Broker or Joker? Finding Reliable Insurance Brokers in Colorado

Finding Your Insurance Ally in the Rocky Mountain State

Insurance brokers Colorado are licensed professionals who represent multiple insurance carriers and work on your behalf to find the best coverage at competitive rates. If you're looking for reliable insurance assistance in Colorado, here’s what you need to know:

Top Traits of a Great Colorado Insurance Broker:

- 90%+ client retention rate that reflects strong ongoing service

- No hidden broker fees or surprise charges

- Access to all major health and property & casualty carriers

- Local ownership with deep community involvement

- A proven process for comparing rates across multiple insurers

When navigating the complex world of insurance, having the right guide makes all the difference. In Colorado’s diverse landscape—from Denver’s urban sprawl to the high-risk mountain communities—finding proper coverage requires local expertise and extensive carrier access.

Independent insurance brokers stand apart from captive agents (who work for just one company) by offering unbiased comparisons across multiple carriers. This means more options, potentially lower rates, and coverage truly custom to your specific needs.

The process is straightforward: you share your needs, the broker shops multiple carriers, and you receive personalized recommendations—all at no additional cost to you. Brokers earn commissions from insurance companies, not from your pocket.

Whether you need health insurance for your growing family, want to protect your mountain home from wildfire risks, or are a business owner seeking group benefits for your team, Colorado insurance brokers can simplify an otherwise overwhelming process.

I’m Kelsey Mackley, and as an insurance specialist at Kelmeg & Associates, Inc., I’ve helped countless Coloradans steer the complex insurance landscape through my work with insurance brokers Colorado to find custom solutions that provide both comprehensive coverage and cost savings. My experience has shown that the right broker relationship can transform insurance from a frustrating necessity into a valuable protection strategy.

7 Big Benefits of Working With Independent Insurance Brokers Colorado

Have you ever felt overwhelmed trying to steer Colorado's insurance landscape on your own? You're not alone. Many Coloradans find that partnering with an independent broker makes finding the right coverage simpler, more affordable, and dare I say—even pleasant! Here's why your neighbors are choosing to work with insurance brokers Colorado instead of going it alone:

1. Access to Multiple Carriers

Remember the days of calling company after company for quotes? Independent brokers eliminate that hassle by representing 10-15 different insurance providers under one roof. At Kelmeg & Associates, we shop across numerous A-rated carriers with a single conversation, saving you countless hours of repetitive phone calls and form-filling.

2. Unbiased Recommendations

Unlike captive agents who can only offer products from one company, independent brokers work for you , not an insurance corporation. This freedom means we recommend policies based on what genuinely fits your needs—not what meets our sales quotas. Your best interest is our only interest.

3. Personalized Service

There's a reason insurance brokers Colorado maintain client retention rates exceeding 90%. We build relationships that last. Your dedicated broker gets to know you, your family, and your specific circumstances, providing custom guidance that generic online quotes simply can't match.

4. Expert Claims Advocacy

When disaster strikes, having someone in your corner makes all the difference. Your broker becomes your advocate during claims, helping steer paperwork, deadlines, and negotiations. We speak insurance language fluently so you don't have to become an overnight expert during stressful times.

5. Regular Policy Reviews

Life changes—shouldn't your insurance keep up? The best brokers conduct annual reviews to ensure your coverage evolves with your changing circumstances. Marriage, new home, growing family, retirement planning—we proactively adjust your protection to match life's transitions.

6. Cost Savings

Contrary to what some believe, using a broker typically saves money. By comparing multiple carriers simultaneously, we often uncover discounts, bundling opportunities, and better coverage combinations that can reduce premiums by 30-40% without sacrificing protection. These savings more than offset any potential premium differences.

7. Compliance Updates

Colorado's insurance regulations change frequently. Rather than trying to keep up yourself, your broker monitors these shifts and ensures your coverage remains compliant with state-specific requirements. This proactive approach prevents gaps that could leave you vulnerable.

More info about health brokerage services

Insurance brokers Colorado vs captive agents

Understanding the difference between independent brokers and captive agents can save you thousands:

| Feature | Independent Insurance Brokers | Captive Insurance Agents |

|---|---|---|

| Carrier options | Multiple (typically 10-15 companies) | Single company only |

| Loyalty | To the client | To their employer (insurance company) |

| Pricing comparison | Yes, across multiple carriers | Limited to their company's options |

| Product variety | Wide range of policy types | Limited to what their company offers |

| Renewal shopping | Actively shops your renewal across carriers | Typically renews within same company |

| Local expertise | Often deeply connected to local community | May have standardized national approach |

| Claims advocacy | Acts as your representative | Works within company guidelines |

As one of our clients recently told us, "I felt like I was getting the whole story for the first time. My independent broker showed me options I never knew existed—and I'm paying less for better coverage."

At Kelmeg & Associates, our independence is your advantage. We serve families and businesses across Lafayette, Broomfield, Boulder, and Adams County with the freedom to put your needs first—every single time. No corporate quotas, just honest guidance from your neighbors who understand Colorado's unique insurance landscape.

What Coverage Can Colorado Brokers Place for You?

When it comes to protecting what matters most, insurance brokers Colorado truly shine by offering a one-stop solution for all your coverage needs. Instead of juggling multiple agents across different companies, you can build a relationship with one trusted advisor who handles everything.

Think of your Colorado broker as your personal insurance department. They can secure comprehensive auto insurance that meets our state's 25/50/15 minimum requirements while providing the extra protection your family deserves. Your home insurance needs receive special attention too—particularly important in a state where hailstorms regularly pummel our rooftops (we're second in the nation for hail claims, believe it or not!).

Planning for the future? Your broker can walk you through life insurance options—from simple term policies to more complex whole life and universal coverage—explaining the differences in plain English. And navigating the maze of health insurance becomes infinitely easier with a broker who works with all major carriers in Colorado.

For those approaching retirement, specialized Medicare guidance helps you understand the alphabet soup of Parts A, B, C, D, plus Medicare Advantage and Supplement plans. Business owners aren't left out either—your broker can bundle commercial coverage including liability, workers' comp, and property protection into a comprehensive package.

Those mountain toys need protection too! Whether it's your motorcycle, boat, RV, or classic car, specialty coverage ensures your trips stay worry-free. And because Colorado's weather can turn fierce, many clients benefit from umbrella policies that extend liability protection beyond standard limits, and flood insurance for properties in vulnerable areas.

Even your furry family members can be protected through pet injury coverage that some auto policies include—just one more detail a good broker will point out.

What truly adds value is your broker's ability to find bundling discounts. By combining policies with the same carrier, you'll often save 15-20% on premiums—money that stays in your pocket thanks to your broker's expertise.

Insurance brokers Colorado for niche & high-risk needs

Living in Colorado comes with unique challenges that require specialized insurance knowledge. If you own a mountain home, you face distinct risks—heavy snow loads, limited fire department access, and curious wildlife that sometimes becomes too friendly with your property.

The dreaded hail damage that pummels our state each spring requires special attention to deductibles and coverage limits. A knowledgeable broker can explain the difference between actual cash value and replacement cost coverage—a distinction that could mean thousands out of pocket when those golf-ball sized hailstones strike.

Perhaps most concerning for many Coloradans is living in wildfire zones. As these areas expand, finding willing carriers becomes increasingly difficult. Experienced insurance brokers Colorado maintain relationships with companies still writing policies in high-risk areas and can suggest mitigation strategies to improve your property's insurability.

Drivers needing SR-22 filings after violations find that brokers can steer these tricky waters to secure necessary coverage despite past mistakes. Those between jobs can find gap health coverage to maintain protection during transition periods. Colorado triprs heading abroad benefit from travel medical policies that provide coverage where domestic plans fall short.

In our increasingly digital world, businesses need protection against cyber liability threats—something standard policies rarely address adequately without specific endorsements.

At Kelmeg & Associates, we've developed deep expertise in these challenging scenarios across Boulder, Lafayette, Broomfield, and Adams County. Our understanding of Colorado's unique insurance landscape allows us to find solutions where online providers often return only declinations. We pride ourselves on never saying "that can't be insured" without exhausting every possible option first.

More info about health brokerage services

Learn more about wildfire risk mitigation strategies

Step-by-Step: How a Colorado Broker Shops, Compares & Saves You Money

Ever wonder what happens behind the scenes when you work with insurance brokers Colorado? It's actually a fascinating process designed with one goal in mind: finding you fantastic coverage without breaking the bank.

The journey begins with a friendly conversation about your life, your concerns, and what keeps you up at night. Your broker listens carefully during this needs analysis, because understanding your unique situation is the foundation of everything that follows.

Next comes a bit of homework – gathering those important details about your vehicles, home, health history, or business. Don't worry though! Your broker will guide you through exactly what's needed, making this step painless.

This is where the magic happens. Using sophisticated quote engines and tapping into relationships with numerous insurance carriers, your broker simultaneously shops your profile across the marketplace. It's like having a personal shopper who visits a dozen stores at once!

But finding great insurance isn't just about the lowest price. Your broker carefully matches coverage options to your specific situation, ensuring there are no dangerous gaps that could leave you exposed. They'll help you understand how different deductible levels affect your premium, finding that sweet spot between monthly payments and potential out-of-pocket costs.

Insurance brokers Colorado are discount detectives too! They know exactly which discounts each carrier offers and make sure you receive every single one you qualify for. For health insurance clients, they'll even screen for premium tax credits through Connect for Health Colorado that could save you thousands annually.

When everything's ready, you'll receive clear comparisons of your options with recommendations explained in plain, everyday English – not insurance jargon. Once you make your choice, your broker handles all the paperwork and ensures a smooth transition from your previous coverage.

The relationship doesn't end there. Your broker keeps track of your policy anniversary dates and shops your coverage again before renewal to make sure you continue getting competitive pricing year after year.

This thoughtful, systematic approach is why clients working with independent brokers like us at Kelmeg & Associates often save 30-40% compared to their previous insurance costs. It's not just about saving money today – it's about having a trusted partner for the long haul.

Getting a Quote: What You'll Need

Ready to get started with a quote? Having certain information handy will make the process smooth and efficient. For auto insurance, we'll need driver's license numbers, VINs, driving history, and details about your current coverage. Home insurance quotes require property address, square footage, construction details, safety features, and replacement cost estimates.

If you're looking for business insurance, be prepared to share your industry classification, payroll figures, revenue projections, property values, and loss history. Health insurance quotes need ages of family members, tobacco use status, estimated income for subsidy calculations, and any preferred doctors or hospitals. And for life insurance, we'll discuss your age, health history, lifestyle factors, and desired coverage amount.

Pro tip: Having your current policy declarations pages on hand can really streamline the process, helping us ensure we're making appropriate coverage comparisons.

Fees & Compensation—What It Really Costs

Here's the best part about working with insurance brokers Colorado – our services typically come at no direct cost to you! That's right – at Kelmeg & Associates, we don't charge clients fees for our services.

You might wonder how this works. Brokers earn commissions from insurance companies when we place policies. These commissions are already built into insurance premiums whether you use a broker or not. By going direct to an insurance company, you're not saving that commission – you're just not getting the benefit of a broker's expertise.

We believe in complete transparency about how we're compensated and are always happy to discuss commission structures if you're curious. The expertise, time savings, and potential premium reductions we provide typically far outweigh any minimal difference in commissions between going direct or using a broker.

As one of our clients recently told us: "I was hesitant to use a broker because I thought it would cost more. I was shocked to find out not only was the service free, but they saved me over $800 a year on my auto and home insurance."

That's the power of having someone truly in your corner when it comes to insurance shopping!

10-Question Checklist to Choose the Right Colorado Broker

Finding the right insurance brokers Colorado feels a bit like dating – you need someone who's qualified, communicates well, and truly understands your needs. Not all brokers offer the same level of service or expertise, especially when it comes to Colorado's unique insurance landscape.

When you're ready to find your insurance partner, here's a straightforward checklist to help you make the right choice:

First, verify their licensing status through the Colorado Division of Insurance. This isn't just a formality – proper licensing ensures they've met the state's education and ethical requirements.

Next, consider their experience in the Colorado market. An established broker with 5+ years of experience has weathered different insurance cycles and understands the nuances of coverage in our state – from hail damage concerns along the Front Range to wildfire risks in mountain communities.

The carrier relationships a broker maintains directly impacts your options. Quality brokers should represent multiple A-rated insurance companies, giving you diverse choices rather than a one-size-fits-all approach.

Ask about their claims support process. The true test of any insurance relationship comes when you need to file a claim. A good broker doesn't disappear after selling you a policy but becomes your advocate during the claims process.

Pay attention to their client retention rate. When a broker keeps 90% or more of their clients year after year, it speaks volumes about their service quality and customer satisfaction.

Consider how they communicate with clients. Do they prefer phone calls, emails, or text messages? Make sure their style aligns with your preferences – you want someone who's accessible when you have questions.

Online tools and resources matter. Modern brokers should provide convenient access to policy documents and simple ways to submit service requests without playing phone tag.

The value of local presence can't be overstated. A broker with offices in your community understands Colorado's regional insurance challenges – whether you're in Lafayette, Broomfield, Boulder, or Adams County.

Professional credentials also matter. Look for membership in industry associations like the National Association of Health Underwriters or Independent Insurance Agents & Brokers of America, which indicates commitment to ongoing education and ethical standards.

Finally, don't hesitate to ask for references from similar clients. Speaking with others who have insurance needs similar to yours provides real-world feedback about the broker's performance.

At Kelmeg & Associates, we're proud to check all these boxes. Our deep roots in Colorado communities give us unique insights into local insurance challenges that national chains or online-only providers simply can't match. We believe insurance is personal – it should protect what matters most to you, not just offer the cheapest premium.

Looking for specialized group health solutions? Learn more about our group health insurance services and how we can help your business provide valuable benefits while managing costs.

Frequently Asked Questions About Colorado Insurance Brokers

What ongoing help should I expect after I buy a policy?

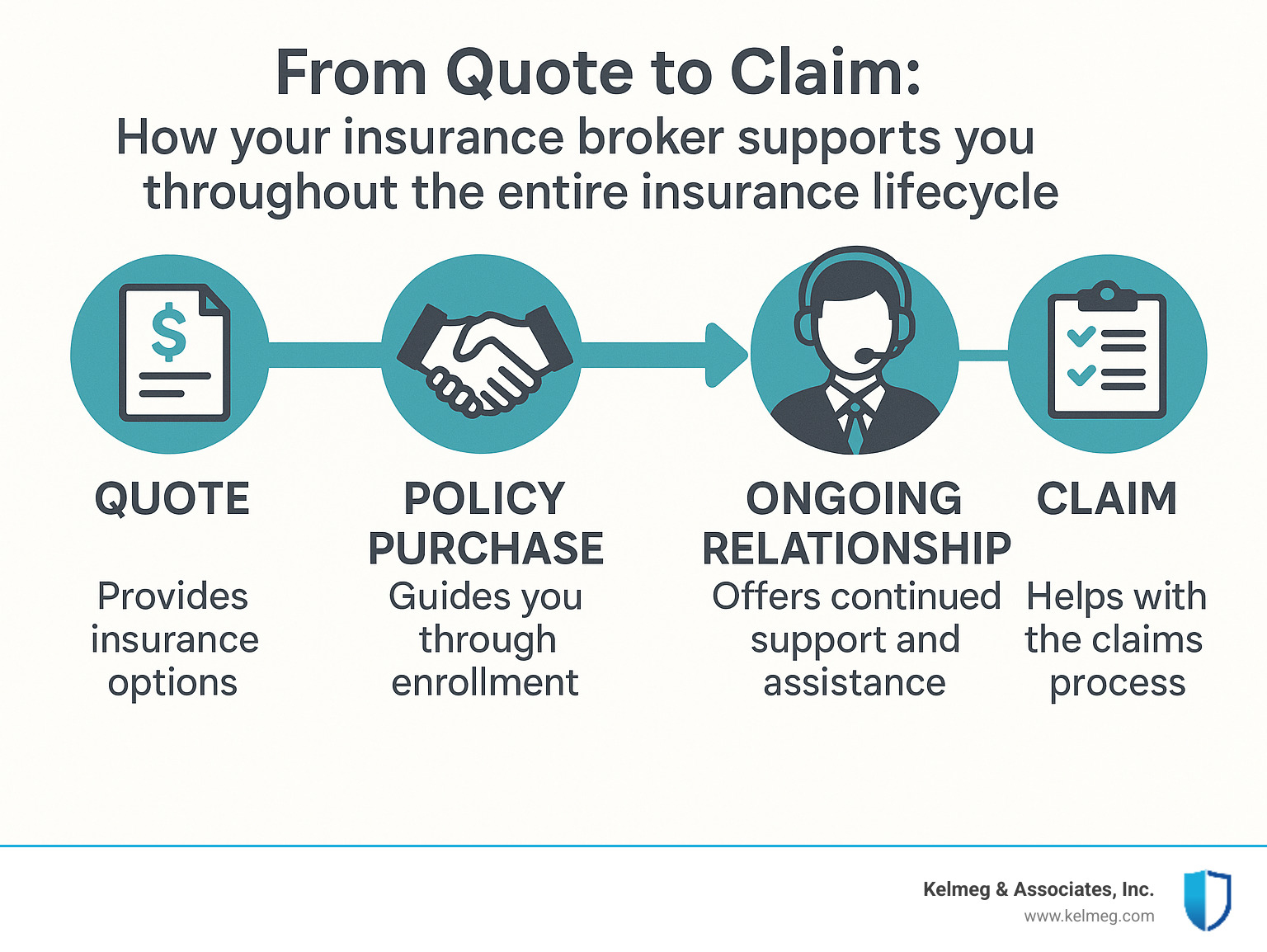

The relationship with your insurance brokers Colorado doesn't end once you sign on the dotted line - in fact, that's just the beginning! Think of your broker as your insurance partner for the long haul.

Good brokers become your go-to resource whenever life throws changes your way. Need to add a teenage driver to your auto policy? Your broker handles that. Finishing your basement and need to update your homeowner's coverage? One call does it all.

When the unexpected happens and you need to file a claim, this is where broker relationships truly shine. Rather than navigating an unfamiliar claims department alone, your broker serves as your advocate, helping gather documentation, explaining the process, and sometimes even pushing back when claims adjusters undervalue your loss.

Most insurance brokers Colorado also provide annual policy reviews to ensure you're not paying for coverage you don't need – or worse, missing protection you do need. At Kelmeg & Associates, we proactively reach out to clients before renewal time to explore options and prevent surprise rate increases.

"My broker at Kelmeg doesn't just disappear after the sale," shares one client. "When hail damaged my roof last spring, she walked me through every step of the claims process and made sure the insurance company treated me fairly. That kind of support is priceless."

Your broker should also provide secure document storage, easy access to proof of insurance, and thoughtful guidance during major life transitions like marriage, home purchases, or retirement planning.

Can a broker assist with ACA subsidies or Medicare enrollment?

Absolutely! In fact, health insurance might be where broker expertise provides the most value – especially with systems as complex as the Affordable Care Act and Medicare.

For ACA marketplace plans, insurance brokers Colorado do much more than just help you pick a plan. They'll calculate your potential subsidy eligibility based on your household size and income projections, which can dramatically reduce your premium costs. They explain confusing concepts like cost-sharing reductions, premium tax credits, and network restrictions in plain English.

The real magic happens when brokers help you compare plan networks to ensure your preferred doctors and hospitals are covered. At Kelmeg & Associates, we take time to understand which healthcare providers matter most to you before recommending plans.

For Medicare-eligible Coloradans, the guidance is equally valuable. Medicare comes with its own language – Parts A, B, C, D, Medicare Advantage, Medigap plans – and the choices you make can impact your healthcare for years. Specialized Medicare brokers explain these options clearly and help you avoid costly late enrollment penalties.

They'll also analyze your prescription medications to find the Part D plan that covers your specific drugs at the lowest cost, potentially saving you hundreds or thousands of dollars annually.

The best part? This expert guidance comes at no additional cost to you, as brokers are paid by the insurance companies, not by consumers.

Is there ever a situation where buying direct is better than using a broker?

While I firmly believe most people benefit from working with insurance brokers Colorado, I'll be completely honest – there are a few limited scenarios where going direct might make sense.

If your insurance needs are truly bare-bones simple with no special circumstances (though this is rarer than most people think), direct carriers might provide adequate service. Some newer, online-only insurers operate exclusively through direct sales channels. And occasionally, carriers offer special promotions only available through direct purchase.

But here's the reality check: even in these situations, the value of having a dedicated advocate who understands the fine print and can help you steer claims often outweighs any small savings from going direct.

Insurance policies are increasingly complex legal contracts filled with exclusions and conditions. Having someone in your corner who can translate "insurance speak" into plain English and advocate for you when problems arise is invaluable.

One client who came to Kelmeg after a frustrating direct insurance experience put it perfectly: "I thought I was saving money by cutting out the middleman. But when my basement flooded and the insurance company denied my claim, I had no one to turn to except a random call center. Now I have a broker who knows me by name and fights for me when I need help – and I'm actually paying less than before!"

The truth is, working with a broker typically costs you nothing extra, while potentially saving you both money and headaches. That's why over 90% of our clients at Kelmeg & Associates stay with us year after year.

Conclusion

Finding the right insurance brokers Colorado shouldn't feel like searching for a needle in a haystack. When you connect with the perfect broker, you gain more than just insurance policies—you find a personal consultant, navigator, and advocate who transforms what could be a bewildering process into a straightforward experience that brings genuine peace of mind.

Here at Kelmeg & Associates, Inc., we take pride in being trusted insurance advisors for families and businesses throughout Lafayette, Broomfield, Boulder, Adams County, and surrounding communities. We blend our deep roots in Colorado with extensive carrier relationships to create insurance solutions that truly protect what matters most to you.

Colorado presents some unique insurance challenges that you won't find elsewhere. Mountain properties face distinctive risks, health insurance has its own set of complexities, and navigating these waters requires specialized knowledge. Working with a local, independent broker ensures you have someone in your corner who understands these nuances and can guide you toward appropriate coverage without breaking the bank.

One of the most beautiful things about working with insurance brokers Colorado? Our services come at no additional cost to you. This makes exploring your options completely risk-free and often leads to significant savings on your insurance expenses. The fact that top Colorado brokers maintain client retention rates above 94% speaks volumes about the value these relationships bring.

Whether you're in the market for personal insurance, exploring Medicare options as you approach retirement, or seeking comprehensive group benefits for your growing business, we invite you to experience the Kelmeg difference. There's something special about working with dedicated insurance brokers Colorado who truly care about your wellbeing. Reach out today and take the first step toward better coverage, better service, and the peace of mind you deserve.