Your Simple Guide to Applying for Medicare in Colorado

Why Understanding Medicare Enrollment in Colorado Matters

Applying for medicare in colorado can feel overwhelming, but the process is actually straightforward when you know the key steps and deadlines. Here's what you need to know:

Quick Answer - How to Apply for Medicare in Colorado:

- Check your eligibility- Age 65, disability for 24+ months, or certain medical conditions

- Know your enrollment window- 7-month Initial Enrollment Period (3 months before to 3 months after turning 65)

- Apply through Social Security- Online at ssa.gov, by phone at 1-800-772-1213, or in person

- Get free help- Colorado SHIP counselors at 1-888-696-7213 provide unbiased guidance

- Choose your coverage- Original Medicare, Medicare Advantage, or supplement plans

Medicare is our country's health insurance program for people age 65 or older, plus certain younger individuals with disabilities. In Colorado, you have 21 stand-alone Medicare Part D prescription drug plans and 46 Medicare Health Plans to choose from in 2024.

Missing your enrollment deadline can cost you. The standard monthly premium for Medicare Part B in 2024 is $174.70, but late enrollment penalties can increase this amount permanently. That's why understanding your timeline is crucial.

The good news? Colorado offers excellent support through the State Health Insurance Assistance Program (SHIP), which provides free, unbiased Medicare counseling at 17 local locations statewide.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I help individuals and families steer complex health insurance decisions, including applying for medicare in colorado. My experience has shown me that with the right guidance, Medicare enrollment becomes much simpler than most people expect.

Eligibility & Enrollment Deadlines

Getting the timing right is everything when applying for medicare in colorado. Think of Medicare enrollment like catching a train – miss your window, and you might be waiting on the platform longer than you'd like, possibly paying extra for the privilege.

Who qualifies for Medicare? The rules are pretty straightforward. You're eligible if you're 65 or older and either a U.S. citizen or permanent resident. But age isn't the only ticket to Medicare. If you're under 65 with a qualifying disability, you can enroll after receiving Social Security disability benefits for 24 months.

There are also two medical conditions that fast-track your eligibility: End-Stage Renal Disease (ESRD) requiring regular dialysis or a kidney transplant, and ALS (Lou Gehrig's disease), which gets you immediate Medicare coverage with no waiting period.

Here's some good news about costs: most people qualify for premium-free Part A because they or their spouse worked and paid Medicare taxes for at least 10 years. If you don't have enough work credits, you can still get Part A, but you'll pay a monthly premium.

Now, let's talk about those crucial enrollment windows. Your Initial Enrollment Period (IEP) is your golden opportunity – a 7-month window that starts 3 months before you turn 65, includes your birthday month, and extends 3 months after. So if you're turning 65 in June, your IEP runs from March through September. Here's a quirky rule: if your birthday falls on the first of the month, your IEP actually starts one month earlier.

What if you miss your IEP? Don't panic, but do prepare for some consequences. The General Enrollment Period runs from January 1 to March 31 each year. The catch? Your coverage won't start until July 1, and you'll likely face late-enrollment penalties that stick with you permanently.

Special Enrollment Periods (SEPs) can be lifesavers if you experience qualifying life events like losing employer coverage or moving to a new area. These give you extra opportunities to enroll outside the standard windows.

Still working past 65? You might be able to delay Medicare enrollment without penalty if you have employer group health coverage. The key is understanding your 8-month Special Enrollment Period, which begins when either your employment ends or your group coverage stops – whichever comes first.

Key Dates You Must Circle

Let me share the dates that could save you hundreds or even thousands of dollars in penalties and coverage gaps.

Your 7-month Initial Enrollment Period is your best friend. Birthday quirk I mentioned? If you're born on July 1st, your IEP actually begins in March, not April. Mark it clearly on your calendar.

The January 1 through March 31 General Enrollment Period is your backup plan, but it comes with strings attached – late-enrollment penalties and coverage that doesn't start until July 1st.

October 15 through December 7 brings the Annual Open Enrollment Period, when you can switch between Original Medicare and Medicare Advantage, change plans, or add or drop Part D coverage. Any changes you make take effect January 1st.

Finally, that 8-month Special Enrollment Period after employer coverage ends is absolutely critical. This window is specifically for folks who delayed enrollment because they had employer coverage. Don't let this one slip by – it's your penalty-free path back to Medicare eligibility.

Applying for Medicare in Colorado: Step-by-Step

Ready to take the plunge? Applying for medicare in colorado doesn't have to feel like solving a puzzle with missing pieces. Once you know your timeline, the actual application process is surprisingly straightforward.

Before you dive in, take a moment to gather your paperwork. You'll need your Social Security number, a birth certificate or other proof of birth, details about any current health insurance coverage, and W-2 forms or tax returns if you're still working. Having your bank account information handy will also speed things up for premium payments.

Here's something that might surprise you: if you're already receiving Social Security benefits, Medicare might find you instead of the other way around. You'll be automatically enrolled in Medicare Parts A and B starting the month you turn 65, and your Medicare card will arrive in the mail about three months before your birthday. Pretty convenient, right?

For everyone else, you have several paths to choose from. The Social Security Administration handles Medicare enrollment, so you can apply online at ssa.gov(the fastest option), call 1-800-772-1213, or visit your local Social Security office in person. If you want extra support navigating the process, Colorado SHIP counselors at 1-888-696-7213 provide free, personalized assistance.

The Social Security Administration offers more info about online enrollment through their dedicated Medicare portal. You can also apply for Medicare in Colorado with our help at Kelmeg & Associates - we're here to make sure you don't miss any important details.

Online – applying for medicare in colorado in minutes

The online route is like having a 24/7 customer service representative who never gets cranky. Most people find it's the quickest way to get things done.

Start by creating or logging into your mySocialSecurity account at ssa.gov. If you're new to the system, you'll need to verify your identity with some personal information - think of it as a digital handshake.

Once you're in, you'll see two main options. Choose "Apply for Medicare Only" if you're not ready to claim Social Security benefits yet, or "Apply for Retirement and Medicare" if you want to tackle both at once.

The application itself walks you through everything step by step. You'll enter your personal information, work history, and current insurance details. Here's the cool part: the system does real-time eligibility checks, so you'll know right away if there are any hiccups to address.

After reviewing everything carefully, you'll submit with an electronic signature and get a confirmation receipt immediately. No waiting by the mailbox or wondering if your paperwork got lost in a pile somewhere.

You can check your application status anytime through your mySocialSecurity account, and most applications get processed within a few weeks. Your Medicare card will arrive by mail once everything's approved.

In-person or phone – applying for medicare in colorado with local support

Sometimes you want to hear a friendly voice or get help untangling a complicated situation. That's completely understandable, especially when dealing with something as important as your healthcare coverage.

Calling 1-800-772-1213 connects you with representatives who can walk you through the entire application over the phone. They're available 8 AM to 7 PM, Monday through Friday, and they're used to answering all sorts of questions about unique situations.

If you prefer face-to-face interaction, schedule an appointment at your local Social Security office. This works especially well if you have a complicated work history, questions about eligibility, or just feel more comfortable with in-person help. Bring all your documents and plan to arrive a few minutes early.

Here's a special note: if you receive Railroad Retirement benefits, you'll work with the Railroad Retirement Board instead. Give them a call at 1-877-772-5772 rather than going through Social Security.

Colorado SHIP counselors deserve a special mention here. These trained volunteers provide free, unbiased help with Medicare enrollment at 17 locations across Colorado. They can sit with you to complete applications and help you understand your coverage options without any sales pressure.

In some situations, you might need specific CMS forms like CMS-40B(Application for Enrollment in Medicare Part B) or CMS-L564(Request for Employment Information). Don't worry - your SHIP counselor or Social Security representative can help figure out if these apply to your situation and guide you through completing them.

Comparing & Selecting Your Medicare Coverage

After you've completed applying for medicare in colorado, the next big decision is choosing your coverage. This is where many people feel like they're drowning in a sea of brochures and confusing plan names. But here's the thing - it's actually not as complicated as it looks once you understand the basics.

Think of it this way: you're building your Medicare coverage like you'd build a sandwich. Original Medicare (Parts A and B) is your bread - the foundation that covers hospital stays and doctor visits. But just like bread alone doesn't make a great lunch, Original Medicare by itself leaves some gaps.

Medicare Advantage (Part C) is like getting a pre-made sandwich from the deli. These private plans replace your Original Medicare and usually include prescription drug coverage, plus extras like dental and vision care. Colorado offers 46 Medicare Health Plans in 2024, so you've got plenty of options to choose from.

If you prefer to stick with Original Medicare, you can add your own "toppings" with Medicare Supplement (Medigap) insurance. These plans help cover the costs that Original Medicare doesn't, like deductibles and copayments. You'll also need to add a separate Part D prescription drug plan- Colorado has 21 stand-alone Part D plans available.

The choice between Medicare Advantage and Original Medicare with supplements often comes down to whether you want the convenience of one plan that covers everything, or the flexibility to see any doctor who accepts Medicare.

For detailed information about your options, you can explore our Medicare Advantage Plans Colorado and Medicare Supplement Plans Colorado resources. The official Medicare website also lets you review and sign up for Medicare Advantage and drug plans on Medicare.gov.

| Coverage Type | Monthly Premium Range | Provider Network | Out-of-Pocket Limit | Prescription Drugs |

|---|---|---|---|---|

| Original Medicare + Medigap | $0-200+ | Any Medicare provider | Varies by plan | Separate Part D needed |

| Medicare Advantage | $0-116 | Plan network only | $0-8,300 annually | Often included |

| Original Medicare Only | $174.70 (Part B) | Any Medicare provider | No limit | Not covered |

Medicare Advantage plans often have $0 monthly premiums, but you'll be limited to their network of doctors and hospitals. They also have annual out-of-pocket limits, which can provide peace of mind if you have a serious health issue.

Original Medicare with a supplement typically costs more each month, but gives you the freedom to see any doctor who accepts Medicare anywhere in the country. There's no network to worry about, which is especially valuable if you travel frequently or have specialists you don't want to give up.

How to Use Plan Finder Effectively

The Medicare Plan Finder tool on Medicare.gov is like having a personal shopping assistant for your health coverage. But like any tool, you'll get better results if you know how to use it properly.

Before you dive in, gather your prescription medications- all of them, including vitamins and over-the-counter drugs you take regularly. The Plan Finder can calculate your estimated annual drug costs, and trust me, this can save you hundreds or even thousands of dollars.

Upload your complete drug list into the system, including dosages and how often you take each medication. The tool will show you exactly what you'd pay with each plan, taking the guesswork out of your decision.

Check your preferred pharmacies too. Many plans offer lower copays when you use their preferred pharmacy networks. If your neighborhood pharmacy isn't preferred, you might pay significantly more, or you might find a convenient alternative you hadn't considered.

Look for five-star rated plans in your area. Medicare rates plans on quality and performance, and five-star plans offer a special bonus - you can switch to them outside of normal enrollment periods if you change your mind later.

Medicare Advantage plans are sold by county in Colorado. A great plan in Denver might not be available in Grand Junction, so make sure you're looking at options actually available where you live.

The Plan Finder might seem overwhelming at first, but take your time with it. This decision will affect your healthcare and budget for the entire year, so it's worth spending an hour or two to get it right.

Costs, Penalties, Savings & Fraud Protection

Let's talk about money - because understanding Medicare costs upfront prevents sticker shock later. When you're applying for medicare in colorado, knowing what you'll pay helps you budget and choose the right coverage.

Here's what Medicare costs in 2024: Most people pay nothing for Part A if they've worked and paid Medicare taxes for 10 years. However, you'll face a $1,632 deductible each time you're admitted to the hospital. Part B costs $174.70 per month with a $240 annual deductible, then you pay 20% of most services with no cap on your out-of-pocket spending.

Part D prescription drug plans range from $0 to $132 monthly for standalone plans, with deductibles between $0 and $545. The exact amount depends on which plan you choose and your income level.

High earners pay more through something called IRMAA (Income-Related Monthly Adjustment Amount). If your income was high two years ago, you'll pay extra premiums for Parts B and D. For example, if you're single and earned over $103,000 in 2022, you'll pay higher premiums in 2024.

Late enrollment penalties hurt your wallet permanently. Miss your Part B enrollment window, and you'll pay an extra 10% for every 12 months you waited. Wait 18 months to enroll? That's a 20% penalty added to your premium forever. Part D penalties work similarly - you'll pay an extra 1% of $34.70 for each month you went without drug coverage.

Here's some good news: Starting in 2025, your out-of-pocket prescription costs will be capped at $2,000 per year under Part D. This provides real protection if you take expensive medications.

Protecting yourself from fraud is just as important as understanding costs. Medicare fraud schemes cost billions annually and can mess up your benefits. Colorado's Senior Medicare Patrol helps educate residents about common scams.

Watch out for unsolicited phone calls offering "free" medical equipment, door-to-door salespeople(which is illegal for Medicare plans), and anyone asking for your Medicare number in exchange for services. When in doubt, hang up and call Medicare directly at 1-800-MEDICARE. You can also report suspected fraud to Colorado SMP at 1-800-503-5190.

Stretch Your Budget with Assistance Programs

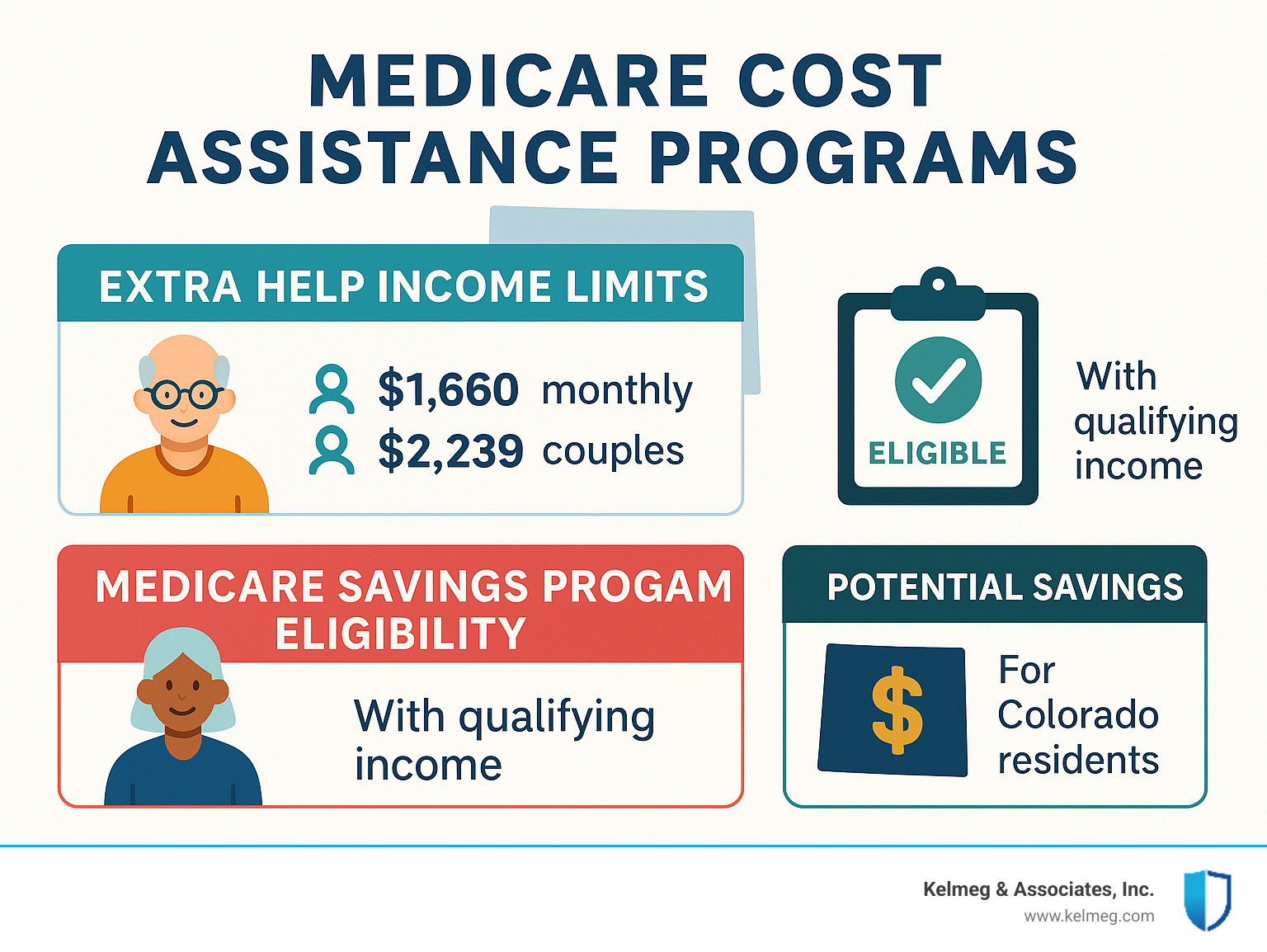

Nobody should struggle to afford their Medicare coverage. Several programs can significantly reduce your costs if you qualify, and many Colorado residents don't even know these programs exist.

Extra Help (also called the Low-Income Subsidy) is a federal program that helps pay your Part D prescription drug costs. In 2024, you might qualify if you earn less than $1,660 per month as a single person or $2,339 per month as a couple. Your savings accounts and investments must be under $10,590 for singles or $16,630 for couples, but your home and car don't count toward these limits.

Medicare Savings Programs through Colorado can pay your Medicare premiums, deductibles, and copayments. These state programs have different income requirements and can save you hundreds of dollars monthly.

Dual eligibility means you qualify for both Medicare and Medicaid. This combination provides excellent coverage with very low costs, plus Medicaid covers services Medicare doesn't, like long-term care.

Drug manufacturer assistance programs help with expensive medications. If you take costly prescriptions, ask your pharmacist or doctor about Patient Assistance Programs (PAPs) from pharmaceutical companies.

Here's my advice for applying: Don't wait if you think you might qualify. Benefits can be retroactive, meaning you could get money back. Gather your Social Security statements, recent pay stubs, and tax returns before applying. You need to reapply annually as your financial situation changes.

The application process isn't complicated, but it helps to have someone guide you through it. That's where our team at Medicare Resource Center Colorado Springs comes in - we help Colorado residents understand and apply for these money-saving programs every day.

Conclusion & Free Colorado Support

Applying for medicare in colorado is a journey that millions of Americans take each year, and you don't have to walk this path alone. Think of it like learning to ride a bike – it seems intimidating at first, but once you understand the basics, it becomes second nature.

The most important thing to remember? Time is your friend when you start early. Your 7-month Initial Enrollment Period gives you plenty of room to research, compare, and make thoughtful decisions about your healthcare future. Don't wait until the last minute – that's when mistakes happen and stress levels skyrocket.

Your immediate next step is determining exactly when your enrollment period begins. Grab your calendar right now and mark those seven months clearly. If you turn 65 in August, your window runs from May through November. Write it down, set phone reminders, or ask a family member to help you stay on track.

Once you know your timeline, gather your important documents – your Social Security number, birth certificate, and information about any current insurance coverage. Having these ready makes the actual application process smooth and quick.

The application itself is surprisingly straightforward. Most people can complete it online at ssa.gov in less than 30 minutes. If you prefer talking to a real person, calling 1-800-772-1213 connects you with helpful Social Security representatives who guide you through every step.

Here's where many people get stuck – choosing between all those coverage options. Colorado offers 67 different Medicare plans in 2024, which sounds overwhelming until you realize that's actually a good thing. More choices mean better odds of finding coverage that fits your specific needs and budget.

Medicare Part B has no out-of-pocket limit, which is why most people benefit from additional coverage through either Medicare Advantage or a Medigap policy. This isn't about selling you more insurance – it's about protecting you from potentially devastating medical bills.

Don't forget to check if you qualify for financial assistance programs. Extra Help and Medicare Savings Programs can reduce your costs significantly, and there's no shame in using benefits you've earned through years of paying taxes.

At Kelmeg & Associates, we've helped thousands of Colorado residents steer their Medicare enrollment. What makes us different? We provide expert guidance at no extra cost to you – our goal is helping you find the best coverage for your situation, not pushing the most expensive plan.

Colorado offers exceptional free support through the State Health Insurance Assistance Program (SHIP). Call 1-888-696-7213 to connect with trained counselors at one of 17 locations statewide. These volunteers provide unbiased advice and can even help you fill out applications.

We serve clients throughout Colorado, from the mountains to the plains, including Lafayette, Broomfield, Boulder, Adams County, and beyond. Whether you prefer meeting in person, talking on the phone, or getting help via email, we're here to support you.

The decisions you make during Medicare enrollment will affect your health and finances for years to come. That's exactly why free resources exist – to ensure you have the information and support needed to make confident choices.

Contact us for a no-cost consultation where we'll review your specific situation and help you understand your options. You can also use the Plan Finder tool on Medicare.gov to compare coverage options available in your county.

Medicare enrollment might seem like a big mountain to climb, but thousands of Coloradans successfully apply for Medicare every year. With the right guidance, timeline, and support system, you'll have the coverage you need to enjoy your retirement with complete peace of mind.

Start early, ask questions, and remember – we're here to help make this process as simple and stress-free as possible.