Budget-Friendly Group Health Plans Employees Actually Love

Why Your Business Needs Budget-Friendly Group Health Plans That Work

Affordable group health insurance is more than just a low premium; it's a strategic benefits package that attracts top talent while keeping costs manageable. With 88% of employers rating healthcare as a vital benefit, the right plan is a key investment in your company's future.

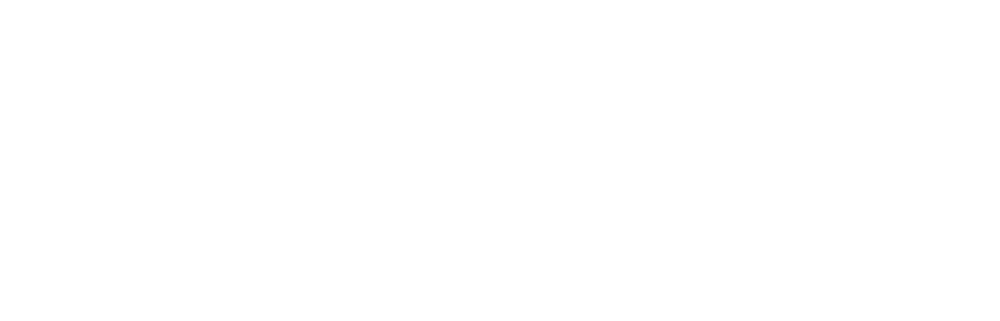

Quick Guide to Affordable Group Health Insurance:

- Minimum Requirements: Usually 2+ employees (including the owner).

- Cost Savings: Group plans are often cheaper than individual coverage.

- Tax Benefits: Premiums are typically tax-deductible.

- Small Business Credit: Qualifying businesses can get up to 50% in premium credits.

- Funding Options: Choose from fully-insured, level-funded, or self-funded plans.

- Network Savings: Local networks can offer significant savings over national ones.

The core principle that makes group insurance affordable is risk pooling. By spreading healthcare costs across your entire employee group, everyone benefits from lower premiums and better coverage than they could secure individually. This collective approach, combined with tax advantages like deductible premiums and the Small Business Health Care Tax Credit, creates substantial financial benefits.

I'm Kelsey Mackley from Kelmeg & Associates. I've helped countless Colorado businesses steer the complexities of affordable group health insurance to find plans that work for their budget and their people. The right plan doesn't just control costs-it becomes a powerful tool for attracting and retaining the talent your business needs to thrive.

What is Group Health Insurance and Why Does It Matter?

A group health plan is employer-sponsored coverage that provides medical benefits to your employees and their families. It's a powerful employee benefit that signals to your team, "we've got your back." More than just a line item, it's a tool that can transform your business by making quality healthcare accessible and affordable.

More info about Employer Sponsored Health Insurance

Offering affordable group health insurance creates a win-win for your business and your team.

For your business, it's a competitive advantage. A strong benefits package is crucial for talent attraction and employee retention. When employees have access to care, including preventive care and early treatment, it leads to a healthier workforce, reduced absenteeism, and higher productivity. This fosters a positive company culture and strengthens employee loyalty.

For your employees, group coverage provides access to care with lower out-of-pocket costs than most individual plans. It offers financial protection and peace of mind, knowing a medical issue won't lead to financial hardship. Modern plans often include vital mental health support and wellness programs, promoting a whole-person approach to health that allows your team to bring their best selves to work.

More info about Employer Group Benefits

Opening up Financial Wins with Affordable Group Health Insurance

Offering affordable group health insurance is a savvy business move that strengthens your bottom line. Through risk pooling, healthcare costs are spread across your workforce, creating predictable monthly expenses and making budgeting easier. This collective approach consistently delivers a lower total cost of care compared to individual coverage.

Tax Advantages and Credits for Your Business

The financial benefits are improved by significant tax advantages. Premiums you pay are generally considered tax-deductible business expenses. Furthermore, qualifying small businesses can receive the Small Business Health Care Tax Credit, worth up to 50 percent of the premiums paid. You can also implement Section 125 plans, which allow employees to pay their premium share with pre-tax dollars, reducing their taxable income and your payroll taxes.

Small Business Health Care Tax Credit

How Insurers Help Control Costs

Insurers actively work to keep costs manageable through several key strategies. They establish provider networks with negotiated rates far lower than what individuals can access. They also use data analytics and care management programs to guide employees toward cost-effective care and promote preventive health. Finally, a focus on value-based care(paying for quality outcomes, not just services) and payment integrity ensures your healthcare dollars are spent efficiently.

More info about Colorado Group Insurance Plans

Understanding Your Funding Options

Choosing how to fund your plan is key to finding the most affordable group health insurance for your business.

- Fully-insured plans offer predictable costs. You pay a fixed monthly premium, and the insurer assumes all the risk. This is the simplest option, ideal for many small businesses.

- Level-funded plans blend predictability with potential savings. You pay a steady monthly amount, and if your group's claims are lower than expected, you may receive a refund.

- Self-funded plans offer the most control and savings potential but also the highest risk tolerance. Your business pays for claims directly, so costs can vary. This is typically for larger companies that can manage the financial exposure.

The right choice depends on your company's size, cash flow, and comfort with risk.

A Guide to Common Group Health Insurance Plans and Networks

Understanding different plan and network types is key to finding affordable group health insurance that balances employee choice with cost control.

More info about The Ultimate Guide To Group Health Insurance Plans In Colorado

Comparing Common Plan Types: HMO, PPO, EPO, and HDHP

The four main plan types offer different levels of flexibility and cost.

| Plan Type | Primary Care Provider (PCP) Requirement | Out-of-Network Coverage | Referrals for Specialists | Typical Cost & Flexibility |

|---|---|---|---|---|

| Health Maintenance Organization (HMO) | Yes, usually required | No, except emergencies | Yes, usually required | Lower premiums, less flexibility |

| Preferred Provider Organization (PPO) | No | Yes, at higher cost | No, usually not required | Higher premiums, more flexibility |

| Exclusive Provider Organization (EPO) | No | No, except emergencies | No, usually not required | Mid-range premiums, limited flexibility outside network |

| High-Deductible Health Plan (HDHP) | No | Yes, at higher cost | No, usually not required | Lower premiums, high deductible, often paired with HSA |

- HMOs offer lower premiums by requiring members to use a specific network of doctors and get referrals from a Primary Care Provider (PCP).

- PPOs provide the most flexibility, allowing members to see any doctor (in or out-of-network) without a referral, but at a higher premium.

- EPOs are a hybrid, offering the freedom to see specialists without referrals but requiring members to stay within the network for care.

- HDHPs have low premiums but higher deductibles. They are often paired with a Health Savings Account (HSA), a tax-advantaged account for medical expenses.

Choosing the Right Network for Savings and Access

The provider network is crucial for both cost and convenience. Large national networks are ideal for businesses with employees in multiple states or who travel often, offering the broadest access. Local solutions networks focus on a specific geographic area, often providing significant savings by partnering with regional health systems. The best choice depends on where your employees live and work. Using in-network providers is the most effective way for everyone to save money.

Enhancing Your Offerings with Ancillary Benefits

A comprehensive benefits package addresses the whole-person approach to health. Consider bundling integrated benefits to improve your offering and potentially lower costs. Popular additions include dental, vision, and life insurance, as well as disability insurance, wellness programs, virtual care options, and robust mental health support. These ancillary benefits show employees you are invested in their overall well-being and financial security.

Dental, vision and life insurance coverage

How to Choose the Right Plan for Your Colorado Business

Finding affordable group health insurance that fits your business involves a few key steps. By understanding your needs, options, and available support, you can make a confident choice.

More info about Health Insurance For Small Business Colorado

Step 1: Determine Your Eligibility and Business Needs

First, confirm your eligibility. Most group plans require a minimum of two employees, often including the owner. Next, assess your business needs. This involves a realistic budget analysis to set a sustainable employer contribution strategy. It's also vital to understand your employee demographics and preferences-consider a simple employee survey to learn what your team values most, whether it's lower premiums or broader network access.

More info about Colorado Small Group Health Insurance Regulations

Step 2: Special Considerations for Very Small Businesses and the Self-Employed

Even sole proprietors and startups have great options. Health Reimbursement Arrangements (HRAs) are a popular choice, allowing you to reimburse employees tax-free for their individual health plan premiums (see our FAQ for more on HRAs). Also, consider joining professional organizations or your local Chamber of Commerce, as many offer group health plans to their members, leveraging collective buying power for better rates.

More info about Group Health Insurance For Small Business

Step 3: Leverage Digital Tools and Administrative Support

Modern benefits administration doesn't have to be a burden. Digital tools and platforms can streamline the entire process. Look for solutions that offer online enrollment, seamless payroll integration, and robust claims support. These tools reduce administrative work, prevent errors, and empower employees with direct access to their benefits information through portals like the myCigna Member Portal. This lets you focus on your business, not paperwork.

Frequently Asked Questions about Affordable Group Health Insurance

Here are answers to some of the most common questions businesses have when exploring group health insurance.

How many employees do I need to qualify for group health insurance?

Most insurance carriers require a minimum of just two employees to qualify for a group plan. This typically includes the business owner, as long as they are actively involved in the business. This makes it possible for even very small businesses and partnerships to offer great benefits. Requirements can vary slightly by carrier, but the two-employee rule is a common starting point.

More info about Colorado Health Insurance Application Small Group

Why is group health insurance generally cheaper than individual plans?

Group plans are more affordable due to several factors. The primary reason is risk pooling, where the risk of high medical claims is spread across the entire group, lowering premiums for everyone. Additionally, costs are shared through employer contributions, which significantly reduce the employee's financial burden. Finally, groups have greater negotiating power to secure better rates and benefit from administrative efficiencies that lower the insurer's costs.

What is a Health Reimbursement Arrangement (HRA)?

An HRA is an employer-funded account used to reimburse employees tax-free for qualified medical expenses, including premiums for individual health insurance plans. It is not an insurance plan itself but an alternative to traditional plans. HRAs offer a way for businesses to provide health benefits with predictable costs while giving employees the employee choice to select a plan that best fits their needs. This makes them an excellent option for small businesses seeking flexibility and cost control.

Find the Perfect Plan for Your Team Today

Choosing the right affordable group health insurance is a strategic investment in your business. By leveraging risk pooling, tax advantages, and the right plan design, you can offer a competitive benefits package that strengthens your workforce and boosts employee satisfaction. The long-term value of a healthy, supported team is immeasurable.

At Kelmeg & Associates, we specialize in taking the complexity out of this process for Colorado businesses. Serving Lafayette, Broomfield, Boulder, Adams County, and beyond, we provide personalized consultation and expert guidance at no extra cost to you. We do the research, handle the paperwork, and find the plan that perfectly aligns with your budget and goals.

Offering quality health benefits is more important than ever. With the right guidance, providing a plan your team will appreciate is absolutely achievable.

More info about Small Business Health Insurance Brokers Colorado

Ready to find a health plan that supports your employees and your bottom line? Let's talk about the possibilities for your business.