The Truth About Life Insurance Suicide Coverage in Colorado—No Myths, Just Facts

Understanding Life Insurance Coverage for Suicide in Colorado

Does life insurance pay for suicidal death in Colorado? The answer is yes—but with important timing considerations:

Timing of Death: Within first year of policy

Coverage Outcome: Not covered

What Beneficiaries Receive: Return of premiums paid

Timing of Death: After first year of policy

Coverage Outcome: Fully covered

What Beneficiaries Receive: Full death benefit

Colorado has more protective laws than most states regarding suicide and life insurance. Under Colorado Revised Statute § 10-7-109, life insurance companies cannot deny payment for suicide if the policy has been in force for more than one year. This is true regardless of whether the suicide was voluntary or involuntary, and whether the policyholder was sane or insane at the time.

This one-year suicide exclusion period is shorter than the two-year period common in most other states. Only Colorado, Missouri, and North Dakota limit suicide exclusions to one year.

If a policyholder dies by suicide during the first year of coverage, the insurance company typically refunds the premiums paid rather than paying the death benefit.

I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc. with extensive experience helping Colorado families understand how life insurance policies address suicide claims and steer the complexities of does life insurance pay for suicidal death in Colorado situations to ensure beneficiaries receive the benefits they're legally entitled to.

Does Life Insurance Pay for Suicidal Death in Colorado? Your Rights Under the One-Year Rule

Colorado law takes a more consumer-friendly approach to suicide exclusions in life insurance policies than most other states. The cornerstone of this protection is Colorado Revised Statute § 10-7-109, which establishes that suicide cannot be used as a defense to deny payment of a life insurance policy after the first policy year.

This means that in Colorado, if a policyholder dies by suicide after having their policy for more than one year, the insurance company must pay the full death benefit to the named beneficiaries. This protection applies regardless of the policyholder's mental state at the time of death.

A landmark case that reinforced this law was the 2020 Colorado Supreme Court decision in Amica Life Insurance Co. v. Wertz. In this case, the court confirmed that a two-year suicide exclusion clause in a life insurance policy was unenforceable in Colorado, and that the statutory one-year limit prevails.

If a suicide occurs within the first year of the policy, most insurers will return the premiums paid into the policy, minus any outstanding loans or fees. This ensures that while the full death benefit isn't payable, the family doesn't lose the financial investment made in the policy.

Key text of § 10-7-109 and what it means

The exact language of Colorado Revised Statute § 10-7-109 states:

"The suicide of a policyholder after the first policy year of any life insurance policy issued by any life insurance company doing business in this state shall not be a defense against the payment of a life insurance policy, whether said suicide was voluntary or involuntary, and whether said policyholder was sane or insane."

This language is significant for several reasons:

- It specifically mentions "after the first policy year," establishing the one-year exclusion period

- It applies whether the suicide was "voluntary or involuntary"

- It applies whether the policyholder was "sane or insane"

- It explicitly states suicide "shall not be a defense against payment"

The statute makes no distinction based on the policyholder's mental state or intent. This broad protection ensures that families aren't left without financial support due to the circumstances of their loved one's death.

There is one notable exception to this rule: fraternal benefit societies are not covered by this statute. These organizations, which provide life insurance to members, may have different rules regarding suicide coverage.

How this law overrides longer exclusions written in policies

Many life insurance policies issued in Colorado still contain standard two-year suicide exclusion clauses, despite the state's one-year limitation. This is because insurance companies often use standardized policy forms across multiple states.

However, the Colorado Supreme Court has made it clear that any suicide exclusion beyond one year is void and unenforceable in Colorado. In the Amica v. Wertz case, the court ruled that Colorado's statute takes precedence over any contradictory policy language.

This means that even if your life insurance policy states it has a two-year suicide exclusion, Colorado law reduces that period to one year. Insurance companies operating in Colorado are bound by this limitation, regardless of what the policy itself states.

This consumer protection measure is particularly important because most policyholders don't read or fully understand all the fine print in their insurance contracts. Colorado's law ensures that all residents receive the same protection, regardless of the specific wording in their policies.

Suicide, Contestability & Incontestability Clauses Explained

When families ask me "does life insurance pay for suicidal death in Colorado," I explain that understanding three key policy provisions makes all the difference in knowing your rights.

Think of these provisions as three separate guardrails in your policy, each serving a different purpose but often confused with one another.

First, the Suicide Clause specifically addresses deaths by suicide. Colorado's consumer-friendly law limits this exclusion to just the first year of your policy. After that initial year passes, suicide must be covered just like any other cause of death – no exceptions.

Second, the Contestability Period works differently. This two-year window allows insurance companies to investigate claims for any material misrepresentations in the application. Even in Colorado, this period typically lasts a full two years. During this time, insurers can deny claims for reasons completely unrelated to suicide – like undisclosed health conditions or risky hobbies that would have affected their decision to issue the policy.

Finally, the Incontestability Clause is your protection after that contestability period ends. Once your policy passes the two-year mark, the insurance company can no longer contest the policy based on application misstatements, except in rare cases of outright fraud.

While Colorado limits suicide exclusions to one year, the two-year contestability period remains fully in effect. This creates an interesting overlap in the second year when suicide would be covered, but the policy could still be contested for other reasons.

Insurance companies take great care in determining intent in cases of self-inflicted death. They often review toxicology reports, autopsy findings, and other evidence to distinguish between accidental and intentional deaths. This becomes particularly relevant with drug overdoses, where the line between accident and intention can be difficult to determine.

Does life insurance pay for suicidal death in Colorado during the contestability window?

The answer involves several important considerations:

If the suicide occurs within the first year (Colorado's exclusion period), you'll typically receive only a refund of premiums paid rather than the full death benefit.

However, if the suicide occurs after that first year but still within the two-year contestability period, the death benefit should be paid – with one significant exception. If the insurer finds material misstatements in the application that would have changed their decision to issue the policy, they may still have grounds to deny the claim.

Mental health disclosures deserve special attention here. If a policyholder didn't disclose a history of mental health issues or suicidal thoughts when applying, and then dies by suicide during the contestability period, the insurer might investigate whether this omission constitutes a material misrepresentation.

I've seen this scenario play out: someone applies for life insurance, denies having depression or suicidal thoughts despite having such a history, then dies by suicide 18 months later. Even though the suicide exclusion period has ended, the insurer might deny the claim based on the application misrepresentation.

This is why I always emphasize complete honesty when applying for life insurance. While disclosing mental health history might affect your rate, withholding this information could lead to a denied claim when your family needs the benefits most.

How policy reinstatement or increases can restart the suicide clock

Another crucial consideration when answering "does life insurance pay for suicidal death in Colorado" is understanding how policy changes affect the suicide exclusion period. Several common modifications can reset that one-year countdown:

Policy Reinstatement restarts the clock completely. If your policy lapses because you missed premium payments and you later reinstate it, the one-year suicide exclusion typically starts fresh from the reinstatement date. For example, if you had coverage for three years, let it lapse, then reinstated it, a suicide within one year of reinstatement would likely not be covered.

Coverage Increases can create a split situation. If you significantly increase your death benefit, the additional coverage amount typically falls under a new one-year suicide exclusion period. The original coverage amount would still be payable for suicide after the original exclusion period has passed.

Policy Conversions from one type to another (like term to whole life) may or may not restart the suicide exclusion period, depending on your specific insurer. Some conversions maintain your original policy date, while others treat the conversion as essentially a new policy.

Supplemental Riders added to an existing policy might subject just those specific additions to a new suicide exclusion period, while the base policy continues under the original timeline.

I always remind clients that these resets apply specifically to the suicide exclusion period and don't necessarily affect the broader incontestability provisions, which follow different rules.

At Kelmeg & Associates, we recommend reviewing your policy documents carefully before making any significant changes to your life insurance coverage, especially if there are concerns about how these changes might affect the suicide exclusion period. We're here to help you steer these complex provisions with clarity and compassion.

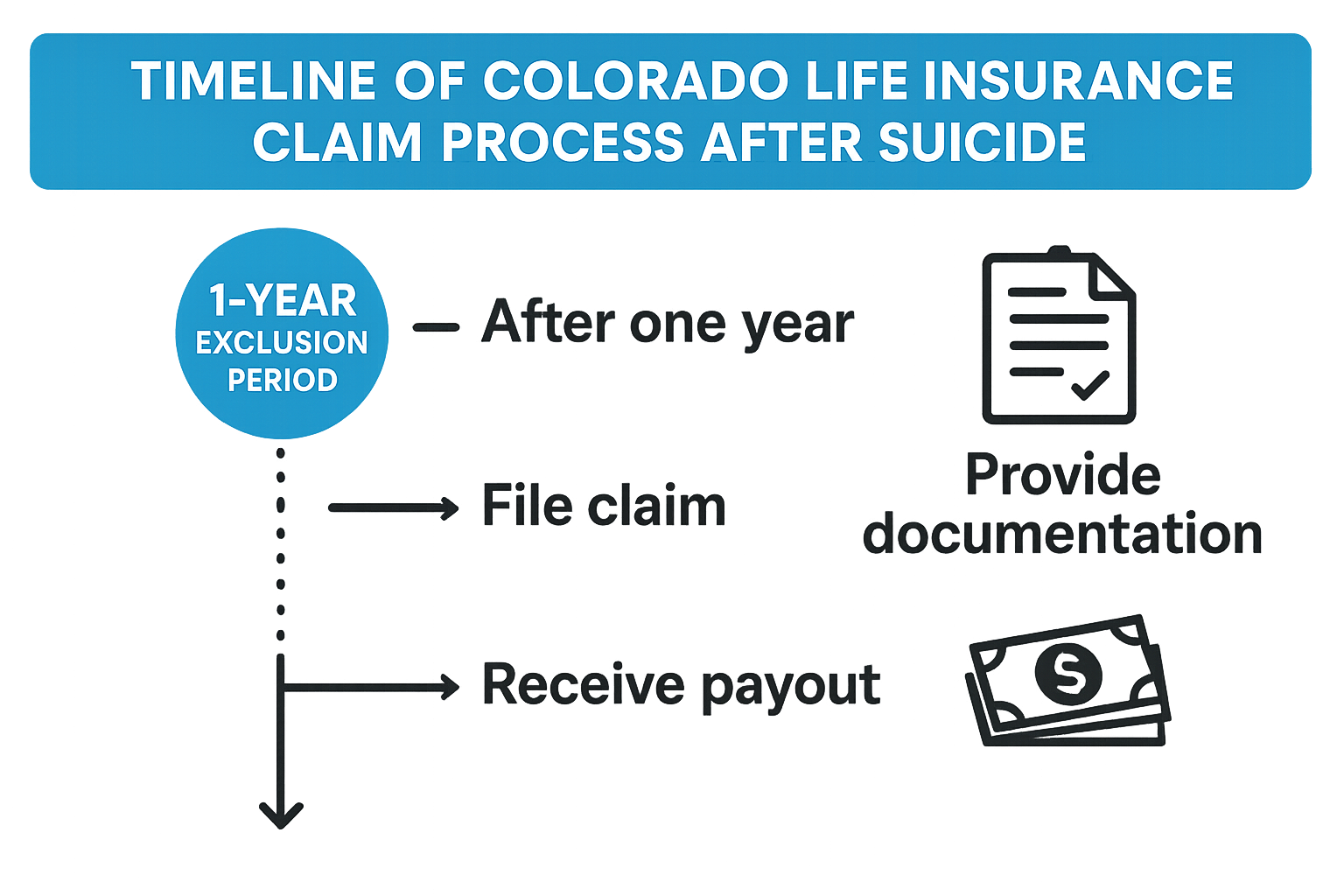

Claim Process & Appeals After a Suicide

Filing a life insurance claim after a loved one's suicide follows a similar process to other claims, but with some additional considerations. Understanding this process can help beneficiaries steer a difficult time with less stress.

Here are the typical steps for filing a claim:

Notify the insurance company of the death as soon as possible.

Gather necessary documentation, including:

- The original policy document

- A certified copy of the death certificate (which will indicate cause of death)

- Coroner's report or autopsy findings (if available)

- The insurer's claim form (usually provided after notification)

Submit the completed claim package to the insurance company.

Wait for the claim to be processed, which typically takes 30-60 days for most claims but may take longer for suicide-related claims due to additional investigation.

Insurance companies may deny claims for several reasons, including:

- Death occurred during the suicide exclusion period

- Material misrepresentations on the application

- Policy lapse due to non-payment of premiums

- Fraud or other policy violations

Some insurers may employ tactics that could be considered "bad faith," such as unreasonable delays, inadequate investigations, or misrepresenting policy provisions. Being aware of these possibilities can help beneficiaries protect their rights.

If a claim is denied, the appeal process typically involves:

- Initial internal appeal with the insurance company

- Secondary review by a different claims examiner

- External review by an independent third party

- Complaint to the Colorado Division of Insurance

- Legal action, if necessary

What Are the Reasons Why Life Insurance Payments Are Denied?

What beneficiaries should do if the claim is denied

If your claim is denied after a loved one's suicide, take these steps:

Request a written denial letter if one wasn't provided. This should explain the specific reason for denial and reference the relevant policy provisions.

Gather supporting documentation that addresses the reason for denial. This might include:

- Medical records showing the policy was in force for more than one year

- Proof of premium payments

- Evidence that any alleged misrepresentations were not material to the policy

- Documentation showing the policy was reinstated more than one year before the death

File an internal appeal with the insurance company. This should be done in writing and include all supporting documentation. Be sure to reference Colorado Revised Statute § 10-7-109 if the denial is based on a suicide exclusion beyond one year.

File a complaint with the Colorado Division of Insurance if the internal appeal is unsuccessful. The Division can review the case and determine if the insurer is violating Colorado law.

Consult with legal counsel experienced in insurance matters. Many attorneys specializing in insurance claims offer free initial consultations and work on a contingency basis, meaning they only get paid if you win your case.

Time limits often apply to appeals, so it's important to act promptly after receiving a denial. At Kelmeg & Associates, we can help guide beneficiaries through this process and connect them with appropriate resources if needed.

When can an insurer still refuse payment after the one-year period?

While Colorado law is clear that suicide cannot be used as a defense to deny payment after the first policy year, there are still some circumstances where an insurer may legitimately refuse to pay a claim:

Fraud: If the policyholder committed fraud in obtaining the policy, such as by knowingly providing false information about their health or other material facts, the insurer may deny the claim even after the contestability period has ended. However, the burden of proof is on the insurer to demonstrate clear evidence of fraud.

Policy Lapse: If the policy had lapsed due to non-payment of premiums and was not in force at the time of death, no benefits would be payable. It's important to keep premium payments current and be aware of grace periods.

Slayer Statute: Under Colorado's "slayer statute," a beneficiary who feloniously kills the policyholder cannot receive the death benefit. This prevents murderers from profiting from their crimes.

Unpaid Policy Loans: If the policyholder had taken loans against the policy's cash value and these loans, plus interest, equal or exceed the death benefit, the benefit may be reduced or eliminated entirely.

It's worth noting that these exceptions are not specific to suicide cases but apply to all life insurance claims. The key point is that after the one-year exclusion period has passed in Colorado, suicide itself cannot be used as a reason to deny payment, but other valid contractual reasons may still apply.

Special Situations: Group, Military, Physician-Assisted & Policy Changes

When examining does life insurance pay for suicidal death in Colorado, several special situations deserve particular attention, as they may have different rules regarding suicide coverage.

Group Life Insurance policies, often provided through employers and governed by ERISA (Employee Retirement Income Security Act), frequently have different provisions regarding suicide. Many group policies omit the suicide exclusion entirely, providing immediate coverage regardless of cause of death. However, this varies by plan, so it's important to check your specific policy details.

Supplemental Group Coverage that employees purchase in addition to their basic employer-provided coverage may include the standard suicide exclusion period. These policies should still adhere to Colorado's one-year limitation.

Military Life Insurance such as Servicemembers' Group Life Insurance (SGLI) and Veterans' Group Life Insurance (VGLI) typically have no suicide exclusion at all. These policies pay the death benefit regardless of the cause of death, including suicide from the first day of coverage.

Physician-assisted suicide under Colorado's End-of-Life Options Act presents unique considerations. Since this is a legal medical procedure for terminally ill individuals in Colorado, most insurers treat these deaths differently than other suicides. We'll explore this in more detail below.

Accidental Death vs. Intentional Act: In cases involving drug overdoses, insurers may investigate whether the death was accidental or intentional. This distinction can affect coverage, particularly for accidental death benefit riders, which typically exclude intentional self-harm.

Mental Illness Underwriting: Individuals with a history of mental illness may face higher premiums or coverage limitations when applying for life insurance. However, once a policy is issued and the exclusion period has passed, a history of mental illness cannot be used to deny a claim for suicide.

Does Life Insurance Cover Suicide?

How group life in Colorado handles suicide differently

Group life insurance policies, typically provided through employers, often handle suicide differently than individual policies:

- No Suicide Exclusion: Many group life insurance policies don't include a suicide exclusion at all. This means that death benefits are payable immediately, even if the policyholder dies by suicide shortly after coverage begins.

- Immediate Payout: For policies without exclusions, beneficiaries can receive the full death benefit regardless of how long the coverage has been in force.

- Evidence of Insurability Issues: When employees increase their coverage beyond guaranteed issue amounts, they may need to provide evidence of insurability. If the employee fails to disclose mental health conditions during this process, it could potentially lead to claim denials.

- Conversion to Individual Policies: When employees leave their jobs and convert group coverage to individual policies, the new individual policy typically starts a new suicide exclusion period, even though the original group policy might not have had one.

- ERISA Protections: Group policies governed by ERISA have specific appeal procedures that must be followed if a claim is denied. These procedures provide additional protections for beneficiaries.

For Colorado residents with group life insurance, it's important to:

- Review your certificate of coverage to understand if there is a suicide exclusion

- Keep documentation of when coverage began

- Understand conversion options if you leave your employer

- Know that Colorado's one-year limitation would apply to any suicide exclusion in a group policy

At Kelmeg & Associates, we can help you understand your group life insurance benefits and how they would apply in various scenarios, including suicide.

Physician-assisted death and the question "does life insurance pay for suicidal death in Colorado?"

Colorado is one of the states that has legalized physician-assisted death through the End-of-Life Options Act, passed in 2016. This law allows terminally ill adults with a prognosis of six months or less to live to request medication that will end their life.

From a life insurance perspective, physician-assisted death is typically treated differently than suicide:

- Not Classified as Suicide: Most insurers do not classify deaths under the End-of-Life Options Act as suicide. Instead, they are often recorded as deaths from the underlying terminal illness.

- Death Certificate Listing: In Colorado, the death certificate for someone who uses the End-of-Life Options Act typically lists the underlying terminal illness as the cause of death, not suicide.

- Policy Coverage: Because these deaths are not classified as suicide, the suicide exclusion clause generally does not apply. This means that even if the death occurs within the first policy year, the full death benefit would typically be payable.

- Insurer Approach: Most major insurers have adopted policies that explicitly state they will pay claims for legal physician-assisted deaths, treating them as natural deaths from the underlying condition.

- Statutory Compliance: Colorado's End-of-Life Options Act includes provisions stating that actions taken in accordance with the act do not constitute suicide for the purpose of insurance policies.

This distinction is important for terminally ill individuals who are considering their end-of-life options. It provides reassurance that their life insurance benefits will still be available to their beneficiaries if they choose to use the legal option of physician-assisted death.

However, it's always advisable to review your specific policy language and consult with an insurance professional if you have questions about how your policy would treat a physician-assisted death. At Kelmeg & Associates, we can provide guidance on these sensitive matters with compassion and expertise.

Conclusion

Understanding the answer to does life insurance pay for suicidal death in Colorado requires navigating complex legal, medical, and insurance considerations. The key takeaway is that Colorado law provides stronger consumer protections than most states, limiting the suicide exclusion period to just one year.

To summarize the main points:

- In Colorado, life insurance must pay for death by suicide if the policy has been in force for more than one year, per Colorado Revised Statute § 10-7-109.

- This one-year limitation overrides any longer exclusion periods written into policies, even if the policy states a two-year exclusion.

- During the first year, insurers typically return the premiums paid rather than paying the death benefit for suicide.

- The contestability period (usually two years) is separate from the suicide exclusion and allows insurers to investigate misrepresentations in the application.

- Policy changes, reinstatements, or increases may restart the suicide exclusion clock in some circumstances.

- Group life insurance and military policies often have more favorable terms regarding suicide coverage.

- Physician-assisted death under Colorado's End-of-Life Options Act is generally not classified as suicide for insurance purposes.

If you're a beneficiary facing a denied claim related to suicide, you have rights under Colorado law. Don't hesitate to appeal a denial, especially if the policy had been in force for more than one year. The Colorado Division of Insurance can be a valuable resource, as can legal professionals who specialize in insurance matters.

For those struggling with thoughts of suicide, please remember that help is available. The 988 Suicide and Crisis Lifeline provides free and confidential support 24/7. Just dial 988 from any phone.

At Kelmeg & Associates, Inc., we're committed to helping Colorado residents understand their life insurance options and steer the claims process during difficult times. While we hope you never need to use this information, being informed about your rights can provide peace of mind and financial security for your loved ones.

More info about Life Insurance

If you have questions about life insurance coverage for suicide or any other insurance matters, please don't hesitate to contact us. Our team of experts in Lafayette, Broomfield, Boulder, and throughout Adams County is here to provide personalized guidance at no extra cost to you.

The right insurance coverage can provide financial protection for your family no matter what circumstances arise, and understanding the specific protections offered by Colorado law is an important part of making informed insurance decisions.