Colorado Family Insurance Plans That Won't Break the Bank

Finding Affordable Family Protection in Colorado

When it comes to protecting your loved ones in the Centennial State, family insurance plans Colorado offer peace of mind without breaking the bank. I've seen how the right health coverage can transform a family's financial security and wellbeing.

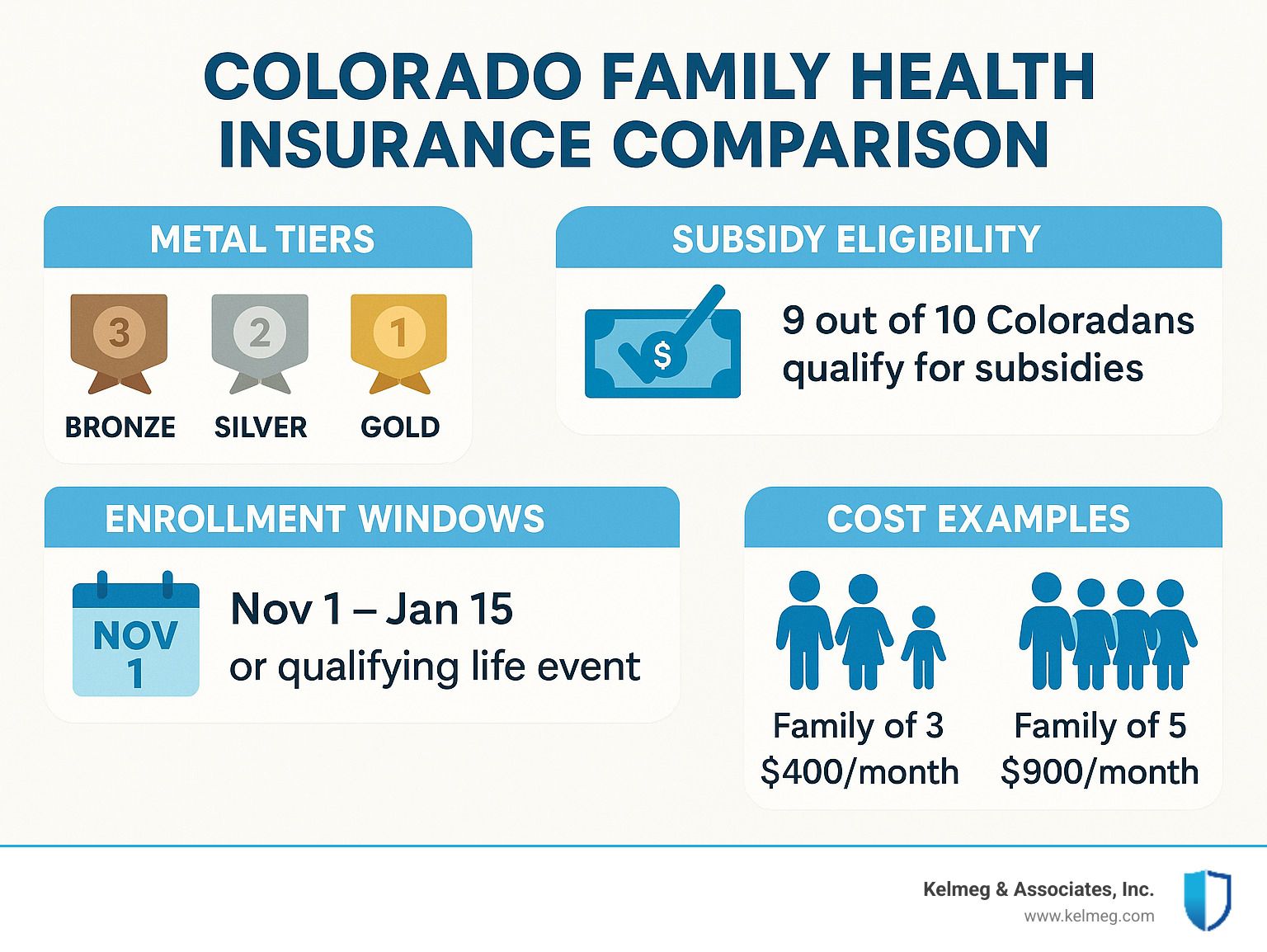

Colorado families have access to comprehensive health plans designed specifically with households in mind. The Connect for Health Colorado Marketplace serves as our state's official exchange, where an impressive 9 out of 10 Coloradans find they qualify for financial assistance. This isn't just a small discount – for many families, these subsidies can dramatically reduce monthly premiums to fit comfortably within their budgets.

Understanding the metal tier system helps you balance costs and coverage. Bronze plans keep your monthly premiums lowest but come with higher out-of-pocket costs when you need care. Silver plans hit that sweet spot in the middle and are the only plans eligible for additional cost-sharing reductions if you qualify. Gold plans set you up with higher monthly premiums but significantly lower costs when you actually use your insurance.

For a typical Colorado family of four with household income between $41,400 and $75,000, the available subsidies can be truly game-changing. Many families are pleasantly surprised to learn just how affordable their coverage can be after financial assistance is applied.

Every family insurance plans Colorado option covers the essentials your household needs: doctor visits, hospital stays, maternity care, mental health services, and prescription medications. No more worrying about whether a particular health need will be covered – these essential benefits are guaranteed.

Timing matters when enrolling. The annual open enrollment window runs from November 1st through January 15th. Miss that window? Life happens, and qualifying events like marriage, having a baby, or losing other coverage open a special 60-day enrollment period just for you.

I'm Kelsey Mackley, and at Kelmeg & Associates, Inc., I've dedicated my career to helping Colorado families steer these waters. Nothing makes me happier than seeing the relief on parents' faces when they find affordable coverage custom to their family's unique situation. My expertise in family insurance plans Colorado allows me to guide you through what can otherwise feel like an overwhelming process.

Understanding Family Insurance Plans Colorado: Who They're For and How They Work

When it comes to protecting your loved ones, family insurance plans Colorado offer something special – comprehensive health coverage for your entire household under one policy. These plans are built with families in mind, whether you're a couple with young children, a single parent, or caring for multiple generations under one roof.

Think of family health insurance as a shared umbrella of protection. Instead of managing separate policies for each family member, everyone's covered together, which typically creates better value and simplifies your healthcare management.

Jessica, a Denver mom of three, shared with me: "Having one family plan means I only need to keep track of one set of insurance cards, one member portal, and one billing statement. That alone has made our healthcare so much easier to manage."

Your family insurance plans Colorado will include several important cost components that work together. Your monthly premium is like a subscription fee that keeps your coverage active. When you need care, you'll typically pay toward your deductible first – that's the amount you cover before insurance kicks in for most services.

For routine care, you'll often pay copays – fixed amounts like $25 for a doctor visit or $15 for a prescription. Once you've met your deductible, you might pay coinsurance – a percentage of costs (usually 20-30%) while your insurance covers the rest. The good news? There's a safety net called your out-of-pocket maximum that caps your annual spending, after which your plan covers 100% of eligible costs.

All family insurance plans Colorado must include ten essential health benefits by law:

- Outpatient care

- Emergency services

- Hospital stays

- Maternity and newborn care

- Mental health and substance use treatment

- Prescription medications

- Rehabilitation services

- Lab services

- Preventive care at $0 cost

- Pediatric services including dental and vision care for kids

One of the most helpful features for growing families is that your children can stay on your plan until they turn 26 – even if they're married, not living at home, or eligible for their own employer's insurance.

What Makes "Family insurance plans Colorado" Different?

Colorado has gone above and beyond federal requirements to make family health insurance more valuable and accessible. Our state has implemented several family-friendly provisions that might not be available elsewhere.

For starters, Colorado enforces the age-26 rule that lets young adults stay on a parent's plan longer, providing crucial coverage during college years and early careers. The state also requires that all plans cover preventive care with $0 out-of-pocket cost. That means your children's well-checks, vaccinations, and screenings won't cost you anything additional.

Many family insurance plans Colorado now offer $0 virtual care visits too, which has been a game-changer for busy families. As Carlos from Longmont told me, "When my son developed a rash at 8 PM, we had a video call with a doctor within minutes. No driving to urgent care, no exposure to other illnesses, and best of all – no bill!"

Colorado Option plans have also introduced improved benefits for families managing chronic conditions, including $0 cost-sharing for diabetic supplies – a significant relief for parents of children with diabetes or family members managing the condition.

Key Cost Terms Every Colorado Family Must Know

Understanding the financial side of family insurance plans Colorado helps you budget effectively and avoid surprises. Let's break down these terms in everyday language:

Your premium is simply what you pay each month to keep your coverage active. Think of it as your health insurance "subscription fee." It varies based on your family size, ages, where you live in Colorado, the level of coverage you choose, and whether any family members use tobacco. The good news? Many Colorado families qualify for premium subsidies that significantly reduce this monthly cost.

The deductible is what you pay before insurance starts covering most services. Family plans typically have both individual deductibles for each person and a family deductible. Once either is met, coverage kicks in. A mom from Fort Collins explained it this way: "I think of our deductible as our skin in the game – we cover the first $3,000, then our insurance partner handles most costs after that."

Copays are your fixed costs for specific services – like $25 to see your doctor or $10 for generic medications. These are predictable and often apply even before you meet your deductible, which helps with budgeting.

Coinsurance is your percentage share of costs after meeting your deductible. If your plan has 20% coinsurance and you have a $1,000 procedure after meeting your deductible, you'd pay $200 while your insurance covers $800.

All these expenses together make up your cost-sharing – but there's a limit. Your out-of-pocket maximum is the absolute most you'll pay in a year, providing crucial financial protection against major health events.

Understanding these terms helps you compare plans realistically. A plan with a lower premium but higher deductible might work well for a generally healthy family, while a plan with higher premiums but lower out-of-pocket costs might be better if you expect significant medical needs.

Types of Family Health Coverage in Colorado

Colorado families have several options when it comes to health insurance coverage, each with distinct advantages depending on your family's needs and financial situation.

"Family insurance plans Colorado" Metal Tiers at a Glance

The marketplace organizes plans into metal tiers that represent how you and your insurance company share costs. Think of it as a seesaw – as one side goes up, the other goes down.

Bronze Plans are perfect for families who rarely visit the doctor and want to keep monthly costs low. The Martinez family in Denver County pays just $175/month after subsidies for their Bronze plan. They're healthy and don't expect many medical expenses, but they sleep better knowing they have protection against unexpected health disasters. With Bronze, you'll typically pay about 40% of costs while your insurance covers the other 60%.

Silver Plans strike that sweet middle ground and come with a special bonus – they're the only plans eligible for cost-sharing reductions if your income qualifies. The Wilson family earns about $60,000 annually and was amazed when their Silver plan deductible dropped from $4,000 to just $800 thanks to these extra savings. With Silver, you generally pay about 30% of costs while your insurance handles 70%.

Gold Plans are ideal when you know medical expenses are coming. The Chen family has a child with asthma who needs regular specialist visits and medications. Their slightly higher monthly premium is more than offset by much lower costs throughout the year when they actually use their insurance. Gold plans typically have you paying about 20% of costs while insurance covers a generous 80%.

Colorado Option Standardized Plans are our state's unique solution to make insurance more predictable. Alicia from Broomfield told me, "For our family with a diabetic teenager, the Colorado Option plan has been life-changing. Not having to worry about the cost of glucose monitors and test strips means we can focus on managing her condition rather than our budget." These plans offer $0 cost-sharing for diabetic supplies, no deductibles for primary care or mental health visits, and networks designed to be culturally responsive.

Public Programs that Act Like a Safety Net

When finances get tight, Colorado offers robust public insurance options that can be lifesavers for families.

Health First Colorado (Medicaid) provides comprehensive coverage for families with limited incomes – generally up to 138% of the Federal Poverty Level. Unlike marketplace plans, you can enroll year-round, so there's no waiting for an open enrollment period if your financial situation changes. The coverage is either free or very low-cost and includes dental for both adults and children.

Child Health Plan Plus (CHP+) fills an important gap for children and pregnant women in families that earn too much for Medicaid but still need assistance. If your family of four makes less than about $63,000 annually, your children might qualify. The program features minimal copayments (and pregnant women, American Indians, and Alaska Natives pay nothing at all).

I recently helped the Jackson family enroll their children in CHP+ after dad got a new job that paid more but didn't offer affordable family coverage. "We were caught in the middle," Mrs. Jackson explained, "making too much for Medicaid but not enough to afford private insurance for the kids. CHP+ was our bridge to keeping them covered."

Whether you're looking at marketplace plans, employer coverage, or public programs, the right family insurance plans Colorado option depends on your unique family situation. At Kelmeg & Associates, we help you steer these choices without charging you extra – the insurance companies pay us, not you.

Many families tell me they've spent hours researching only to end up more confused than when they started. That's where we come in – translating insurance jargon into plain English and helping you find the plan that fits your family's health needs and budget.

Cutting Costs: Premium Tax Credits, Subsidies & Other Ways to Save

Let's talk about what most families really want to know - how to make health insurance affordable. The good news is that family insurance plans Colorado come with plenty of opportunities to save.

The numbers tell an encouraging story: if you're a family of four in Colorado earning between $41,400 and $75,000, you'll likely qualify for significant financial help through Connect for Health Colorado. In fact, about 9 out of 10 families who apply receive some form of assistance.

These savings primarily come in two flavors. First, there's the Advanced Premium Tax Credits (APTC), which directly lower your monthly premium payments. Think of these as an instant discount on your insurance bill. For example, I recently helped a family in Adams County with a $70,000 annual income secure over $1,000 monthly in premium tax credits – that's like getting a $12,000 annual raise!

The second type of assistance is Cost-Sharing Reductions (CSR). These magical little helpers lower what you pay out-of-pocket when you actually use your insurance – your deductibles, copays, and coinsurance all shrink. The catch? You can only get CSRs with Silver plans, but for many families, the savings are substantial. I've seen deductibles drop from $5,000 to just $1,000, and out-of-pocket maximums cut in half.

"We were paying over $1,200 monthly for our family's health insurance before working with Kelmeg & Associates," the Rodriguez family from Boulder told me recently. "After they helped us apply for subsidies through Connect for Health Colorado, our premium dropped to $320 per month for better coverage than we had before."

Thanks to the American Rescue Plan Act and the Inflation Reduction Act, these subsidies are more generous than ever. Some families even qualify for $0 premium plans, depending on their specific situation. You can explore more options for Affordable Health Coverage Colorado on our dedicated page.

How to Check If You Qualify for Help

Figuring out if you're eligible for financial assistance comes down to a few key factors.

First is your household size – who counts in your tax household. This typically includes you, your spouse, and your tax dependents.

Next is your Modified Adjusted Gross Income (MAGI). This includes your wages, salaries, tips, taxable interest, business income, capital gains, retirement income (except non-taxable Social Security), rental income, and other taxable income. It's essentially what you report on your tax return, with a few specific adjustments.

For 2024, a family of four generally qualifies

for premium tax credits with an income between roughly $30,000 and $120,000, while cost-sharing reductions typically benefit families earning between $30,000 and $75,000.

At Kelmeg & Associates, we offer free subsidy calculators and personalized assessments to pinpoint exactly what financial assistance your family qualifies for. This simple step alone has saved our Colorado families thousands of dollars annually. Scientific research consistently shows that health subsidies significantly improve access to care and financial security, as documented by healthcare.gov.

Tips for Lowering Out-of-Pocket Costs Without Sacrificing Care

Beyond subsidies, there are several smart strategies to reduce your family's healthcare expenses without compromising on quality care.

Choose Silver plans if you qualify for cost-sharing reductions. Even if the premium is slightly higher than Bronze, the reduced deductibles and copays often result in lower total costs for families who use healthcare services regularly. I've seen this strategy save families thousands over the course of a year.

Consider a Health Savings Account (HSA) paired with a qualifying high-deductible health plan. HSAs offer amazing triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. It's like getting a discount on every healthcare dollar you spend.

Stay in-network whenever possible. This simple habit can save you substantial money, as out-of-network care often costs significantly more and may not count toward your plan's out-of-pocket maximum. Most plans have provider lookup tools that make finding in-network doctors easy.

Use $0 preventive care benefits. All plans cover preventive services at no cost to you, including annual wellness exams, immunizations, cancer screenings, and well-child visits. These services help catch issues early, potentially saving both money and heartache down the road.

Take advantage of $0 virtual care. Many Colorado plans now offer telemedicine visits at no cost. "We've saved hundreds by using virtual care for our kids' minor illnesses," shared Jennifer from Lafayette. "Instead of taking time off work and paying $50 copays for in-person visits, we can connect with a doctor online at no additional cost."

By combining these strategies with available subsidies, Colorado families can find quality health coverage that protects both their health and their financial wellbeing. At Kelmeg & Associates, we take pride in helping families steer these options to find the perfect balance of coverage and affordability.

Enrolling in a Plan: Marketplace, Key Dates & Special Enrollment

Getting your family covered with the right Family insurance plans Colorado shouldn't feel like solving a puzzle. Knowing when and how to enroll makes all the difference between seamless protection and frustrating coverage gaps.

Most Colorado families find their plans through Connect for Health Colorado, our state's official health insurance marketplace. Don't worry about navigating it alone, though – licensed brokers like us at Kelmeg & Associates can guide you through enrollment at absolutely no extra cost to you.

The main window to shop for plans happens during Annual Open Enrollment from November 1 to January 15. If you enroll by December 15, your coverage starts January 1. Enroll between December 16 and January 15, and your coverage kicks in February 1 instead. The best part? During open enrollment, insurance companies can't turn you away or charge you more because of pre-existing conditions.

"We always put off health insurance shopping until the last minute," admits Sarah from Fort Collins. "Last year, we finally worked with Kelmeg to enroll in early December. What a relief to have everything set up before the holidays and start the new year with peace of mind."

Miss the enrollment window? Life happens, and fortunately, so do Special Enrollment Periods. These 60-day windows open when you experience qualifying life events like having a baby, getting married (or divorced), losing other coverage through job changes, moving to a new area, or experiencing significant income changes that affect your subsidy eligibility.

Michael from Boulder shares, "When our second child was born in April, we had 60 days to add her to our plan. Kelmeg & Associates helped us not only add the baby but also reassess our coverage needs since our family size had changed."

Step-by-Step Enrollment Timeline for Family insurance plans Colorado

The enrollment journey has three main phases, and understanding each one helps make the process smoother for your family.

Before enrollment even begins, gather your paperwork. Round up income documentation for everyone in your household, make a list of family members needing coverage (with birthdays), and information about any existing coverage. Think about which doctors you want to keep seeing and medications your family takes – this helps narrow down plans that include your preferred providers and prescriptions.

When the enrollment window opens, you'll create an account on Connect for Health Colorado (or work with a broker like us who can help). Complete your application with all your household details and income information to see what financial help you qualify for. This is when you'll apply for those valuable premium tax credits and cost-sharing reductions that can dramatically lower your costs.

The comparison shopping phase is where having expert guidance really helps. You'll see multiple plans with different networks, costs, and benefits. Choose the one that best balances your family's healthcare needs and budget, then pay your first month's premium to activate your coverage.

After enrollment, set up online accounts with your new insurance carrier, select primary care doctors if your plan requires it, and schedule those preventive care appointments that are covered at $0. Remember to report any qualifying life changes within 60 days to keep your coverage and subsidies accurate.

At Kelmeg & Associates, we guide families through each step, ensuring you understand your options and maximize your benefits without feeling overwhelmed.

Frequently Asked Questions about Colorado Family Coverage

What counts as a qualifying life event for special enrollment?

Beyond the common life changes like having a baby or changing jobs, you might not realize that becoming newly eligible for subsidies, experiencing domestic violence, receiving a court order to cover a dependent, or even having a major claim that meets your out-of-pocket maximum can qualify you for a special enrollment period. If you're wondering if your situation qualifies, just ask us – that's what we're here for.

Can I add a newborn mid-year?

Absolutely! You have 60 days from your baby's birth to add them to your existing plan, with coverage backdated to their birthday. Here's a helpful tip many parents don't know: Colorado law actually provides automatic coverage for the first 31 days of a newborn's life under the parent's plan, giving you breathing room to handle the paperwork.

Do I need to re-apply each year?

While some plans offer auto-renewal, we strongly recommend reviewing your options during each open enrollment period. Your family's needs change, plan networks shift, and new options emerge every year. What worked perfectly last year might not be your best choice now. Plus, your subsidy amount may change based on updated income guidelines.

What if my income changes after I enroll?

Life is unpredictable, and income changes happen. Report changes to Connect for Health Colorado promptly. If your income increases, your subsidy might decrease (and you could owe money back at tax time if you don't adjust). If your income drops, you might qualify for additional financial help – why leave money on the table?

Can my children be on a different plan than parents?

Many Colorado families don't realize this is possible and sometimes financially smart. You can enroll children in a separate plan or program like CHP+ while parents maintain different coverage. This "split family" approach often makes sense when children qualify for low-cost public programs but parents don't. We help families determine if this strategy could benefit your budget while maintaining quality coverage for everyone.

At Kelmeg & Associates, we're real Coloradans helping our neighbors steer these complex choices. Our guidance comes at no extra cost to you, but the peace of mind is priceless. Check out Our Services to learn more about how we can help your family find the right coverage.

Beyond Medical: Dental, Vision, Supplemental & Colorado FAMLI

Your family's health needs go beyond just medical coverage. When we talk about complete protection, we need to consider everything from your child's first tooth to those unexpected accidents that seem to happen right when you least expect them.

When Amanda from Adams County came to us, she was only looking for medical coverage. Today, she tells us: "We added dental and vision coverage for about $75 a month for our family of five. The peace of mind knowing routine care is covered and having protection against major dental work makes it well worth the investment."

Dental insurance fills crucial gaps in your family's health protection. Most standalone family dental plans cost between $30-$60 monthly and typically cover 100% of preventive care like cleanings and exams, 80% of basic services such as fillings, and 50% of major work like crowns and root canals. Unlike the pediatric dental coverage included in medical plans, these standalone options have no age limits, covering everyone in your family.

Vision insurance is another affordable addition that pays dividends for growing families. For just $15-$30 monthly, these plans cover routine eye exams, glasses, and contacts. For children especially, regular vision checks are crucial for catching developmental issues early – something many parents don't realize until their child struggles in school.

Why Supplemental Plans Can Plug Costl

y Gaps

Even the best family insurance plans Colorado can leave you vulnerable to certain expenses. That's where supplemental coverage comes in – providing an extra layer of financial protection right when you need it most.

Accident insurance has become a favorite for Colorado families with active kids. When 10-year-old Tyler from Fort Collins broke his arm during soccer practice, his family received a direct cash payment that covered their medical plan's $1,500 deductible and the income his mom lost taking time off work for appointments. These plans pay benefits directly to you for emergency treatment, hospital stays, and follow-up care – no matter what other insurance you have.

Critical illness insurance works similarly but for serious conditions like cancer, heart attack, or stroke. The lump-sum payment (often $10,000-$50,000) can be used for anything – medical bills, mortgage payments, or even childcare while you focus on recovery. For many Colorado families, this peace of mind costs just $30-$40 monthly.

Hospital indemnity plans pay a fixed daily benefit (typically $100-$300) for each day you're hospitalized. With the average hospital stay in Colorado costing over $2,500 per day, these affordable plans (often $20-$30 monthly for families) can make a significant difference in your financial recovery.

The beauty of these supplemental options is their simplicity – no networks to worry about, no pre-approvals needed, and benefits paid regardless of what your other insurance covers. For many family insurance plans Colorado holders, these additions provide the complete protection they're seeking.

Colorado's FAMLI Program: Paid Leave Meets Health Coverage

Colorado has taken a bold step forward with the Family and Medical Leave Insurance (FAMLI) program, which began paying benefits in January 2024. This program bridges the critical gap between health coverage and income protection.

Carlos from Broomfield recently shared his experience: "FAMLI allowed me to take eight weeks off when our twins were born. Not only did it help financially during that time, but it meant I could support my wife and bond with our babies without worrying about losing my job or going without income."

The program provides up to 12 weeks of paid leave annually, with an additional 4 weeks available for pregnancy or childbirth complications. This coverage extends to caring for a new child, supporting a family member with a serious health condition, managing your own health issues, addressing needs related to military deployment, and even providing "safe leave" for domestic violence situations.

What makes FAMLI unique is how it's funded – through premiums split between employers and employees – and how benefits are calculated to replace up to 90% of wages for lower-income workers. The program is easily accessible through the My FAMLI+ portal, making it straightforward for families to apply when they need support.

The numbers speak for themselves – more than 11,000 Colorado fathers have already taken advantage of paid paternity leave in the program's first months. This represents a significant cultural shift in how families can balance work responsibilities with their most important personal moments.

For families juggling health concerns with work responsibilities, FAMLI provides crucial income protection during periods when medical needs must take priority. When paired with comprehensive family insurance plans Colorado, this program helps create a complete safety net for your household.

At Kelmeg & Associates, we help families understand how these various coverage options work together to provide comprehensive protection. From selecting the right Individual and Family plans to explaining how FAMLI might benefit your specific situation, our goal is making sure nothing falls through the cracks in your family's protection strategy.

Conclusion

Finding the right family insurance plans Colorado might seem like searching for a needle in a haystack, but it doesn't have to be that way. With a little knowledge and some expert guidance, your family can find coverage that protects both your health and your wallet.

After working with hundreds of Colorado families, I've seen how the right insurance choices bring peace of mind. Here's what you need to remember:

Metal tiers give you options that match your family's needs and budget. Bronze plans keep your monthly costs low if you rarely need medical care. Silver plans offer that sweet spot of affordability plus valuable cost-sharing reductions if you qualify. Gold plans cost more each month but save you money every time you need care.

The financial help available through Connect for Health Colorado is truly game-changing. I've helped countless families find they qualify for subsidies they never knew existed. 9 out of 10 Coloradans who apply receive some form of assistance!

Colorado families benefit from special features that make healthcare more accessible. Family insurance plans Colorado include $0 preventive care visits, which means your kids' check-ups and vaccines won't cost you a penny. Many plans now offer $0 virtual visits too, saving you time and money when someone wakes up with a sore throat or rash. And don't forget that your adult children can stay on your plan until they turn 26, giving them valuable protection during those early adult years.

Timing matters when it comes to enrollment. Mark your calendar for Open Enrollment between November 1 and January 15. Miss that window? Keep track of qualifying life events like having a baby, getting married, or losing other coverage – these open a 60-day special enrollment period just for you.

Medical coverage is essential, but don't overlook the value of dental, vision, and supplemental plans. I've seen too many families caught off-guard by expenses their medical plan doesn't cover. A comprehensive protection strategy gives you true peace of mind.

Colorado's FAMLI program is a wonderful addition to your family's safety net. With up to 12 weeks of paid leave when health needs require time away from work, you can focus on what matters most – taking care of yourself or a loved one – without worrying about your paycheck.

At Kelmeg & Associates, we believe finding the right insurance shouldn't give you a headache. Our team takes the time to understand what makes your family unique. We explain your options in plain English (no insurance jargon!), and guide you to coverage that fits your life and your budget.

The best part? Our expertise doesn't cost you a penny more. Insurance rates are filed with and regulated by the Colorado Division of Insurance, so you'll pay exactly the same premium whether you shop alone or let us help you steer the process.

Ready to find family insurance plans Colorado that truly protect your loved ones without breaking the bank? Our team at Kelmeg & Associates is just a phone call away. We proudly serve families throughout Lafayette, Broomfield, Boulder, Adams County, and across Colorado, providing the personalized attention every family deserves.