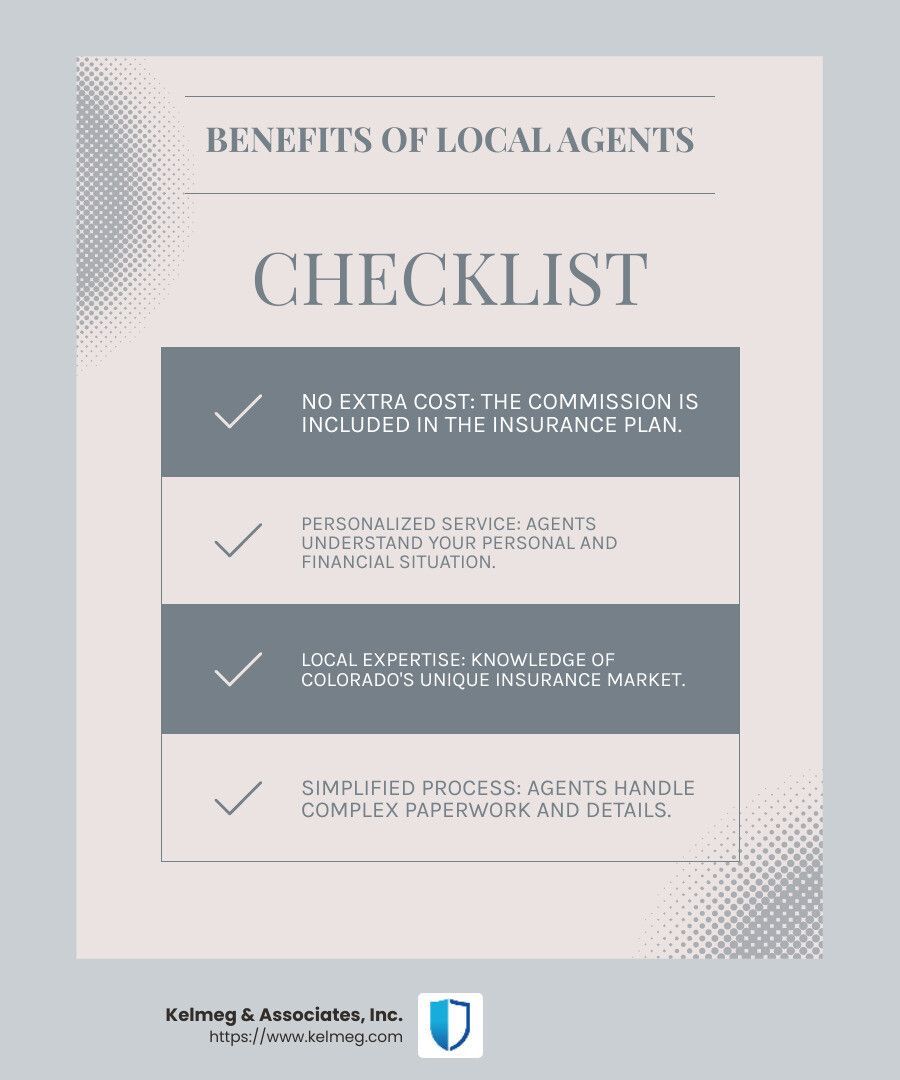

No Extra Cost

One of the best parts about working with a health insurance agent is that there is no extra cost to you. The price of the insurance plan is the same whether you use an agent or not. This is because the commission is already included in the plan's cost, so you can get expert advice without worrying about additional fees.

Why Choose a Local Agent?

- Personalized Service: Agents take the time to understand your personal and financial situation.

- Custom Advice: They offer solutions that fit your specific health needs and budget.

- Simplified Process: Agents handle the complex paperwork and details, making the process smoother for you.

Choosing a health insurance agent with local expertise ensures you get the best possible guidance. At Kelmeg & Associates, Inc., we pride ourselves on providing personalized, cost-effective solutions to help you steer health insurance with ease.

Benefits of Using a Health Insurance Agent

Navigating health insurance can be overwhelming. That's where a health insurance agent in Colorado comes in handy. Let's explore the benefits of using an agent:

Free Services

One of the standout advantages of working with a health insurance agent is that their services are free to you. The cost of the insurance plan remains unchanged whether you use an agent or go it alone. This is because agents earn a commission from the insurance company, not from you. This means you can tap into their expertise and support without incurring extra costs.

Personalized Plans

Every individual and family has unique health needs and financial situations. Health insurance agents excel at crafting personalized plans custom to your specific circumstances. By understanding your health history, budget, and future needs, agents can identify the best options for you. This personalized approach ensures you're not paying for unnecessary coverage or missing out on essential benefits.

Expert Advice

Health insurance agents are well-versed in the complexities of different insurance plans. They provide expert advice to help you make informed decisions. Agents keep up-to-date with the latest changes in the insurance market and regulations, like the Affordable Care Act (ACA). This means they can guide you through the maze of options, ensuring you choose a plan that aligns with your needs and complies with all necessary regulations.

Simplified Enrollment Process

Working with an agent simplifies the often cumbersome enrollment process. They handle the paperwork, clarify any confusing terms, and ensure you meet all deadlines. This support is invaluable, especially during open enrollment periods or when transitioning to a new plan.

Peace of Mind

Knowing you have a knowledgeable professional in your corner provides peace of mind. Agents are there to answer questions, resolve issues, and offer ongoing support. This relationship can be particularly beneficial if your health needs change or if you encounter any problems with your coverage.

In summary, engaging with a health insurance agent in Colorado offers numerous benefits, from cost-free services to personalized and expert advice. It's a smart move to ensure you're covered with the best possible plan for your needs.

How to Choose the Right Health Insurance Agent in Colorado

Choosing the right health insurance agent in Colorado is crucial for finding the best coverage that meets your needs. Here's what you should consider:

Certified Producers

First, ensure that the agent is a certified producer. Certified producers have special training and credentials to help you steer the health insurance landscape. They are knowledgeable about the latest regulations and can provide insights into the most suitable plans for you. Certification ensures that the agent is qualified to offer guidance on various insurance products, including those compliant with the Affordable Care Act (ACA).

ACA Compliance

The Affordable Care Act (ACA) was designed to make health insurance more accessible and affordable. When selecting an agent, verify that they are well-versed in ACA compliance. This means they should help you find plans that cover essential health benefits and protect you against high medical costs. An agent familiar with ACA requirements can also assist in determining if you qualify for any subsidies or tax credits, potentially lowering your premium costs.

Understanding Individual Needs

Every person's health insurance needs are unique. A good agent will take the time to understand your individual needs. This involves assessing your health history, budget, and future health care requirements. By doing so, they can recommend plans that offer the right balance of coverage and cost. Whether you're looking for individual, family, or small business plans, the right agent will tailor their recommendations to fit your situation.

Local Expertise

Finally, consider the agent's local expertise. Agents with a deep understanding of the Colorado health insurance market can offer more relevant advice and options. They are familiar with the local carriers and can provide insights into plans that might not be widely known but are beneficial in your area. Local expertise also means they can quickly address any issues that may arise with your coverage.

By focusing on these factors—certified producers, ACA compliance, understanding individual needs, and local expertise—you can confidently select a health insurance agent who will help you find the best plan for your circumstances.

Frequently Asked Questions about Health Insurance Agents in Colorado

How much do health insurance agents get paid in Colorado?

In Colorado, health insurance agents typically earn through commissions rather than a fixed salary. The average pay for agents can vary widely depending on their experience, the number of clients they serve, and the specific insurance products they offer. On average, health insurance agents in Colorado can expect to earn anywhere from $40,000 to $60,000 per year. However, those with a large book of business—which means a substantial number of clients—can earn significantly more.

Is it cheaper to get health insurance through an agent?

Many people worry about extra costs when using an agent, but here's the good news: health insurance agents in Colorado provide their services at no additional cost to you. Agents like those at Kelmeg & Associates, Inc. offer free services to help you find the best plan for your needs. They earn commissions from the insurance companies, not from you. This means you get expert advice and personalized plan recommendations without paying extra. In fact, working with an agent can often save you money by helping you find plans with the best rates and benefits.

Can you make money as a health insurance agent?

Yes, you can definitely make a living as a health insurance agent in Colorado. The primary source of income for agents is commission from the insurance companies for each policy they sell. As agents build their book of business, they can increase their earnings potential. Successful agents who maintain strong relationships with clients and continue to expand their client base can achieve a lucrative career in this field. The key is to provide excellent service and build trust with clients, which can lead to referrals and repeat business.

Navigating health insurance can be tricky, but with the right agent, you can find the best coverage without the hassle.

Conclusion

Navigating health insurance can feel overwhelming, but that's where Kelmeg & Associates, Inc. steps in. Our team of experienced health insurance agents in Colorado is dedicated to providing expert guidance custom to your individual needs. We believe that everyone deserves access to the best coverage possible, and we work tirelessly to help you achieve that.

Our agents offer personalized service without any extra cost to you. We understand the complexities of the insurance landscape and use our local expertise to simplify the process. Whether you're looking for Medicare, individual, family, or group insurance plans, we have you covered.

Choosing the right health insurance plan is crucial, and having the support of knowledgeable professionals can make all the difference. At Kelmeg & Associates, Inc., we pride ourselves on our commitment to our clients. We're here to ensure you find the most suitable and cost-effective plan for your needs.

Ready to explore your options? Let us help you find the perfect insurance solution. Visit our services page to learn more about how we can assist you today.