Colorado Health Insurance Assistance Made Easy

Why Colorado health insurance assistance Matters for Your Family's Future

Colorado health insurance assistance can save you thousands of dollars while ensuring you get the coverage you need. Whether you're shopping for your first plan, supporting your family, or running a small business, Colorado offers multiple programs and expert help to make healthcare affordable and accessible.

Here's where to get Colorado health insurance assistance:

• Connect for Health Colorado - 77 certified assistance sites statewide offering free help

• Health First Colorado (Medicaid) - Year-round enrollment for income-qualified residents

• Child Health Plan Plus (CHP+) - Low-cost coverage for kids and pregnant women

• SHIP Program - Free Medicare counseling at 17 locations across Colorado

• County human services offices - Local application support and guidance

• Certified insurance brokers - Professional help at no extra cost to you

The numbers tell the story: nearly one in five appointments with Connect for Health Colorado experts were conducted in Spanish last year, and the average monthly premium for a 25-year-old in Denver dropped from $126 to $95 in 2024. These savings happen because Colorado has built a strong network of assistance programs designed to help residents steer complex insurance choices.

As Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc., I've helped countless Colorado families and businesses find the right coverage through these Colorado health insurance assistance programs. My experience has shown me that with the right guidance, even the most complex insurance decisions become manageable and affordable.

Understanding Your Health Coverage Choices in Colorado

Finding the right health insurance in Colorado doesn't have to feel overwhelming. The state offers four main coverage options, and each one is designed with different families and budgets in mind. Whether you're earning $25,000 or $75,000 a year, there's likely a program that fits your situation.

Connect for Health Colorado serves as your marketplace for private insurance plans, while Health First Colorado (Medicaid) covers lower-income residents. Child Health Plan Plus (CHP+) bridges the gap for working families with kids, and Medicare takes care of our seniors and disabled community members. The trick is knowing which door to walk through.

When I work with families across Lafayette, Broomfield, Boulder, and Adams County, I often see the same confused expressions when we start talking about networks and deductibles. Here's the thing - insurance companies love their acronyms, but the differences between plan types are actually pretty straightforward once you know what to look for.

HMO

Smallest

Yes

Emergency only

Lower premiums, don't mind referrals

PPO

Largest

No

Yes (higher cost)

Want flexibility, see specialists often

EPO

Medium

No

Emergency only

Balance of cost and flexibility

POS

Medium

Yes for specialists

Yes (higher cost)

Want some out-of-network options

Think of it this way: HMOs are like having a primary care doctor who acts as your healthcare quarterback, coordinating everything. PPOs give you the freedom to see any doctor you want, but you'll pay more for that flexibility. EPOs and POS plans fall somewhere in between, offering different combinations of cost and choice.

Private Marketplace & ACA Plans

Connect for Health Colorado is where you'll shop for private insurance if you don't qualify for Medicaid or Medicare. These are the plans that follow all the Affordable Care Act rules, which means they cover essential things like preventive care, prescription drugs, maternity care, and mental health services - no matter which plan you choose.

The metal tier system makes comparison shopping easier. Bronze plans have the lowest monthly payments but highest deductibles - think of them as catastrophic coverage that protects you from big medical bills. Silver plans offer the sweet spot for most families, especially if you qualify for extra savings. Gold and platinum plans cost more monthly but cover more of your day-to-day healthcare costs.

Here's what many people don't realize: Connect for Health Colorado is the only place you can get Premium Tax Credits to lower your monthly costs. We've seen these credits save our clients anywhere from $31 to $57 per month compared to previous years. That's real money back in your pocket.

More info about Affordable Health Coverage in Colorado

Health First Colorado (Medicaid)

Health First Colorado provides comprehensive coverage for adults under 65 whose household income falls at or below 138% of the federal poverty level. For 2023, that means a single person earning up to $20,120 annually can qualify - but don't let that number fool you. Family size matters, so a family of four can earn significantly more and still qualify.

The best part? You can apply any time of year through the Colorado PEAK portal. No waiting for open enrollment periods or worrying about missing deadlines. Lost your job? Apply immediately. Had your hours cut? You might qualify right now.

The program has really stepped up its game in recent years. They've eliminated most co-pays and added benefits like adult dental coverage with no annual limits. It's comprehensive coverage that rivals many private plans, and it's designed to keep you healthy without breaking your budget.

Child Health Plan Plus (CHP+)

CHP+ fills a crucial gap for working families. If you earn too much for Medicaid but can't afford private insurance, this program covers children up to age 18 and pregnant women. For a family of four, you can earn up to approximately $63,000 per year and still qualify.

The program recently eliminated its annual enrollment fee, which used to be a barrier for some families. Now you get comprehensive coverage including doctor visits, emergency care, preventive screenings, immunizations, dental, vision for kids, maternity care, mental health services, and prescriptions.

Pregnant women, American Indians, and Alaska Natives don't pay any co-payments, and the co-pays for everyone else are minimal. It's Colorado's way of making sure kids get the healthcare they need, regardless of their family's financial situation.

Medicare & Medigap Basics

Medicare kicks in when you turn 65 or if you're younger with certain disabilities. The program breaks down into Parts A through D: hospital insurance, medical insurance, Medicare Advantage plans, and prescription drug coverage. Each part covers different aspects of your healthcare needs.

Colorado's State Health Insurance Assistance Program (SHIP) offers free Medicare counseling at 17 locations statewide. These aren't salespeople - they're trained counselors who can help you understand your options, compare plans, and spot Medicare fraud before it happens.

There's even a dedicated Spanish-language counseling hotline for Spanish-speaking residents. Medigap insurance can help fill the gaps in traditional Medicare coverage, and SHIP counselors can explain when it makes sense and when it doesn't.

Colorado Health Insurance Assistance Programs

The state has built an impressive network of assistance programs to help residents steer health insurance choices. Connect for Health Colorado boasts 77 certified Assistance Network and Enrollment Center partners across the state, with 13 newly certified sites added recently.

These certified experts provide free help any time of the year, not just during open enrollment. They can help you understand your options, complete applications, and enroll in the best plan for your situation. The assistance is available in multiple languages - nearly one in five appointments last year were conducted in Spanish.

Financial Help Through the Marketplace

Colorado health insurance assistance includes substantial financial help through Premium Tax Credits and cost-sharing reductions. If the benchmark silver plan (the second-lowest-cost silver plan in your area) costs more than 8.5% of your household income, you qualify for premium assistance regardless of your income level.

Cost-sharing reductions are available on silver plans for households earning between 138% and 250% of the federal poverty level. These reductions lower your deductibles, co-payments, and out-of-pocket maximums. Colorado even offers additional state-level cost-sharing reductions that boost the actuarial value of eligible silver plans to 94%.

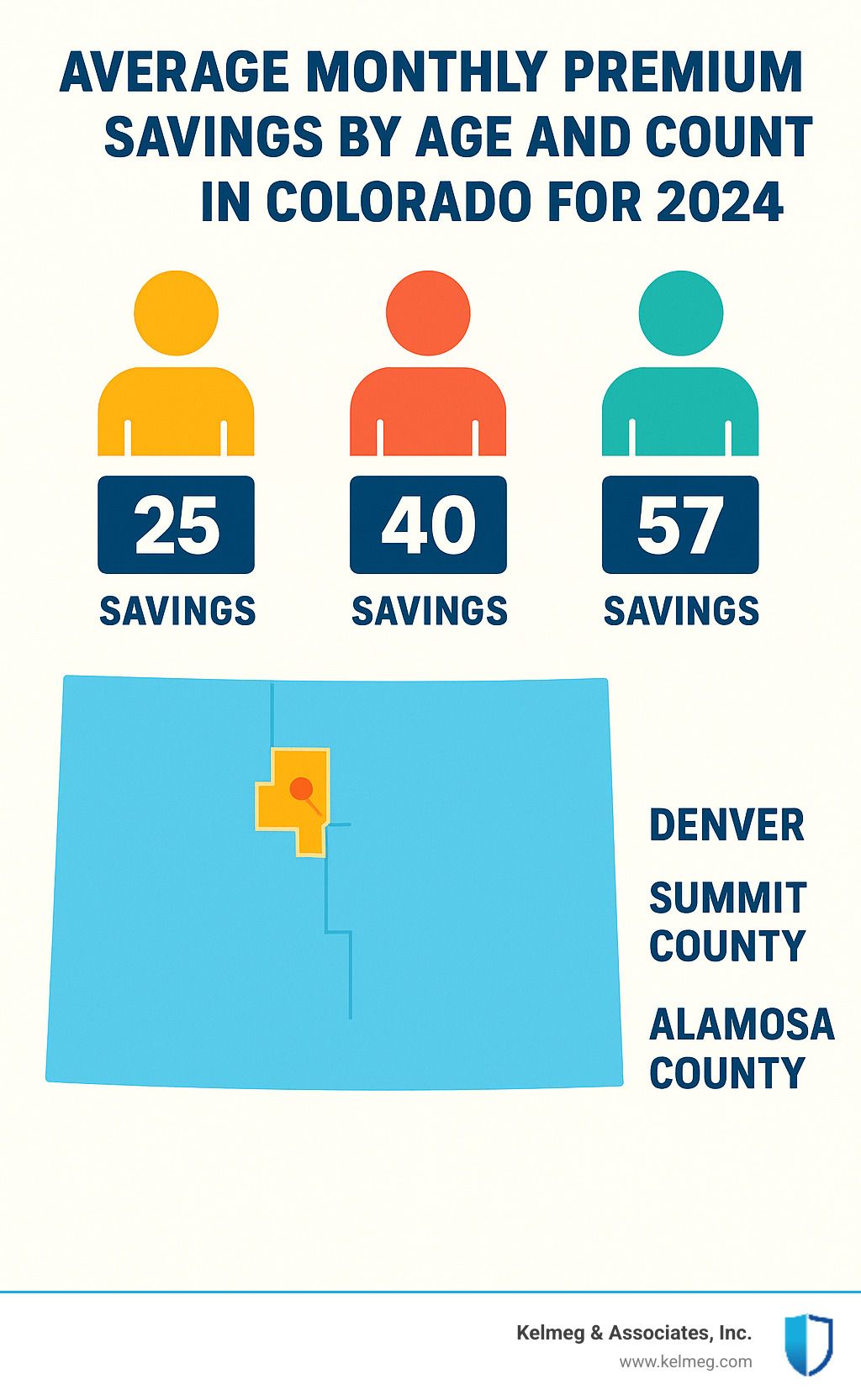

The savings can be substantial. Here are real examples from 2024:

- Single, 25 years old in Denver: Premium dropped from $126 to $95 per month (saving $31)

- Single, 40 years old in Summit County: Premium decreased from $247 to $207 per month (saving $40)

- Single, 50 years old in Alamosa County: Premium reduced from $318 to $261 per month (saving $57)

Health First Colorado & CHP+ Enrollment Support

Both Health First Colorado and CHP+ offer multiple ways to apply and get help. You can apply online through Colorado PEAK, call the customer service line, visit county human services offices, or work with certified enrollment assisters.

The Health First Colorado mobile app makes it easy to check your coverage status, find your renewal date, complete renewals, upload verification documents, and search for participating providers. The app also includes access to nurse advice lines and crisis resources.

More info about Low Income Health Insurance in Colorado

Medicare: Colorado Health Insurance Assistance for Seniors

Colorado's SHIP program provides comprehensive Medicare assistance through 17 local partner agencies. SHIP counselors offer free, unbiased information about Original Medicare, Medicare Advantage plans, Medicare Prescription Drug plans, and Medigap supplemental insurance.

The Senior Medicare Patrol (SMP) component helps detect and prevent Medicare fraud, errors, and abuse. If you suspect Medicare fraud, you can call the dedicated hotline at 303-480-6835 to report suspicious claims.

SHIP services include help with:

- Understanding Medicare benefits and coverage rules

- Comparing Original Medicare versus Medicare Advantage

- Selecting prescription drug plans

- Understanding appeal rights and procedures

- Identifying programs to help with Medicare costs

Colorado Website for Medicare help

How to Apply and Get Personalized Help

Finding the right Colorado health insurance assistance doesn't have to be overwhelming. The state has made it surprisingly straightforward to get help, whether you prefer handling things online, talking to someone on the phone, or meeting face-to-face with a local expert.

The beauty of Colorado's system is that you have choices in how you apply and get support. Some people love the convenience of applying online at 3 AM in their pajamas, while others prefer the reassurance of sitting down with a certified professional who can walk them through every step.

For Health First Colorado and CHP+, you can apply online at CO.gov/PEAK, call 1-800-359-1991, visit county human services offices, or mail a completed paper application. The online portal works around the clock and lets you upload documents directly from your phone or computer.

For private marketplace plans, Connect for Health Colorado's website is your starting point, or you can call their customer service center at 855-752-6749. Even better, you can work with certified enrollment assisters and insurance brokers who provide personalized guidance at no extra cost to you.

The smartest approach? Partner with certified professionals who know the ins and outs of Colorado's programs. They can spot savings opportunities you might miss and help you avoid common mistakes that could cost you money or leave gaps in your coverage.

Open Enrollment vs. Special Enrollment Periods

Think of Open Enrollment as the main shopping season for health insurance. It typically runs from November 1 to January 15 each year, and during this window, anyone can enroll in or change their marketplace health insurance plan. It's like a giant clearance sale, except instead of discounted sweaters, you're getting access to premium tax credits and the full selection of available plans.

But life doesn't always follow the calendar. That's where Special Enrollment Periods come to the rescue. If you experience certain qualifying life events, you get a special 60-day window to enroll in new coverage outside of the regular enrollment period.

The most common qualifying events include losing other health coverage (whether that's job-based insurance, COBRA, or Medicaid), getting married or divorced, having a baby or adopting a child, moving to a new area, changes in household income that affect your subsidy eligibility, and becoming a U.S. citizen.

Here's the important part: you typically have 60 days from the qualifying event to enroll in new coverage. Don't wait until day 59 - coverage usually starts the first day of the month following your enrollment, so acting quickly protects you from coverage gaps.

What to Do If You Lose Coverage or Have a Life Change

Losing health coverage can feel like the rug has been pulled out from under you, but Colorado's health insurance assistance programs are specifically designed to help you land softly and transition to new coverage without missing a beat.

If you lose job-based insurance, you might be offered COBRA continuation coverage. While COBRA can be a temporary bridge, marketplace plans with premium tax credits are often much more affordable and provide better value for your money.

When life throws you a curveball, here's your game plan: Contact Connect for Health Colorado or a certified assister within 60 days of your qualifying event. Update your income information if it has changed - this is crucial for getting the right amount of financial assistance. Upload any required verification documents promptly to avoid delays. Compare your new plan options carefully because your needs might have changed along with your circumstances. Finally, select and enroll in your new plan before your deadline.

If your income changes significantly during the year, report this to Connect for Health Colorado right away. This isn't just a suggestion - it's important for ensuring you receive the correct amount of premium tax credits and avoid owing money back when you file your taxes.

Small Business & Self-Employed Options

Small businesses in Colorado have more flexibility than ever when it comes to providing health insurance benefits. Traditional group plans are still available through insurance carriers, but many smart business owners are finding Individual Coverage Health Reimbursement Arrangements (ICHRAs).

With an ICHRA, you reimburse employees for individual health insurance premiums they purchase on or off the marketplace. It's like giving employees a health insurance allowance instead of choosing one plan for everyone. This approach gives employees more choice in their coverage while potentially saving you money compared to traditional group plans.

Self-employed individuals can purchase coverage through Connect for Health Colorado and may qualify for premium tax credits based on household income. Even better, those premiums may be tax-deductible as a business expense, giving you a double benefit.

Whether you're a solo entrepreneur or managing a growing team, the key is understanding all your options and how they fit with your business goals and budget.

Frequently Asked Questions about Colorado health insurance assistance

We get a lot of questions about Colorado health insurance assistance from families and individuals trying to figure out their coverage options. Here are the answers to the most common questions we hear at Kelmeg & Associates.

Who qualifies for financial assistance or subsidies in Colorado?

The good news is that most Colorado residents can get some type of financial help with their health insurance. The rules are more generous than many people realize, especially after recent changes that expanded eligibility.

For Premium Tax Credits through Connect for Health Colorado, you need to meet a few basic requirements. Your household income must be above the Medicaid threshold (that's 138% of the federal poverty level), you can't have access to affordable employer-sponsored insurance, and you can't already be on Medicare or other government programs.

Here's where it gets interesting - there's actually no upper income limit for premium tax credits through 2025. This means even higher-income families can qualify if their insurance costs too much. If the benchmark silver plan (the second-lowest-cost silver plan in your area) costs more than 8.5% of your household income, you're eligible for help.

Health First Colorado (Medicaid) covers adults under 65 whose household income is up to 138% of the federal poverty level. Child Health Plan Plus (CHP+) helps families with children under 18 and pregnant women, with income limits around $63,000 for a family of four.

The income limits change every year, so it's worth checking even if you didn't qualify before. We've helped many families who were surprised to learn they qualified for assistance.

Where can I find free, in-person enrollment help?

Colorado has built an impressive network of free help across the state. There are 77 certified assistance sites through Connect for Health Colorado's network, and these experts provide guidance at no cost to you.

You can find locations near you by visiting ConnectforHealthCO.com/we-can-help or calling 855-752-6749. These certified assisters speak multiple languages and can help you understand your options, complete applications, and enroll in coverage.

For Health First Colorado and CHP+, every county has human services offices that provide enrollment help. Many community health centers and nonprofit organizations also offer assistance with these programs.

Medicare help is available through Colorado's SHIP program at 17 locations statewide. You can call the statewide SHIP hotline at 1-888-696-7213 or use their online locator to find your nearest office. These counselors provide free, unbiased information about all your Medicare options.

At Kelmeg & Associates, we're also here to help guide you through the process. As certified professionals, we can provide personalized assistance at no extra cost while helping you understand all your Colorado health insurance assistance options.

Can I get coverage outside the Open Enrollment period?

Yes, you absolutely can get coverage outside the regular Open Enrollment period, but it depends on your situation and the type of coverage you need.

For marketplace plans, you can enroll during Special Enrollment Periods if you experience qualifying life events. The most common triggers include losing other coverage (like when you lose a job), getting married or divorced, having a baby or adopting a child, moving to a new area, or income changes that affect your subsidy eligibility.

You typically have 60 days from the qualifying event to enroll, so it's important to act quickly. We always tell our clients to contact us right away when something changes because timing matters for when your coverage starts.

Health First Colorado and CHP+ have year-round enrollment, which is fantastic for families whose income or circumstances change unexpectedly. You can apply anytime if you meet the eligibility requirements, and there's no waiting for an enrollment period.

Medicare has its own special rules with specific enrollment periods. Besides the Annual Open Enrollment from October 15 to December 7, there's Initial Enrollment around your 65th birthday and Special Enrollment Periods for certain circumstances like moving or losing other coverage.

The key is knowing your options and acting quickly when life changes happen. That's where having expert Colorado health insurance assistance really makes a difference in ensuring you don't have gaps in coverage.

Conclusion

Finding the right Colorado health insurance assistance can make all the difference between feeling overwhelmed by insurance choices and feeling confident about your family's coverage. With 77 certified assistance sites across the state, year-round Medicaid enrollment, comprehensive Medicare counseling, and financial help that can save you hundreds of dollars each month, Colorado has created one of the most supportive health insurance networks in the country.

At Kelmeg & Associates, Inc., I've watched countless families transform their insurance stress into peace of mind. Whether we're helping a young family in Lafayette find their first health plan or assisting a Boulder small business owner set up employee coverage, the magic happens when you have an expert guide who understands both the system and your unique needs.

The beauty of Colorado's assistance programs is that they're designed for real life. Lost your job? There's help for that. Had a baby? You can enroll right away. Turned 65? Medicare counselors are waiting to walk you through your options. Nearly 20% of enrollment appointments statewide are conducted in Spanish, showing Colorado's commitment to serving everyone, regardless of language barriers.

What I love most about working with Colorado families is seeing that "aha" moment when complex insurance rules suddenly make sense. A client recently told me, "I thought I'd never understand this stuff, but now I feel like I can make smart choices for my family." That's exactly what Colorado health insurance assistance should do - empower you to make confident decisions.

The assistance is always free, comprehensive, and focused on finding what works best for your specific situation. You don't have to figure this out alone, and you shouldn't have to pay extra for expert guidance.

Ready to turn your insurance confusion into clarity? Let's talk about how we can help you and your family find the perfect coverage solution.