Group Health Insurance That Won't Break the Bank

Why Small Businesses Are Choosing Group Health Insurance Over Individual Plans

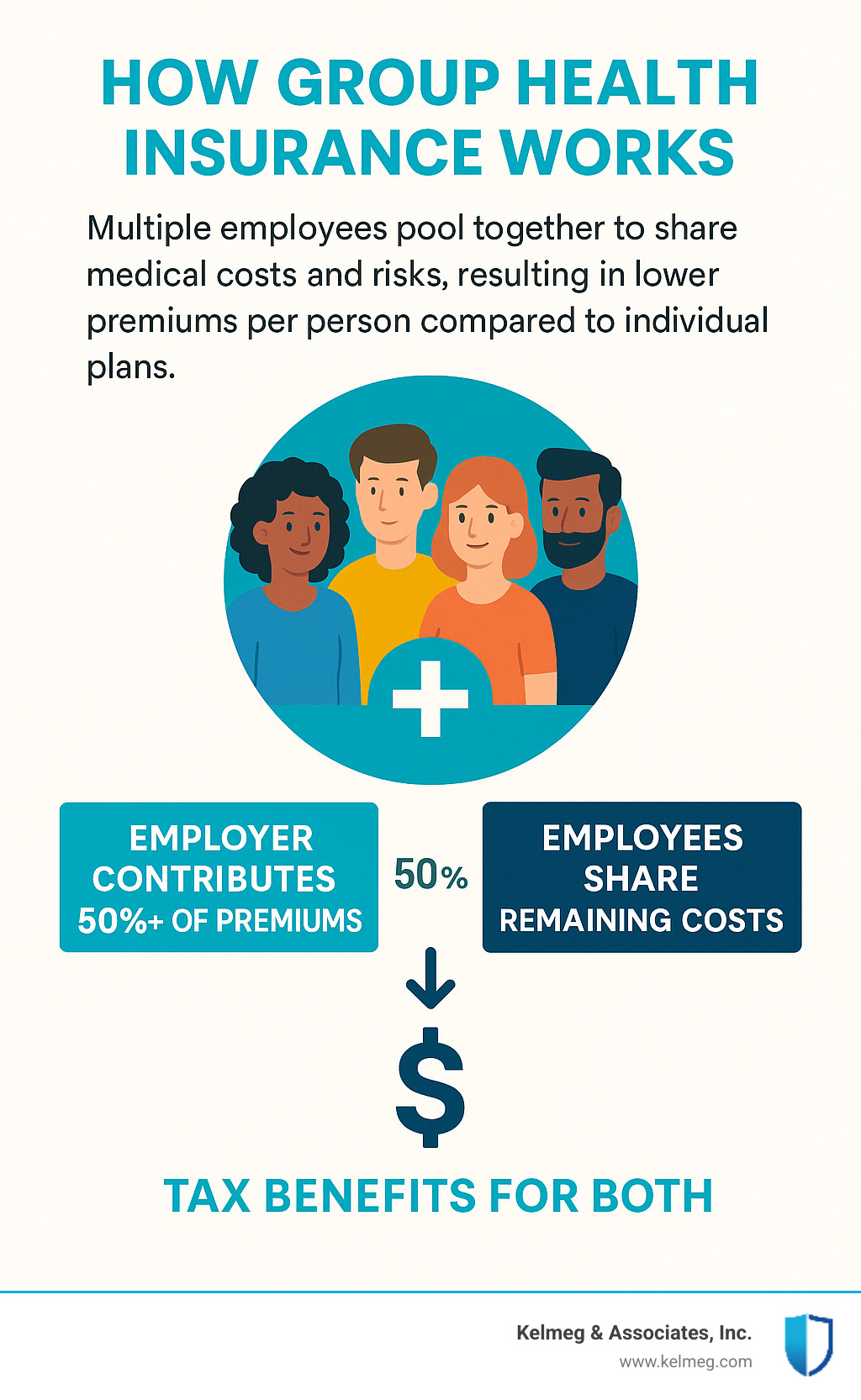

Affordable group health insurance is becoming the go-to solution for small businesses looking to attract top talent without breaking their budget. Here's what makes group coverage more cost-effective than individual plans:

Key Benefits of Group Health Insurance:

- Lower premiums- Risk is spread across multiple employees, reducing costs for everyone

- Employer contributions- Businesses typically cover 50% or more of employee premiums

- Tax advantages- Employers can deduct premium costs as business expenses

- No medical underwriting- Employees can't be denied coverage for pre-existing conditions

- Better benefits- Group plans often include preventive care at 100% coverage

Eligibility Requirements:

- Most states require just 2 employees(including the owner)

- California, Colorado, and Vermont allow groups of 2-100 employees

- All other states typically cover groups of 2-50 employees

The math is simple: when multiple people share the risk, everyone pays less. Group plans can cost 30-50% less than individual coverage because insurance companies spread their risk across your entire team instead of evaluating each person separately.

Small businesses with fewer than 25 full-time employees and average wages under $62,000 may qualify for federal tax credits up to 50% of premium costs, making coverage even more affordable.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., where I help Colorado businesses find affordable group health insurance solutions that fit their budget and protect their employees.

Why Group Coverage Is Typically Cheaper Than Individual Plans

Think of affordable group health insurance like buying groceries at Costco versus your corner store. When you buy in bulk, everyone gets a better deal. That's exactly how group health insurance works through risk pooling.

When insurance companies look at individual applicants, they're placing a bet on one person's health. But with a group of employees, the picture becomes predictable. Insurance companies know that in any group of 10 people, maybe 2-3 will have significant medical expenses while the rest will need routine care. This predictability lets them offer lower premiums.

Most employers contribute at least 50% of premium costs, with many covering 70-80%. If your group plan costs $600 per month and you cover 70%, your employee only pays $180 monthly instead of the $800-1,200 they'd face buying individual coverage.

The tax advantages make this deal even sweeter. As the employer, you can deduct 100% of your premium contributions as business expenses. Your employees typically make their contributions pre-tax, reducing their taxable income.

| Cost Comparison | Individual Plan | Group Plan |

|---|---|---|

| Monthly Premium | $800-1,200 | $600 (employer pays 70%) |

| Employee Pays | $800-1,200 | $180 |

| Annual Deductible | $3,000-8,000 | $1,500-3,000 |

| Out-of-Pocket Max | $8,000-15,000 | $5,000-8,000 |

How Many Employees Does a Group Need?

Good news for small businesses: you don't need a huge workforce to qualify for group coverage. Most states require just two employees, including you as the business owner. Colorado follows this 2-50 employee range.

The Full-Time Equivalent (FTE) calculation matters for tax credits. The IRS counts employees working 30+ hours per week as full-time.

Spreading Risk = Lower Premiums

The actuarial principle behind group insurance is simple. When you have 10 employees instead of 10 separate individual policies, the insurance company can predict costs much more accurately. Lower uncertainty equals lower premiums for everyone.

Roundup of Budget-Friendly Plan Types for Small Businesses

Choosing the right health plan for your small business is about balancing cost with coverage. Affordable group health insurance comes in several types, each making different trade-offs between premium costs, out-of-pocket expenses, and flexibility.

HMO & Narrow-Network Options

Health Maintenance Organizations get their affordability from managed care. Your primary care physician coordinates all healthcare needs, preventing unnecessary duplicate tests and keeping costs down.

HMO plans typically cost 15-25% less than comparable PPO options. The trade-off is structure - you'll need referrals to see specialists.

PPO & EPO Hybrids

Preferred Provider Organizations offer more flexibility at higher costs. PPO plans let employees see specialists without referrals and visit out-of-network providers (though they'll pay more).

EPO plans offer a middle ground- PPO-style flexibility within the network but no out-of-network coverage to keep costs lower. You might save 10-15% compared to traditional PPOs.

High-Deductible & HSA-Compatible Plans

High-Deductible Health Plans paired with Health Savings Accounts offer very low monthly premiums in exchange for higher deductibles. HDHP premiums typically cost 20-40% less than traditional plans.

The HSA triple tax advantage is unique: contributions are tax-deductible, growth is tax-free, and withdrawals for medical expenses are tax-free. For 2024, employees can contribute up to $4,150 for individual coverage or $8,300 for family coverage.

Level-Funded Plans

For businesses with 10+ employees, level-funded plans offer self-insurance with training wheels. You pay a fixed monthly amount, but if your group stays healthy, you receive refunds at year-end. Some businesses see 10-30% savings.

Association Health Plans

Association health plans allow members of professional or trade associations to band together for group purchasing power. Join a qualifying association, then access group rates through the association's plan.

How to Shop & Compare Affordable Group Health Insurance

Finding the right affordable group health insurance comes down to asking the right questions and knowing where to look. The biggest mistake small business owners make is focusing only on the lowest premium instead of total cost of ownership.

Start by surveying your employees about what matters most. Do they have ongoing medications? Preferred doctors? Understanding these priorities helps you focus on plans that deliver real value.

Next, compare the total cost of ownership for each plan type. Look beyond premiums to include deductibles, copays, and out-of-pocket maximums.

Review provider networks carefully. The cheapest plan won't feel affordable if your employees can't see their doctors. Most insurance companies provide online provider directories.

Finally, calculate your potential tax benefits. Small businesses with fewer than 25 employees and average wages under $62,000 can qualify for tax credits up to 50% of premium costs.

Using State & Federal Marketplaces

Colorado's Small Business Health Options Program (SHOP) marketplace offers a streamlined way to compare plans and access tax credits. The SHOP marketplace requires you to contribute at least 50% of employee premiums but offers consolidated billing.

Health Reimbursement Arrangements (HRAs)

For very small businesses, Health Reimbursement Arrangements offer a different approach. Instead of choosing one plan for everyone, HRAs let you give employees money to purchase their own individual coverage.

The Individual Coverage HRA (ICHRA) has no employee size restrictions. Qualified Small Employer HRAs (QSEHRAs) are designed for businesses with fewer than 50 employees, with 2024 contribution limits of $6,150 for individual coverage and $12,450 for family coverage.

Ancillary Benefits

Dental coverage typically costs $15-50 per employee monthly. Vision insurance is usually $5-15 monthly. The smart approach is to offer ancillary benefits as voluntary options where employees pay the full premium through payroll deduction.

Tax Credits, HRAs & Other Cost Hacks That Make Plans Truly Affordable

Finding affordable group health insurance isn't just about choosing the cheapest plan - it's about maximizing every available tax benefit and cost-saving opportunity.

Small-Business Health Care Tax Credit

The federal small business health care tax credit can cover up to 50% of your premium costs. To qualify, you need fewer than 25 full-time equivalent employees, average annual wages below $62,000, and you must pay at least 50% of employee premiums. Coverage must be purchased through the SHOP marketplace.

The maximum benefits go to businesses with 10 or fewer full-time equivalent employees and average wages of $30,000 or less. To claim this credit, file Form 8941 with your business tax return.

Preventive-Care Engagement

Modern group health plans cover annual physical exams at 100% coverage, along with vaccinations, screenings, and wellness visits. Telehealth visits for routine care save both time and money, while wellness programs can reduce renewal rates by 5-10%.

Many plans offer premium discounts for participating in wellness programs, HSA contributions for completing health assessments, and gym membership reimbursements.

The bottom line? Affordable group health insurance isn't just about finding the lowest premium - it's about understanding all the ways the system helps small businesses succeed.

Frequently Asked Questions About Affordable Group Health Insurance

After helping hundreds of Colorado businesses steer affordable group health insurance options, here are the most common questions I hear from small business owners.

What types of group plans are available for 2-to-5-employee companies?

Micro businesses have access to the same plan types as larger companies - HMO networks for budget-conscious coverage, PPO plans for flexibility, and high-deductible options paired with HSAs for tax advantages.

You might pay slightly more per person than a 20-employee company, but you're still saving significantly compared to individual coverage. I recently helped a 4-employee marketing firm find comprehensive PPO coverage for $1,400 monthly total - less than half what they'd pay for individual plans.

Association health plans through trade organizations and Professional Employer Organizations can also provide access to larger group pricing.

Can sole proprietors access group rates, and if so how?

Traditional group insurance requires at least two W-2 employees, so sole proprietors can't access standard group plans. However, the spousal employment strategy works if you're married - hire your spouse as a legitimate W-2 employee for two-person group eligibility.

Association health plans represent another option. The Freelancers Union offers group coverage to independent contractors, and industry-specific trade associations provide similar benefits.

What percentage of premiums must employers pay under the ACA?

While the ACA doesn't dictate exact amounts for small businesses, most insurers require employers to pay at least 50% of employee premiums to qualify for group coverage. Most small businesses contribute 70-80% of employee-only premiums and 50-60% toward dependent coverage.

The SHOP marketplace requires the 50% minimum if you want to qualify for small business tax credits that can cover up to 50% of your premium costs.

Conclusion

Finding affordable group health insurance doesn't have to feel overwhelming. The key is understanding your options, maximizing available tax benefits, and partnering with experienced professionals who know the Colorado market.

At Kelmeg & Associates, Inc., we've helped hundreds of small businesses across Colorado find quality coverage that fits their budget. Whether you're running a two-person startup or managing a 50-employee company, we'll help you steer group health insurance.

Today's market offers tremendous variety - traditional group plans, innovative HRA arrangements, association plans, and level-funded options. What matters most is finding the solution that fits your unique situation - your budget, your employees' needs, and your long-term goals.

The tax benefits alone can transform what seems like an impossible expense into a manageable investment. When you factor in the small business tax credit that can cover up to 50% of your premiums, the payroll tax savings, and the HSA advantages, that monthly premium becomes much more reasonable.

Ready to explore your options? Let's have a conversation about your specific situation. We'll walk through your options together, crunch the numbers, and find the coverage that makes sense for your business and budget.

Contact us today for a free consultation and find how the right group health insurance plan can become a powerful tool for attracting great people, protecting your team, and growing your business with confidence.

For more information about affordable coverage options, visit our Affordable Employee Health Plans resource or give us a call.