From Denver to Dallas—Will Your Colorado Life Insurance Policy Follow You?

Why Your Colorado Life Insurance Policy Works Nationwide

Is a Colorado life insurance policy good in other states? Yes - your Colorado life insurance policy remains valid and enforceable nationwide as long as you continue paying premiums on time. Here's what you need to know:

Key Facts:

- Policy stays active- Coverage continues regardless of where you live

- Premiums remain stable- Moving won't trigger rate increases

- Death benefits guaranteed- Beneficiaries can claim from any state

- State protections may vary- Free-look periods and grace periods differ by state

- Guaranty association coverage- Protection limits depend on your state of residence

Whether you're relocating from Denver to Dallas or anywhere else in the country, your life insurance contract travels with you. The policy terms, death benefit amount, and cash value (if applicable) stay exactly the same.

However, some state-specific protections and regulations will change based on your new home state. Colorado's 15-day free-look period and 31-day grace period may differ from your destination state's requirements. Most importantly, if your insurance company becomes insolvent, your protection will come from your new state's guaranty association rather than Colorado's $300,000 coverage limit.

I'm Kelsey Mackley, and I've helped countless clients steer the complexities of is a Colorado life insurance policy good in other states scenarios during major life transitions. At Kelmeg & Associates, Inc., I specialize in ensuring your life insurance coverage remains seamless and comprehensive, no matter where life takes you.

Is a Colorado Life Insurance Policy Good in Other States?—Quick Facts

Here's the good news: is a Colorado life insurance policy good in other states? Absolutely. Your policy travels with you, and the move won't void your coverage or change your premium payments.

Think of your life insurance policy like a really important contract—one that doesn't care about zip codes. Whether you're leaving the Rocky Mountains for Florida's beaches or Texas plains, your policy stays put in your financial portfolio.

| State | Free-Look Period | Grace Period |

|---|---|---|

| Colorado | 15 days | 31 days minimum |

| Texas | 20 days | 31 days minimum |

Is a Colorado life insurance policy good in other states? Short answer

Your Colorado life insurance policy remains completely valid when you move to another state. The contract law principles that govern insurance don't stop at state borders, and your coverage continues without interruption.

This portability works because of how the insurance industry operates. Most insurer licensing covers multiple states—your insurance company likely does business in your new state too. Plus, interstate commerce regulations ensure that valid insurance contracts stay valid when you cross state lines.

The beauty of this system? Your death benefit amount stays the same. Your premium stays the same. Even your cash value (if you have whole life insurance) keeps growing at the same rate.

Key numbers you should know

Colorado has some specific rules that might change when you move. The 15-day free-look period gives you time to review new policies and cancel if needed. Your 31-day grace period provides breathing room if you're late on premium payments.

Here's what really matters for your financial protection: Colorado's guaranty association provides up to $300,000 in coverage for life insurance death benefits if your insurer fails. They also protect up to $100,000 in cash values.

When you move, your new state's guaranty association takes over this protection role. Some states offer higher limits, others lower. It's worth checking what your new home state provides—though honestly, most major insurers are rock-solid financially, so this backup protection rarely comes into play.

The bottom line? Your policy works everywhere, but the safety nets might look a little different.

What Actually Changes When You Relocate

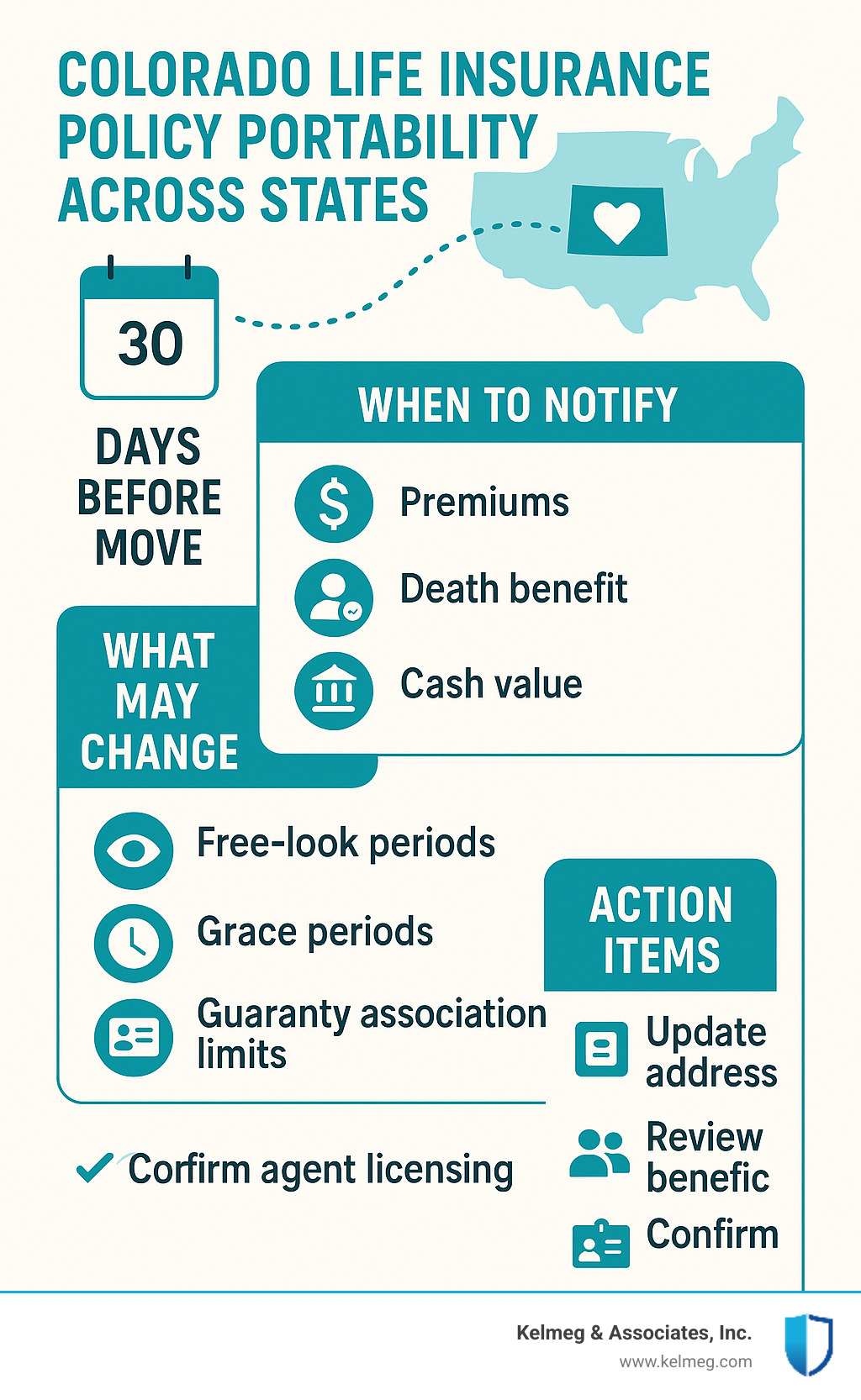

While your policy remains valid, several practical aspects change when you move out of Colorado. Understanding these changes helps you maintain seamless coverage and avoid potential complications.

The first thing on your moving checklist should be updating your address with your insurance company. Most insurers require notification within 30 days of your move. This isn't just bureaucratic paperwork—it ensures you receive premium notices, policy updates, and other important communications at your new home.

Your premium amount stays the same when you relocate, which is great news for your budget. However, the consumer protections you enjoyed in Colorado might shift slightly. Colorado's generous 15-day free-look period and 31-day grace period may differ from your new state's requirements. These changes won't affect your existing policy, but they'll apply to any new coverage you purchase.

If you have beneficiaries living in different states, their location becomes less relevant once you move. The claims process works smoothly regardless of where your beneficiaries live, as long as they have the proper documentation and policy information.

Is a Colorado life insurance policy good in other states when it comes to taxes?

Here's some welcome news: is a Colorado life insurance policy good in other states from a tax perspective? Absolutely. The tax benefits that make life insurance attractive remain intact when you move.

Death benefits stay federally tax-free no matter where you live or where your policy originated. Your beneficiaries won't owe income tax on the death benefit, whether they're in Texas, Florida, or anywhere else in the country.

State premium taxes are already baked into your premium costs and won't change when you move. These taxes are based on where your policy was issued—Colorado—not where you currently live. Your insurance company handles these behind the scenes.

Cash value growth continues to accumulate tax-deferred, and policy loans generally remain tax-free events. The federal tax code treats life insurance consistently nationwide, so you won't lose any tax advantages by relocating.

The technical distinction between your policy's "situs" (Colorado, where it was issued) and your new "domicile" rarely affects day-to-day policy management, though it can matter for complex estate planning situations.

Will your beneficiaries face problems?

Your beneficiaries shouldn't lose sleep over claiming benefits from your Colorado policy, even if they live across the country. The claims process remains straightforward regardless of state boundaries.

The most important requirement is obtaining a certified death certificate from whatever state the death occurs in. This document, along with the policy information and a completed claim form, is typically all that's needed to start the process.

Most insurance companies make filing claims convenient through online portals, phone calls, or mail. Your beneficiaries won't need to travel to Colorado or deal with complicated interstate procedures.

Incontestability protection kicks in after your policy has been in force for two years, providing rock-solid protection for your beneficiaries. Once this period passes, the insurance company cannot contest the policy based on misstatements in the application, giving your loved ones peace of mind.

The key is making sure your beneficiaries know about the policy and can easily access the necessary information when the time comes. Keep policy documents in a safe but accessible place, and consider sharing basic details with your beneficiaries.

More info about Life Insurance

Guaranty Associations & Insolvency Protection Across State Lines

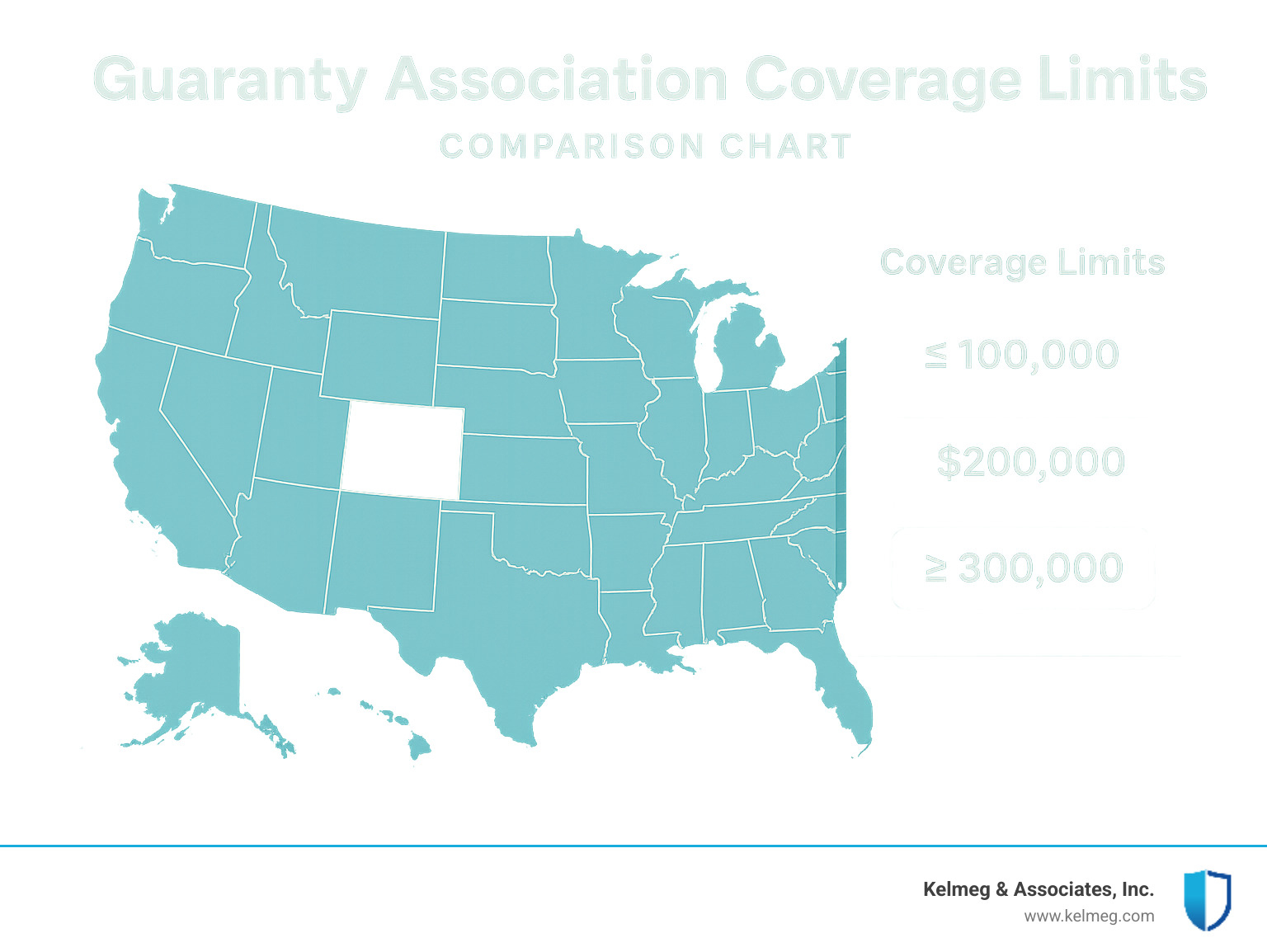

Here's where things get interesting—and potentially concerning—when you move out of Colorado with your life insurance policy. While is a Colorado life insurance policy good in other states in terms of basic coverage? Absolutely. But the safety net protecting you if your insurance company goes belly-up? That's a different story.

In Colorado, you're protected by the Colorado Life & Health Insurance Protection Association, which acts like a backstop if your insurance company fails. This safety net covers up to $300,000 for life insurance death benefits and $100,000 in cash surrender value. It's reassuring protection that most Coloradans never think about—until they move.

When you relocate to another state, your life insurance policy absolutely remains valid and enforceable. You'll keep paying the same premiums, your death benefit stays the same, and your cash value continues growing. But here's the catch: Colorado's guaranty association protection no longer covers you once you establish residency elsewhere.

Instead, you'll fall under your new state's guaranty association umbrella. The National Organization of Life and Health Guaranty Associations (NOLHGA) helps coordinate between states, but each state operates its own protection system with its own rules and limits.

What happens if your insurer fails after you move?

If your insurance company becomes insolvent after you've moved, your protection comes from your state of residence, not Colorado. This rule applies regardless of where you originally bought your policy or how long you lived in Colorado.

Your new state's guaranty association will handle your claim according to their coverage limits and procedures. NOLHGA coordinates the process, ensuring smooth communication between states, but each state's association operates independently under its own laws.

If your policy value exceeds your new state's guaranty limits, the excess becomes a pro-rata claim against the insurance company's liquidation estate. This means you might have to wait longer and potentially receive less than the full amount—similar to how Colorado handles claims that exceed their limits.

The timing of when your insurance company fails matters too. The critical date is your residency status when the insolvency occurs, not when you bought the policy or when you moved.

Can you rely on Colorado's $300k safety net elsewhere?

Unfortunately, no. Once you pack up and establish legal residency in another state, Colorado's $300,000 life insurance protection no longer applies to you. Your protection shifts entirely to your new state's guaranty association.

This change can work in your favor or against you, depending on where you move. Some states offer higher protection limits —up to $500,000 for life insurance death benefits—while others provide less coverage than Colorado's $300,000 limit.

The timing of your residency change determines which state's protection applies. Legal residency is typically established through factors like where you register to vote, get your driver's license, and spend the majority of your time. It's not just about having a mailing address—you need to actually live there.

Most people never need guaranty association protection because insurance company failures are rare. But understanding this change helps you make informed decisions about your coverage, especially if you're moving to a state with lower protection limits.

Licensing & Servicing: Agents, Conversions, and Notifications

Here's some good news: your relationship with your Colorado insurance agent doesn't have to end when you pack up and move. While insurance licensing gets a bit complicated across state lines, most of the important stuff stays exactly the same.

Your Colorado agent can absolutely continue helping you with your existing policy, no matter where you end up living. Think of it this way—they sold you the policy when you lived in Colorado, so they can keep servicing it even if you're now sipping sweet tea in Georgia or skiing in Vermont.

The catch comes when you want to buy new coverage or make major changes to your existing policy. That's when licensing gets tricky. If your agent wants to sell you additional coverage in your new state, they'll need what's called a non-resident license there. The good news? Most experienced agents already have licenses in multiple states, and getting new ones isn't too difficult thanks to the National Insurance Producer Registry (NIPR).

Is a Colorado life insurance policy good in other states when it comes to ongoing service? Absolutely. Your agent maintains full authority to help you with policy loans, beneficiary changes, premium adjustments, and all the other services you might need.

Your action checklist before moving

Moving is stressful enough without worrying about your life insurance. Here's what you need to do to keep everything running smoothly:

About a month before you move, give your insurance company a heads up about your new address. This isn't just courtesy—it's important for making sure you don't miss any critical communications. While you're at it, double-check that your automatic premium payments will still work if you're changing banks or credit cards.

Take a few minutes to review your beneficiaries too. Moving often coincides with other life changes, and you want to make sure the right people are listed. If you're moving closer to some family members or farther from others, now's a good time to think about whether your current setup still makes sense.

Once you're settled in your new home, get your address updated everywhere—driver's license, voter registration, and definitely with your insurance company. Keep good records of all your premium payments and any correspondence with your insurer. Trust me, having everything organized makes life easier if you ever need to reference something later.

Within the first couple months, confirm that everything is working correctly. Are your policy documents arriving at the right address? Are premium payments processing smoothly? It's much better to catch any hiccups early than to find problems when you need your coverage most.

Staying with your Colorado agent from afar

Distance doesn't have to mean saying goodbye to great service. Modern technology makes it incredibly easy to maintain a strong relationship with your Colorado agent, even from thousands of miles away.

Video calls work beautifully for policy reviews and planning discussions. You can share documents electronically, and many agents use secure portals that make managing your coverage just as convenient as when you lived down the street from their office.

Your agent's servicing authority remains completely intact for your existing Colorado policy. They can help you with policy loans, answer questions about your coverage, assist with claims if needed, and handle routine administrative tasks. The insurance company recognizes their ongoing relationship with you regardless of your zip code.

The NIPR system makes it relatively straightforward for agents to expand their licensing if they want to help you with new coverage. Many agents already hold licenses in multiple states, especially those who work with clients who travel frequently or have multi-state connections.

Is a Colorado life insurance policy good in other states for ongoing agent relationships? Absolutely. Your agent remains your advocate and advisor, helping ensure your coverage continues to meet your needs as your life evolves in your new location.

Frequently Asked Questions about Colorado Policies in Other States

These are the questions I hear most often from clients wondering is a Colorado life insurance policy good in other states. Let me give you the straight answers based on years of helping families steer these exact situations.

Will my premiums increase just because I moved?

Your premiums stay exactly the same when you move. That's one of the beautiful things about life insurance—your rate is locked in based on your age and health when you first bought the policy, not where you happen to live now.

I've had clients worry that moving from Colorado Springs to expensive cities like San Francisco or New York would somehow trigger higher premiums. It doesn't work that way. Your insurance company can't suddenly decide to charge you more just because you changed your zip code.

Now, if you're thinking about buying additional coverage in your new state, those premiums might be different from what you'd pay in Colorado. But your existing policy? That rate is yours to keep.

Do I need a new medical exam in my new state?

Absolutely not. Your existing Colorado life insurance policy doesn't require any new medical exams when you move. The health information and underwriting from when you originally applied stays valid no matter where you live.

This is actually a huge advantage if your health has changed since you first got coverage. Maybe you've developed diabetes or had a heart issue—your original policy remains in force at the same premium, with no questions asked about your current health status.

The only time you'd need a new medical exam is if you're applying for completely new coverage or making certain types of policy changes that require fresh underwriting. But for simply maintaining your existing policy in a new state? Your medical information travels with you, unchanged.

Can I switch my Colorado policy to a local one without losing cash value?

This is where I always tell clients to pump the brakes and think carefully. Switching from your Colorado policy to a brand-new local policy is rarely a good financial move.

Here's what typically happens when you "replace" your existing policy: you'll face surrender charges on your current policy, potentially lose accumulated cash value, and start over with a new two-year contestability period. Plus, you'll pay premiums based on your current age and health, which are likely higher than when you were younger.

Instead of switching, consider keeping your Colorado policy and simply adding supplemental coverage if you need more protection. For certain policy types, you might explore 1035 exchanges, which can preserve some tax advantages, but these situations require careful analysis.

The bottom line? In my experience, the vast majority of clients are better off keeping their existing Colorado coverage rather than starting fresh somewhere new. Your policy is portable for a reason—take advantage of that benefit rather than giving it up unnecessarily.

Conclusion

Moving to a new state doesn't have to mean worrying about your life insurance coverage. Is a Colorado life insurance policy good in other states? The answer is a resounding yes—your policy travels with you, maintaining all its original benefits and protections.

Your coverage stays active, your premiums remain unchanged, and your beneficiaries keep their full protection no matter where life takes you. Whether you're heading from Colorado Springs to California or Denver to Delaware, your policy contract follows you across state lines without missing a beat.

Of course, some details do shift when you relocate. Your new state's guaranty association will provide different coverage limits if your insurer ever fails, and regulatory protections like free-look periods might vary from Colorado's standards. But these changes don't weaken your core coverage—they're simply different safety nets in your new home state.

At Kelmeg & Associates, Inc., I've walked countless clients through these transitions, helping them understand exactly how their Colorado policies work after a big move. We've built our reputation serving Boulder, Lafayette, Broomfield, Adams County, and communities throughout Colorado, but our commitment to your peace of mind doesn't stop at state borders.

The truth is, most people overthink the complexity of moving with life insurance. Your policy is designed to protect your family regardless of geography, and that's exactly what it does. The key is staying informed about the changes and taking simple steps like updating your address and reviewing your beneficiaries.

If you're planning a move or have already settled into your new state, don't let questions about your coverage keep you up at night. A quick conversation can clear up any confusion and ensure you're maximizing your policy's benefits in your new location.

Ready for that peace-of-mind review? We're here to help you steer your coverage with the same personalized attention you've come to expect, no matter where you call home.