Rock-Solid Coverage: Top Health Insurance Brokers in Boulder, CO

Navigating Health Insurance in Boulder: Why Local Brokers Matter

Feeling overwhelmed by health insurance options? You're not alone. Many Boulder residents tell me they spent hours researching plans online only to end up more confused than when they started. That's where a health insurance broker Boulder CO can make all the difference.

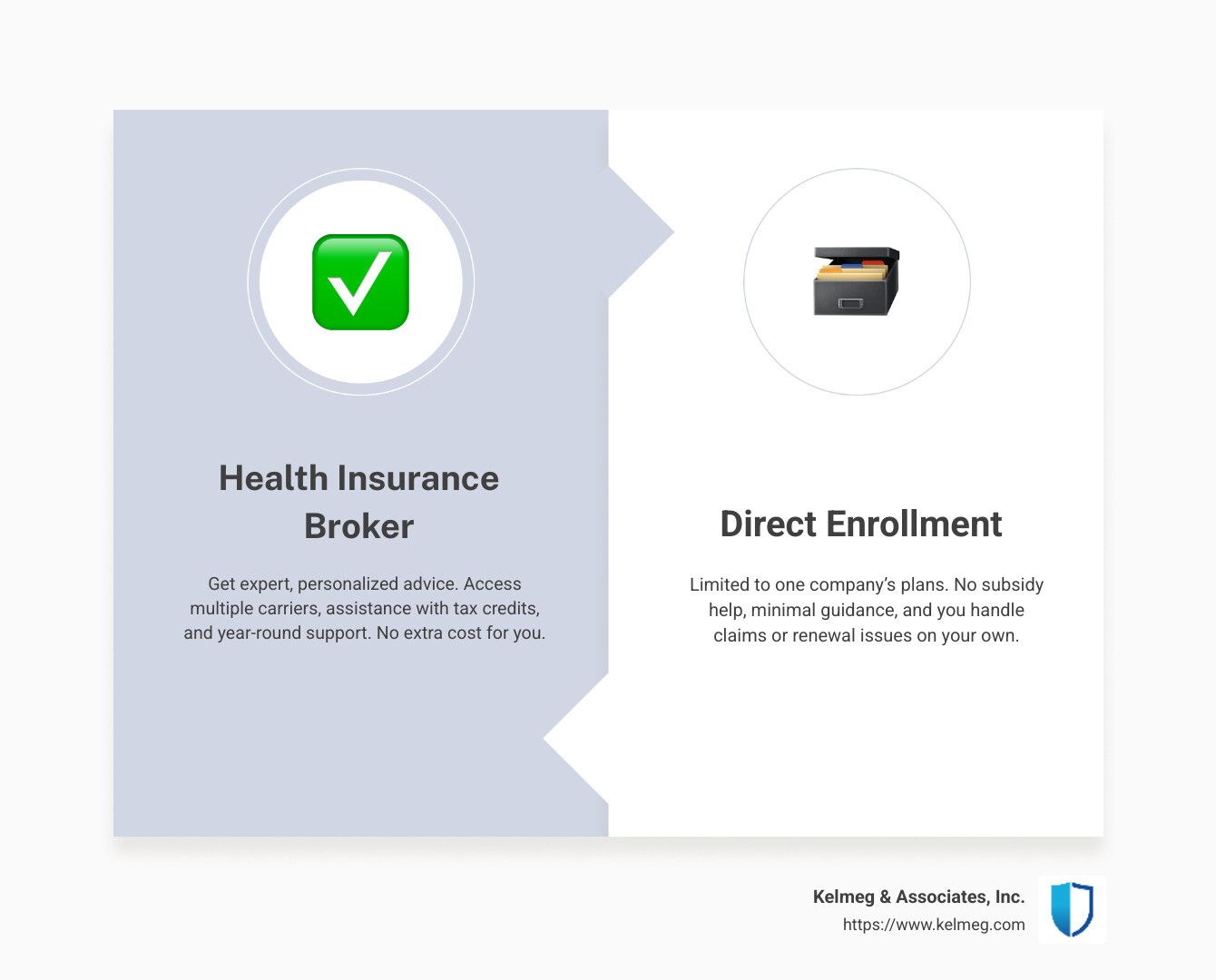

Here's a quick look at what makes working with a local broker so valuable:

- Personalized guidance custom to Boulder's unique healthcare landscape

- Access to multiple carriers for side-by-side comparisons

- Expert assistance with subsidies that might save you thousands

- Ongoing support with claims and policy changes throughout the year

- No additional cost to you - broker services come at zero extra charge

What many folks don't realize is that working with a health insurance broker Boulder CO doesn't cost you a penny more than going directly to insurance companies. That's right - Colorado law requires that all health plans be sold at identical prices whether you use a broker or not. So why tackle this complex decision alone when expert help is available at no extra cost?

A local Boulder broker brings something special to the table - they understand our community's unique healthcare landscape. They know which plans include your favorite doctors at Boulder Community Health or which options work best for active families who might need sports medicine coverage.

When you partner with a local broker, you're getting a personal guide who offers personalized plan selection based on your specific needs, access to multiple carriers for side-by-side comparisons, and assistance with subsidies that might save you thousands. Plus, they provide ongoing support with claims and policy changes throughout the year.

I've seen the relief on clients' faces when they realize they don't have to figure this out alone. From initial consultations to enrollment paperwork and year-round support, your broker handles it all - zero additional cost to you.

Hi there! I'm Kelsey Mackley, a health insurance specialist at Kelmeg & Associates, Inc. I've had the privilege of helping hundreds of Boulder neighbors find coverage that truly fits their lives. My passion is turning insurance jargon into plain English so you can make healthcare decisions with confidence.

Whether you're self-employed, shopping for your family, or running a business looking to offer employee benefits, expert guidance is available without adding to your bottom line. Why not make your health insurance journey easier with a helping hand from someone who knows the terrain?

Why Work With a Local Broker

When you're navigating the maze of health insurance options in Boulder, having a knowledgeable guide can make all the difference. At Kelmeg & Associates, we often hear clients sigh with relief when they realize they don't have to figure everything out alone.

"Finding and choosing affordable health insurance on your own can be a real challenge these days: ACA, ObamaCare, Exchange, Off-Exchange, PPO, HMO, EPO... It's confusing!" This common sentiment captures why so many Boulder residents turn to us for guidance.

Here's the good news: our expert guidance comes at no extra cost to you. That's right—Colorado law requires that all Medicare, Connect for Health (individual), and small-group health insurance plans be sold at identical prices whether you purchase directly or work with a broker. You get our expertise without paying a penny more.

Our clients stick with us year after year—we maintain over a 94% renewal rate, which speaks volumes about the trust people place in our guidance. With over 20 years in the health insurance industry, we've written more than 3,000 policies and helped over 1,500 families find coverage that truly fits their needs.

As Laura G., one of our clients, perfectly put it: "You don't know what you don't know and some things are too important to guess. Kelmeg added value without adding cost."

Benefits Over DIY Shopping

Trying to steer health insurance on your own can quickly become overwhelming. Working with a health insurance broker Boulder CO offers clear advantages that make the process smoother and more effective.

First, we're tremendous time-savers. While many Boulder residents spend hours researching plans only to end up more confused than when they started, our brokers can quickly narrow your options based on your specific situation. We do this every day, so we know exactly what questions to ask to find your perfect match.

We also provide access to all major carriers serving Boulder. Unlike when you shop on your own, we can show you the full spectrum of available plans—including some that might not be prominently featured on public exchanges.

Perhaps most importantly, we offer truly unbiased advice. When you call an insurance company directly, their representatives can only discuss their own company's options. We compare plans across multiple insurers, helping you see the complete picture.

We're also experts at translating insurance jargon into plain English, ensuring you understand exactly what you're getting before you sign up.

Kim M., a Boulder resident, shared her experience: "Colorado health care is a nightmare and so hard to steer. With all the ups and downs, Kelmeg was always there to ease my mind and help us."

Living in Boulder brings unique insurance considerations. For instance, Boulder's health-conscious lifestyle contributes to some of Colorado's lowest individual rates. However, proximity to Denver's medical market can sometimes push those rates higher. A local health insurance broker Boulder CO understands these nuances and how they affect your available options.

Are Brokers Really Free in Colorado?

We get this question all the time, and the answer is simple: Yes, our services come at a zero consumer fee.

Colorado's state-mandated pricing structure ensures that health insurance plans cost exactly the same whether you purchase them directly from an insurance carrier, through the Connect for Health Colorado marketplace, or with our assistance as licensed brokers.

Here's how it works behind the scenes: Insurance carriers pay brokers a commission that's already built into the premium structure of all plans. This commission is paid regardless of how you purchase your plan, so you might as well benefit from professional guidance since you're paying for it either way.

As one satisfied Boulder client explained: "I never thought I could have such a positive experience in the search for insurance. As my partner said after I got off my first call with Kelmeg, 'Sounds like we found our Agent!'"

This cost transparency is mandated by Colorado law, giving you peace of mind that working with Kelmeg & Associates truly comes without hidden fees or price increases. You get expert help navigating one of life's most important decisions—without paying extra for the privilege.

Health insurance broker boulder co: How to Choose the Right Partner

Finding the perfect health insurance broker Boulder CO isn't just about picking a name from a list - it's about finding a trusted partner who'll guide you through one of life's most important decisions. At Kelmeg & Associates, we've seen what makes the difference between a good broker and a great one.

What should you look for? Start with proper credentials. Every broker at our office maintains current licensing and participates in ongoing education. This might sound basic, but in the ever-changing world of health insurance, staying current matters tremendously.

Next, check if they're certified with Connect for Health Colorado - our state's official health insurance marketplace. This certification isn't just a fancy title; it means your broker understands the ins and outs of marketplace plans and knows how to help you access valuable subsidies that could save you thousands.

Medicare expertise is another crucial factor, especially as you approach your golden years. Medicare follows entirely different rules than other insurance types, with unique enrollment periods and coverage options. A broker who understands these nuances can help you avoid costly penalties and coverage gaps.

For Boulder's entrepreneurs and small business owners, finding a broker with small-business focus makes all the difference. Group health insurance and newer options like Individual Coverage Health Reimbursement Arrangements (ICHRAs) require specialized knowledge that not all brokers possess.

We're proud to say that at Kelmeg & Associates, we check all these boxes while providing the personalized attention that larger agencies often can't match.

What a health insurance broker Boulder CO will do for you

When you partner with a health insurance broker Boulder CO like us, you're getting much more than someone who just fills out paperwork. You're gaining a dedicated advocate who does the heavy lifting for you.

We start with thorough plan comparisons. Rather than just looking at monthly premiums, we dig into the details that really matter - deductibles, out-of-pocket maximums, coverage limits, and prescription formularies across multiple carriers. This deep-dive analysis helps identify which plans truly offer the best value for your specific situation.

We also perform careful network checks to make sure your favorite doctors and specialists are covered. There's nothing worse than signing up for a plan only to find your trusted family physician is out-of-network. We prevent these unwelcome surprises before they happen.

Many Boulder residents don't realize they qualify for substantial premium tax credits. We conduct thorough tax-credit screening to help you access these savings. One client was amazed to find she qualified for a $600 monthly reduction in premiums - money she would have left on the table without proper guidance.

Dr. Don Schmidt from Canyon Chiropractic Center put it perfectly: "Thank you for saving us money on our health insurance! We really appreciated your willingness to 'hand hold' us through the process. It can be a daunting task to choose from all the available insurance plans out there. You made it almost easy!"

Beyond helping you choose and enroll in the right plan, we provide year-round support. Have a claim denied? Not sure if a procedure is covered? Need help understanding a bill? We're just a phone call away, ready to help steer these challenges.

Working with a health insurance broker Boulder CO step-by-step

Working with Kelmeg & Associates follows a friendly, straightforward process designed to take the stress out of health insurance decisions.

We begin with an initial consultation where we get to know you and your specific needs. This isn't a sales pitch - it's a conversation about your healthcare concerns, budget constraints, and priorities. We can meet at our Boulder office, chat by phone, or connect virtually - whatever works best for you.

After our conversation, we conduct a thorough needs analysis. We consider factors like your medical history, regular prescriptions, preferred doctors, and anticipated healthcare needs. A young, healthy family has very different requirements than someone managing a chronic condition, and we tailor our approach accordingly.

Next comes the quote review, where we present carefully selected options with clear explanations of each plan's strengths and limitations. We translate insurance jargon into plain English and help you understand exactly what you're getting. As Don Marting of Martin Auctioneering shared: "I truly believe that you had my best interest at heart."

Once you've chosen your plan, we handle the application process from start to finish. We ensure all information is accurate, help determine your subsidy eligibility for marketplace plans, and make sure everything is submitted properly and on time.

But our relationship doesn't end at enrollment. We provide year-round service, serving as your advocate with insurance companies and answering any questions that arise. When renewal time comes around, we'll reach out to review your coverage and make adjustments as your needs change.

This personalized approach is why so many Boulder residents trust us with their health insurance decisions year after year. We're not just helping you buy insurance - we're building a relationship that ensures you always have someone in your corner when healthcare questions arise.

Plans and Programs Brokers Can Open up

Working with a health insurance broker Boulder CO is like having a master key that opens up doors to coverage options you might never find on your own. At Kelmeg & Associates, we help Boulder residents steer the full landscape of health insurance possibilities.

The world of health coverage can feel like a maze, but it doesn't have to. Let's break down the main options we can help you explore:

ACA Exchange Plans through Connect for Health Colorado offer potential game-changing savings for many Boulder families. Thanks to the 2022 Inflation Reduction Act, even households with higher incomes may qualify for premium subsidies that significantly reduce monthly costs. One client told us, "I never thought I'd qualify for assistance with my income level—what a pleasant surprise!"

For those who value flexibility and wider provider networks, Off-Exchange PPO Plans might be your best fit. These plans often include more doctors and hospitals, giving you greater freedom in your healthcare choices. They're particularly valuable for Boulder residents who travel frequently or have established relationships with specific specialists.

Turning 65 soon? The Medicare landscape can be especially confusing with its alphabet soup of Parts A, B, C, D, plus Medigap supplements. We guide Boulder seniors through choosing between Original Medicare, Medicare Supplements, Medicare Advantage plans, and prescription coverage. The Annual Election Period runs from October 15 through December 7—mark your calendars!

Boulder business owners love our Group Benefits solutions that help them attract and retain talent in our competitive local market. As one Boulder entrepreneur shared, "Having professional guidance on our benefits package has been instrumental in building our team." We design customized plans that balance comprehensive coverage with budget realities.

For businesses seeking more flexibility, Individual Coverage Health Reimbursement Arrangements (ICHRA) offer an innovative approach. These allow Boulder employers to reimburse employees tax-free for individual health insurance premiums and qualified medical expenses, creating a win-win situation for everyone involved.

Health Savings Account (HSA) Plans pair particularly well with Boulder's wellness-focused lifestyle. These high-deductible health plans come with tax-advantaged savings accounts that can be used for everything from conventional medical expenses to many alternative and preventive care options popular in our community.

Boulder's vibrant entrepreneurial scene means we work with many Self-Employed individuals seeking affordable coverage. Whether you're a freelance writer working from a Pearl Street café or running a small consulting firm, we understand the unique challenges of finding coverage without employer support.

The beauty of working with a local broker is that we understand which plans work best in Boulder's unique healthcare environment. We know which networks include popular local providers like Boulder Community Health and which plans best cover the active lifestyles many Boulder residents enjoy.

"Having someone translate all these options into plain English made all the difference," shared Mike, a local small business owner. "I finally understand what I'm paying for and why."

Individual and Family Health Insurance Group Health Insurance Colorado Health Insurance for Self-Employed

Key Deadlines, Tax Credits & Ongoing Support

Health insurance has its own calendar, and missing important dates can leave you without coverage. At Kelmeg & Associates, we make sure our Boulder clients never miss these crucial deadlines.

The Open Enrollment Period for individual and family plans through Connect for Health Colorado runs from November 1 through January 15. But here's an important tip: if you want your coverage to begin on January 1 (and avoid that gap in protection), you need to enroll by December 15.

"I nearly missed the deadline last year and would have been without insurance for a month," shares Boulder resident Melissa T. "My health insurance broker Boulder CO at Kelmeg sent me timely reminders that saved me from that mistake."

For our Medicare clients, the Annual Election Period (AEP) runs from October 15 through December 7. This window allows Medicare beneficiaries to change their Medicare Advantage or Part D prescription drug plans for the upcoming year. We often see Boulder seniors overwhelmed by the options, which is why we start preparing our clients weeks before AEP begins.

Life doesn't always follow a calendar, though. That's why Special Enrollment Periods (SEP) exist. These allow you to enroll outside the standard windows when you experience qualifying life events. Maybe you lost your employer coverage, got married (or divorced), welcomed a new child, moved to a new area, or had an income change affecting your subsidy eligibility. When these life changes happen, you typically have 60 days to secure new coverage.

Good news for Boulder residents who thought they made "too much" for subsidies: The Inflation Reduction Act has dramatically expanded tax credit eligibility. Previously, if your household earned more than 400% of the Federal Poverty Level, you weren't eligible for any help. Now, subsidies ensure no one pays more than 8.5% of their income for a benchmark silver plan. This has been a game-changer for many of our Boulder clients.

"Kelmeg called my insurer and Connect for Health CO daily for hours at a time until she did what everyone said was absolutely impossible," shared one grateful Boulder client. "She got my insurance coverage back in full force with no lapse in coverage!"

But our relationship doesn't end after enrollment. Our ongoing support includes:

Claims advocacy when your insurance carrier gives you trouble. We speak their language and know how to cut through the red tape. Renewal reminders arrive well before your plan expires, so you're never caught off guard. We conduct plan reviews annually to ensure your coverage still aligns with your changing needs. And if you ever face a denied claim, we provide assistance with appeals, guiding you through what can be an intimidating process.

"She and her team are also available if you have an emergency," one client noted. "They will actually call you back and are interested in your well-being, not only as a client but as a person."

This continuous relationship means you're never alone in navigating the complexities of health insurance. We believe that's how it should be.

Help at Customer Service Center Affordable Health Coverage Colorado

Real Stories From Boulder Residents

The true measure of a health insurance broker Boulder CO comes from the experiences of real clients. At Kelmeg & Associates, we're proud of the positive impact we've had on countless Boulder residents' lives.

Take the case of the Johnson family, who had been struggling with their health insurance costs. They were paying nearly $1,800 monthly for a family plan purchased directly from an insurance carrier. After sitting down with our team for a consultation, we finded they qualified for premium tax credits through Connect for Health Colorado that they had no idea existed. Their new monthly premium? Just under $700 for comparable coverage—an annual savings of over $13,000. They were able to redirect those savings toward their children's college funds instead.

Then there's Michael, a self-employed graphic designer who was about to lose his COBRA coverage after leaving his corporate job to pursue his passion. With just days remaining before his coverage would lapse, he came to us in a panic. We helped him steer the Special Enrollment Period process and secured an individual plan that maintained access to his existing doctors while fitting his entrepreneur's budget. Michael later told us the relief he felt was "like having a weight lifted off my shoulders."

"Barbara called my insurer and Connect for Health CO daily for hours at a time until she did what everyone said was absolutely impossible. She got my insurance coverage back in full force with no lapse in coverage!" shares Melanie A. from Boulder. Melanie had been caught in a bureaucratic nightmare until our team stepped in to advocate on her behalf.

For the Rodriguez family, finding coverage for their college-age children presented a challenge they weren't sure how to handle. We explained their options—keeping their kids on the family plan until age 26 or helping the students find their own affordable coverage through the marketplace with potential subsidies. After weighing the pros and cons together, the family chose to maintain a single family plan, simplifying their administration while ensuring everyone remained covered. Mrs. Rodriguez mentioned that "having someone talk through our options in plain English made all the difference."

What Boulder residents value most about working with a dedicated health insurance broker Boulder CO is the peace of mind that comes from knowing their coverage truly fits their needs. They appreciate the financial savings through proper subsidy application and plan selection. The time saved by delegating research and enrollment tasks allows them to focus on what matters most in their lives.

Clients repeatedly tell us how much they value having ongoing advocacy when questions or problems arise with their coverage. Our local expertise that understands Boulder's unique healthcare landscape proves invaluable when selecting the right network of providers. Perhaps most importantly, they cherish the relationship continuity with a broker who knows their history and needs, eliminating the need to explain their situation repeatedly to different representatives.

As Frauke F. from Boulder explains: "She and her team are also available if you have an emergency. They will actually call you back and are interested in your well-being, not only as a client but as a person."

These stories represent just a small sample of the thousands of Boulder residents we've helped steer the complex world of health insurance over our years of service. Each client brings unique circumstances, but they all share the same need for compassionate, expert guidance through what can otherwise be an overwhelming process.

Frequently Asked Questions about Boulder Health Insurance Brokers

Is there any cost to use a broker in Colorado?

One question I hear almost daily from Boulder residents is about broker fees. The answer always brings relief: No, using a health insurance broker Boulder CO won't cost you a penny more than going it alone.

This often surprises people, but it's actually written into Colorado law. All Medicare plans, Connect for Health Colorado marketplace plans, and small-group health insurance must be sold at identical prices whether you use a broker or shop directly.

Here's how it works behind the scenes: Insurance companies already build broker commissions into their premium structures. That commission gets paid regardless of how you purchase your plan. So when you work with us at Kelmeg & Associates, you're essentially getting our expertise as a free bonus.

As Mary from North Boulder told us after saving over $4,000 on her family's annual premiums: "Kelmeg added value without adding cost. I had no idea I could get all this help without paying extra!"

Can a broker help me qualify for ACA subsidies or Medicare plans?

Absolutely! In fact, subsidy optimization is one of the most valuable services a health insurance broker Boulder CO provides.

For ACA marketplace plans, we conduct a thorough assessment of your specific situation—household size, projected income, and other qualifying factors—to maximize your premium tax credits and cost-sharing reductions. Many Boulder clients don't realize they qualify for subsidies until we show them the math.

Just last month, I worked with a self-employed photographer who was paying $890 monthly for coverage. After our subsidy analysis, her new premium dropped to $340 for better coverage—an annual savings of over $6,600!

For Medicare, we help explain the alphabet soup of Parts A, B, C, D, and supplements. We evaluate whether Original Medicare with a supplement or a Medicare Advantage plan better suits your specific healthcare needs, prescription requirements, and preferred providers. We also ensure you enroll during the appropriate periods to avoid costly penalties.

The Medicare transition can be particularly stressful, but as one client put it: "Barbara made my switch from employer coverage to Medicare completely seamless. I never had a single day without coverage, and she found me a supplement plan that covered all my medications for less than I expected."

What kind of support will I receive after enrollment?

At Kelmeg & Associates, we believe the relationship is just beginning when your enrollment is complete. Our 94% client renewal rate speaks to the ongoing support we provide throughout the year.

When you work with our health insurance broker Boulder CO team, you gain a year-round advocate who helps with:

• Claims issues that inevitably arise. When Boulder Community Health accidentally billed a client as out-of-network (when they were very much in-network), we spent three hours on conference calls resolving the error and saving our client over $3,800.

• Life changes that affect your coverage needs. Marriage, new babies, retirement, job changes—we help you steer these transitions without coverage gaps.

• Annual plan reviews before renewal to ensure your coverage still matches your needs and budget as both the market and your situation evolve.

• Provider network verification so you know whether that specialist your doctor referred you to is covered before you make the appointment.

• Benefits explanation in plain English. When your EOB (Explanation of Benefits) looks like it was written in another language, we translate it for you.

As Frauke from South Boulder shared: "They will actually call you back and are interested in your well-being, not only as a client but as a person. That level of service is rare these days."

Think of us as your personal health insurance concierge—here to help not just during enrollment season, but whenever questions or concerns arise throughout the year.

Conclusion: Take the Next Step Toward Confidence in Your Coverage

Health insurance doesn't have to be a maze you steer alone. As your trusted health insurance broker Boulder CO, Kelmeg & Associates stands ready to be your guide through the complex world of healthcare coverage—and remember, our expert guidance comes at absolutely no additional cost to you.

We've spent over two decades building relationships with Boulder residents just like you. Our approach isn't about pushing policies; it's about listening to your unique situation and finding coverage that truly fits your life. After all, health insurance isn't just paperwork and premiums—it's about sleeping better at night knowing you're protected when life throws unexpected challenges your way.

Are you a young professional looking for affordable individual coverage? A growing family needing comprehensive benefits without breaking the bank? Perhaps you're approaching Medicare eligibility and feeling overwhelmed by the options? Or maybe you're a small business owner wanting to attract talent with competitive benefits? Whatever your situation, we've been there before and can help light the path forward.

Our 94% client renewal rate tells a story that marketing claims simply can't. When people stick with us year after year, it's because they've experienced the difference a dedicated broker makes. With over 3,000 policies written and countless Boulder families served, we've built our reputation one relationship at a time.

"Insurance is complicated, but having Kelmeg on our side makes it so much easier," one client recently told us. "It's like having a friend in the business who's looking out for your best interests."

That's exactly what we aim to be—not just an insurance broker, but a trusted partner in your healthcare journey. From your initial consultation through enrollment and beyond, we'll be there answering questions, solving problems, and ensuring your coverage evolves as your life does.

Why tackle this alone when expert help is available at no extra charge? Take that first step toward coverage confidence today. A simple conversation could save you thousands of dollars while providing better protection for you and your loved ones.

Reach out to Kelmeg & Associates through our website to request your personalized quote. Your perfect health insurance solution is closer than you think—and we'd be honored to help you find it.