The Truth About Medicare Dental Coverage in Colorado

Good dental health is essential at any age, but it becomes even more important as we grow older. For many Colorado seniors navigating Medicare, one question comes up surprisingly often: "Does my medicare insurance in Colorado cover toothpaste and other dental necessities?"

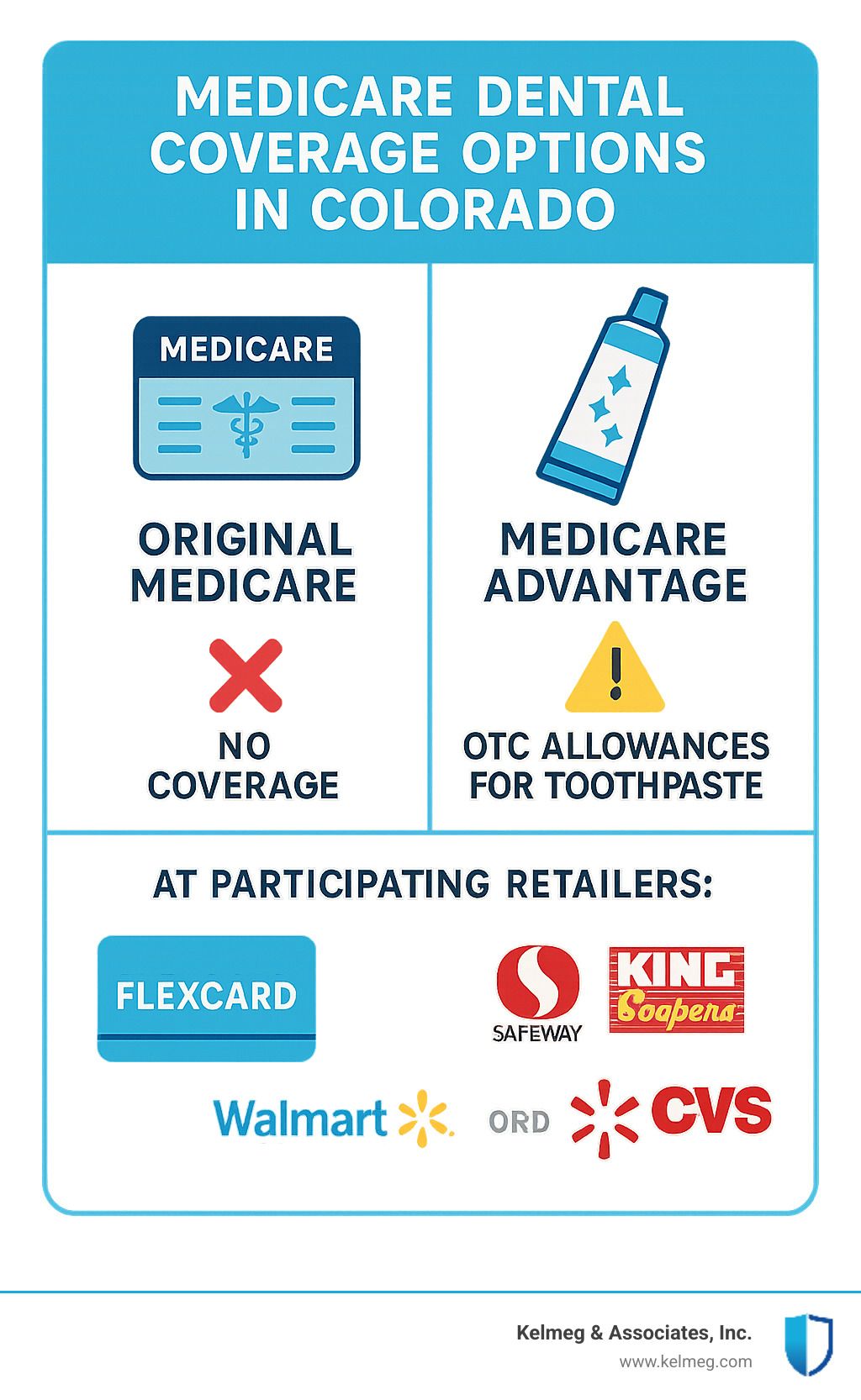

The short answer might disappoint you – Original Medicare doesn't cover most dental care, including everyday essentials like toothpaste. But don't worry, you've got options!

I'm Kelsey with Kelmeg & Associates, and I've helped hundreds of Colorado seniors understand their Medicare benefits. Let's clear up the confusion around dental coverage and explore the real possibilities for getting help with dental care costs.

Medicare's relationship with dental care has always been complicated. When the program was established in 1965, routine dental care was specifically excluded. This decision continues to affect millions of seniors today who are surprised to find that basic oral hygiene products and preventive dental visits aren't covered under Original Medicare.

For Colorado residents specifically, understanding your Medicare dental options requires looking beyond the basics. While medicare insurance Colorado covering toothpaste isn't available through traditional Medicare, certain Medicare Advantage plans offer alternatives worth exploring

The good news is that Medicare coverage in Colorado has evolved over the years. Some Medicare Advantage plans now include quarterly over-the-counter (OTC) allowances that can be used for dental hygiene products. These benefits can make a real difference in maintaining oral health while keeping your budget intact.

Let's explore what Medicare really covers, what it doesn't, and how Colorado seniors can find the dental benefits they need – including those elusive toothpaste benefits some plans offer.

What Original Medicare Really Covers—and Why Toothpaste Isn't on the List

When folks ask me about Medicare insurance Colorado covering toothpaste, I have to break the news gently. Original Medicare doesn't cover toothpaste—and it's not because the government doesn't think oral health matters. It's actually written into law!

Back in 1965, when Medicare was created, Congress specifically excluded routine dental care in Section 1862(a)(12) of the Social Security Act. The law plainly states that Medicare won't pay for services "in connection with the care, treatment, filling, removal, or replacement of teeth or structures directly supporting teeth."

What does this mean for you? Under Original Medicare (Parts A & B), you're responsible for 100% of the costs for routine dental care and personal hygiene products. That includes your regular cleanings, fillings, and yes, that tube of toothpaste sitting on your bathroom counter.

As Medicare.gov confirms: "In most cases, Medicare doesn't cover dental services like routine cleanings, fillings, tooth extractions, or items like dentures."

What's Covered Under Part A & Part B

Now, before you think Medicare never covers anything dental-related, there are some exceptions—they're just pretty narrow.

Medicare Part A (Hospital Insurance) might have your back when:

- You need emergency dental work during a hospital stay

- You're having a kidney transplant or heart valve replacement and need a dental exam first

- You require jaw reconstruction after an accident or cancer surgery

- You need dental splints after jaw surgery

I remember helping Martha from Fort Collins steer this exact situation. "I broke my jaw in a fall," she told me. "I was so relieved when Medicare covered the wiring I needed during my hospital stay—it was one less thing to worry about during a scary time."

Medicare Part B (Medical Insurance) occasionally covers dental services too, but only when they're an essential part of another covered procedure—like extractions before radiation for jaw cancer or oral exams before an organ transplant.

When these exceptions apply, standard Medicare cost-sharing kicks in:

- For Part A: The $1,736 deductible (2025) for each benefit period, plus daily coinsurance for longer stays

- For Part B: 20% of the Medicare-approved amount after meeting the $254 annual deductible (2025)

Why Routine Dental Care and "medicare insurance colorado covering toothpaste" Don't Mix

So why doesn't Medicare cover the basics like Medicare insurance Colorado covering toothpaste? It comes down to how the program was designed. Medicare focuses on acute medical needs rather than preventive or routine care items.

Think about it this way—toothpaste is considered everyday hygiene, like soap or shampoo. Since everyone uses these items regardless of age, they weren't included in Medicare's coverage scope.

This creates a real gap in care that frustrates many of my clients. Research clearly shows strong connections between oral health and conditions like heart disease, diabetes, and respiratory infections—all things Medicare will cover when they get serious enough to need treatment.

As Dr. Lisa Corbin, a geriatric specialist I often refer clients to in Lafayette, puts it: "It's a frustrating paradox—Medicare won't cover the $5 tube of toothpaste that might prevent dental disease, but will cover thousands in medical care for conditions that could be exacerbated by poor oral health."

This disconnect between preventive oral care and Medicare coverage is why I work so hard to help my Colorado clients find Medicare Advantage plans with good OTC allowances. Sometimes the best solution isn't in the original program, but in knowing where else to look!

Medicare Insurance Colorado Covering Toothpaste: Myth vs. Reality

I've heard it so many times in my office: "I thought Medicare would cover my toothpaste!" This misconception is surprisingly common, especially here in Colorado where some Medicare Advantage plans do offer extra benefits that blur the lines. Let's sort fact from fiction so you can make better decisions about your coverage.

The truth is, Original Medicare (Parts A & B) never covers toothpaste or routine dental care – not in Colorado, not anywhere. This surprises many new Medicare beneficiaries who assumed basic dental hygiene products would be included in their healthcare coverage.

Where the confusion often stems from is the difference between Original Medicare and Medicare Advantage plans. While the government-administered Original Medicare has strict limitations, Medicare Advantage plans in Colorado (run by private insurance companies) have flexibility to offer supplemental benefits including OTC allowances that can be used for toothpaste and other dental supplies.

And no, having Medicare doesn't mean you can skip budgeting for dental expenses. Most Medicare beneficiaries need to plan for out-of-pocket dental costs or look into additional coverage options. I've helped countless Colorado seniors develop strategies to manage these expenses without breaking the bank.

Does Any Colorado Medicare Plan Actually Pay for Toothpaste?

Yes! But there's a catch – it's only through specific Medicare Advantage plans that offer over-the-counter allowances or FlexCard benefits. These plans provide members with a prepaid card or allowance specifically for health-related items, including dental hygiene products like toothpaste.

Denver Health Medicare Advantage plans are a good example. Their members receive a FlexCard with an OTC allowance that can be used at participating stores. According to their 2025 catalog, members can use their FlexCard for "approved OTC items such as: antacids, cold and allergy remedies, first-aid supplies, personal care products like toothpaste and toothbrushes."

The benefits vary significantly between plans. Lift Medicare Choice (HMO D-SNP) members can receive up to $2,500 annually, while Lift Medicare Select (HMO) members get up to $925 annually. That's a substantial difference!

I remember helping James, a 68-year-old client from Broomfield, steer this benefit. He was delighted to find he could use his quarterly allowance at King Soopers: "I just swipe the FlexCard like a regular credit card when I buy toothpaste and floss. The eligible items are covered automatically – no paperwork or reimbursement hassles."

These allowances can be used at many popular Colorado retailers including Safeway, King Soopers, Walmart, CVS, and Walgreens (both in-store and online). Some plans even allow online or phone orders through Medline, which is particularly helpful for seniors with mobility issues.

When Dental Services ARE Covered Under Medicare

While medicare insurance colorado covering toothpaste isn't available through Original Medicare, there are rare situations where Medicare will cover dental services. The key phrase here is "medically necessary" and "inextricably linked" to other covered treatments.

For instance, if you need a dental examination before a kidney transplant or heart valve replacement, Medicare will likely cover it – not because they're suddenly interested in your dental health, but because they want to eliminate potential infection sources before major surgery.

Similarly, dental work required before radiation treatment for jaw cancer is typically covered. Medicare also steps in for jaw reconstruction following accidents or cancer surgery, hospital inpatient services for complex dental procedures, and dental splints or wiring after certain jaw surgeries.

I worked with a client from Denver who was surprised when Medicare covered her dental examination before heart valve surgery. "They wouldn't pay for the actual fillings I needed," she told me, "but they covered the exam to check for infections that might complicate my surgery."

The important thing to understand is that in these scenarios, Medicare covers dental services only as an essential component of another covered medical procedure – not as standalone dental care. It's a narrow exception, not a change in the overall policy of excluding routine dental care.

When you're trying to determine if medicare insurance colorado covering toothpaste or other dental services might be available to you, the best approach is to review your plan's Evidence of Coverage document or speak with a Medicare specialist who understands Colorado's specific options. At Kelmeg & Associates, we help clients steer these nuances every day, finding the coverage that best fits their unique needs.

Supplemental Paths: OTC Allowances, FlexCards & Medicaid Work-Arounds

So your Original Medicare won't cover that tube of Crest—now what? Don't worry! Colorado seniors have several clever workarounds to get help with dental hygiene products.

Medicare Advantage OTC Allowances & FlexCards in Colorado

Prepaid Visa gift card your grandkids gave you last Christmas? Medicare Advantage FlexCards work similarly, but they're specifically for health items—including medicare insurance colorado covering toothpaste.

Denver Health's FlexCard program is particularly generous. Their cards work just like a regular MasterCard at stores all across Colorado. You simply shop for eligible items, swipe the card at checkout, and the system automatically recognizes what's covered. If you pick up something that isn't covered (like that pint of ice cream), the register will ask for another payment method for those items.

"I was skeptical at first," admits Frank, a 70-year-old from Lakewood. "But now I use my FlexCard every quarter at King Soopers. I get my toothpaste, dental floss, even those little interdental brushes my dentist is always nagging me about."

Most plans load these funds quarterly—think January, April, July, and October—and here's the important part: use it or lose it! Unused funds typically vanish at quarter's end, so mark your calendar and stock up before those deadlines.

Kaiser Permanente takes a slightly different approach with their OTC program. Rather than shopping in person, members can browse an online catalog or order by phone. Your dental supplies then arrive right at your doorstep—perfect for those snowy Colorado winter days when you'd rather not venture out.

Checking your balance is simple too. Most plans offer online portals, mobile apps, or a customer service number on the back of your card. A quick five-minute check could save you from the embarrassment of having your card declined while buying medicare insurance colorado covering toothpaste with a line forming behind you!

Leveraging Colorado Medicaid & Dual-Eligible SNPs

For seniors working with limited incomes, Health First Colorado (our state's Medicaid program) offers additional dental support that works alongside Medicare.

Colorado has actually improved its Medicaid dental benefits in recent years. Since 2023, they've maintained a generous annual dental cap of $1,500 per fiscal year. While this primarily covers dental services rather than products, having those cleanings and fillings covered means more money in your pocket for toothpaste and other necessities.

The real winners in this system are dual-eligible folks—those who qualify for both Medicare and Medicaid. Special Needs Plans (D-SNPs) designed for dual-eligibles often include the most comprehensive coverage available anywhere.

Take the Denver Health Lift Medicare Choice (HMO D-SNP) plan, for example. It offers an impressive $2,500 annually in OTC benefits for 2025. That's enough for quite a stockpile of dental supplies!

"It's like night and day," shares Elaine from Commerce City, who recently qualified for dual coverage. "I used to skip dental check-ups to save money for basics like toothpaste. Now my D-SNP plan covers both. My daughter says my smile looks ten years younger!"

Not sure if you qualify for Medicaid? It's worth checking—the income thresholds might be higher than you think. You can visit the Health First Colorado website, call their Member Contact Center at 1-800-221-3943, or stop by our office at Kelmeg & Associates. We help people steer dual-eligibility every day and never charge for this guidance.

Smart Shopping Tips for Oral-Care Products If You're on Medicare

Let's face it—dental care can take a bite out of your budget when you're on Medicare. If you don't have a Medicare Advantage plan with those handy OTC benefits (or if your allowance runs dry before your toothpaste tube does), you're not out of options.

Many of my Colorado clients have found clever ways to keep their smiles bright without emptying their wallets. Take Eleanor from Lafayette, for example. At 75, she's become something of a dental supply shopping expert: "I combine coupons with store sales at Walgreens and stock up on toothpaste when it's at its lowest price. I haven't paid full price for dental supplies in years."

Eleanor's onto something smart. Store brands often contain identical active ingredients to the fancy name brands, but at half the price or less. And buying in bulk when there's a good sale can slash your per-unit cost dramatically. Don't overlook those Sunday newspaper coupons either—they might seem old-fashioned, but the savings add up quickly for items like toothpaste that you know you'll use.

Another tip from my client Robert in Denver: "I always ask my dentist for samples during my checkups. They're usually happy to send me home with a toothbrush and travel-sized toothpaste." These dental office samples can supplement your supply and let you try premium products without the premium price tag.

Using Over-the-Counter Networks at Major Retailers

If you're fortunate enough to have Medicare insurance Colorado covering toothpaste through an OTC allowance, you'll want to maximize every penny of that benefit. The key is knowing how to steer the system efficiently.

Before heading to the store, take a moment to check which items are eligible. Most plans with FlexCard benefits have mobile apps that let you scan product barcodes right in the aisle to confirm coverage. This simple step can save you the frustration of reaching the checkout only to find your chosen toothpaste isn't covered.

Many Colorado seniors don't realize they can often order their dental supplies online through their plan's dedicated website. The Denver Health Medicare Advantage documentation notes that "online orders process in 1–4 days," while mail orders might take up to four weeks. If you're running low on supplies, that timing matters.

Sarah from Boulder has mastered the online approach: "I order my toothpaste, mouthwash, and other health items through Kaiser's online portal every quarter. The items arrive within a few days, and I never have to worry about going to the store or paying out of pocket."

Most OTC benefits refresh quarterly—typically in January, April, July, and October. Any unused funds usually expire at the end of each quarter, so it's smart to set a calendar reminder to place your orders early. Your future self (and smile) will thank you.

Stretching Your Dental Budget Beyond Insurance

Good oral health involves more than just having the right toothpaste. It's about creating a comprehensive approach that prevents costly problems down the road.

Dr. Michael Rodriguez, a dentist in Boulder, puts it perfectly: "The most cost-effective dental strategy is prevention. Investing in good home care habits and regular cleanings will save thousands in restorative work later."

Those preventive habits really do pay dividends. Brushing twice daily, flossing regularly, and using a fluoride rinse creates a powerful defense against decay and gum disease. These simple routines can help you avoid expensive treatments that Medicare typically doesn't cover.

For professional care, consider alternatives to traditional private practices. The University of Colorado School of Dental Medicine offers discounted cleanings and treatments provided by supervised students. The quality is excellent, though appointments may take longer than at a private practice.

Many of my clients have also found significant savings through dental discount plans. Unlike insurance, these plans charge an annual membership fee (usually $100-200) in exchange for reduced rates at participating dentists. For seniors needing several procedures, the savings often far exceed the membership cost.

Colorado's network of Federally Qualified Health Centers provides another option, with sliding-scale fees based on your income. Centers like Clinica Family Health in Boulder County or Salud Family Health in several northern Colorado locations offer quality dental care at rates many seniors find much more manageable than private practice fees.

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA) from previous employment, remember those funds can be used for dental expenses even if Medicare insurance Colorado covering toothpaste isn't available through your plan.

By combining these strategies with smart shopping for everyday dental supplies, you can maintain excellent oral health without letting dental costs drain your retirement savings. At Kelmeg & Associates, we're always happy to help you explore which Medicare Advantage plans offer the best dental and OTC benefits for your specific needs.

Frequently Asked Questions about Medicare Dental & OTC Coverage in Colorado

Does Original Medicare ever cover toothpaste or toothbrushes?

I hear this question almost daily in my office, and I have to deliver the disappointing news: Original Medicare (Parts A & B) never covers toothpaste, toothbrushes, or any dental hygiene products. These items fall into the "personal care" category – just like your shampoo or deodorant – and are specifically excluded by Medicare law.

The good news? If you're looking for Medicare insurance Colorado covering toothpaste, you do have options through Medicare Advantage plans. Many of these plans offer those handy OTC allowances or FlexCard benefits I mentioned earlier. These work almost like a pre-paid gift card you can use at places like King Soopers or Walgreens to grab your dental supplies without reaching for your wallet.

One of my clients, Ruth from Aurora, was thrilled when she found her Advantage plan gave her $75 quarterly for OTC items. "I've been using the same toothpaste for decades," she told me, "and now it's covered by my plan. It's not a fortune, but those little savings add up!"

How do I find out if my Medicare Advantage OTC card covers a specific brand of toothpaste?

This is where a bit of homework pays off! There are several easy ways to check if your favorite Crest or Colgate is covered:

First, look at your plan's OTC catalog. Every Medicare Advantage plan with OTC benefits provides a catalog – either online or in print – showing exactly what's covered. Some even mark items with helpful icons showing which products qualify.

Your plan's mobile app can be a true shopping companion. Many let you scan product barcodes right in the store to instantly check if an item is covered. I always recommend doing this before checkout to avoid surprises.

When in doubt, just call the customer service number on the back of your OTC card. The representatives can tell you immediately if that specific sensitivity toothpaste or whitening product is included.

Eligible items can change quarterly, so what was covered in January might not be in April. It's always worth double-checking before filling your cart!

What are my out-of-pocket costs for routine dental care in Colorado?

Without dental coverage, Colorado seniors often experience sticker shock at the dentist. A routine cleaning and exam typically runs $125-$250 in 2025, while a single filling might cost $175-$350 per tooth. More extensive work gets expensive quickly – crowns average $1,200-$1,800, and a full set of dentures can hit $3,500 for just one arch.

When I sit down with clients to review their Medicare options, dental costs are often a major concern. Take my client James from Littleton – he was paying over $900 annually just for basic preventive care until we found him a Medicare Advantage plan with comprehensive dental benefits.

With a good Medicare Advantage dental plan in Colorado, your costs become much more manageable. Most plans cover preventive services (those regular cleanings and check-ups) at 100% when you stay in-network. Basic services like fillings are typically covered at 70-80%, while major work like crowns might be covered at 50%.

The annual maximums vary significantly between plans. For example, Kaiser Permanente's Medicare Advantage plans in Colorado offer different coverage levels for 2025:

- Their Core HMO provides a $1,550 annual maximum

- The Choice PPO includes a $1,450 annual maximum

- Their premium Bronze HMO PPO increases to $2,450 annually

- Their D-SNP plan for dual-eligible members offers the most generous $2,500 maximum

Medicare insurance Colorado covering toothpaste through OTC benefits is separate from these dental service maximums – they're additional benefits that help complete your oral healthcare picture.

At Kelmeg & Associates, we help match you with the plan that balances your dental needs with your budget. After all, a healthy smile shouldn't cost you your retirement savings!

Conclusion

Navigating Medicare insurance Colorado covering toothpaste and dental benefits can feel like solving a puzzle with missing pieces. While Original Medicare leaves you without coverage for that tube of Crest or Colgate, there are pathways to getting help with these everyday necessities.

I've worked with hundreds of Colorado seniors who were surprised to learn that their Medicare coverage had such significant gaps when it came to oral health. The good news? You have options that many beneficiaries don't even know exist.

If you're currently on Original Medicare without supplemental coverage, you're likely paying 100% out-of-pocket for all dental care and supplies. Taking a few minutes to review your coverage could save you hundreds of dollars annually on items as simple as toothpaste.

Medicare Advantage plans in Colorado often include those valuable OTC allowances we've discussed. These benefits can transform your dental budget, turning what was once an out-of-pocket expense into a covered benefit. Many of my clients use their quarterly allowances to stock up on dental supplies at their favorite local stores – from King Soopers to Walgreens.

For those with limited income, exploring dual-eligibility between Medicare and Medicaid could open doors to the most comprehensive coverage available. I recently helped Martha from Lafayette find she qualified for a D-SNP plan that now covers not just her dental visits but provides a generous allowance for dental supplies too.

Some seniors prefer to stay with Original Medicare for their primary coverage. If that's you, consider a standalone dental insurance plan to fill the gaps. While these plans won't typically cover toothpaste directly, they offset other dental expenses, freeing up your budget for personal care items.

At Kelmeg & Associates, we understand that good oral health is fundamental to your overall wellbeing and quality of life. When your teeth and gums are healthy, you feel better, eat better, and often avoid more serious health complications down the road.

We're here to help you understand all your options in plain English – no insurance jargon, no pressure tactics. Our approach is simple: we listen to your needs, explain your options, and help you find the plan that works best for your unique situation.

Whether you're in Lafayette, Broomfield, Boulder, or anywhere in Colorado, our team is ready to provide personalized guidance on Medicare dental coverage. The best part? Our service comes at no additional cost to you.

Don't let confusion about Medicare insurance Colorado covering toothpaste prevent you from getting the coverage you deserve. A simple conversation could be the first step toward better benefits and better health.

For personalized guidance on navigating Medicare dental options in Colorado, reach out to our friendly team at Kelmeg & Associates. We're real people who understand that behind every Medicare question is a person who just wants straight answers and honest advice.