Insuring Your Team in Colorado Without Losing Your Mind

Why Colorado Group Health Insurance Doesn't Have to Be Overwhelming

Colorado group health insurance is a critical decision that affects both your business finances and employee satisfaction. The good news? You have more options than ever before - from traditional plans to innovative alternatives that could save you up to 50% on costs.

Quick Answer for Colorado Businesses:

- Small groups (2-100 employees) can enroll any time of year

- Colorado Option plans offer $0 primary care and mental health visits

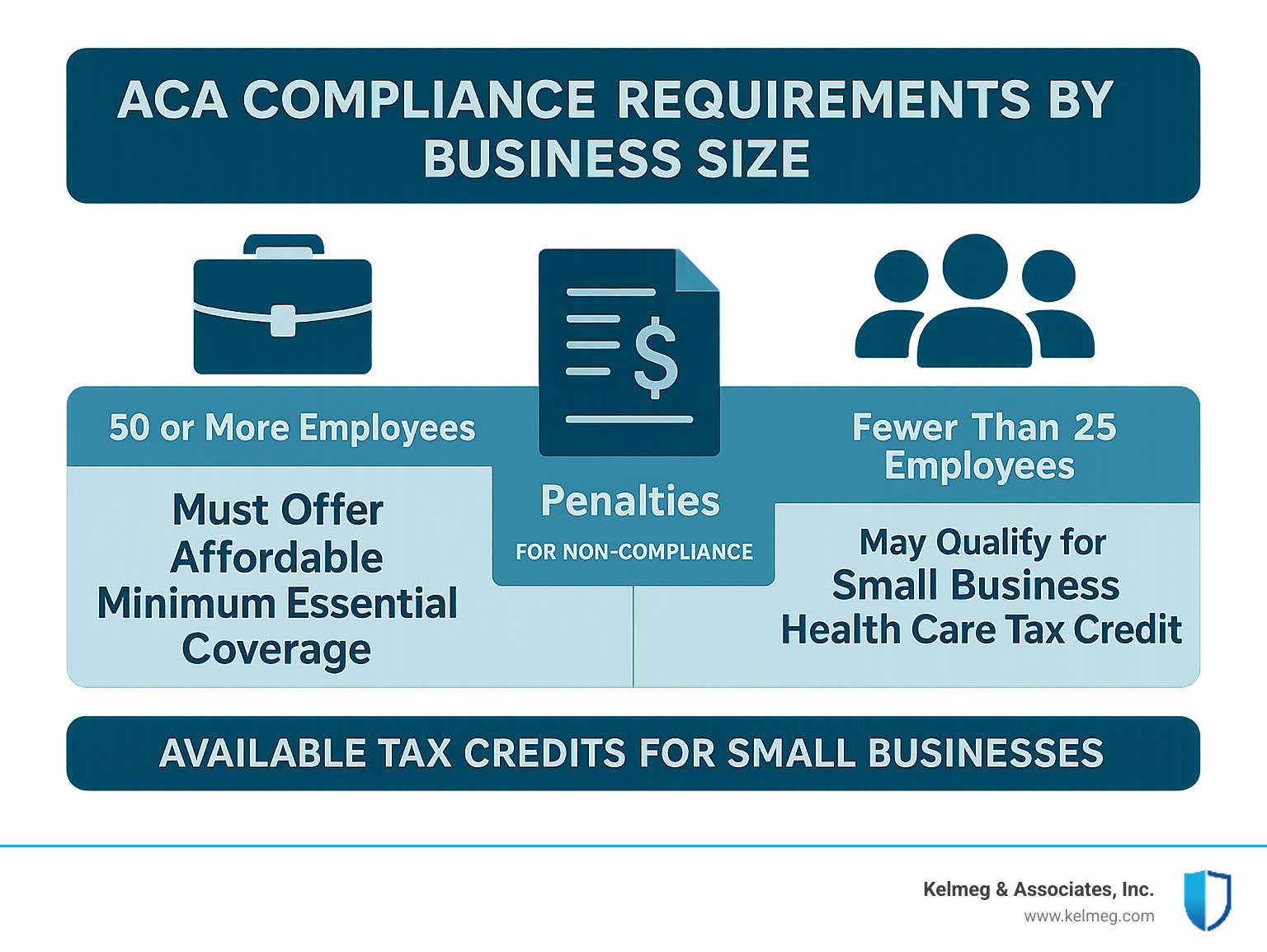

- Employers with 50+ full-time employees must offer coverage or face penalties

- Tax credits available for businesses with ≤25 employees earning average wages ≤$50,000

- Alternative options like health sharing and Direct Primary Care can reduce costs by 20-30%

Finding affordable health insurance for Colorado businesses is getting tougher every year, but it doesn't have to drive you crazy. Between rising premiums, confusing plan designs, and compliance requirements, many business owners feel overwhelmed before they even start shopping.

The reality is simple: your employees want good healthcare coverage, and you want to control costs while staying compliant. Whether you're a small business with just two employees or a larger company approaching the 50-employee ACA threshold, understanding your options is the first step toward making a smart decision.

As Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., I've helped countless Colorado businesses steer the complexities of Colorado group health insurance to find solutions that work for both employers and employees.

Colorado Group Health Insurance 101

Think of Colorado group health insurance as a team sport where everyone wins. Instead of each employee going it alone in the individual market, your business creates a group where everyone shares the risk - and the benefits.

The magic happens through risk-pooling. When you have multiple people in one insurance group, the healthy employees help balance out the costs for those who need more medical care.

Most Colorado employers pay between 50-80% of their employees' premium costs, with workers covering the rest through payroll deductions. In Colorado, you can start a group plan with as few as 2 employees and go up to 100- that's the "small group" market. Once you hit 101 employees, you graduate to the "large group" market with different rules and more customization options.

One of the best parts about group coverage? Guaranteed issue protection. None of your employees can be turned down or charged extra because of health problems. However, you'll need to meet minimum participation requirements - typically 70% of eligible employees must enroll unless they already have coverage elsewhere.

| Small Group (2-100 employees) | Large Group (101+ employees) |

|---|---|

| Community-rated pricing | Experience-rated pricing allowed |

| Must offer essential health benefits | More flexibility in benefit design |

| Limited plan customization | Can self-insure or use stop-loss |

| Colorado Option plans available | Not eligible for Colorado Option |

| SHOP marketplace access | Direct carrier negotiations |

How Colorado group health insurance works

Colorado keeps things fair for small businesses through community rating. This means your premiums are based on the overall health of the community, not whether your specific team happens to be older or dealing with more health issues.

When shopping for plans, you'll see three main network types. HMO plans offer the lowest costs but require referrals from primary care doctors before seeing specialists. PPO plans cost more but give employees freedom to see specialists directly and even go out-of-network (though they'll pay more). EPO plans split the difference- no referrals needed, but employees must stay within the network.

Don't focus only on premium costs. Your employees will also deal with deductibles, copays, and coinsurance that affect how much they actually pay when they need care.

Colorado group health insurance typically runs on annual open enrollment periods, but employees can join during special enrollment periods when they experience qualifying events like getting married, having a baby, or losing other coverage.

Who qualifies for Colorado group coverage

To get a group plan started in Colorado, you need at least two employees working 30+ hours per week, and here's the key detail: at least one must be a non-spouse W-2 employee. This means if you and your spouse run a business together, you'll need to hire that third person before you can qualify for group coverage.

Business owners and partners can usually participate in their own group plans, though some insurance carriers have specific rules about how this works. Seasonal workers can be included as long as they're working during your plan's active coverage period.

You can set up waiting periods for new employees, but they can't exceed 90 days. Many Colorado businesses find that 30-60 day waiting periods work well - long enough to make sure new hires are sticking around, but not so long that good employees get frustrated waiting for benefits.

Plan Types, Costs & Innovative Alternatives

When it comes to Colorado group health insurance, you've got more choices than you might realize - and some of them could save you serious money.

HMO plans are your budget-friendly option. Your employees will need to pick a primary care doctor and get referrals to see specialists, but the trade-off is lower premiums.

PPO plans are the flexibility champions. Your employees can see any doctor they want, though they'll save money by staying in-network. Yes, you'll pay higher premiums, but the employee satisfaction factor is real.

High Deductible Health Plans paired with Health Savings Accounts are gaining popularity for good reason. Lower premiums mean more money in your pocket each month, and HSAs offer a triple tax advantage that's hard to beat.

Colorado Option plans are a game-changer for small businesses. Every insurance company has to offer the exact same standardized benefits, which makes shopping so much easier. Your employees get $0 primary care visits, $0 mental health visits, and $0 prenatal care. Plus, instead of confusing coinsurance percentages, you get predictable copays like $50 for specialist visits.

But let's talk about the innovative alternatives that are quietly revolutionizing how businesses handle healthcare. Individual Coverage Health Reimbursement Arrangements (ICHRAs) let you give employees a monthly allowance to buy their own individual coverage. It's particularly brilliant for businesses with diverse employee needs.

Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs) are perfect for smaller businesses. You can reimburse employees for their individual health insurance premiums and medical expenses up to annual limits.

Health sharing plans operate on a fascinating community model where members share each other's medical costs. While they're not technically insurance, they can slash your costs by up to 50%. They work especially well for businesses with younger, healthier employees.

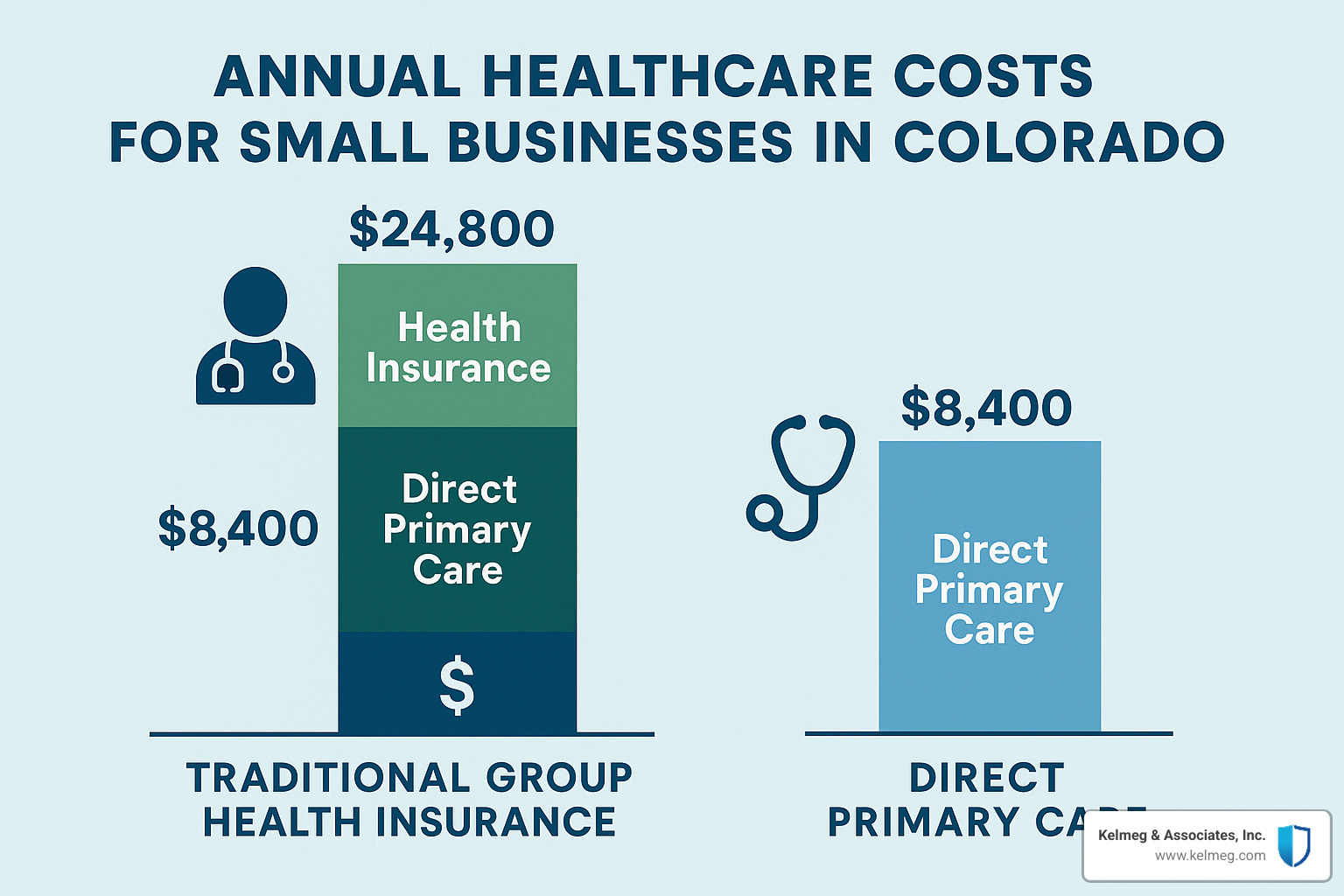

Direct Primary Care might be the most exciting development in years. You pay a monthly fee directly to a primary care practice, and your employees get unlimited access to their doctor - no copays, no deductibles, no insurance hassles. Research shows DPC can lower overall healthcare costs by 20-30% while dramatically improving the doctor-patient relationship.

You can also bundle ancillary benefits like dental, vision, and life insurance. Package pricing often saves you 5% or more, and employees love the convenience of having everything in one place.

Traditional vs Alternative costs for Colorado group health insurance

Colorado group health insurance costs go way beyond monthly premiums. You're looking at premium costs, out-of-pocket expenses, network limitations, administrative burden, and employee satisfaction.

Traditional group insurance has been the standard for decades, but the math is changing. When premiums keep rising 8-12% annually, smart business owners are exploring alternatives. Health sharing combined with Direct Primary Care, for example, might cut your total healthcare spending by 30-40% while actually improving your employees' access to care.

The key is understanding that predictability matters as much as cost. Alternative approaches often provide better cost predictability. Direct Primary Care gives you a flat monthly fee with no surprises. Health sharing plans have clear sharing amounts. ICHRAs let you set a fixed monthly allowance and know exactly what you'll spend.

Here are five cost-cutting strategies that actually work: implementing an HSA-qualified high-deductible plan with employer HSA contributions, bundling ancillary benefits typically saves 5-10%, adding Direct Primary Care as a supplement can reduce urgent care visits, exploring health sharing works well for younger workforces, and using wellness programs can earn premium discounts.

Spotlight on the Colorado Option small-group plans

The Colorado Option deserves its own spotlight because it solves one of the biggest headaches in shopping for Colorado group health insurance- comparing apples to oranges. Starting in 2024, every insurance company offering small group coverage must provide identical standardized plans.

This standardization is brilliant for business owners. Since all carriers offer the same benefits, you can focus on what really matters: cost, network quality, and customer service.

The benefits themselves are genuinely employee-friendly. $0 primary care visits mean your team can see their doctor without thinking twice about cost. $0 mental health office visits remove barriers to getting help. $0 prenatal and post-pregnancy visits support growing families without financial stress.

Instead of percentage-based coinsurance that leaves employees guessing what they'll owe, Colorado Option plans use predictable copays. Your employee knows they'll pay $50 to see a specialist, not "20% of whatever the doctor charges after you meet your deductible."

You can find complete details in the Colorado Option Overview , but the bottom line is simple: Colorado Option plans make shopping easier and provide benefits that employees actually use and appreciate.

Compliance, Tax Credits & Transparency

Compliance isn't the fun part of offering Colorado group health insurance, but it's absolutely critical to get right. The good news is that once you understand the rules, staying compliant becomes much more manageable.

If your business has 50 or more full-time equivalent employees, the ACA employer mandate kicks in. This means you must offer Minimum Essential Coverage (MEC) that meets affordability standards - specifically, the employee's premium can't exceed 9.12% of their household income for 2023.

The penalties for non-compliance are steep. You could face $2,880 per employee(after the first 30) if you don't offer coverage at all. If you offer coverage but it's not adequate and employees end up getting marketplace premium tax credits, the penalty jumps to $4,320 per affected employee.

You'll also need to handle the paperwork side of compliance. This means filing Forms 1094-C and 1095-C annually to report your compliance status to the IRS and provide coverage statements to your employees.

Colorado has also implemented price transparency requirements that affect group health plans. The CAA/Transparency Resource Center provides helpful resources to understand these requirements and stay compliant.

But here's where things get exciting - small businesses can qualify for substantial tax credits that make offering health insurance much more affordable. The federal small business health care tax credit can reimburse up to 50% of the premiums you pay for employee medical, vision, and dental insurance.

To qualify for this credit, your business needs to meet three key requirements: fewer than 25 full-time equivalent employees, average annual wages less than $50,000, and you must pay at least 50% of employee premium costs.

The full 50% credit is available to the smallest businesses - those with fewer than 10 employees and average wages of $25,000 or less. As your business grows beyond these thresholds, the credit gradually phases out, but even partial credits can provide meaningful savings.

Leveraging HRAs & credits inside Colorado group health insurance

Health Reimbursement Arrangements (HRAs) offer some of the most creative and cost-effective approaches to providing health benefits. These arrangements let you reimburse employees for health insurance premiums and medical expenses with tax-free dollars.

ICHRAs provide incredible flexibility by allowing you to define different employee classes and provide different allowance amounts. For example, you might offer executives $800 per month while providing other employees $400 per month.

QSEHRAs are simpler but more limited in scope. For 2024, the maximum annual benefit is $6,050 for individual coverage and $12,250 for family coverage.

Some particularly creative approaches include using HRAs to reimburse high deductibles. You might offer a low-premium, high-deductible plan paired with employer-funded deductible coverage.

When tax time comes, you'll use IRS Form 8941 to claim the small business health care tax credit. Keep detailed records of your premium payments and employee information to make this process smooth.

The key to maximizing these benefits is understanding how they work together. A well-designed HRA strategy combined with available tax credits can make offering quality health benefits surprisingly affordable, even for smaller Colorado businesses.

Choosing, Implementing & Managing Your Plan

Getting the right Colorado group health insurance plan isn't just about finding the cheapest option - it's about understanding what your people actually need. Think about who works for you. Do you have a young tech team that rarely sees doctors, or experienced professionals with families who need comprehensive coverage?

Age makes a huge difference in what employees value. Younger workers often prefer lower monthly premiums even if it means higher deductibles, while older employees typically want predictable copays and comprehensive coverage. Family status matters too- employees with kids need plans where family coverage won't break their budget.

Don't forget about income levels when making your choice. Higher earners might jump at HSA options for the tax benefits, but employees living paycheck to paycheck need coverage that actually covers things without massive out-of-pocket costs.

You've got three ways to shop for coverage. Working with a broker(like us at Kelmeg & Associates, Inc.) costs you nothing extra but gives you expert guidance and comparison shopping. Going direct to carriers might feel faster, but you'll miss out on seeing all your options. Online platforms seem convenient, but they can't answer the tough questions when things get complicated.

Here's something most businesses get wrong: they focus entirely on premiums during negotiations. Smart employers also look at network quality- can employees actually see good doctors? Customer service ratings matter when someone's trying to get a claim approved.

Set your enrollment timeline early and give yourself plenty of breathing room. Most Colorado businesses choose January 1 start dates, but you can begin coverage any month. Just plan for 60-90 days of lead time.

Supplemental benefits like dental, vision, and life insurance often make sense to bundle. You'll save money through package pricing, and your employees get the convenience of one-stop shopping.

For more detailed information about our employer group benefits services, visit our Employer Group Benefits page.

Enrollment periods & administration for Colorado group health insurance

Here's one of the best things about Colorado group health insurance: unlike individual coverage, you can start your group plan any month of the year. That flexibility is golden when you're trying to coordinate with your business planning or cash flow.

Once you pick your plan year though, you're generally stuck with those renewal dates.

New employees can join your plan during special enrollment periods. They can enroll when they're first hired (within your waiting period), when they get married, have a baby, lose other coverage, or experience significant income changes. These special enrollment windows typically last 60 days from whatever triggered them.

Annual renewal time is your chance to make changes, and smart employers start planning 90-120 days ahead. This isn't just about comparing prices - it's your opportunity to reassess whether your current plan still fits your team.

Employee education might be the most important part of this whole process. Many of your employees probably don't understand the difference between a deductible and a copay, or why staying in-network matters. Clear communication during enrollment and throughout the year prevents those panicked phone calls when someone gets a surprise bill.

The good news is that modern administration tools have made managing group plans much easier than it used to be. Most carriers provide online portals where you can handle enrollment, order ID cards, and manage who's eligible. Many integrate directly with your payroll system, so premium collection happens automatically.

Frequently Asked Questions about Colorado Group Health Insurance

Let's tackle the three questions I hear most often from Colorado business owners. These come up in almost every conversation I have about Colorado group health insurance, so you're definitely not alone if you're wondering about these topics.

What happens if my Colorado business with 50+ employees doesn't offer coverage?

Here's the truth - the penalties can really hurt your bottom line. If you have 50 or more full-time equivalent employees and don't offer health insurance, you'll face what's called the employer shared responsibility penalty. For 2023, that's $2,880 per full-time employee after you exclude the first 30 employees.

Let me put this in perspective with a real example. Say you have 60 full-time employees and no health coverage. You'd pay $2,880 times 30 employees (60 minus the first 30), which equals $86,400 per year in penalties. That's a substantial hit that could easily fund a decent group health plan instead.

The IRS doesn't mess around with this either. They'll send you Letter 226-J if they determine you owe a penalty, and you'll have just 30 days to respond with information about your coverage offerings. The penalties are assessed annually, so this isn't a one-time cost - it keeps coming back every year until you provide coverage.

The good news is that offering Colorado group health insurance often costs less than paying these penalties, and you get the added benefit of attracting and keeping better employees.

Can I offer different plans to different employee classes?

This is where things get interesting, and honestly, it's more flexible than most business owners realize. With traditional group insurance, you generally need to offer the same plans to all similarly situated employees, but you can create different classes based on legitimate business reasons.

You might separate employees by full-time versus part-time status, different job categories or departments, various geographic locations, or even union versus non-union employees. The key is having a genuine business reason for the distinction - you can't just pick and choose based on who you like better or who costs more to insure.

But here's where it gets really exciting - ICHRAs provide much more flexibility. With Individual Coverage Health Reimbursement Arrangements, you can define employee classes and provide completely different reimbursement amounts to each class. Maybe executives get $800 per month while other employees get $400 per month. This approach works particularly well for businesses with diverse employee needs or big differences in compensation levels.

The nondiscrimination rules still apply, but ICHRAs give you creative ways to tailor benefits that make sense for your specific workforce.

When can new hires join our group plan?

New employees joining your Colorado group health insurance plan depends entirely on your waiting period policy, which cannot exceed 90 days by federal law. Most businesses I work with choose one of these common approaches:

Immediate eligibility means coverage starts on the first day of employment - this is great for attracting top talent but can be administratively complex. First of the month following hire date gives you a predictable start date and easier payroll management. Many companies prefer 30, 60, or 90 days after hire date to ensure employees are committed before adding them to the plan.

Once your waiting period is satisfied, new employees get a special enrollment period to join the plan. Here's something important to remember - if they decline coverage initially, they'll need to wait until the next open enrollment period unless they experience a qualifying life event like getting married or having a baby.

I usually recommend keeping waiting periods reasonable - maybe 30 to 60 days maximum. Longer waiting periods can hurt your ability to recruit good employees, especially in today's competitive job market where people expect benefits to start relatively quickly.

Conclusion

Finding the right Colorado group health insurance solution really comes down to one thing: having someone in your corner who understands both the complexities of the insurance world and the unique challenges facing Colorado businesses.

After helping hundreds of businesses steer these waters, I've learned that the "perfect" plan doesn't exist - but the right plan for your specific situation absolutely does. Whether you're drawn to the simplicity of Colorado Option plans, intrigued by the cost savings of health sharing, or curious about how Direct Primary Care could transform your employees' healthcare experience, the key is making an informed decision based on your actual needs, not just the lowest premium.

The truth is, your health insurance choice affects everything- from your ability to attract top talent to your monthly cash flow to your employees' peace of mind when they're facing a health challenge. That's why we never rush the process or push you toward a particular solution. Instead, we take time to understand your workforce, your budget, and your goals.

At Kelmeg & Associates, Inc., we've built our entire approach around a simple belief: every Colorado business deserves expert guidance without the hefty consulting fees. We're paid by the insurance carriers, which means our expertise costs you nothing extra. But more importantly, it means we can focus entirely on finding you the best solution rather than selling you the most expensive one.

Whether you're a small business in Boulder just starting to offer benefits, a growing company in Adams County approaching that 50-employee ACA threshold, or an established business looking to control rising costs while keeping employees happy, we've been there. We understand the late-night worries about premium increases, the frustration of comparing plans that seem designed to confuse, and the pressure of making decisions that affect people's lives.

Here's what makes working with us different: we don't just help you buy insurance - we help you build a benefits strategy that strengthens your business. From ensuring seamless compliance with Colorado regulations to maximizing available tax credits to educating your employees so they actually understand and appreciate their benefits, we're with you every step of the way.

Ready to stop feeling overwhelmed by Colorado group health insurance and start feeling confident about your benefits strategy? Let's have a conversation about your specific situation. You can learn more about our comprehensive approach at our Colorado Group Insurance Plans page, where we'll walk you through exactly how we can help you find the right coverage without the stress.

Because at the end of the day, the right health insurance isn't just about managing costs or checking compliance boxes - it's about building the kind of workplace where great people want to stay, knowing they're truly taken care of. And that's exactly what we're here to help you create.