Plan G and Beyond—Navigating Colorado Medicare Supplement Plans

Why Colorado Medicare Supplement Plans Are Essential for Your Financial Security

As you approach retirement in Colorado, your focus shifts from accumulating wealth to preserving it. While Original Medicare (Part A and Part B) provides a foundational layer of health coverage, it was never designed to cover 100% of your costs. It leaves behind significant “gaps”—deductibles, coinsurance, and copayments—that can quickly lead to thousands of dollars in unexpected medical bills, threatening your financial security.

This is where Colorado Medicare Supplement plans, also known as Medigap, play a crucial role. These state- and federally-regulated insurance policies are designed specifically to fill the financial gaps in Original Medicare. By paying a predictable monthly premium, you gain a powerful safety net that protects both your health and your retirement savings from unpredictable out-of-pocket expenses. This guide will provide a comprehensive overview of how to choose the right Medigap plan in Colorado, from understanding the benefits and costs to navigating the critical enrollment periods that guarantee your coverage.

What Are Medicare Supplement (Medigap) Plans and What Do They Cover?

To understand Medigap, you must first understand the gaps in Original Medicare. While Part A (Hospital Insurance) and Part B (Medical Insurance) cover a wide range of services, they leave you responsible for significant out-of-pocket costs. These include a hefty Part A hospital deductible ($1,632 per benefit period in 2024), daily hospital coinsurance for long stays, and a 20% coinsurance for most Part B services with no annual limit on your spending.

Medigap: Your Financial Safety Net

A Medigap policy works in tandem with Original Medicare to cover these costs. When you receive care, Medicare pays its share first, and then your Medigap plan automatically pays its portion of the remaining bill. This seamless process eliminates most, if not all, of your out-of-pocket medical bills. A key advantage is freedom of choice: you can see any doctor or visit any hospital in the U.S. that accepts Original Medicare, with no network restrictions or referral requirements.

Crucially, Medigap benefits are federally standardized. This means a Plan G from one company has the exact same medical benefits as a Plan G from any other. This simplifies shopping, allowing you to focus on comparing price and company stability, not confusing coverage levels.

Every Medigap plan covers these core benefits:

- Part A Coinsurance and Hospital Costs: Covers daily hospital costs and gives you 365 extra lifetime hospital days.

- Part B Coinsurance or Copayment: Covers the 20% you typically owe for doctor visits and outpatient care.

- First 3 Pints of Blood: Covers the cost of blood transfusions.

- Part A Hospice Care Coinsurance: Covers out-of-pocket costs for hospice care.

Visit our Medicare Supplemental Insurance Colorado page for a deeper dive.

Colorado Plans at a Glance

The chart below shows the standardized Medigap plans. A checkmark (✓) means the plan covers 100% of that benefit.

| Plan | Part A Deductible | Part B Deductible | SNF Coinsurance | Foreign Travel | Part B Excess |

|---|---|---|---|---|---|

| A | – | – | – | – | – |

| B | ✓ | – | – | – | – |

| C* | ✓ | ✓ | ✓ | ✓ | – |

| D | ✓ | – | ✓ | ✓ | – |

| F* | ✓ | ✓ | ✓ | ✓ | ✓ |

| G | ✓ | – | ✓ | ✓ | ✓ |

| K | 50% | – | 50% | – | – |

| L | 75% | – | 75% | – | – |

| M | 50% | – | ✓ | ✓ | – |

| N | ✓ | – | ✓ | ✓ | – |

Plans C and F are only for those eligible for Medicare before 1/1/2020. High-deductible F and G options are also available, requiring you to meet a large annual deductible ($2,800 in 2024) in exchange for a much lower monthly premium.

Spotlight on Colorado’s Favorites: Plan G and Plan N

Decoding the Costs of Colorado Medicare Supplement Plans

Your premium isn’t pulled from thin air. Carriers weigh five main factors:

- Age (premiums rise as you get older)

- Gender (some carriers price men and women differently)

- Tobacco use (always costs more)

- ZIP code (health-care costs vary by region)

- The carrier’s own pricing strategy

Because benefits are identical across companies, shopping multiple quotes can save you hundreds each year. See additional tips on our Medicare Plans Colorado page.

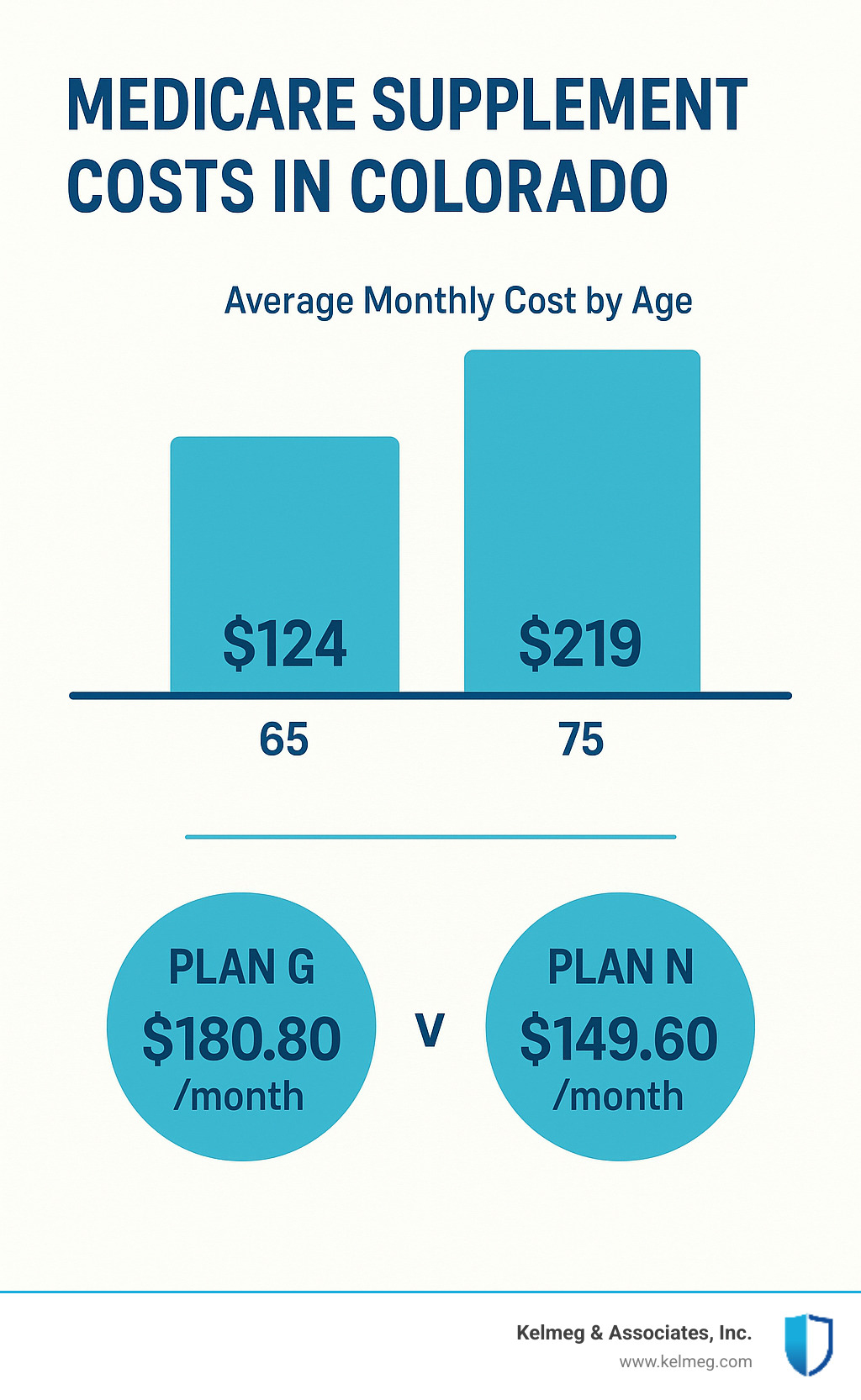

Average Premiums Today

- 65-year-olds pay about $124/mo statewide

- 75-year-olds pay about $219/mo

- Plan G averages $180.80/mo

- Plan N averages $149.60/mo

Those are only averages—individual quotes for Plan G, for example, currently range from roughly $139 to over $200 per month.

Three Pricing Methods to Know

- Attained-Age(most common): starts lower, rises with age + inflation.

- Issue-Age: based on age when issued; no extra age-related increases later.

- Community-Rated: everyone in an area pays the same rate regardless of age.

Regardless of method, expect annual adjustments for medical inflation. Compare both today’s price and a company’s rate-increase history before deciding.

When and How to Enroll: Your Key to Guaranteed Coverage

Your 6-Month Golden Window

Your Medigap Open Enrollment Period (OEP) begins the first day of the month you’re 65 + and enrolled in Part B. For six months, insurers must:

- Accept your application

- Skip medical underwriting

- Charge the standard rate—no health up-charges

Miss this window and underwriting kicks in, which can mean higher prices or denial.

If you delayed Part B because you had employer coverage, your OEP starts once Part B begins—no matter your age.

Learn more on Medicare’s ready-to-buy page.

Guaranteed Issue Outside the OEP

Certain life events restart protections, including:

- Losing employer or union coverage

- Moving out of your Medicare Advantage or Select plan’s area

- Your insurer leaving the market

- Using a one-time “trial right” to drop an Advantage plan within 12 months

Colorado goes a step further by requiring companies to sell Medigap to Medicare-eligible people under 65 due to disability(premiums are usually higher, but coverage is available). Complete details are on Medicare’s guaranteed issue rights page.

How to Choose the Right Medigap Plan for Your Needs

Buying a supplement is like choosing a ski jacket: warmth (coverage) must match your tolerance for cold (risk) and cost (budget).

Questions to ask yourself:

- How often do I see doctors or specialists?

- Do I manage chronic conditions that could become costly?

- Am I comfortable with small copays to save on premiums?

- Do I travel abroad (foreign travel benefit)?

- What monthly amount feels comfortable long-term?

A Five-Step Comparison Shortcut

- Assess needs – frequency of care, travel, risk tolerance.

- Match benefits – Plans G & F (if eligible) are most comprehensive; Plan N offers savings for modest cost-sharing; Plans K/L cap annual out-of-pocket costs but share more along the way.

- Vet insurers – look at A.M. Best ratings, complaint ratios, and local reputation.

- Collect quotes – identical benefits mean price and service are the only real differences.

- Project the future – review each carrier’s 3- to 5-year rate-increase history.

Common Pitfalls to Avoid

- Waiting too long to apply – once your six-month Medigap Open Enrollment Period ends, underwriting can make switching expensive—or impossible if your health changes.

- Focusing only on today’s premium – a rock-bottom rate loses its charm if the company has a history of 12 %–15 % annual increases. Always ask for a carrier’s past rate-adjustment letters.

- Ignoring doctor billing habits – if your favorite specialist bills Part B excess charges, skipping a plan that covers them (like Plan G) can backfire.

- Over-buying coverage – healthy travelers who are comfortable with an occasional $20 copay often do well with Plan N, freeing cash for dental, vision, or wellness programs.

Real-World Scenario: Mary from Denver

Mary, 67, skis at Eldora in winter and gardens all summer. She sees her primary doctor twice a year and an allergist every spring. After discussing her lifestyle with a Kelmeg advisor, Mary chose Plan N for its lower premium and small, predictable copays. She paired it with a $0-deductible Part D drug plan and a discount dental policy, keeping her total monthly outlay under $200 while still protecting herself from major medical bills.

Your story will differ, but the lesson holds: match the plan to your health patterns and budget, then fine-tune with expert guidance.

Free help is a click away: our Medicare Insurance Brokers Colorado team compares dozens of carriers at no extra cost to you.

Frequently Asked Questions about Colorado Medigap Plans

Do Medigap plans include drug, dental, or vision coverage?

No. Supplements only pay the gaps in Medicare-covered hospital and medical services. For prescriptions add a standalone Part D plan; for dental or vision buy separate coverage or pay out-of-pocket. See Medicare’s info on Part D.

Can an insurer deny me a policy?

- During your 6-month OEP: No.

- After that period: Yes, unless you qualify for a guaranteed-issue event. Medical underwriting can result in surcharges or denial.

Colorado also guarantees access for disabled beneficiaries under 65, though premiums may be higher.

How many companies sell supplements in Colorado?

Roughly 40 carriers offer Plan G and 36 offer Plan N. State law requires every carrier to sell at least Plan A. Because benefits are identical, comparing price, stability, and service is critical. For a customized list, contact Kelmeg & Associates, Inc..

Your Next Steps and Colorado-Specific Resources

The easiest way to protect your finances is to act during your Open Enrollment Period —it never comes back. But even if you’ve missed it, options remain.

Helpful Colorado resources:

- SHIP (State Health Insurance Assistance Program) – 1-888-696-7213 for free, unbiased counseling. Colorado SHIP information

- Area Agencies on Aging – local Medicare guidance and aging-services referrals.

- Colorado Division of Insurance – consumer complaints: insurance@dora.state.co.us or 303-894-7490.

Kelmeg & Associates serves Lafayette, Broomfield, Boulder, Adams County—and all of Colorado. We compare every major carrier, explain the fine print, and stay with you long after enrollment. Since insurers pay our fees, our help costs you nothing extra.

Ready to see your options? Request your personalized Medicare review and move forward with confidence.